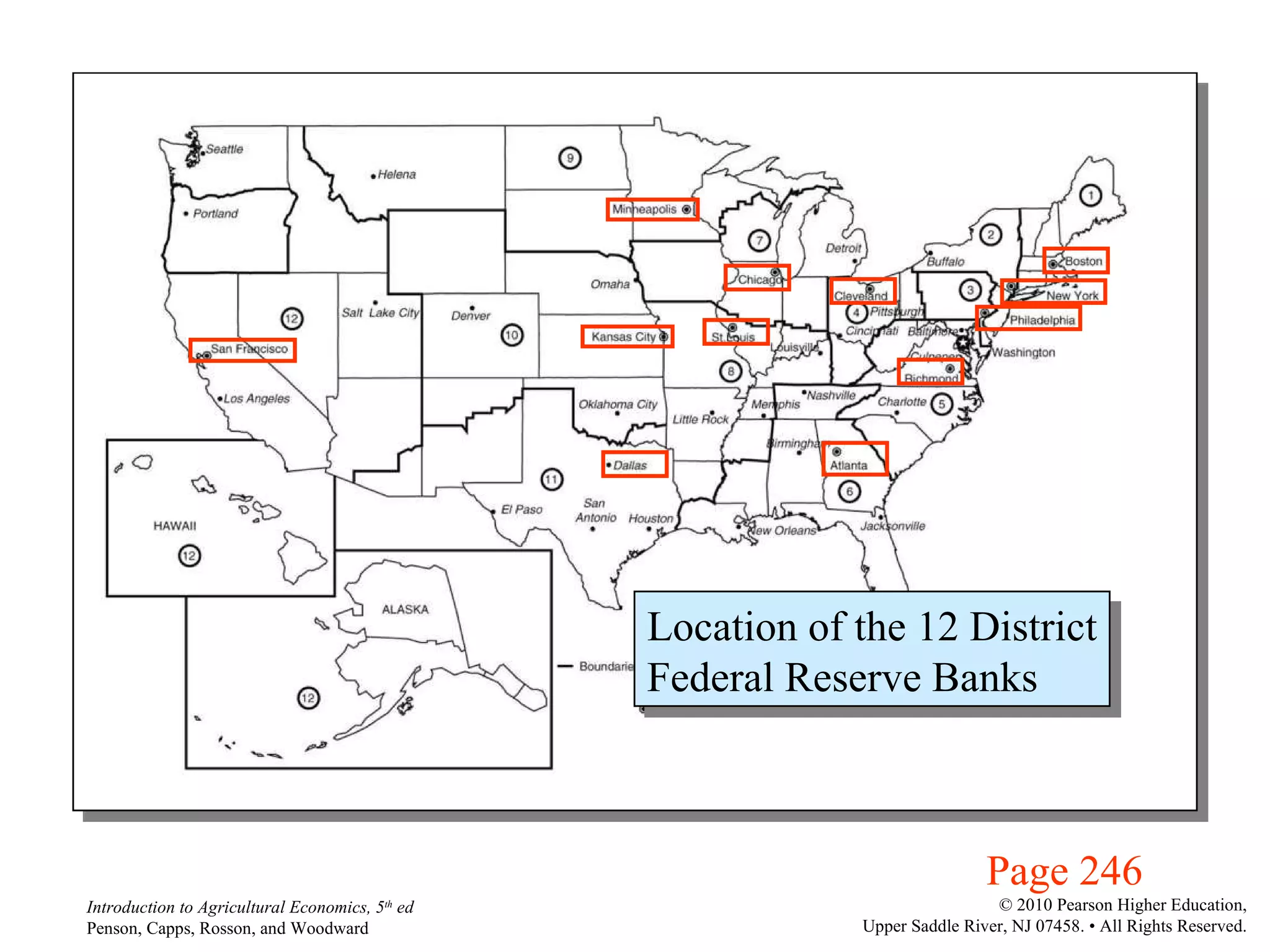

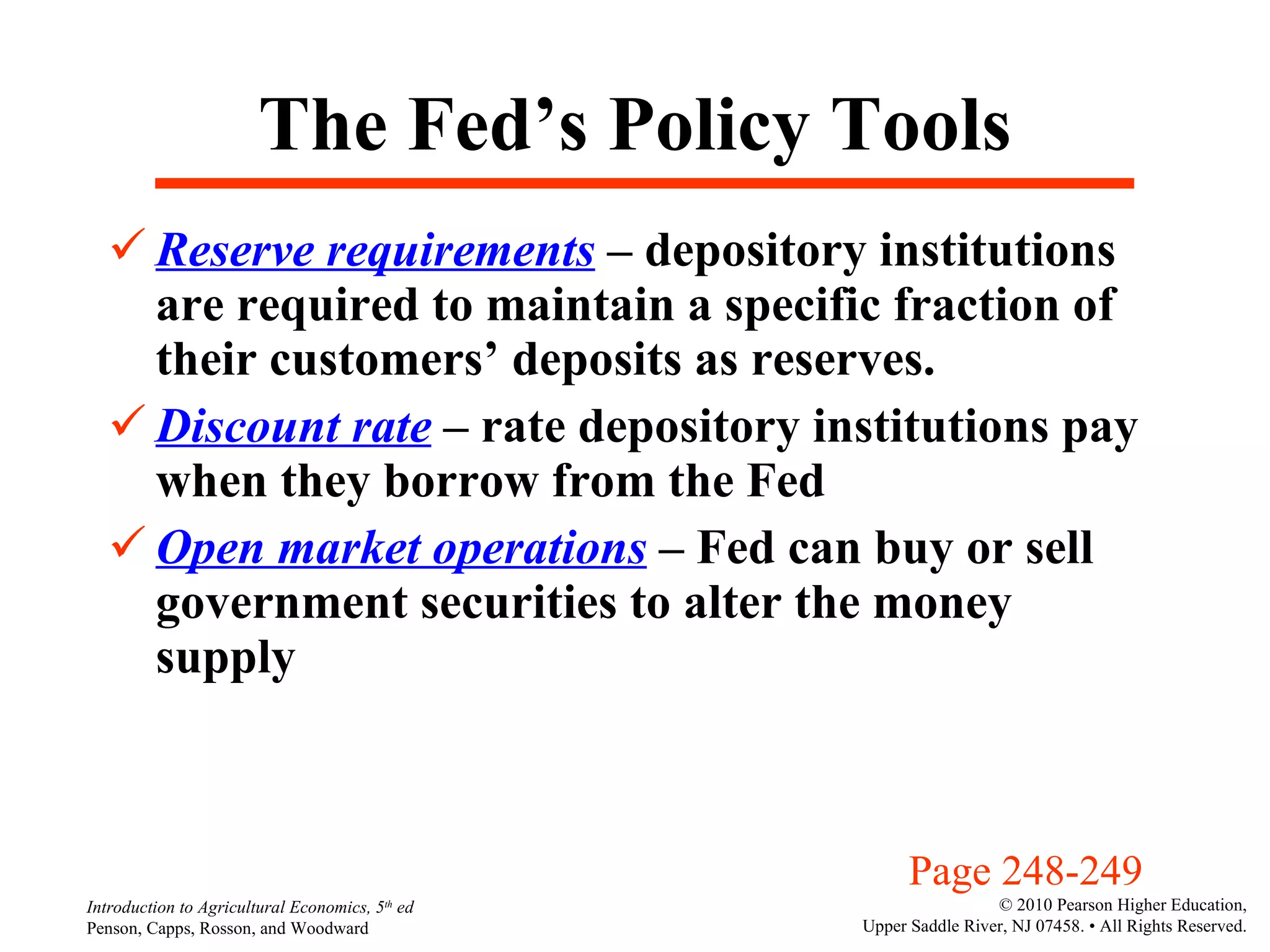

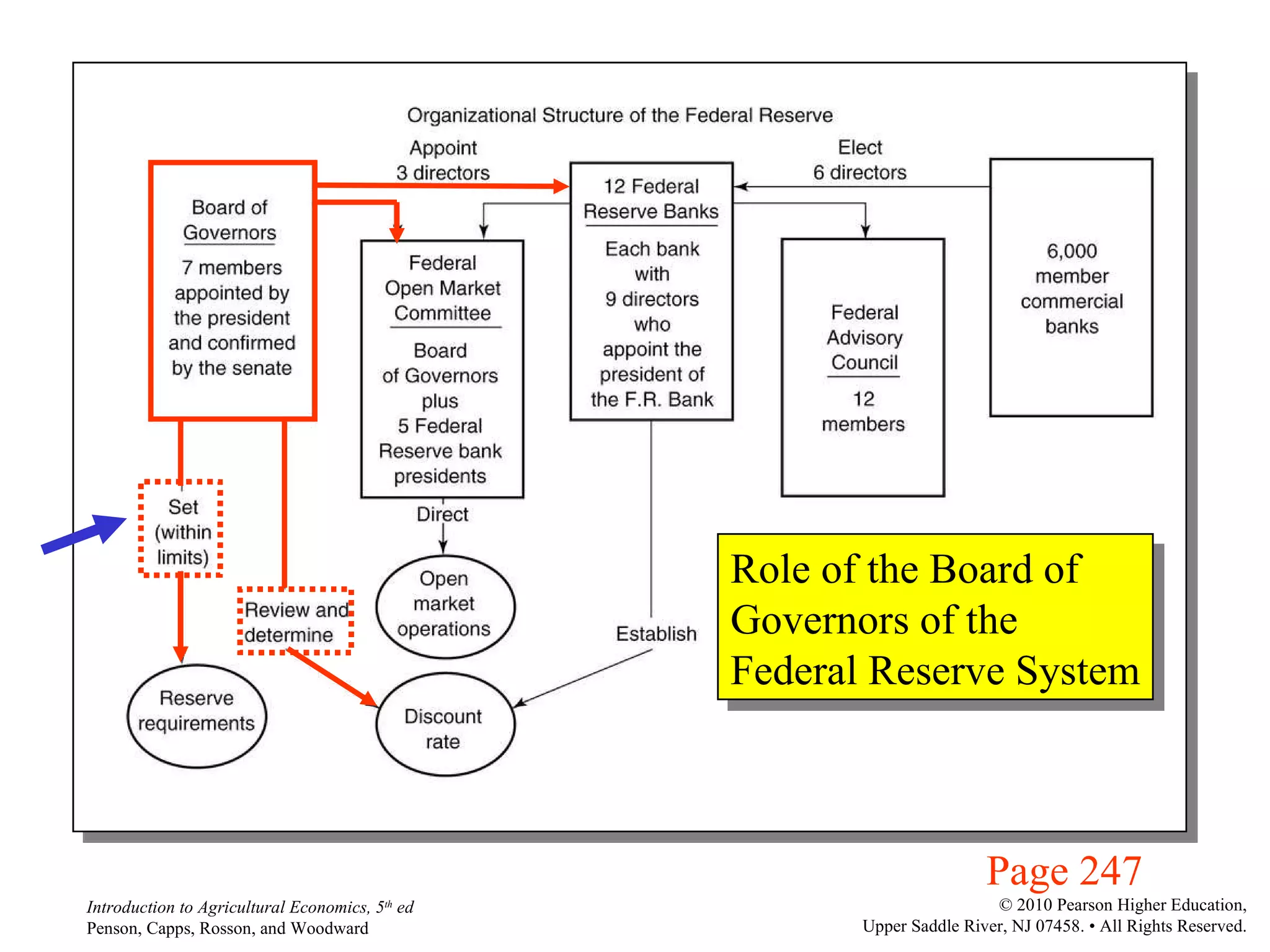

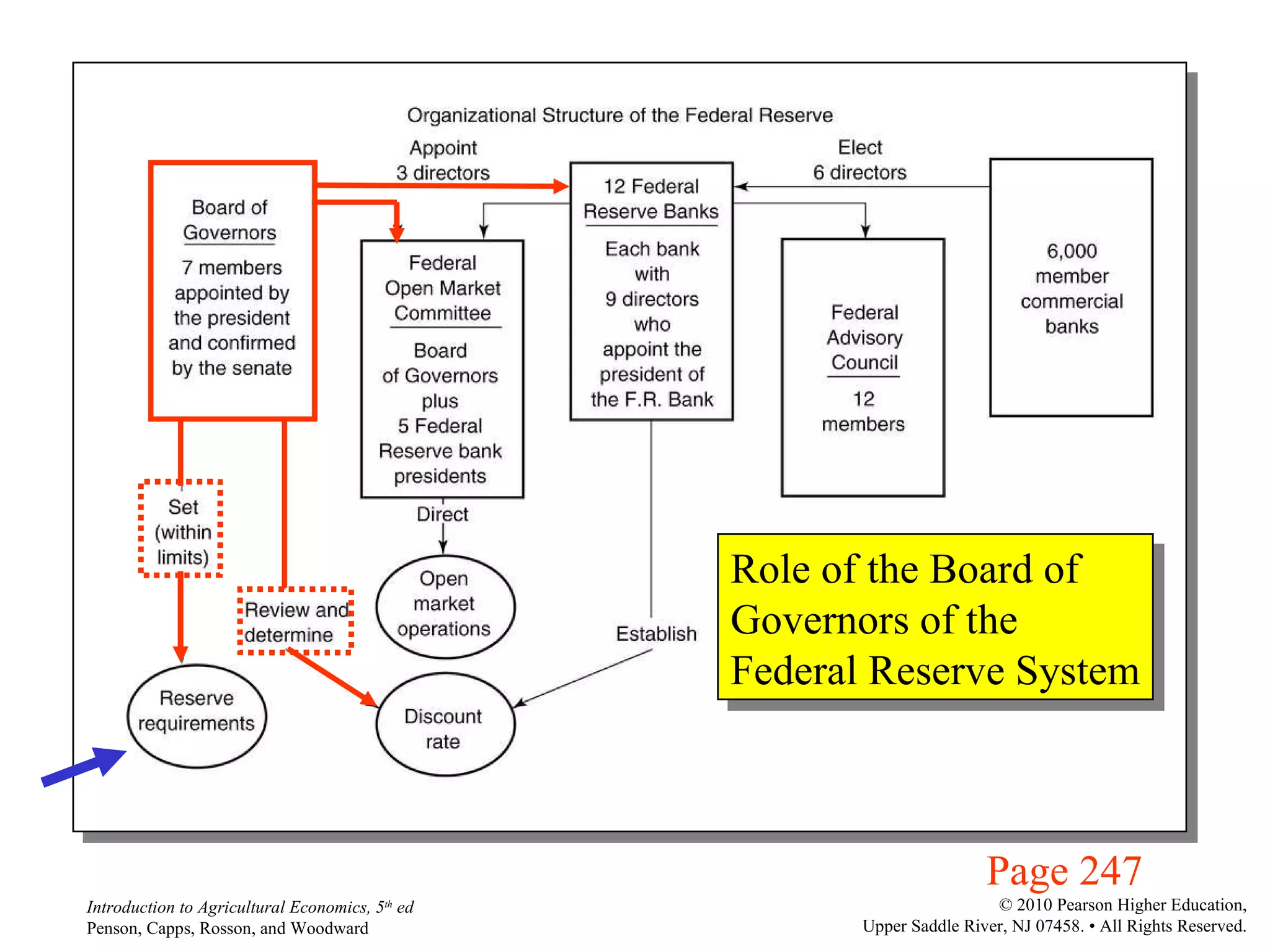

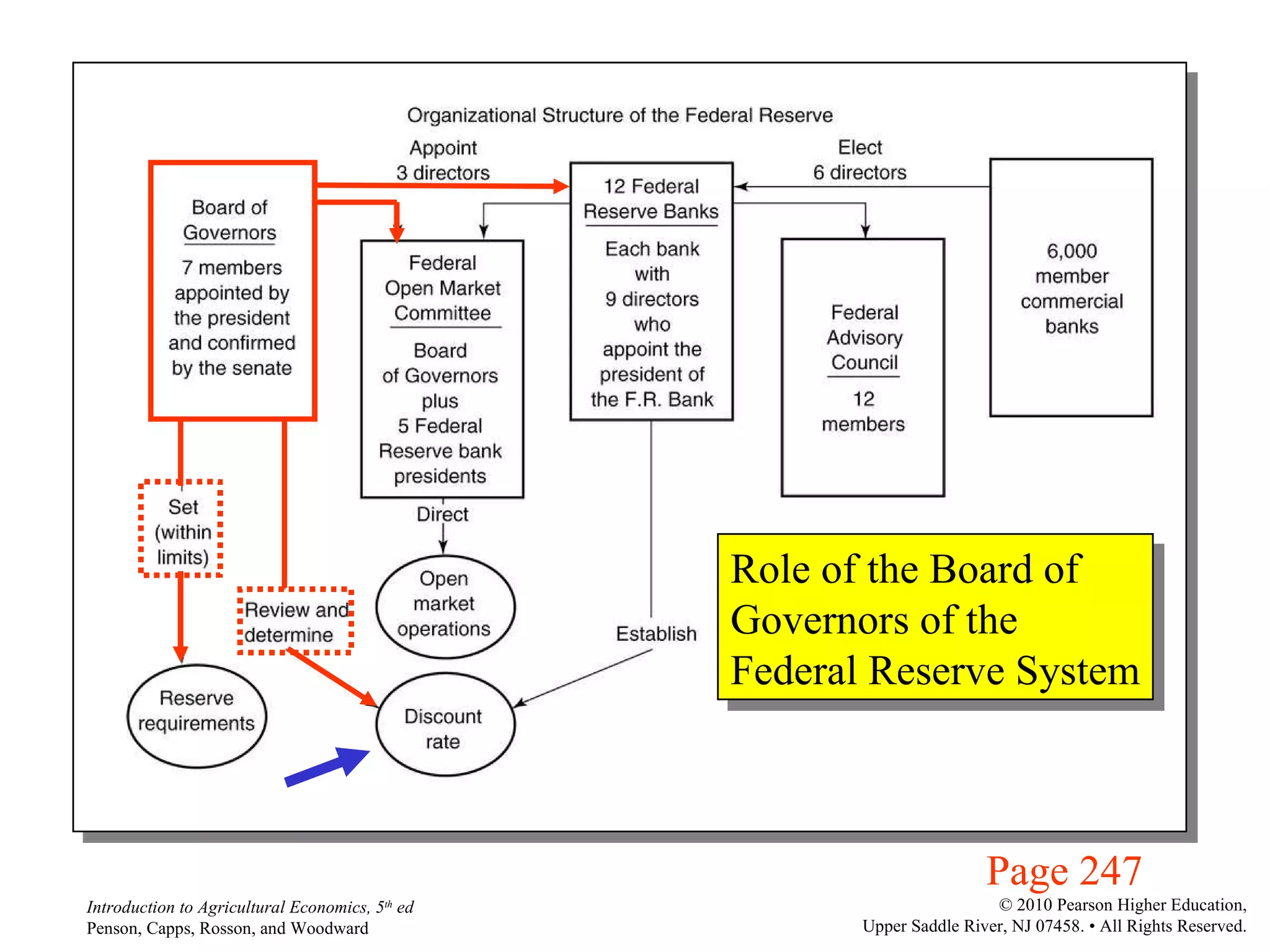

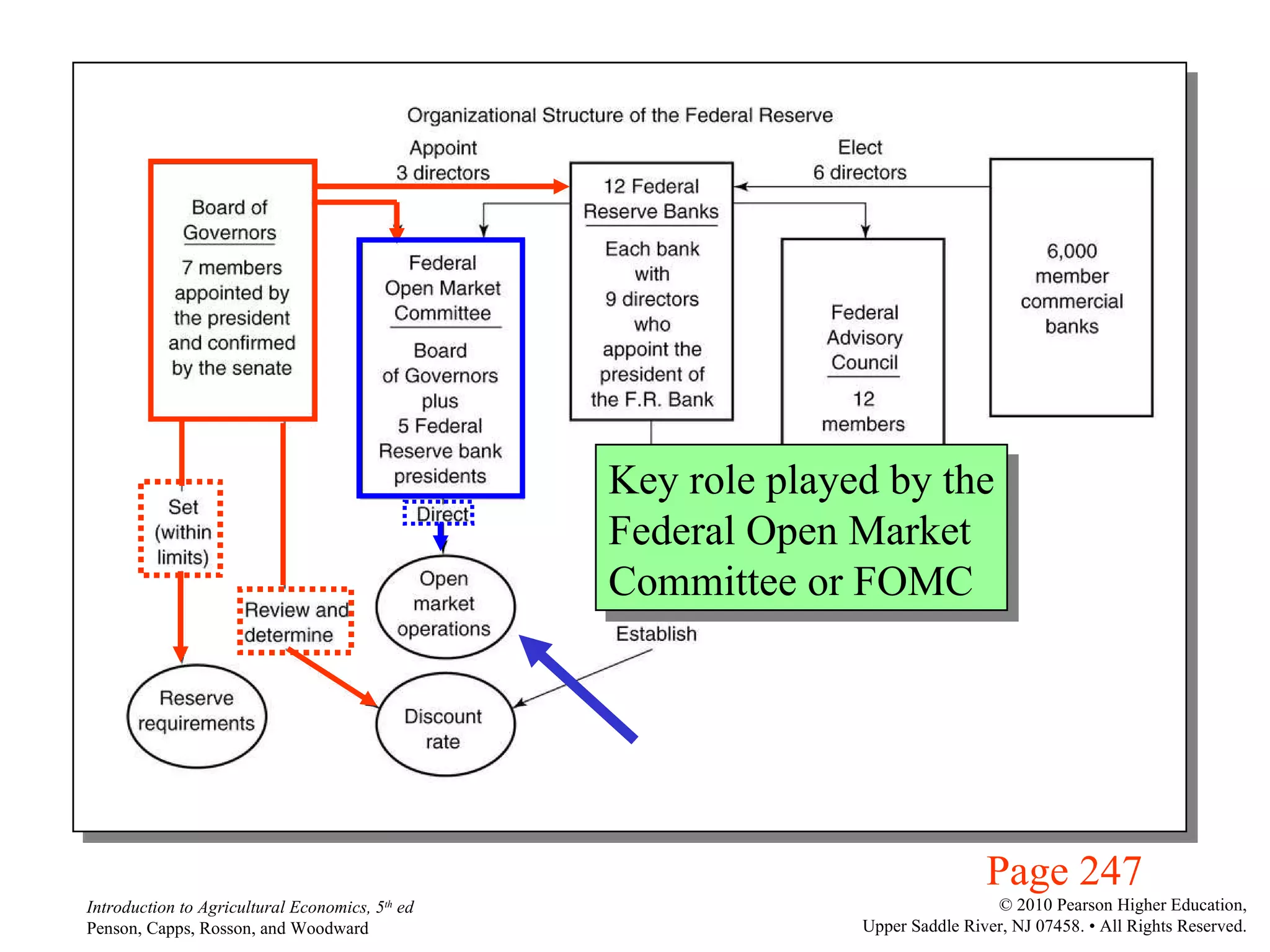

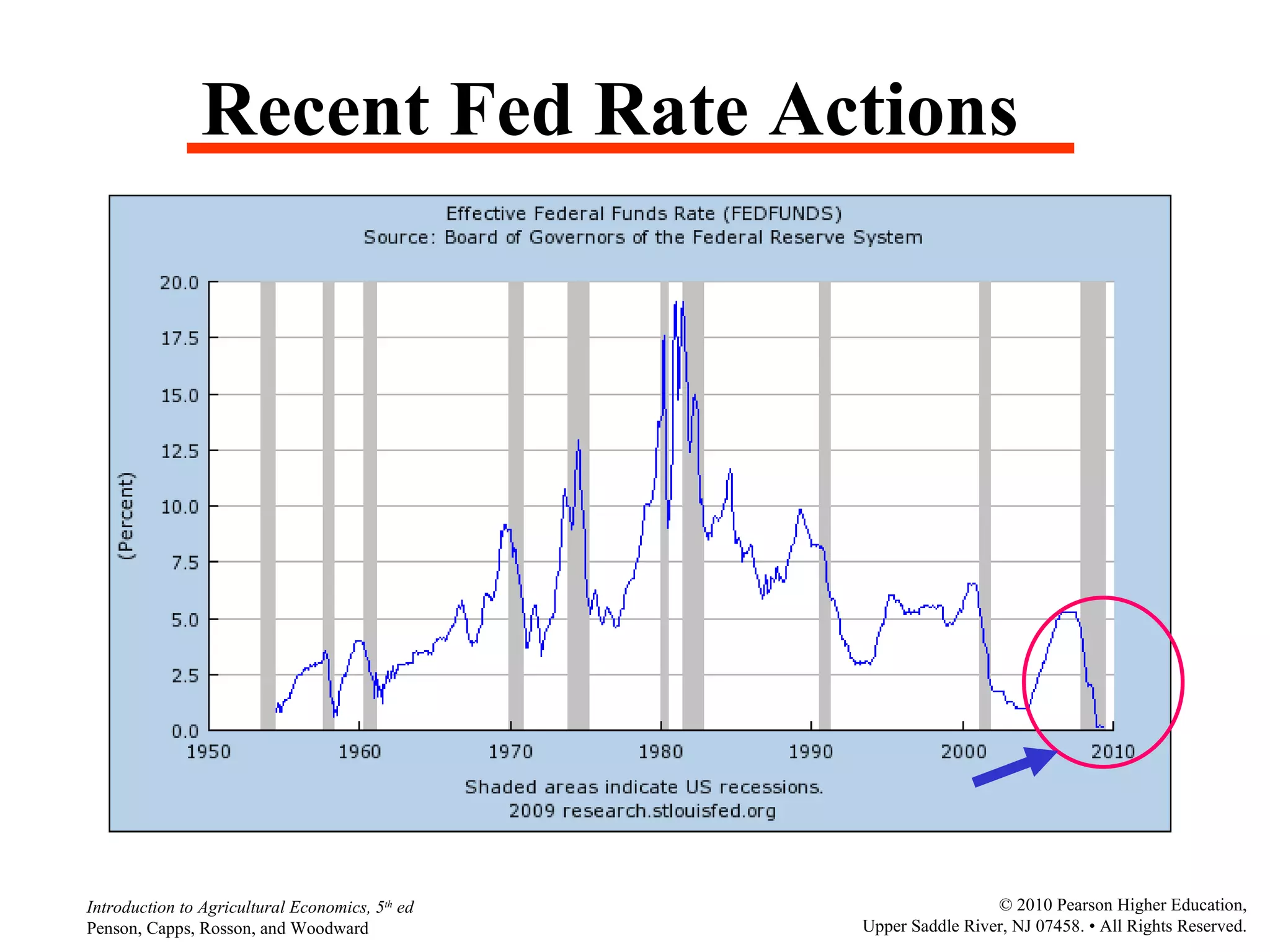

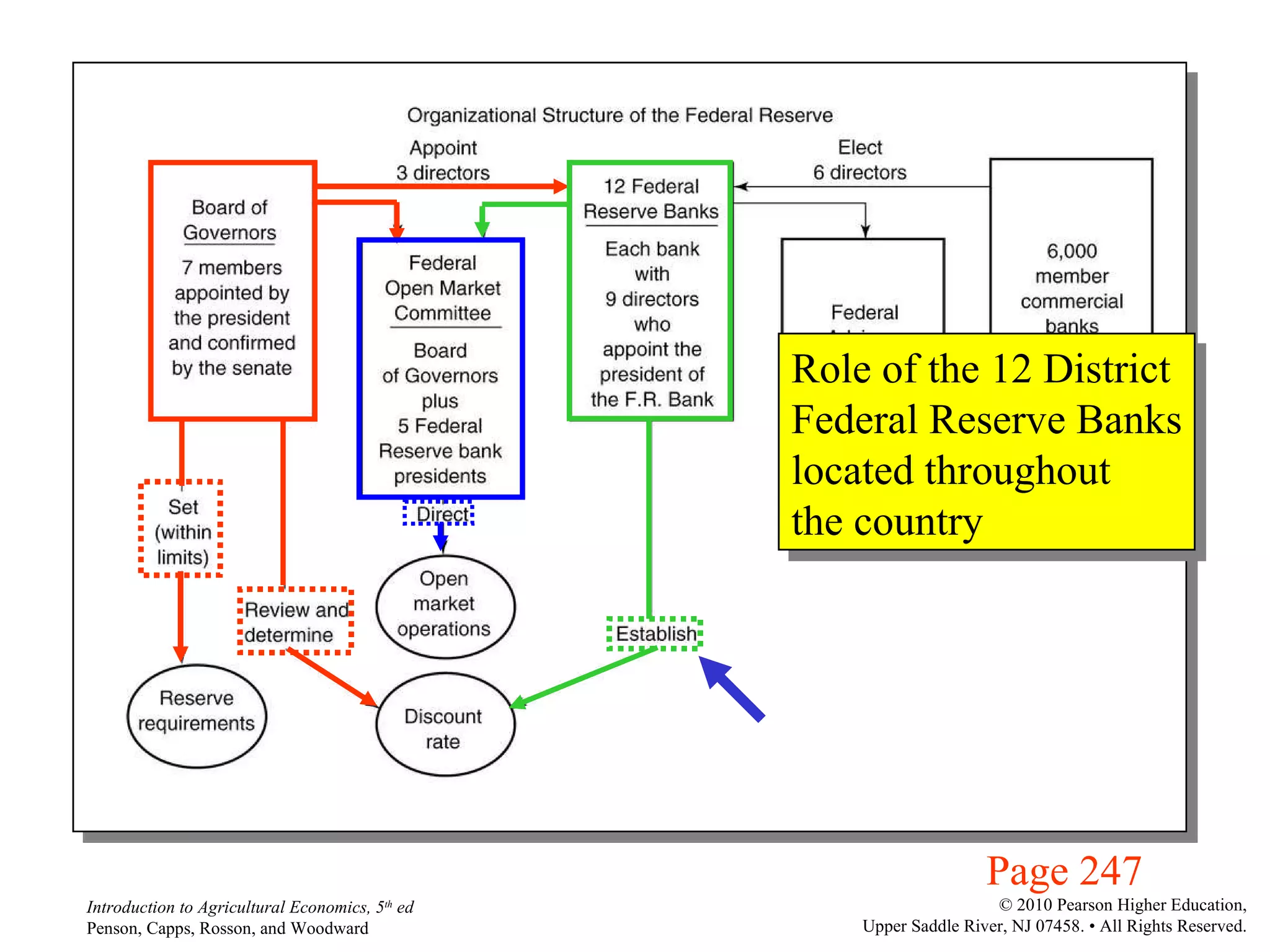

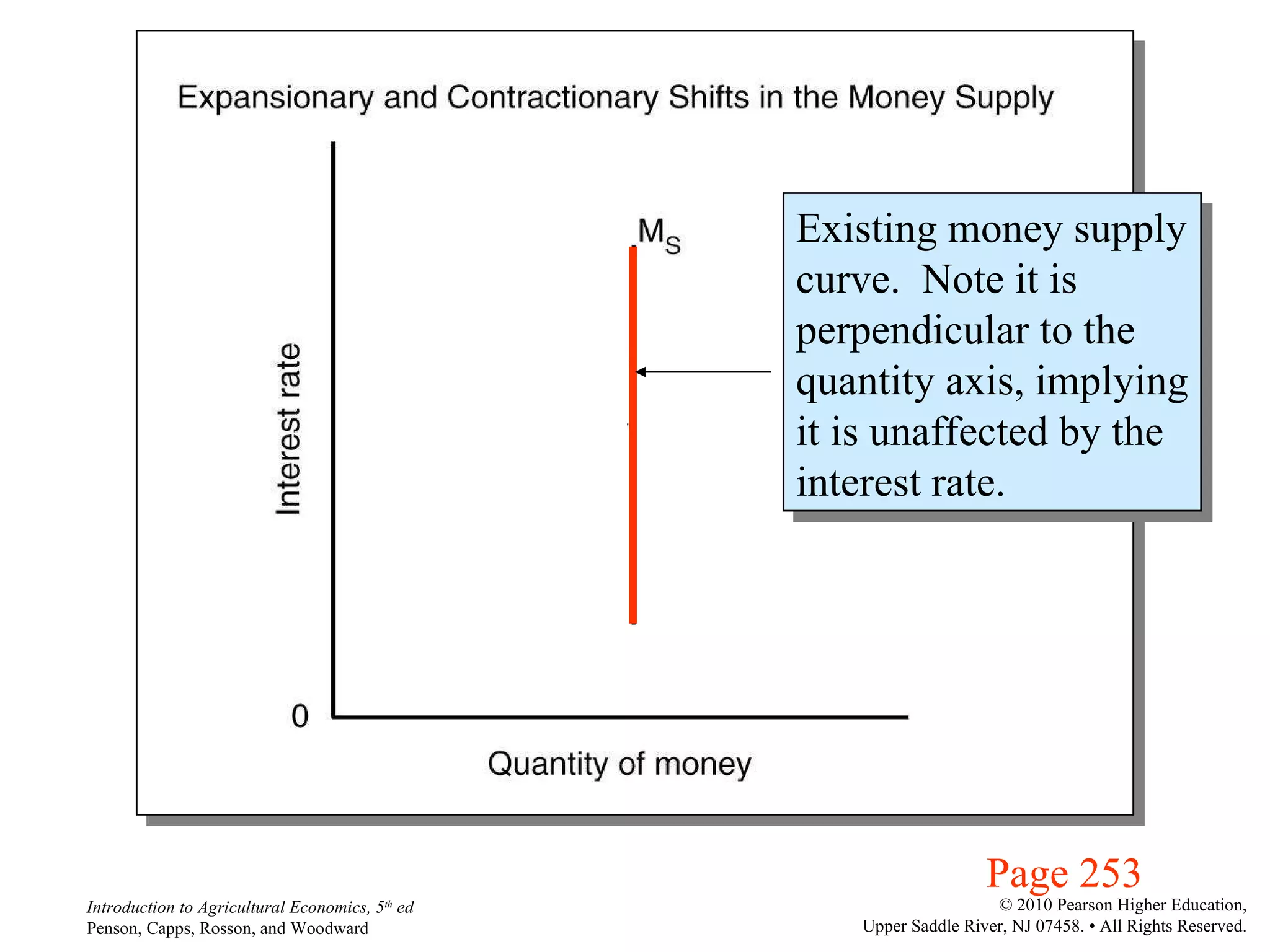

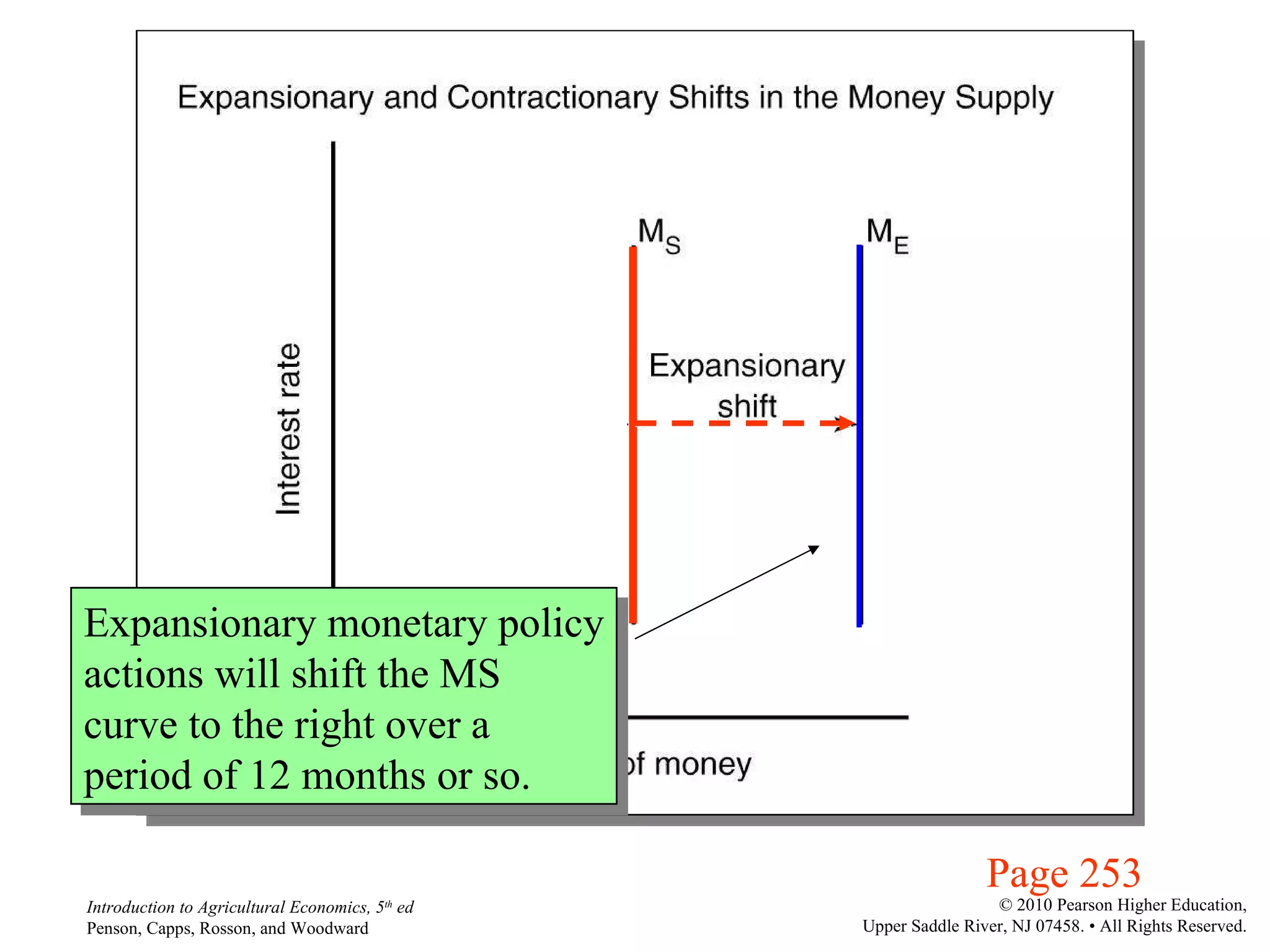

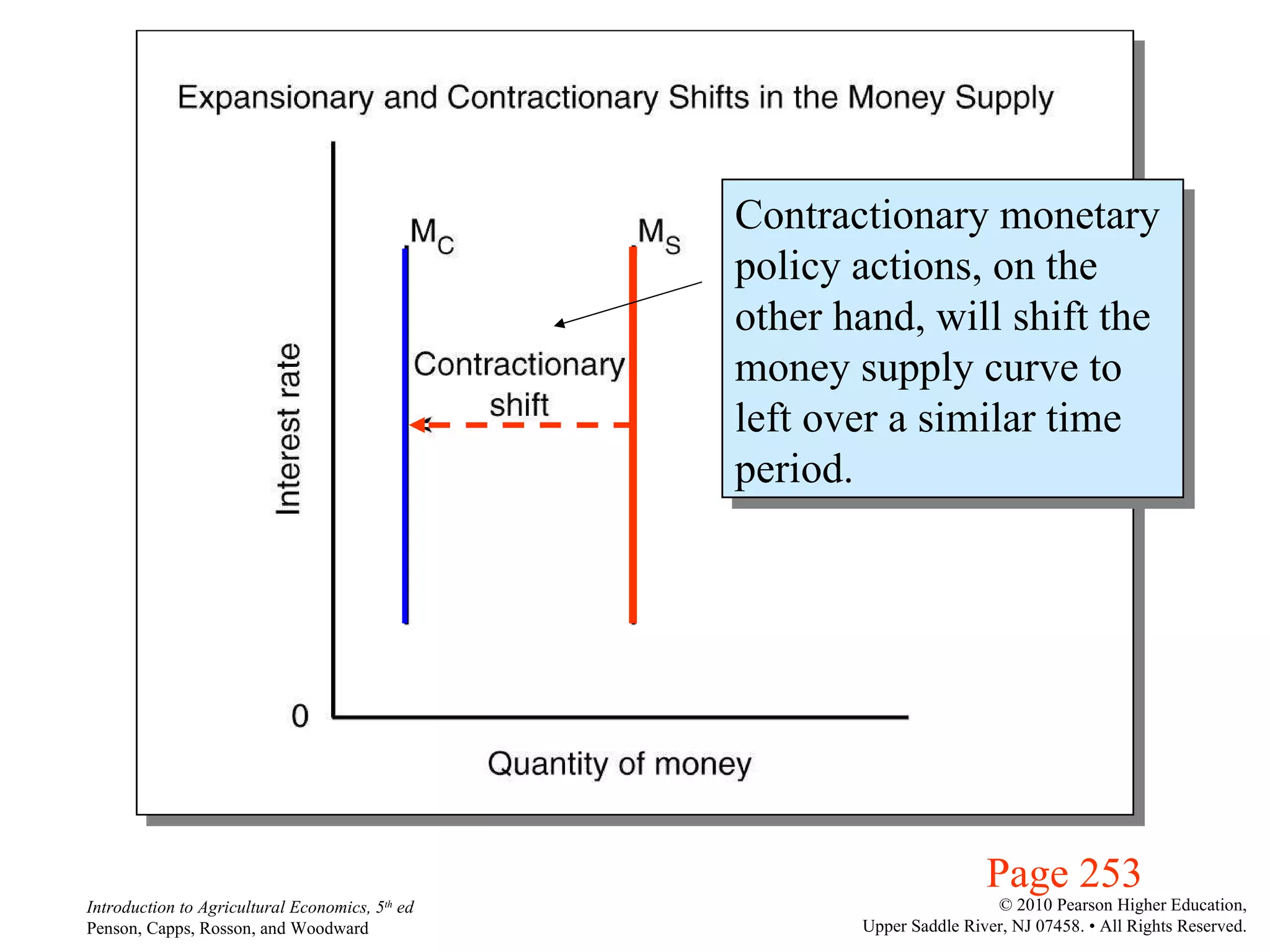

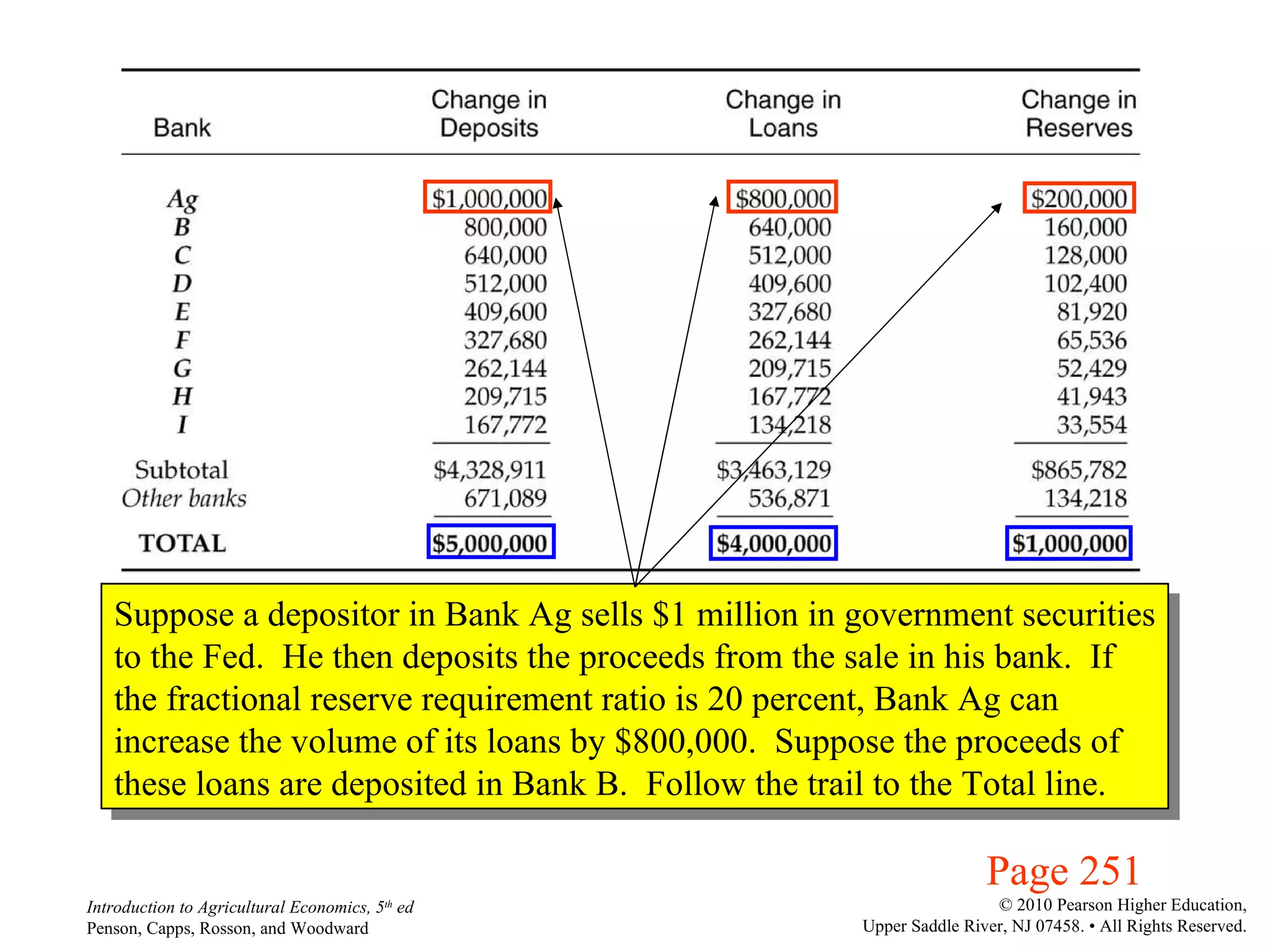

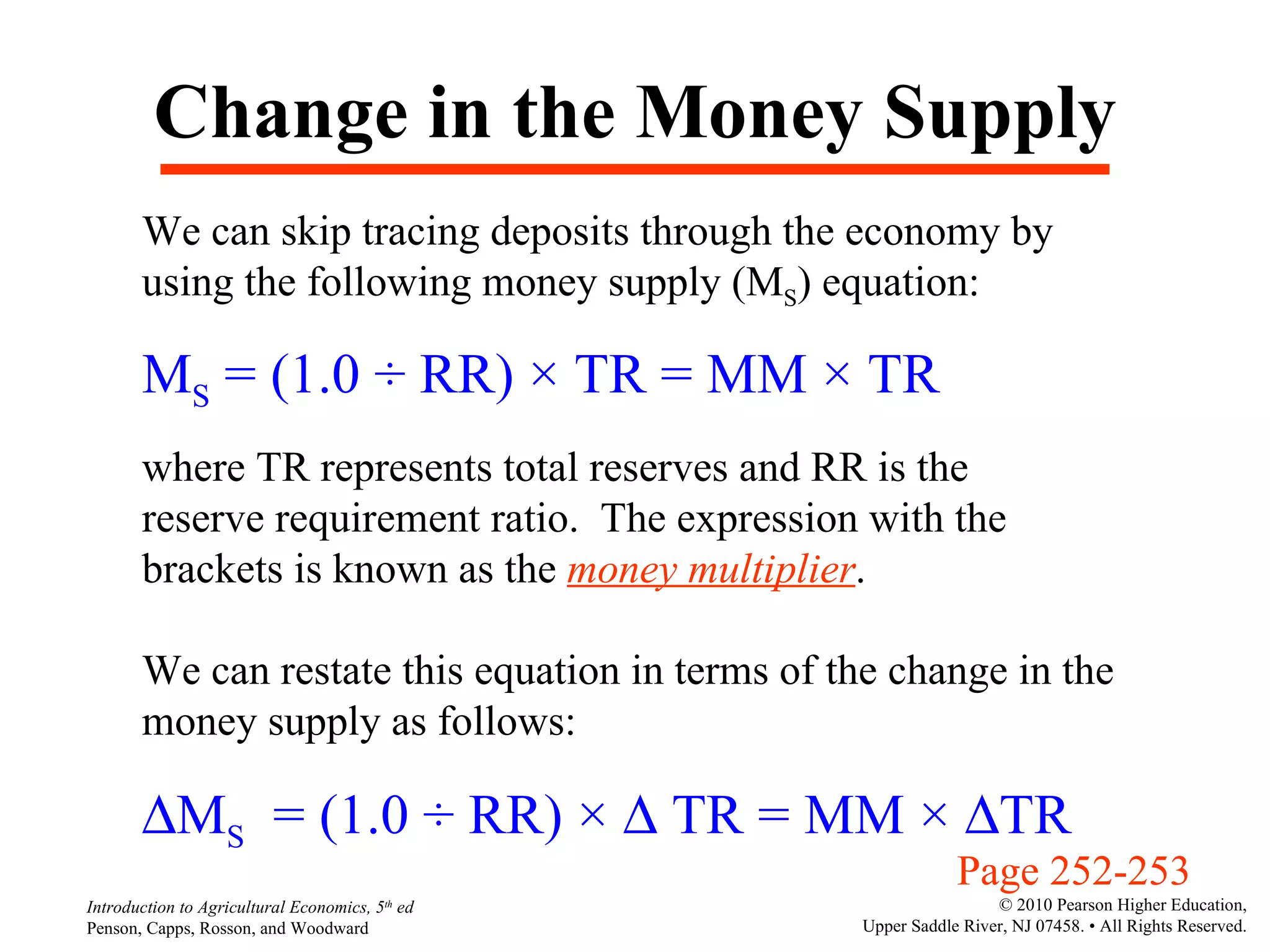

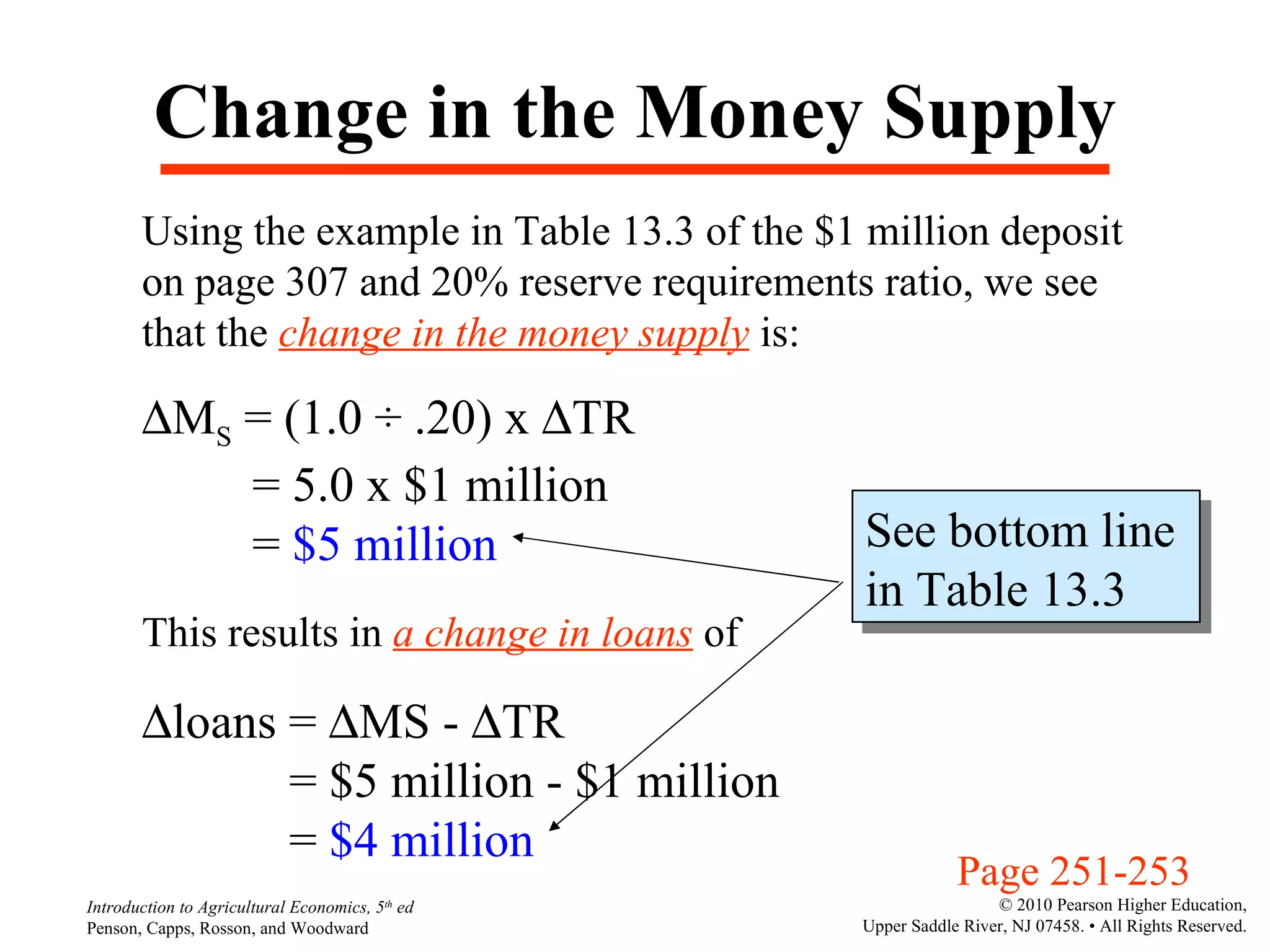

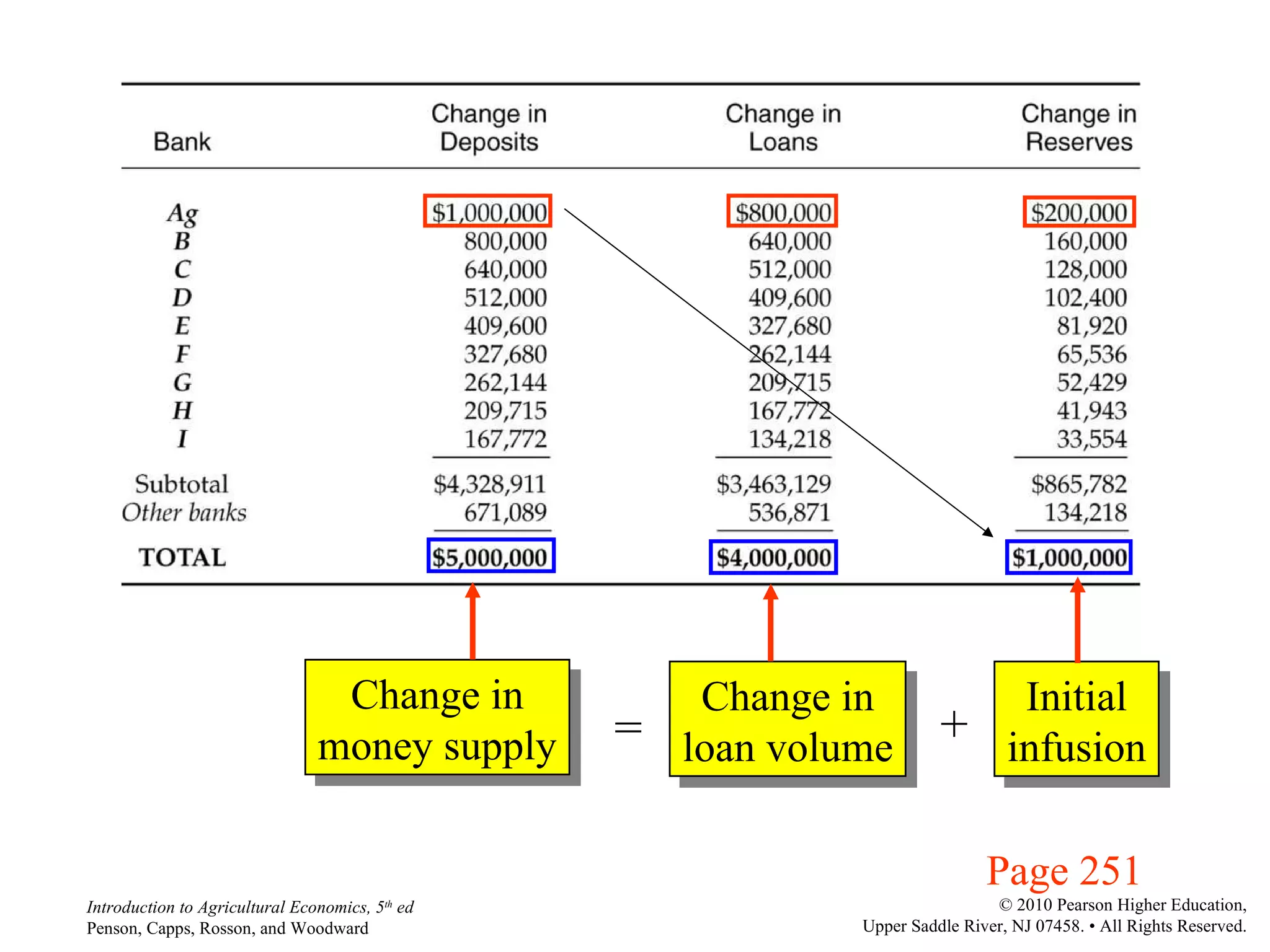

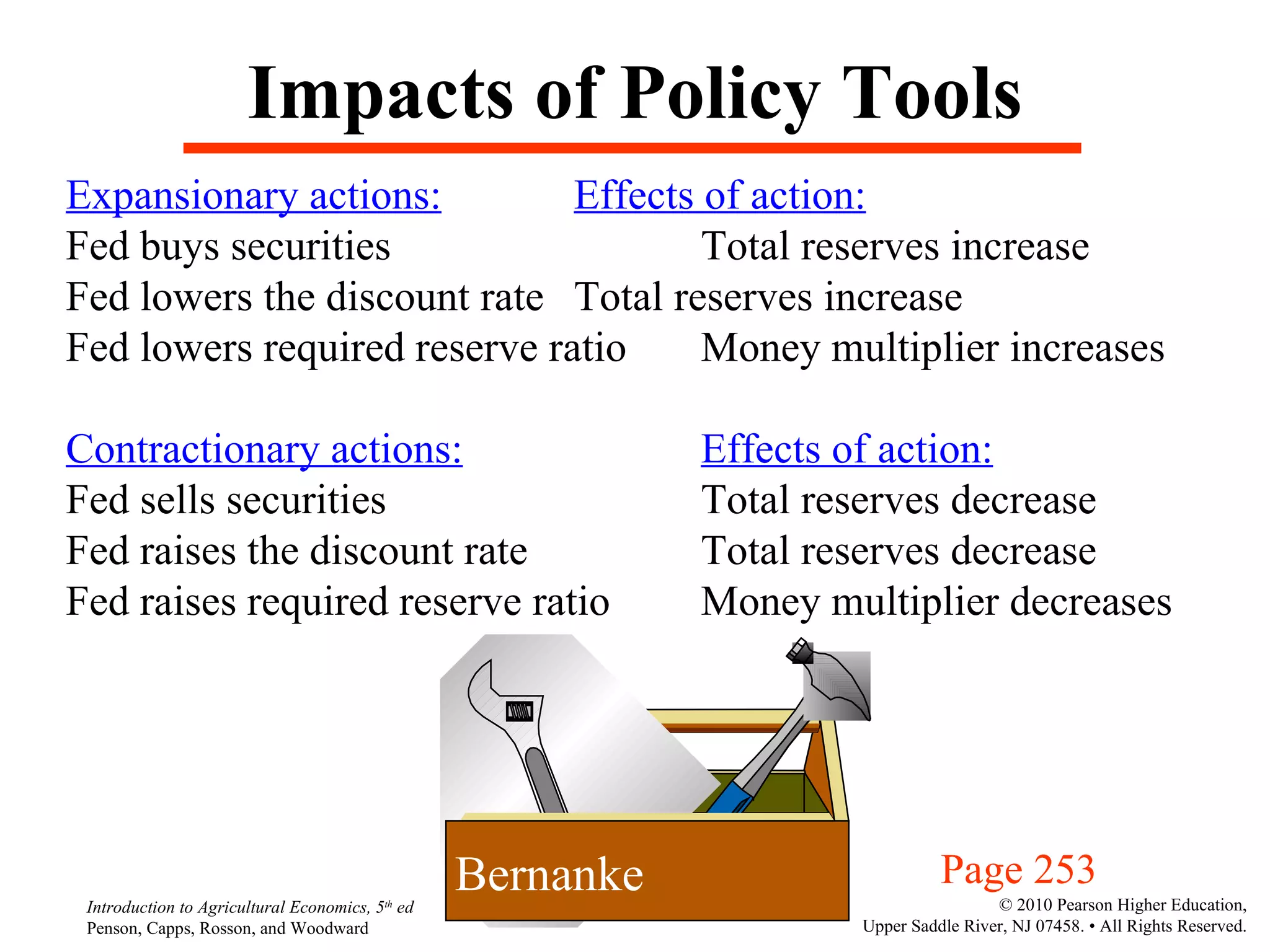

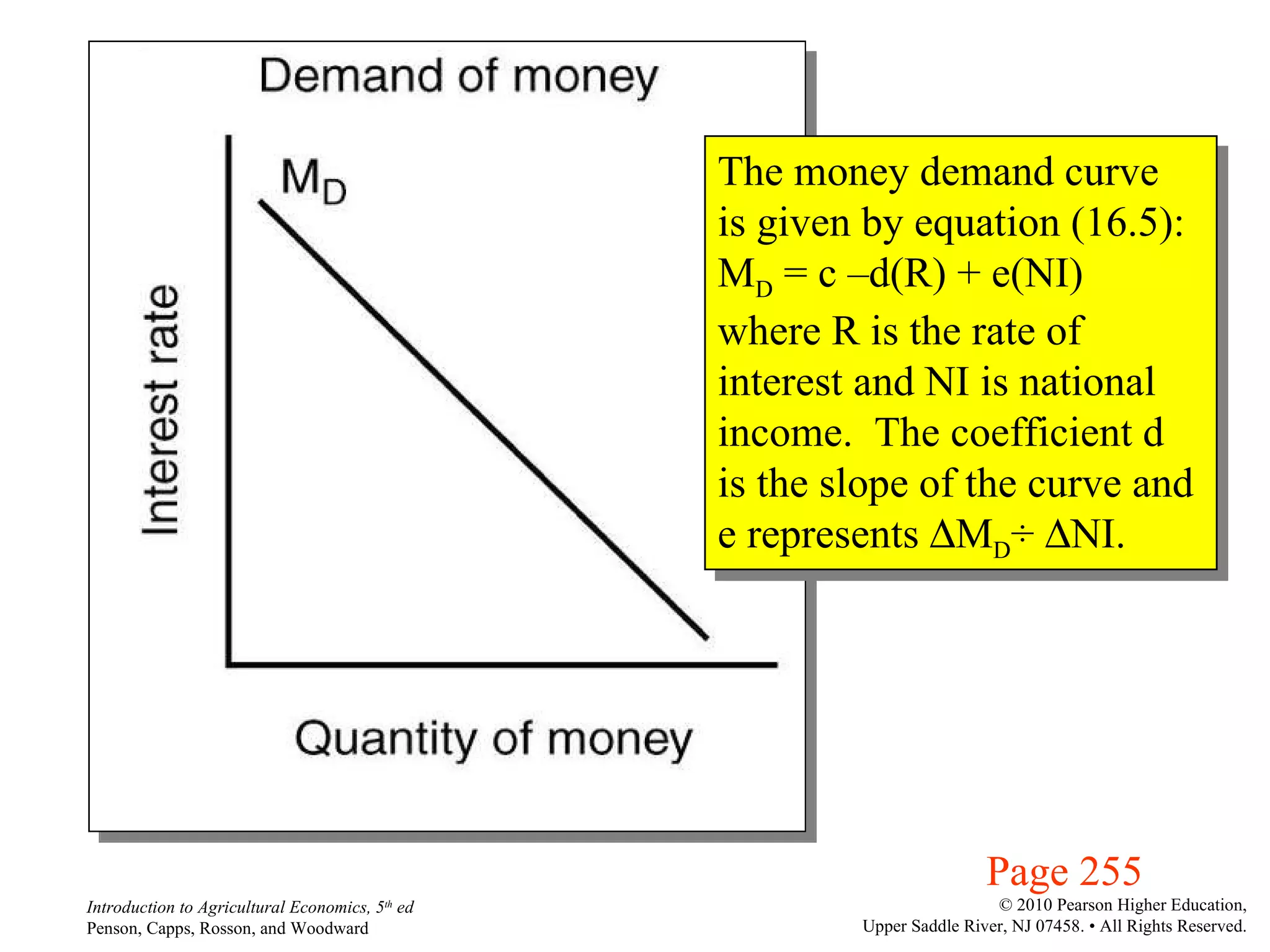

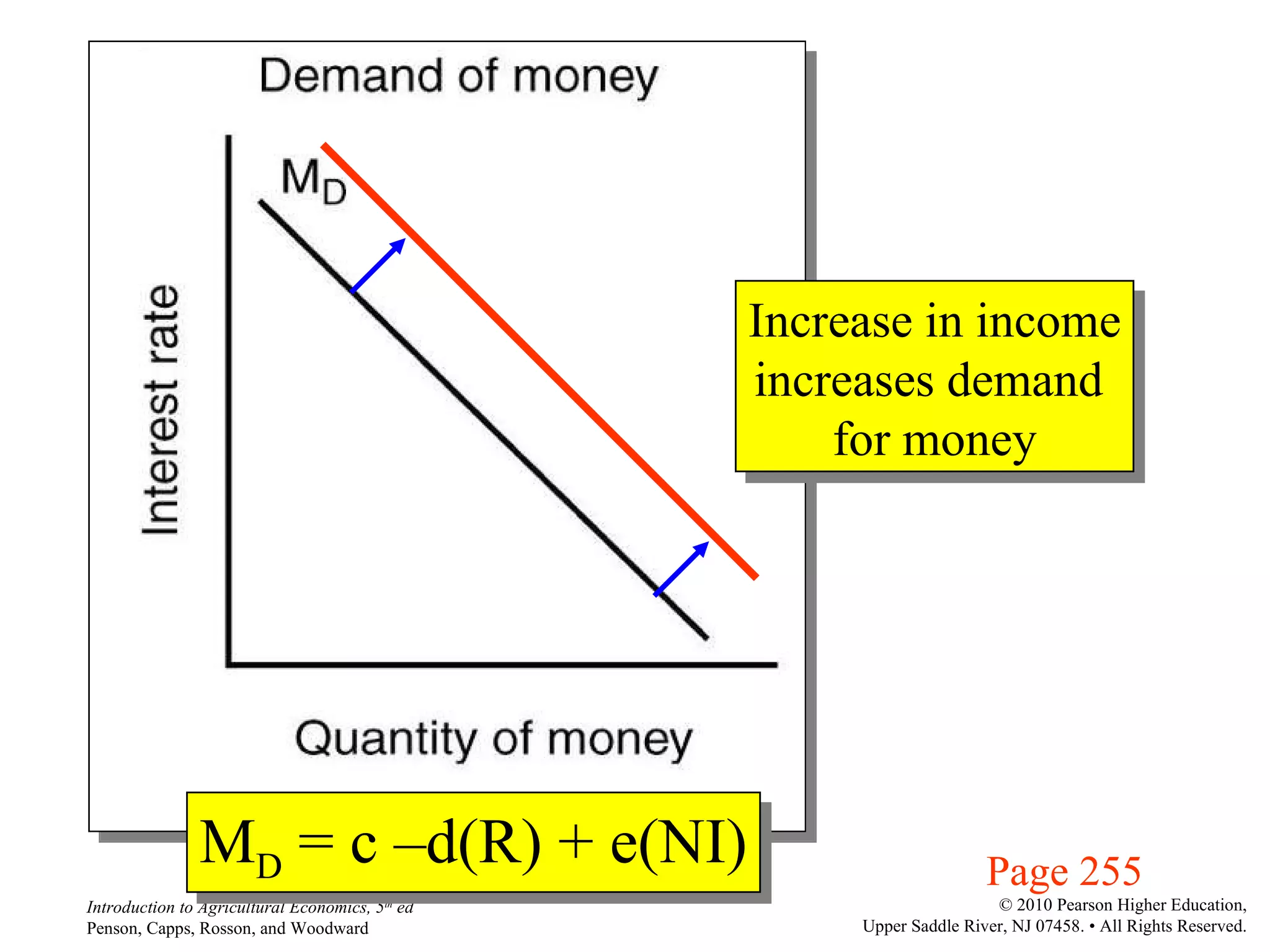

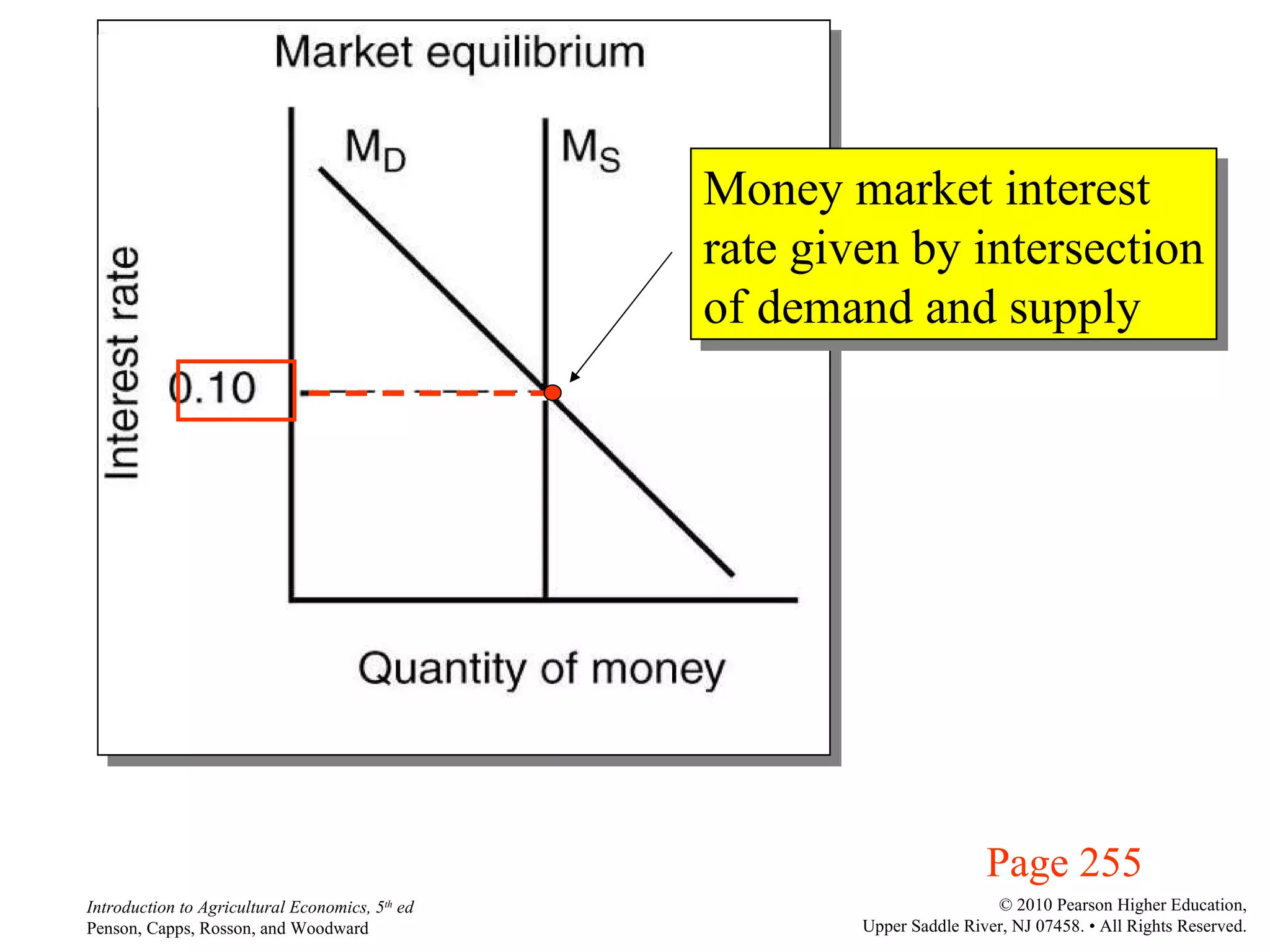

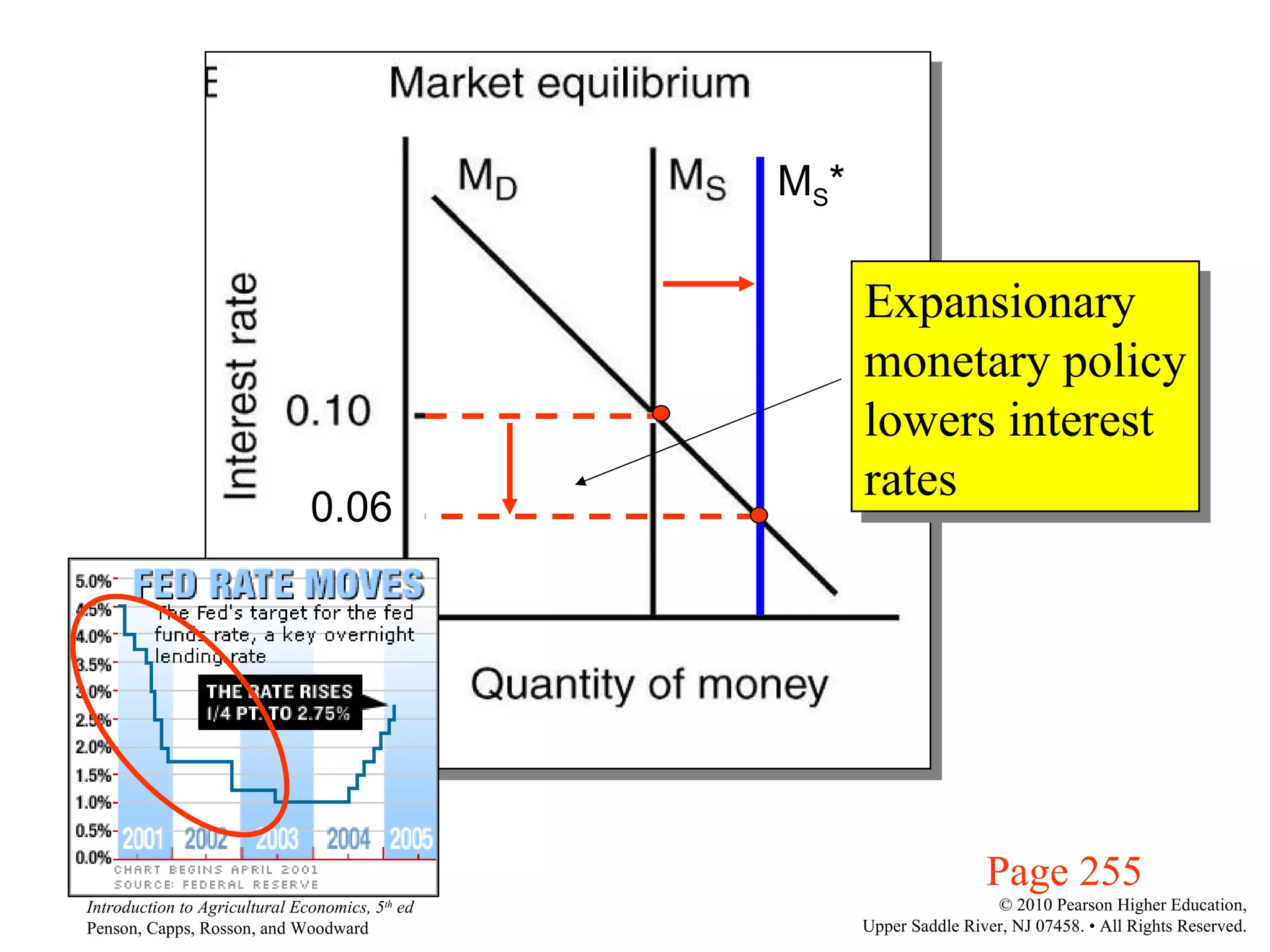

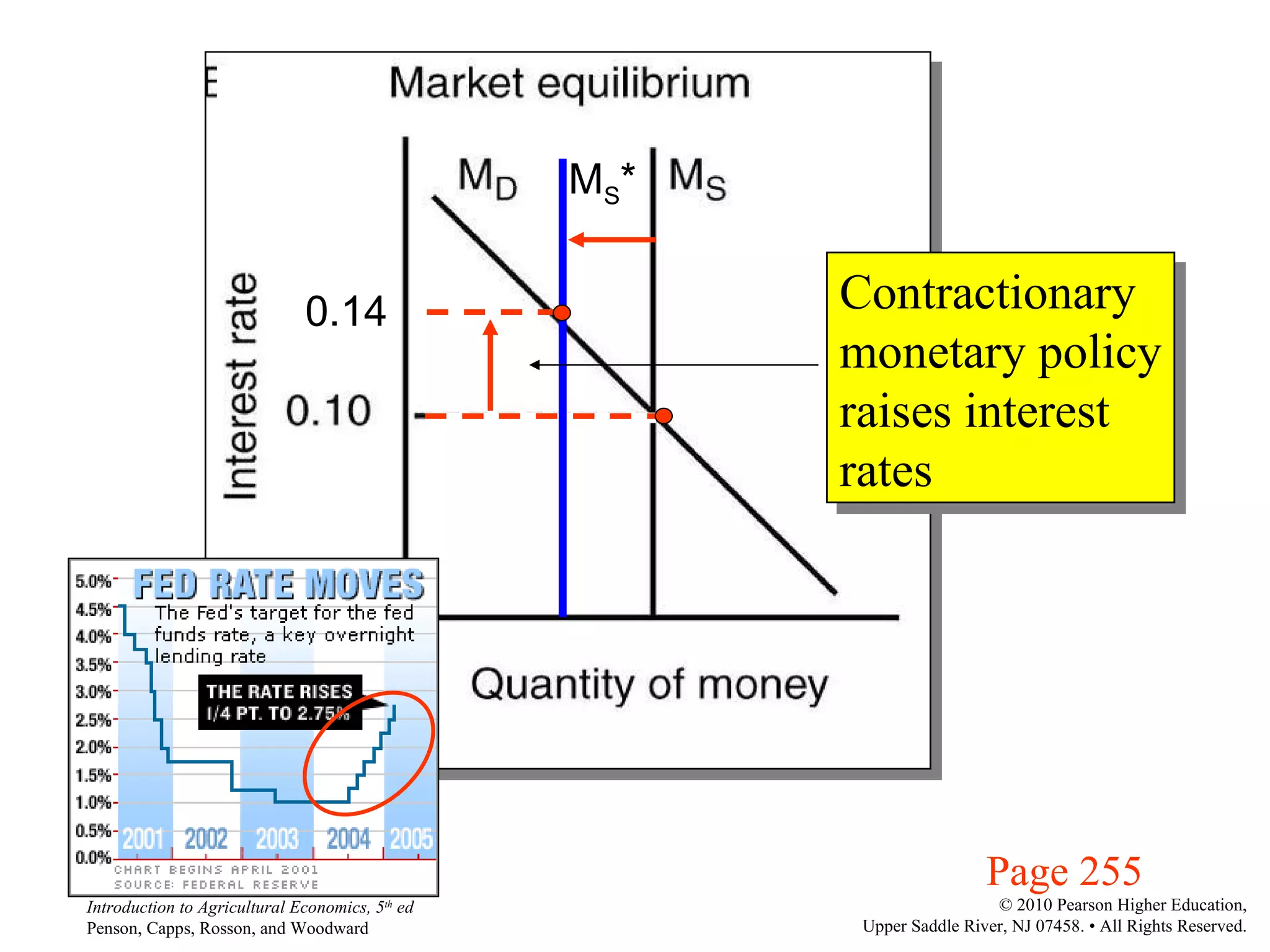

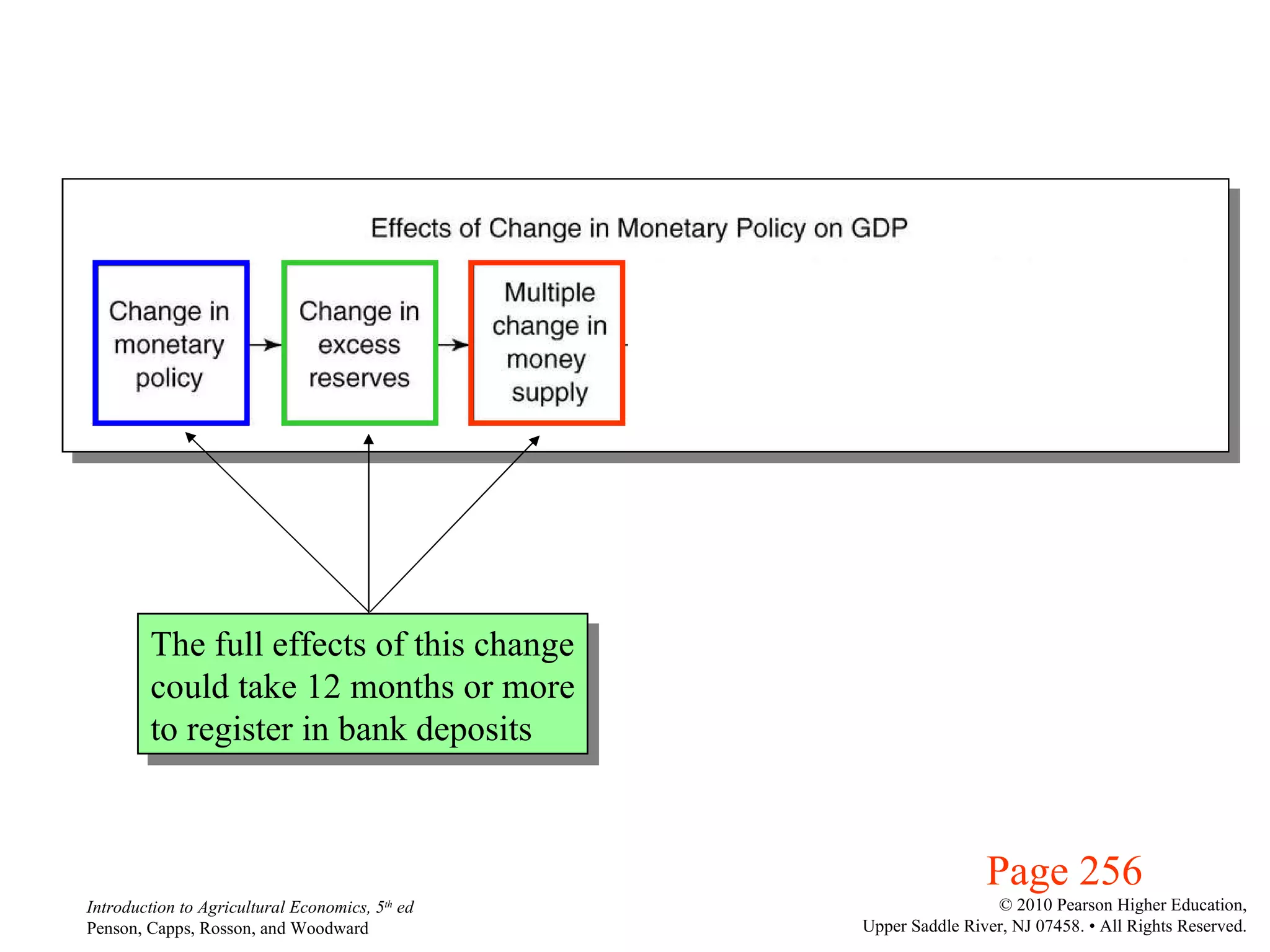

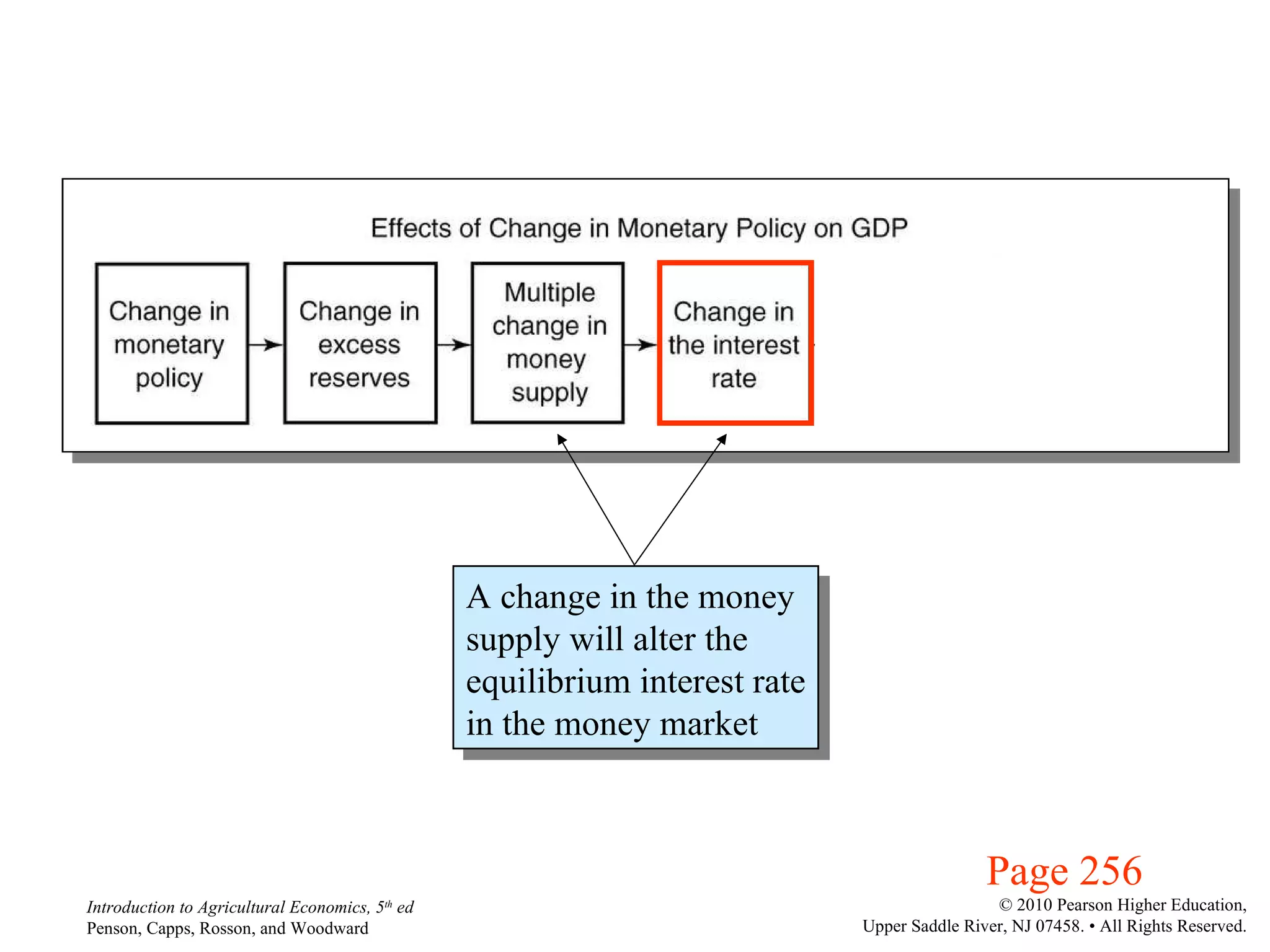

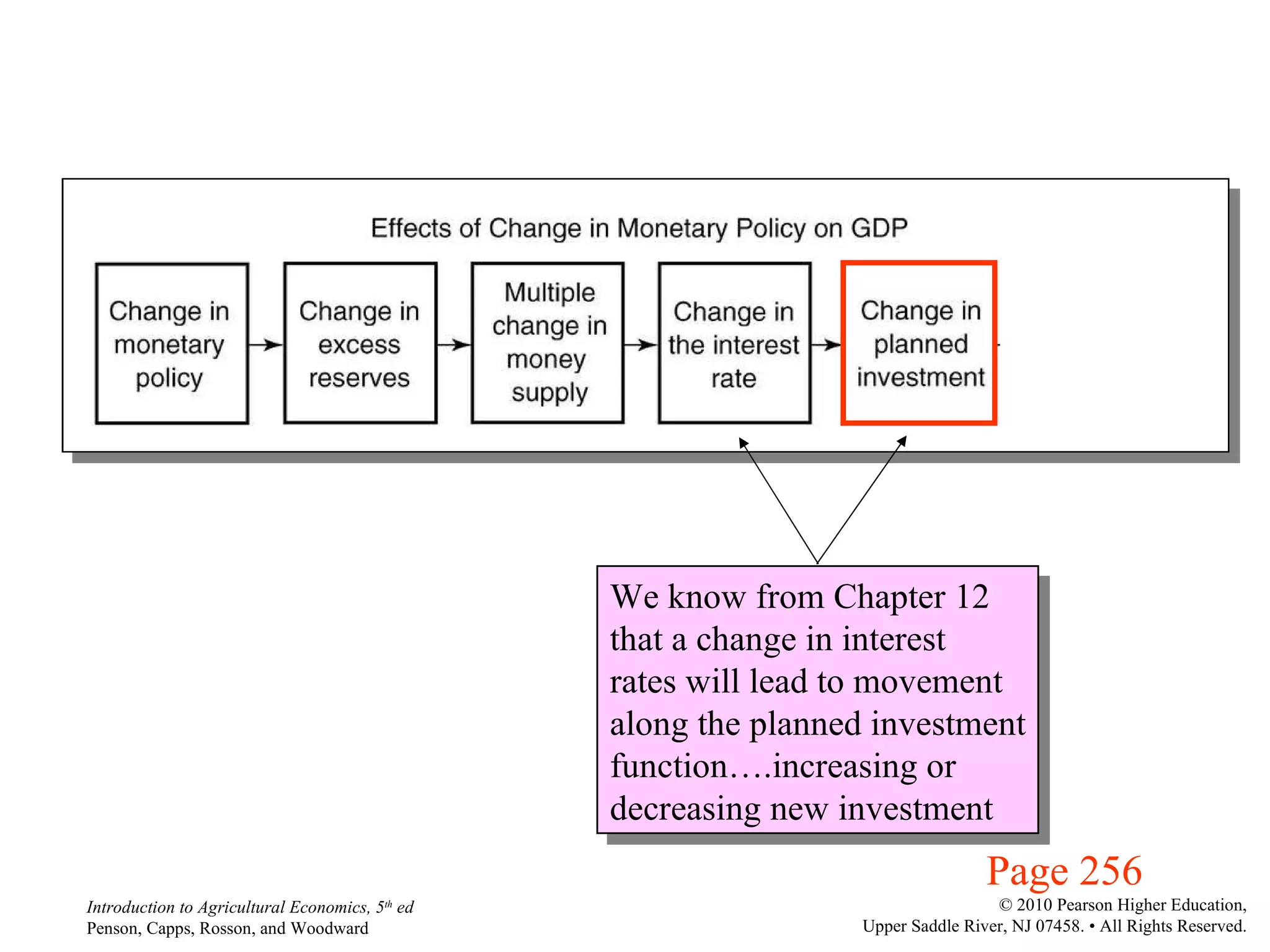

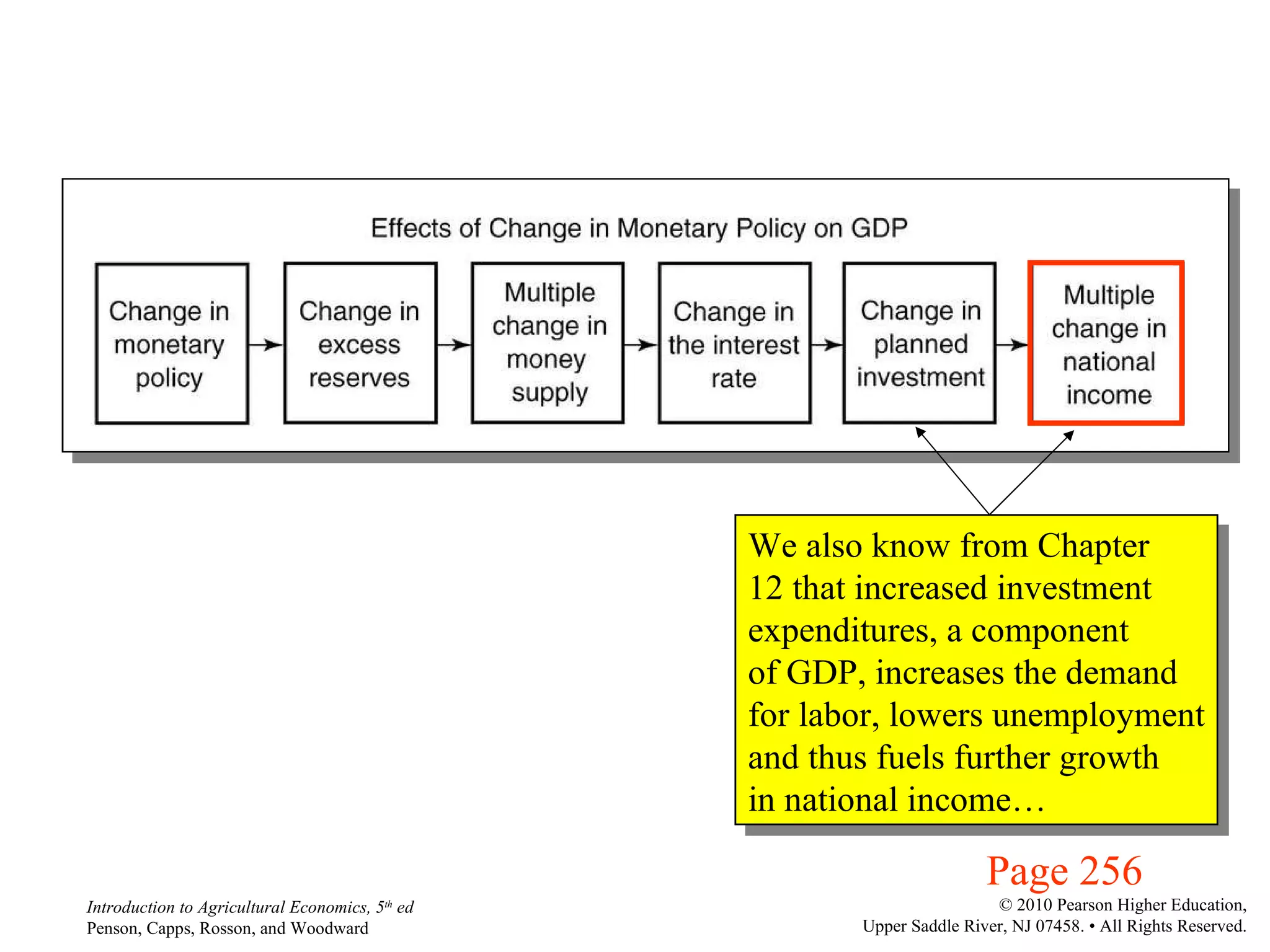

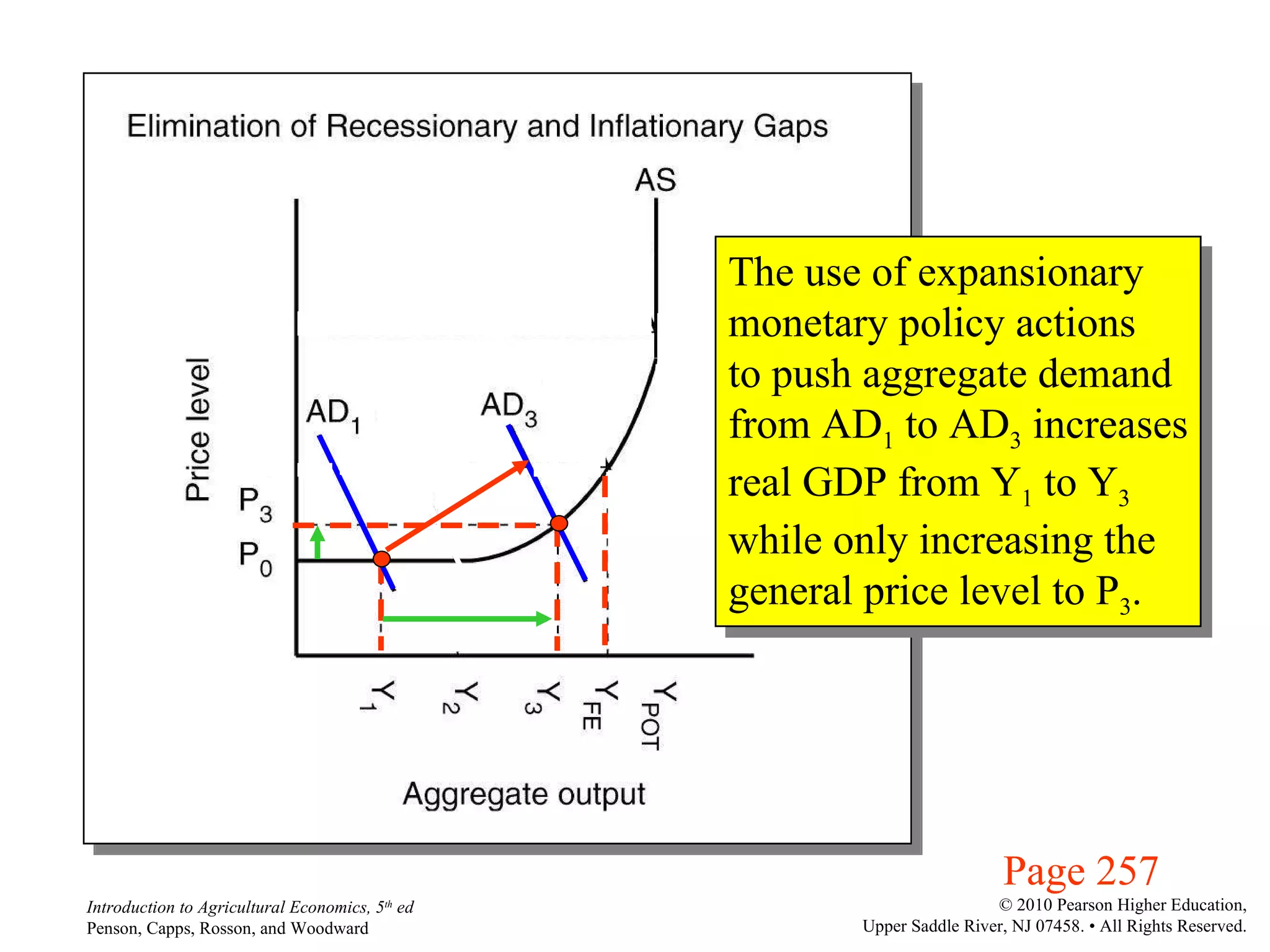

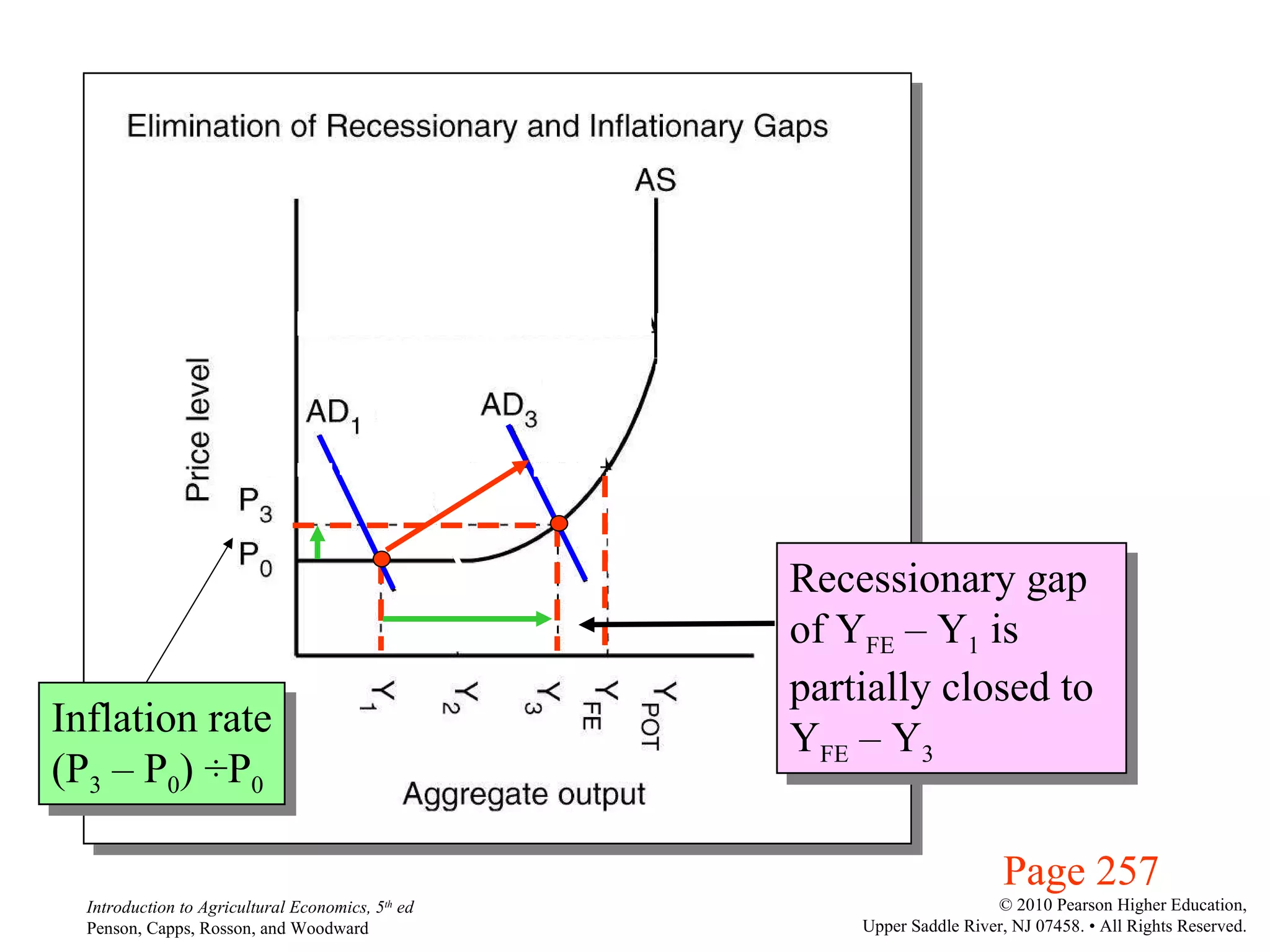

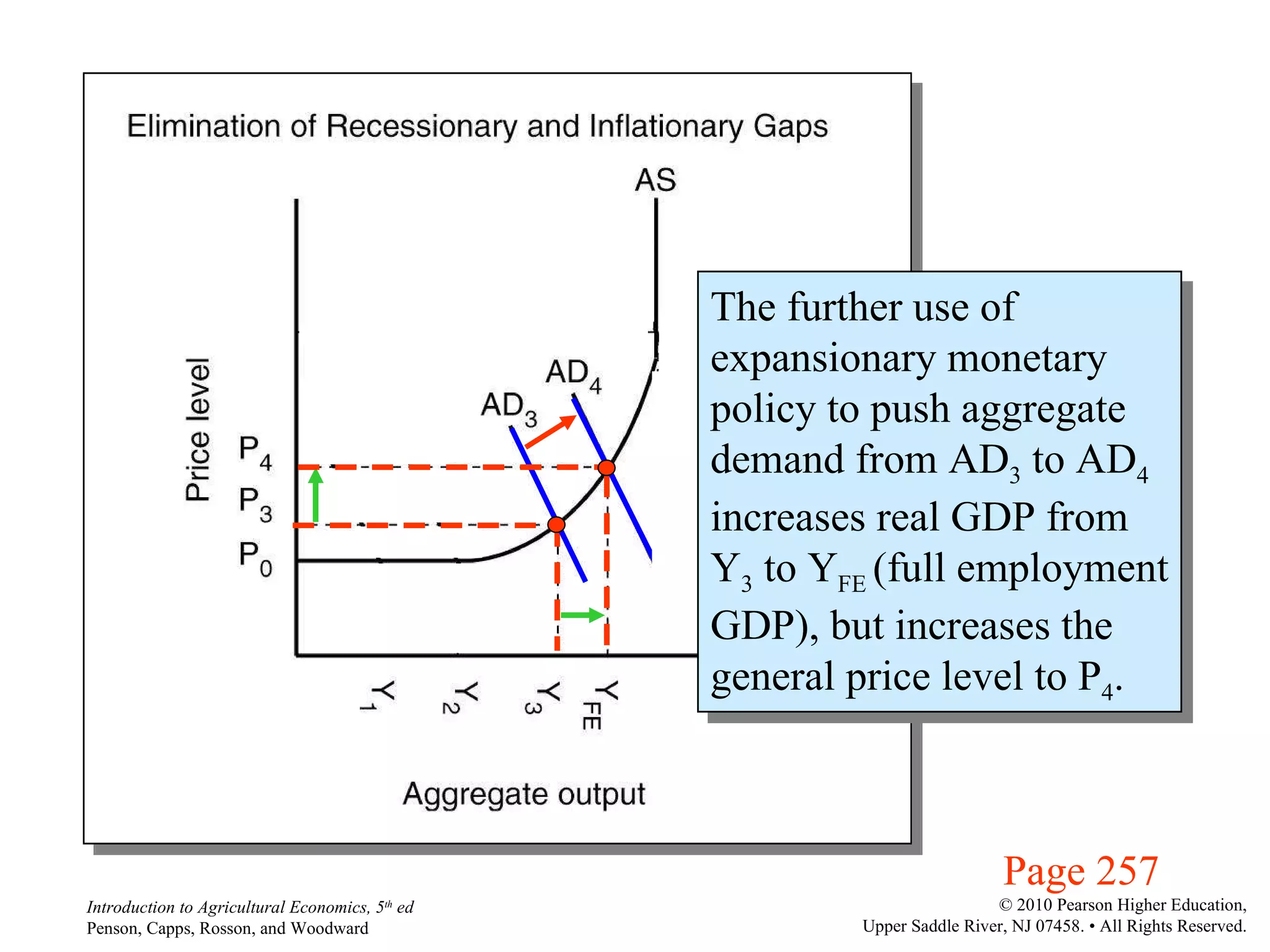

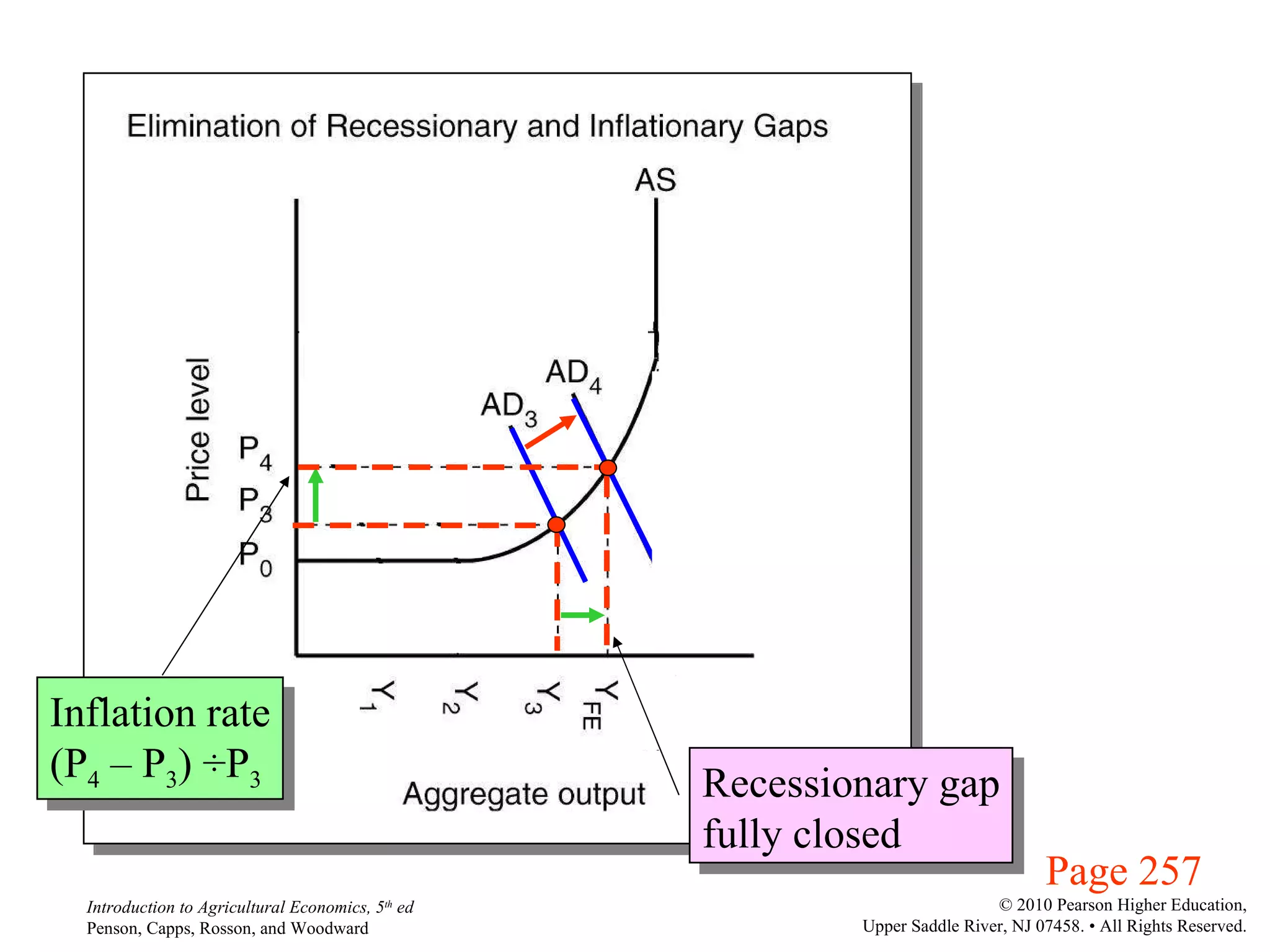

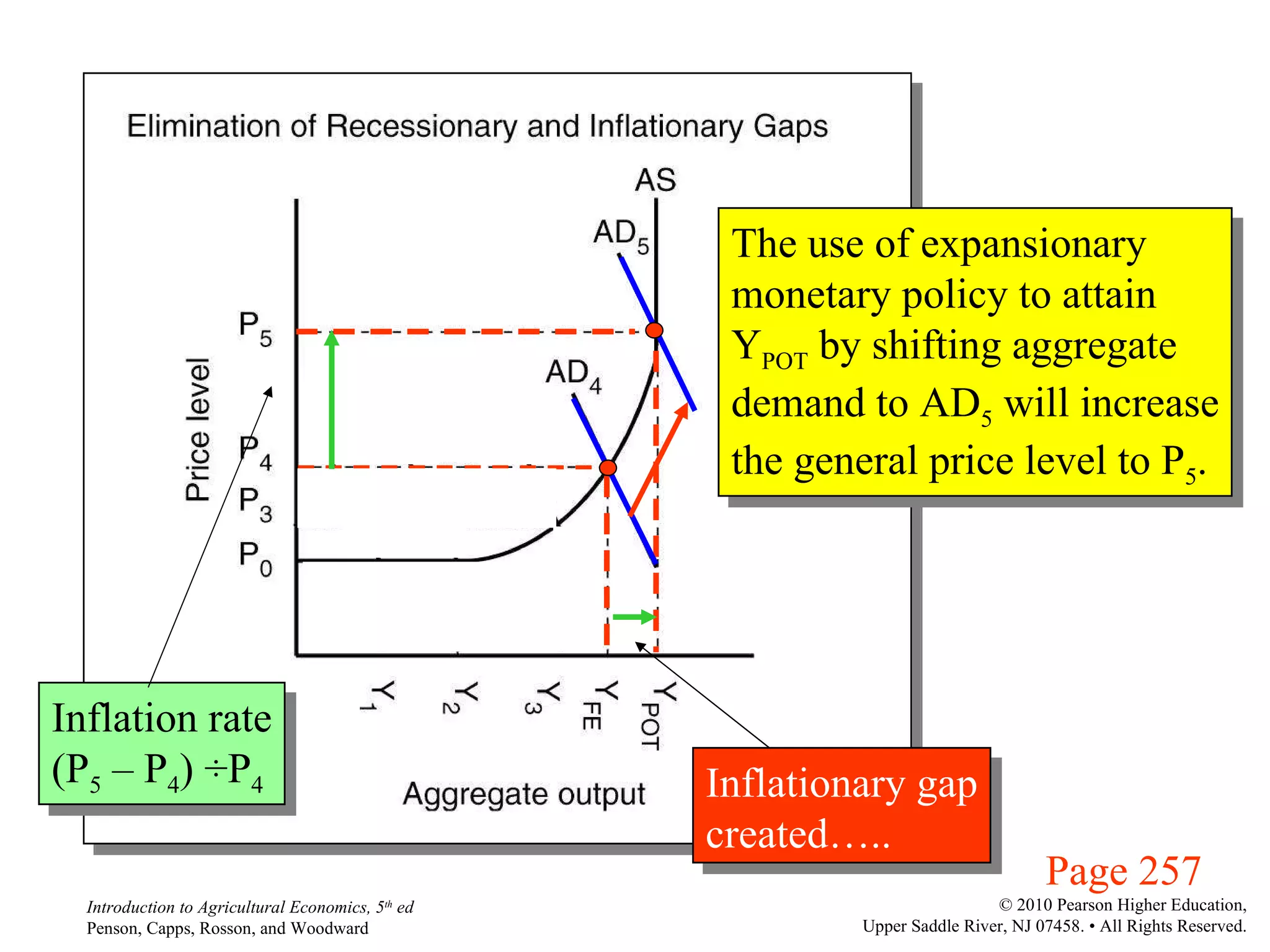

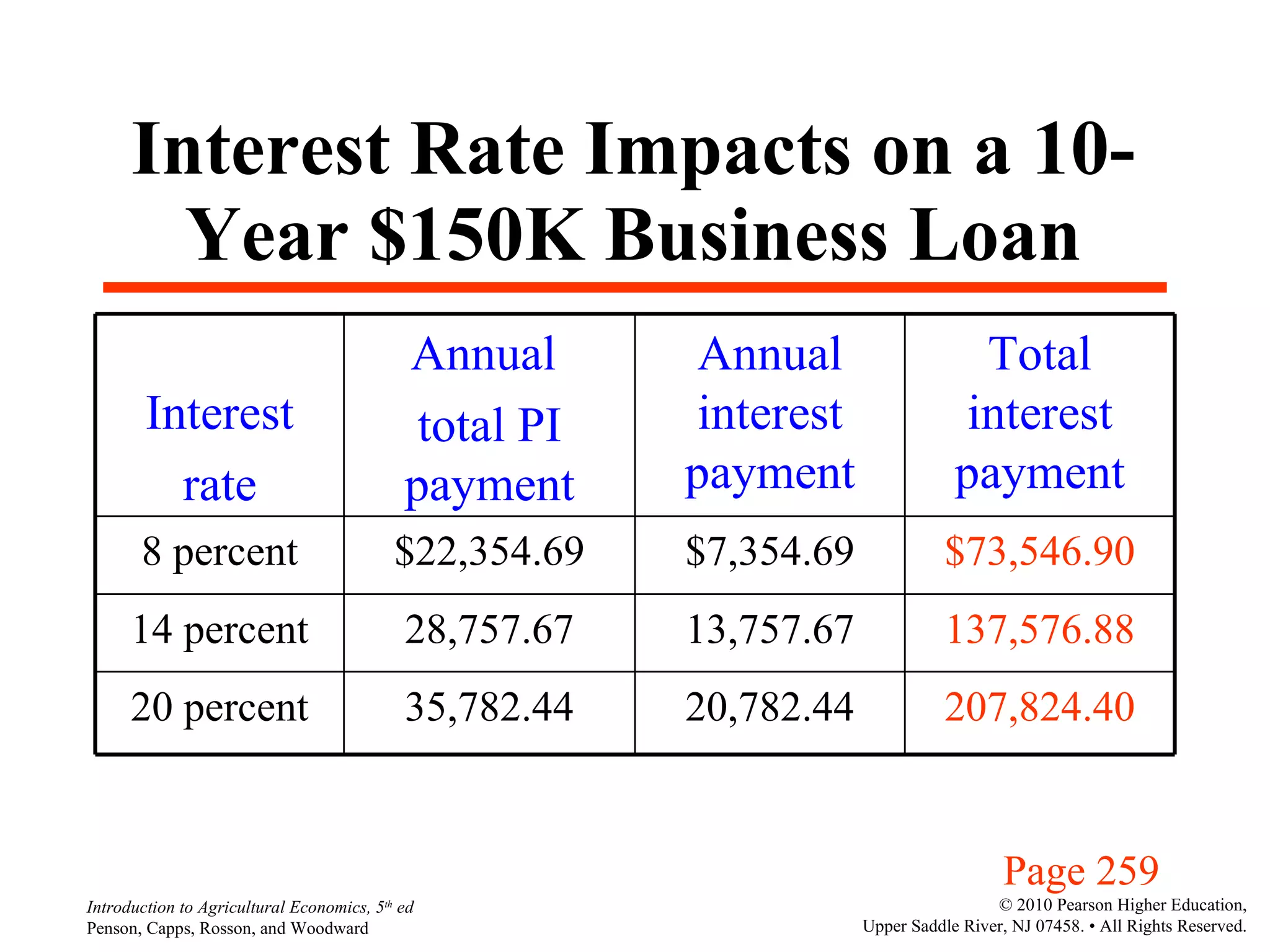

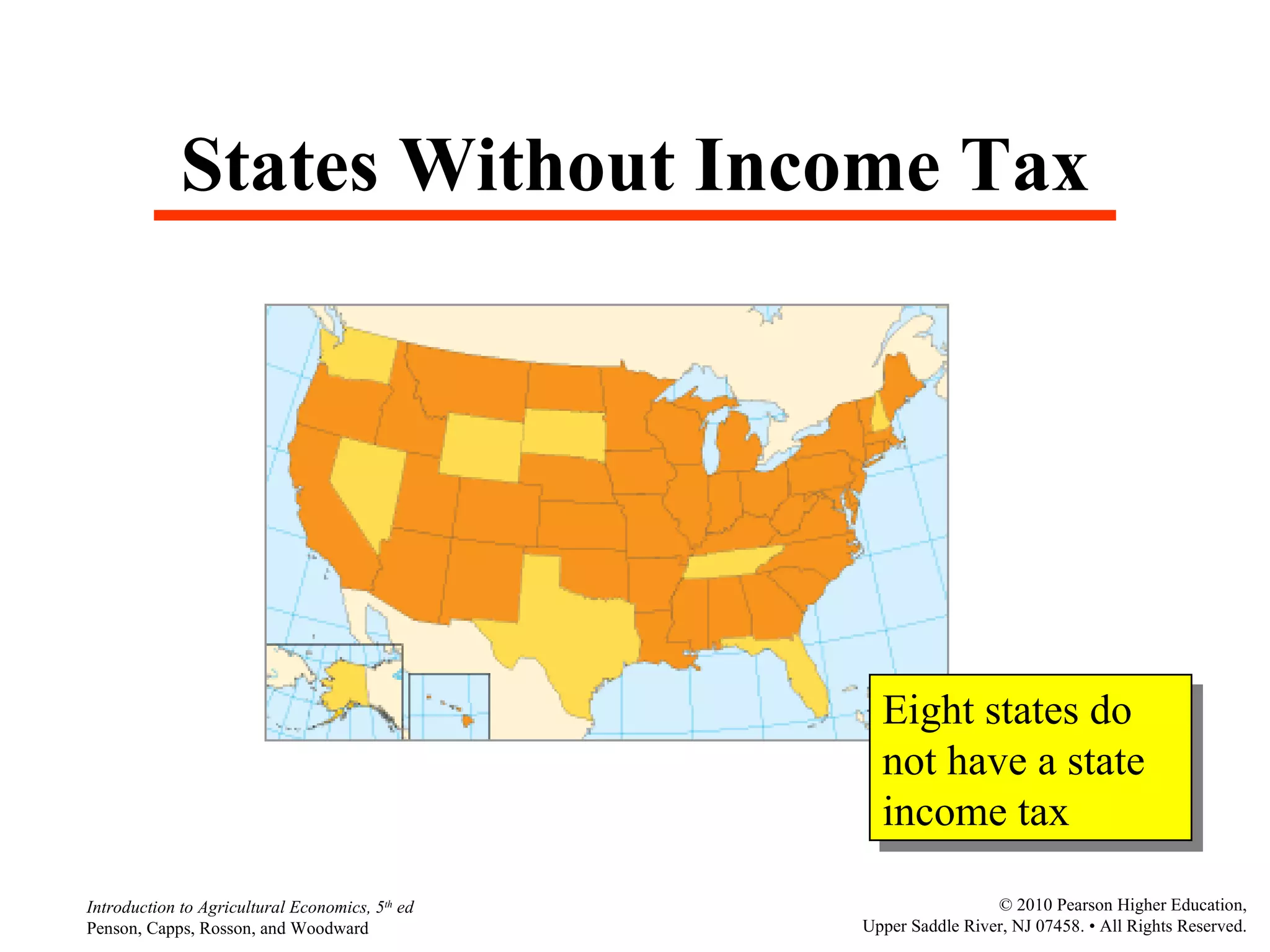

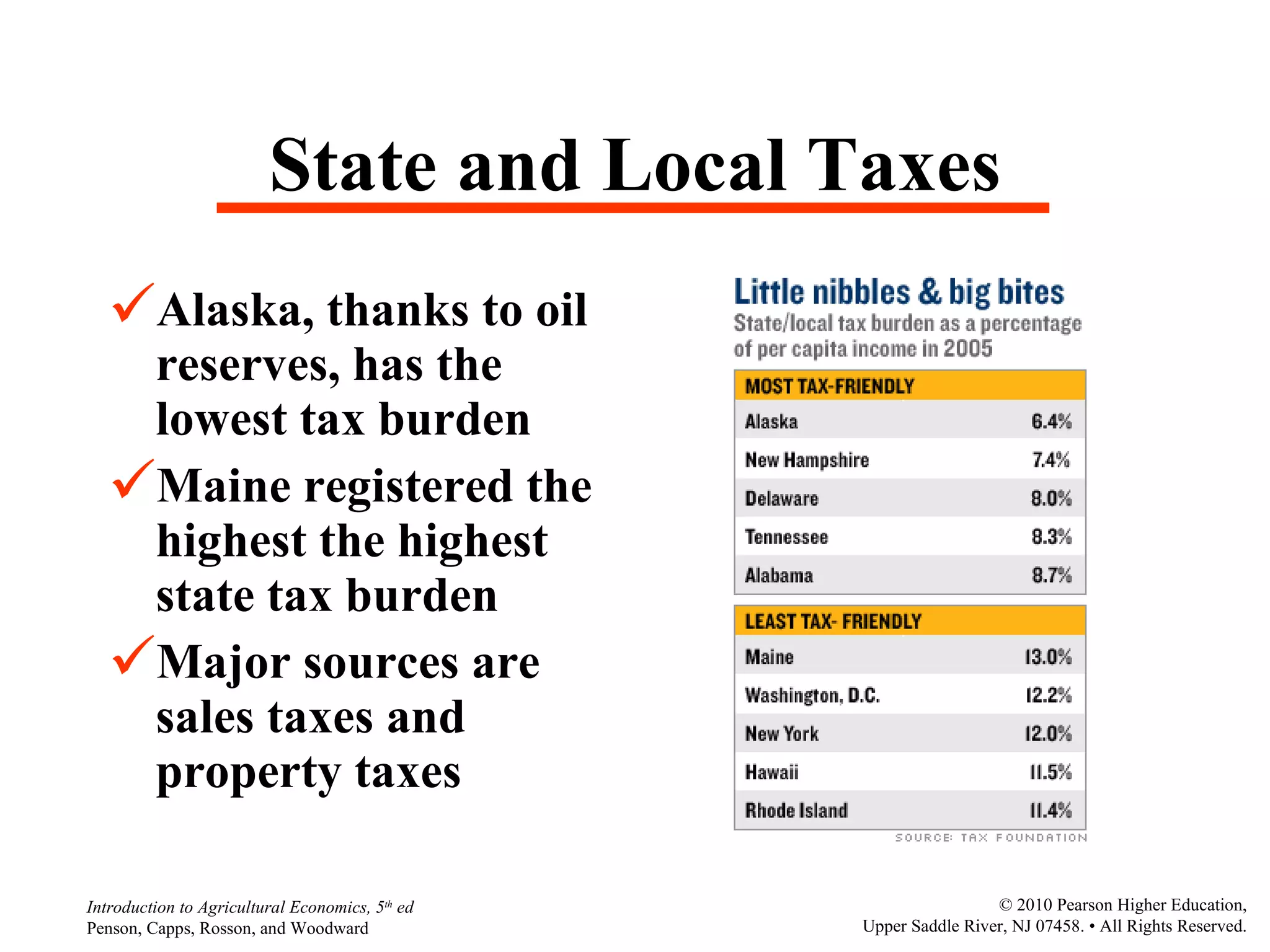

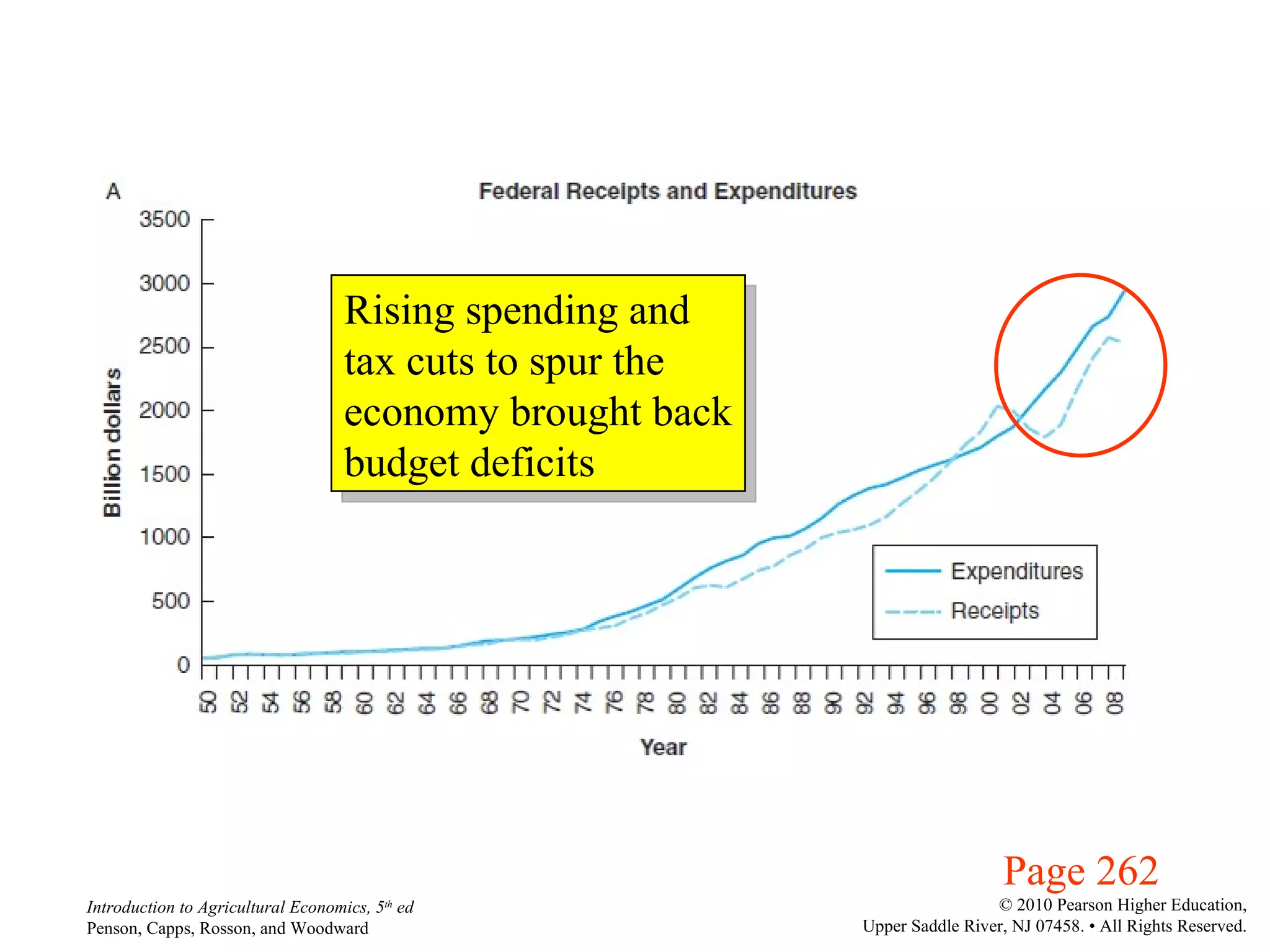

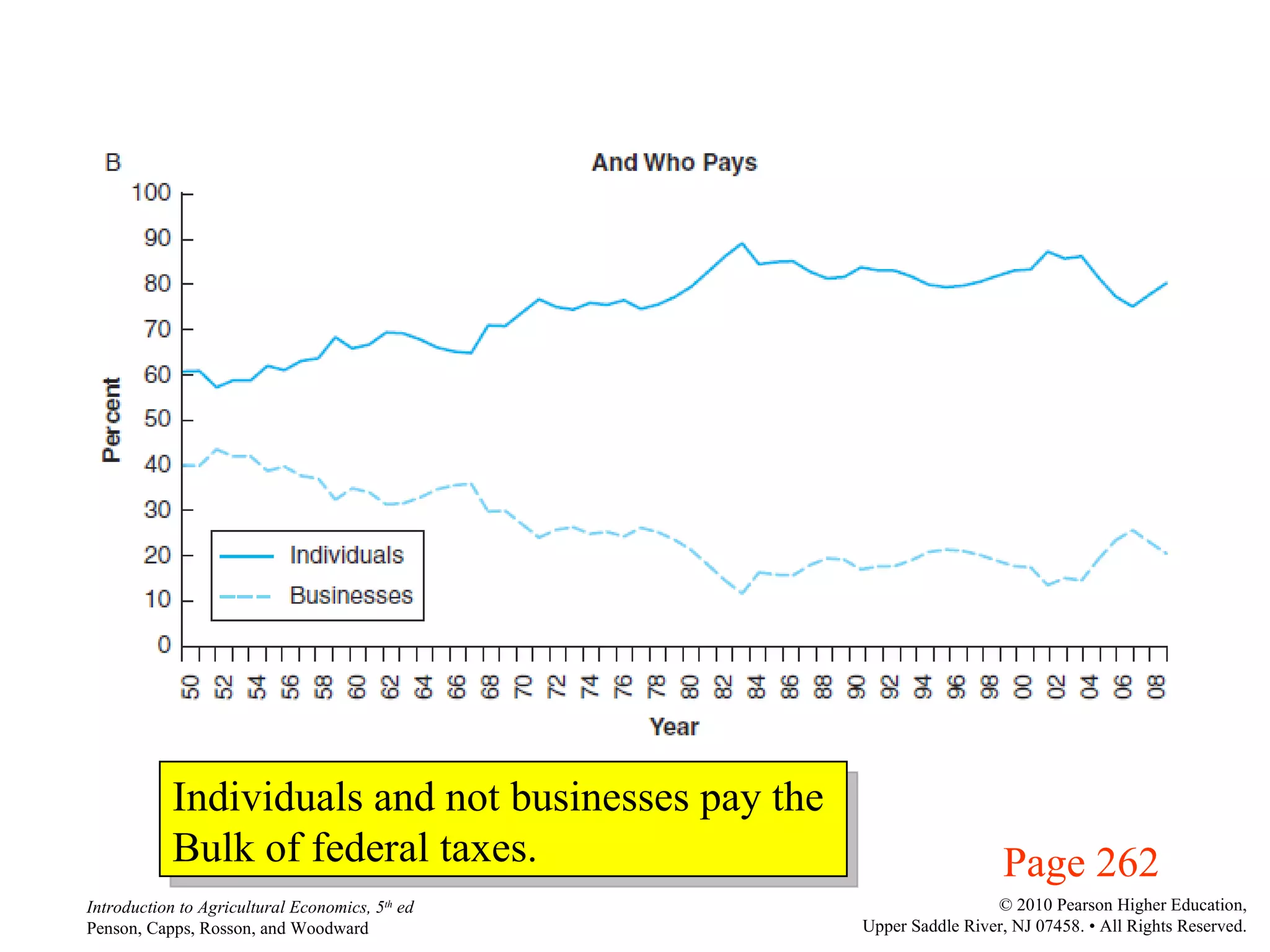

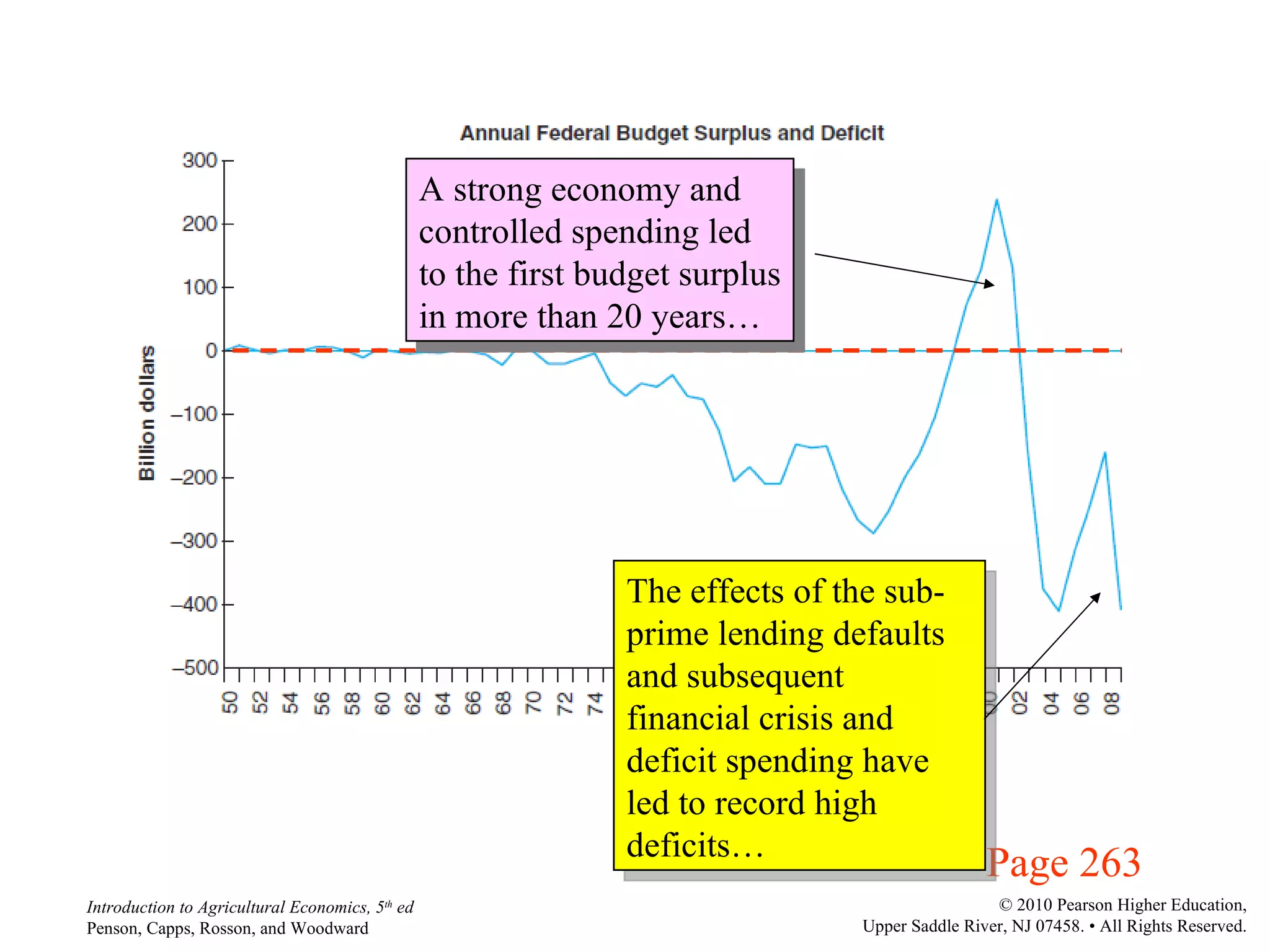

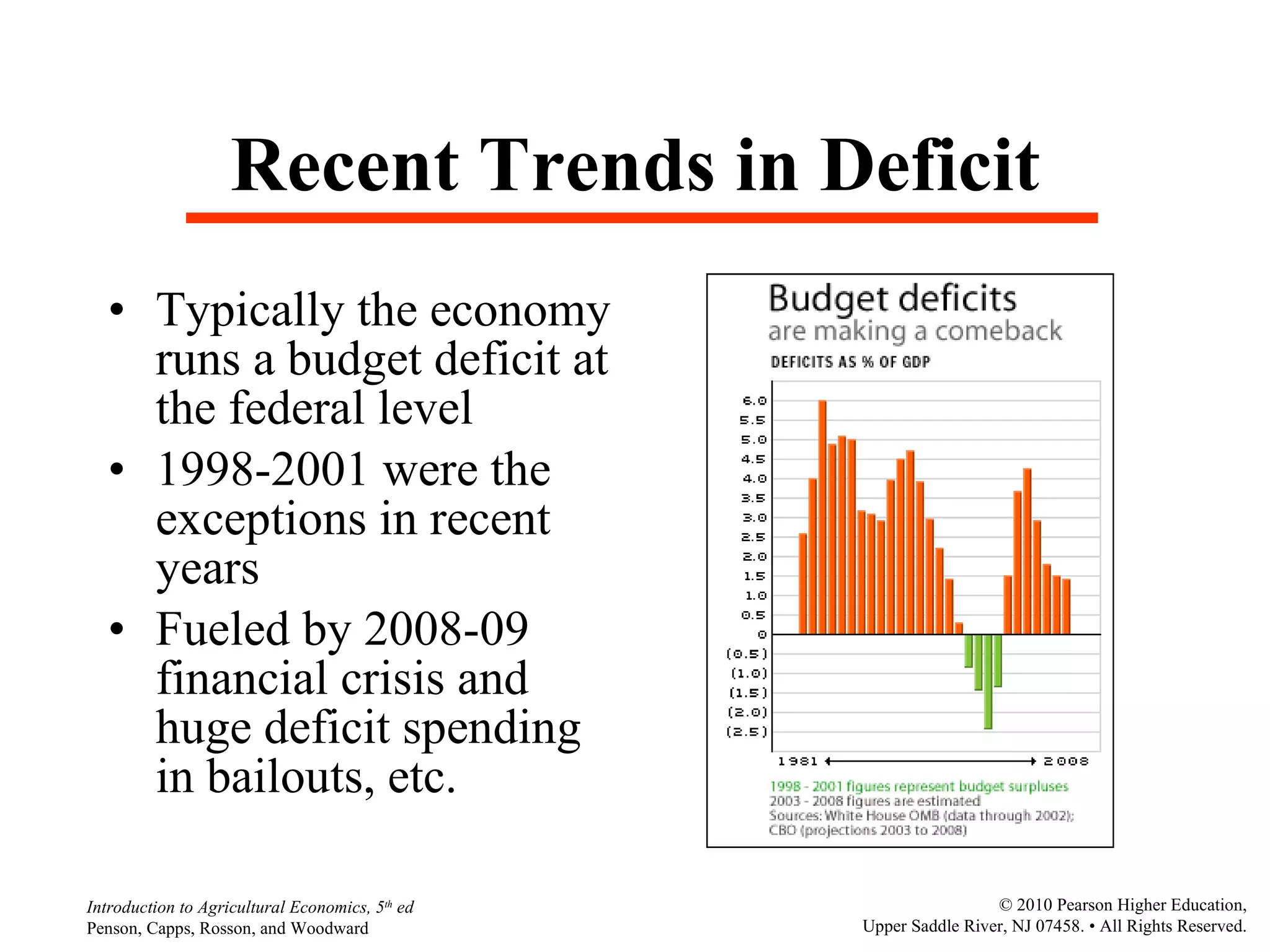

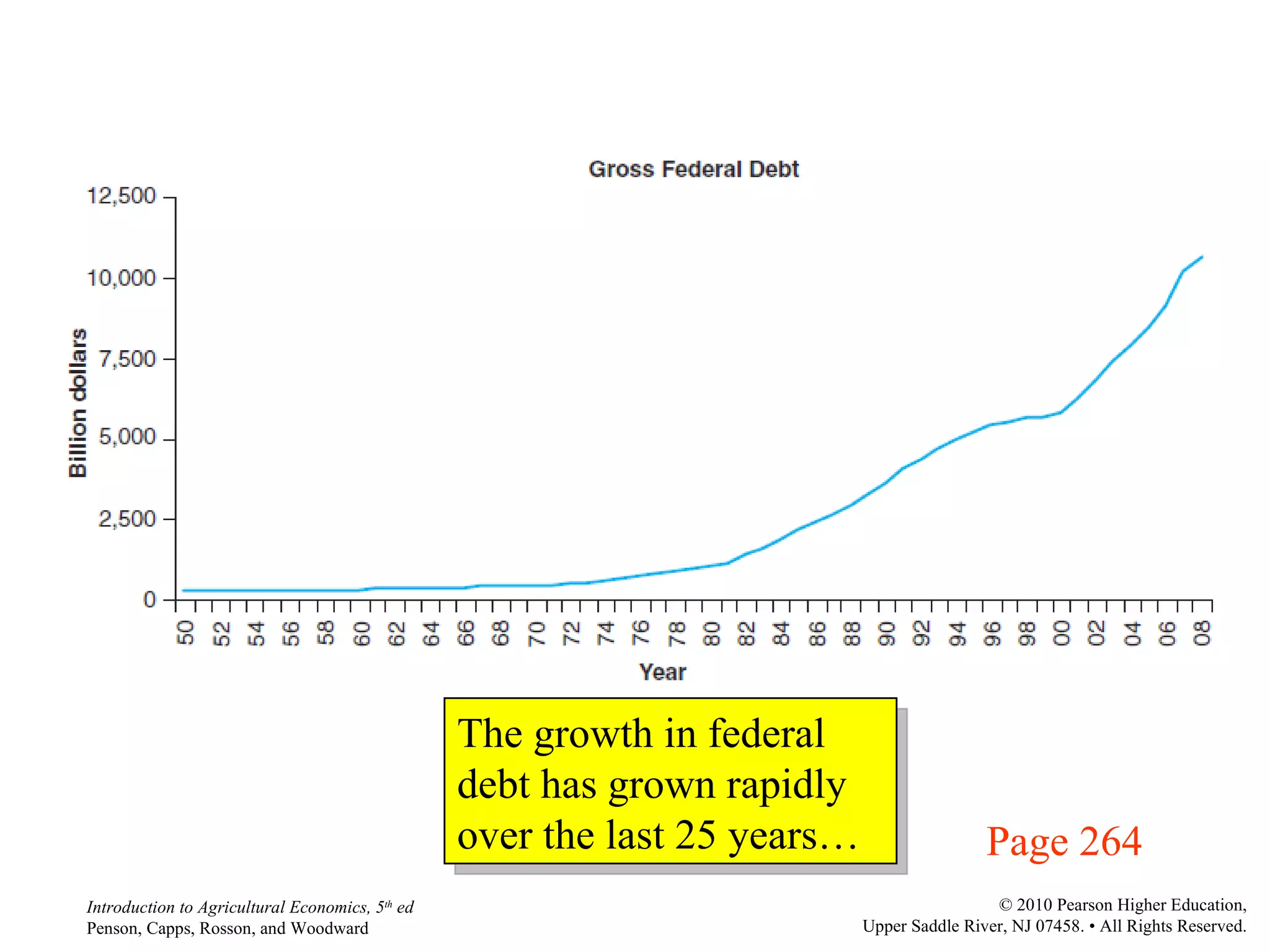

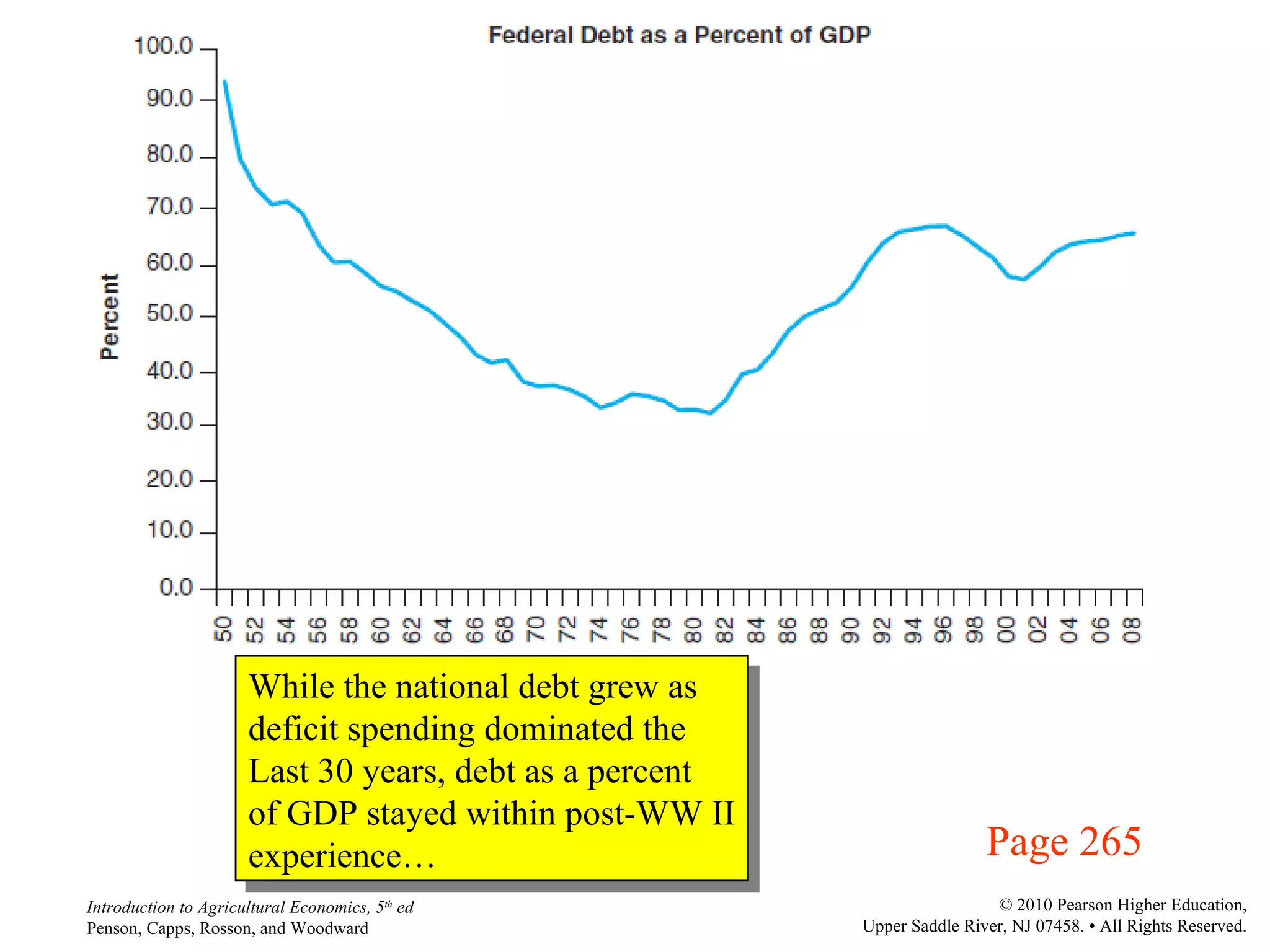

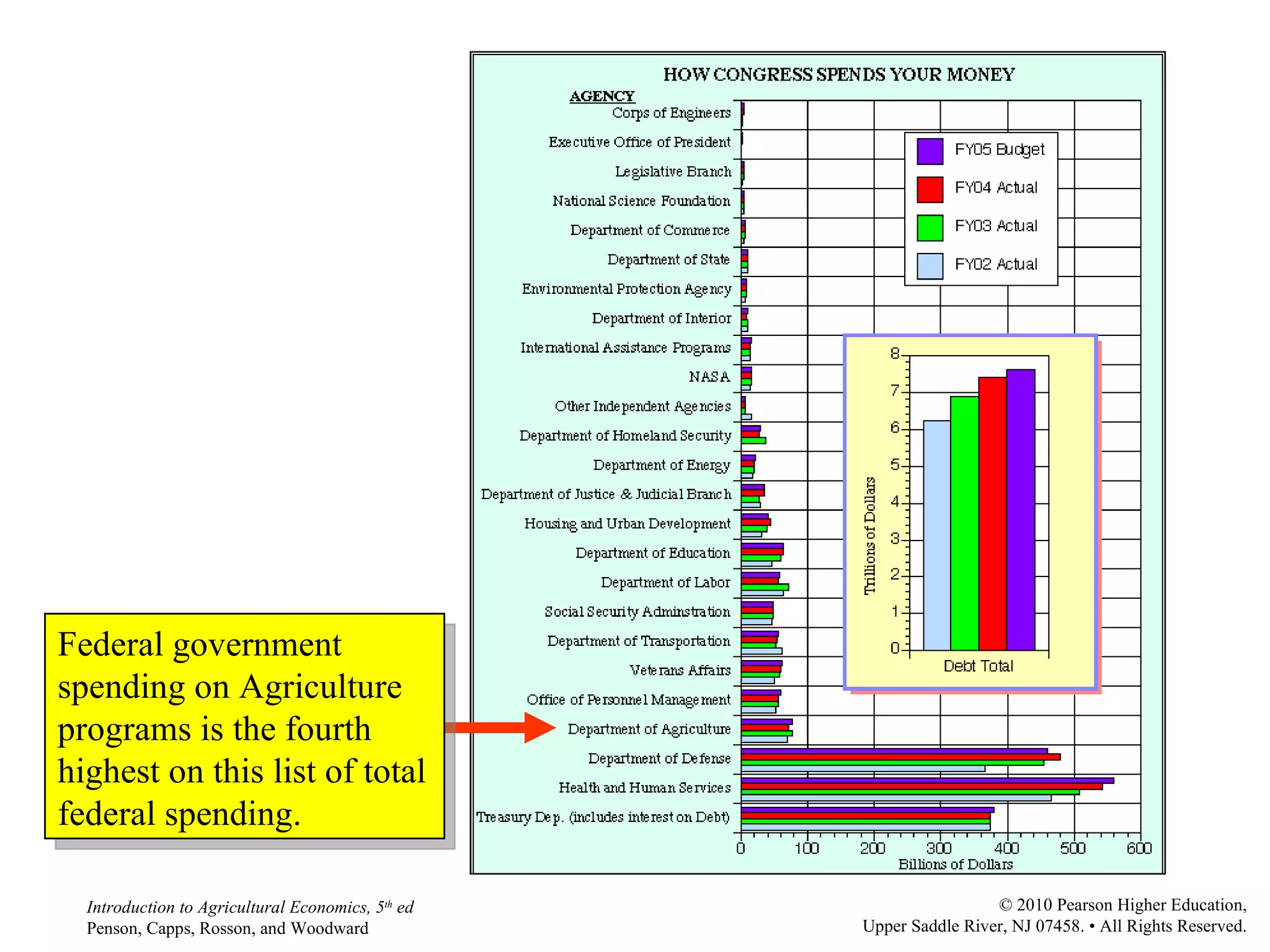

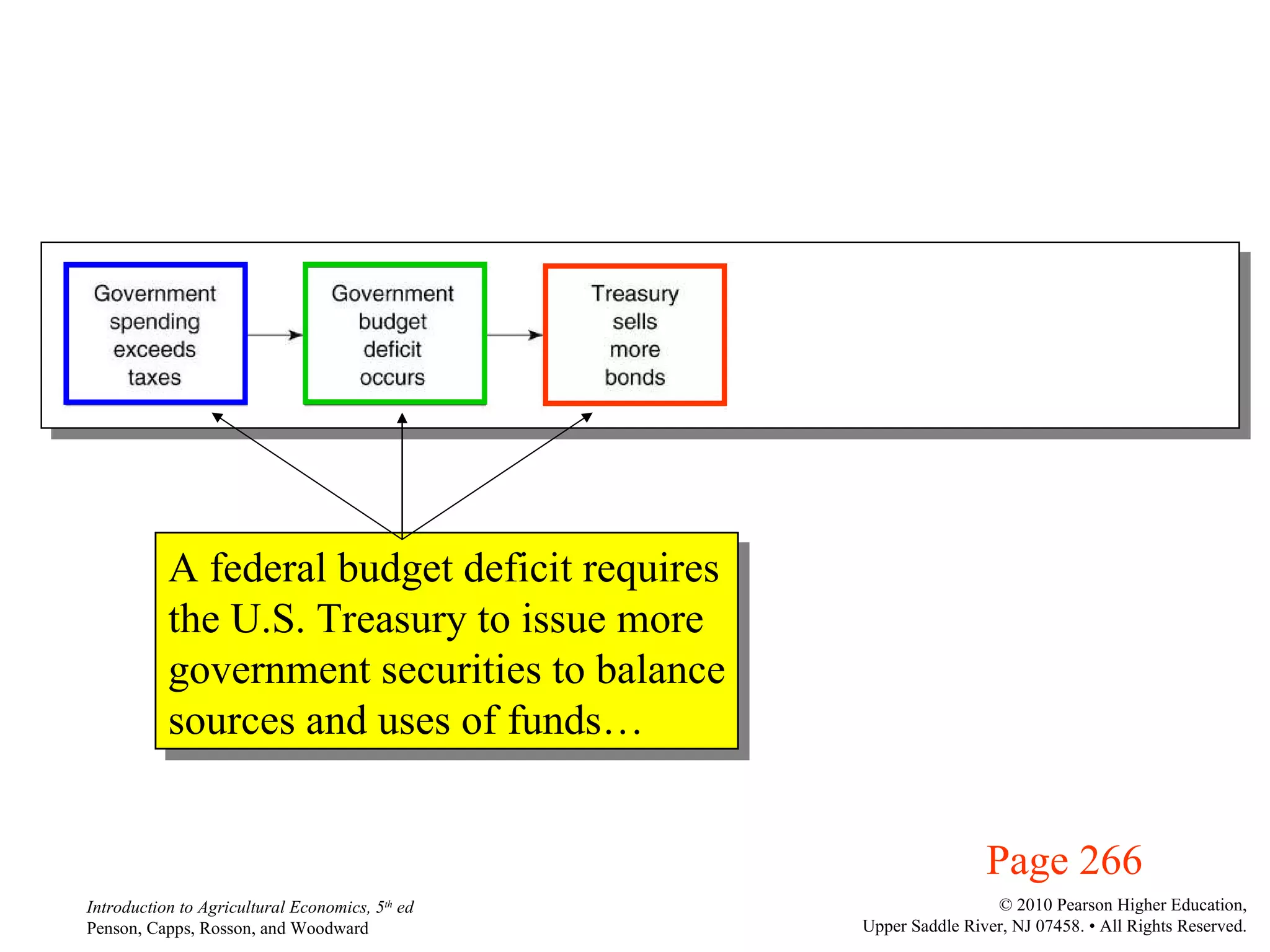

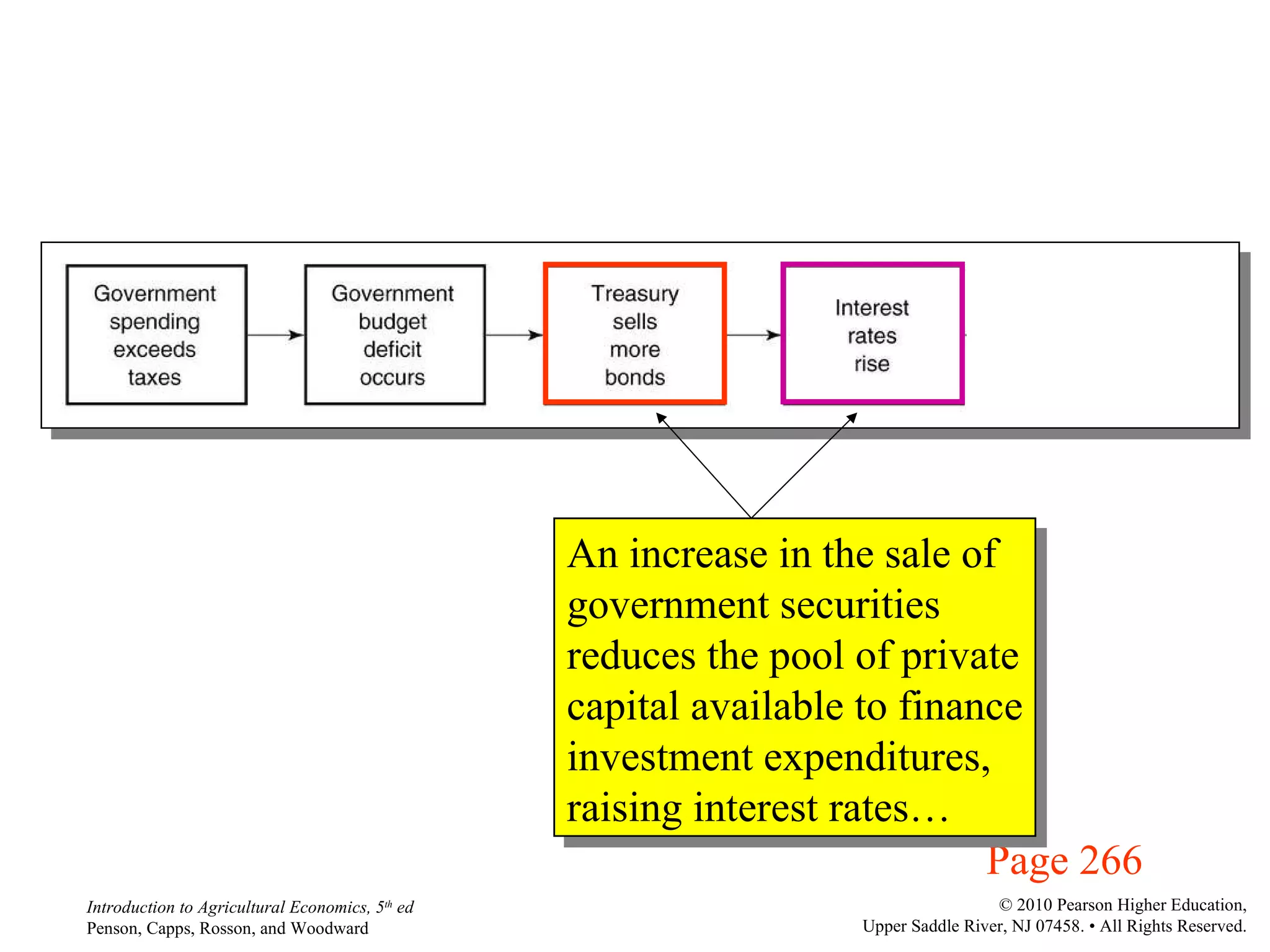

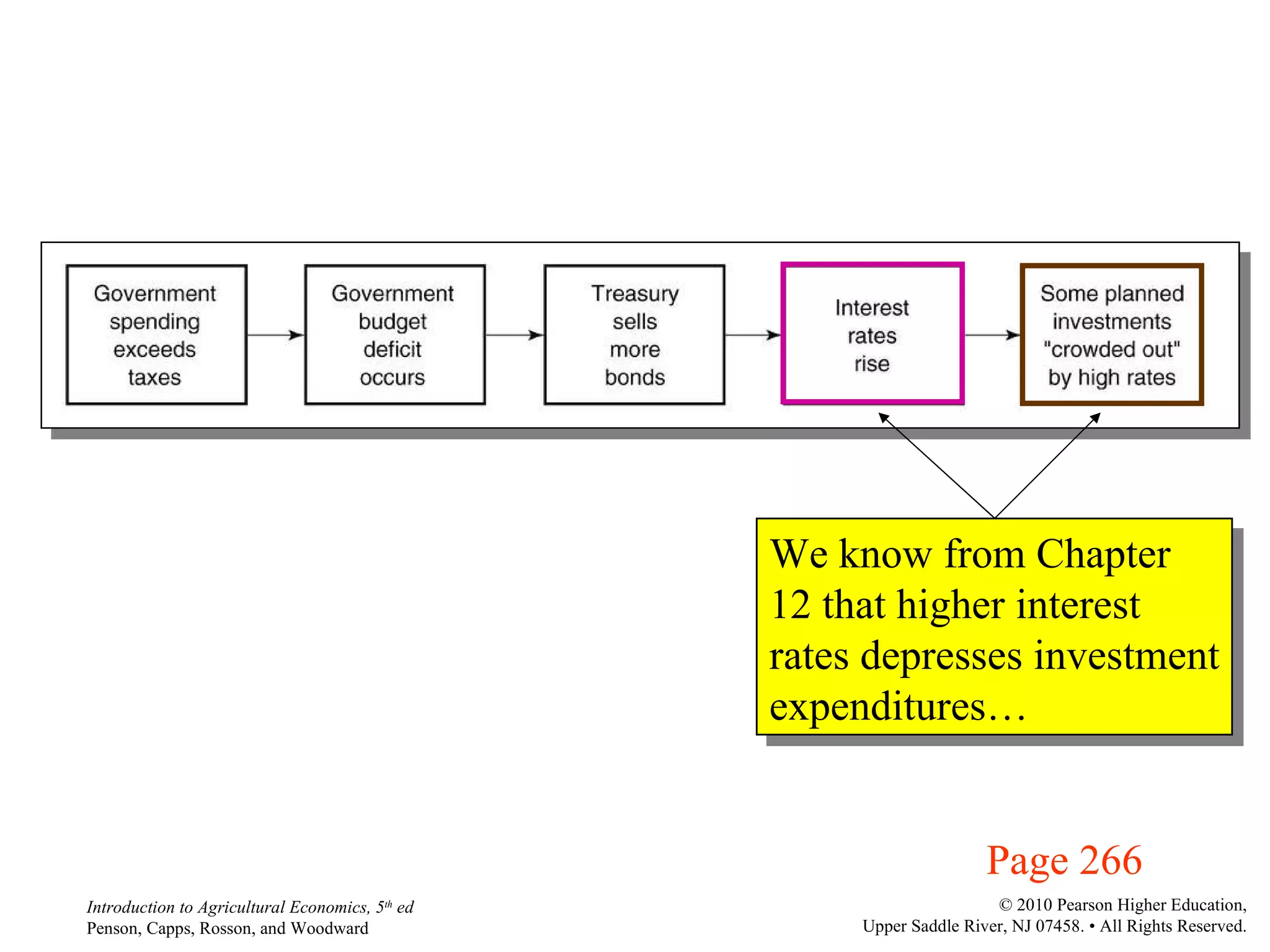

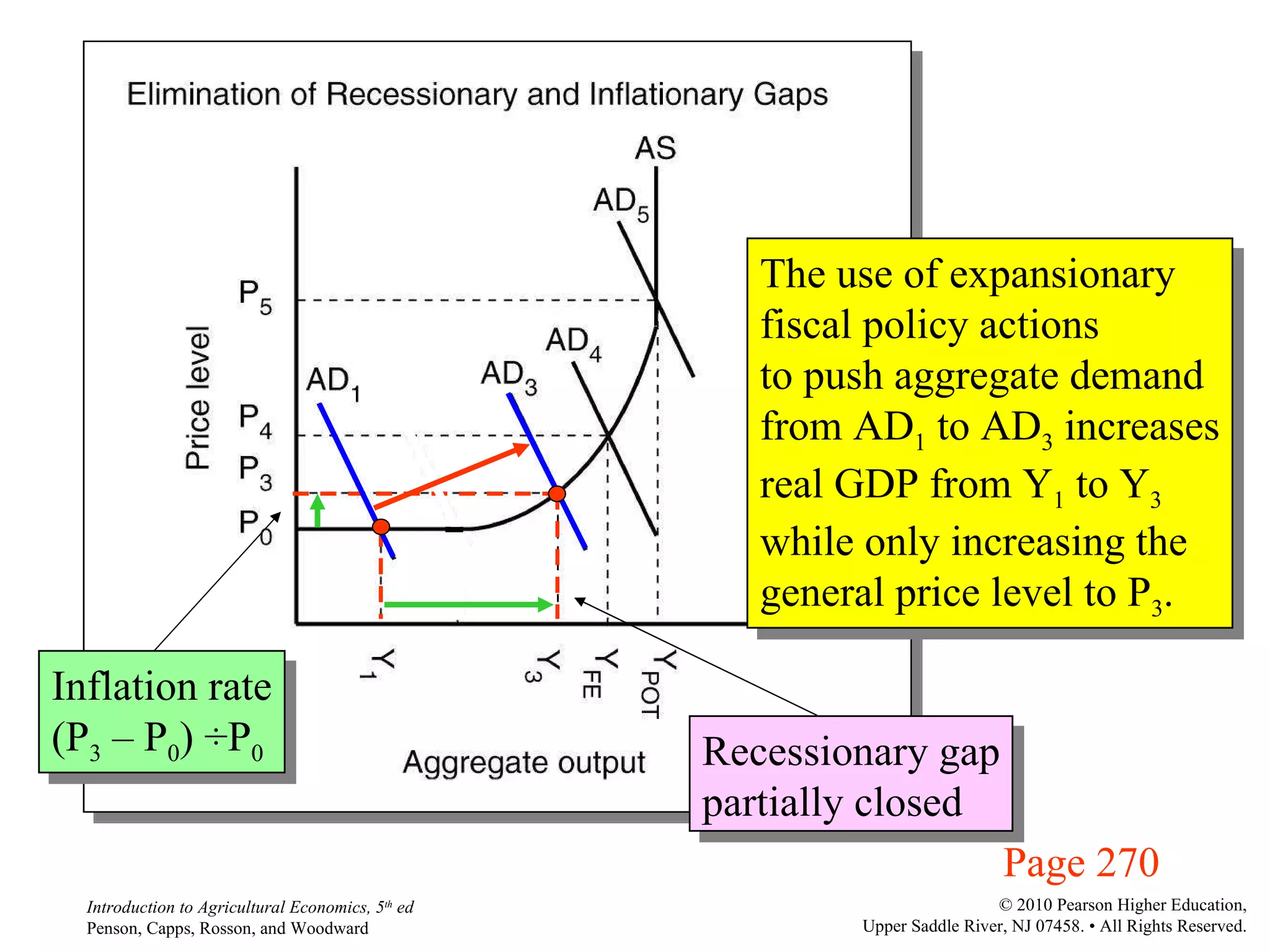

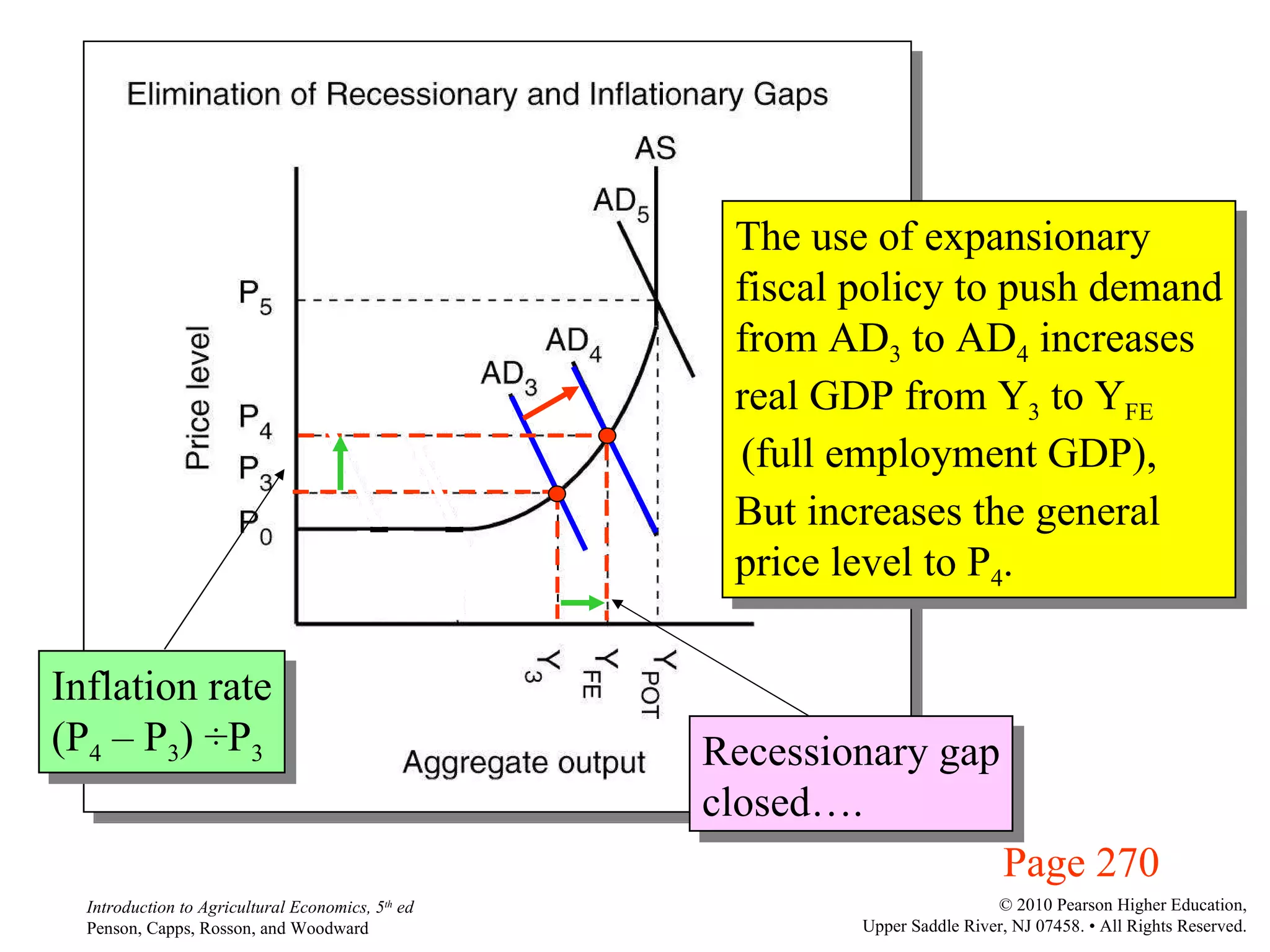

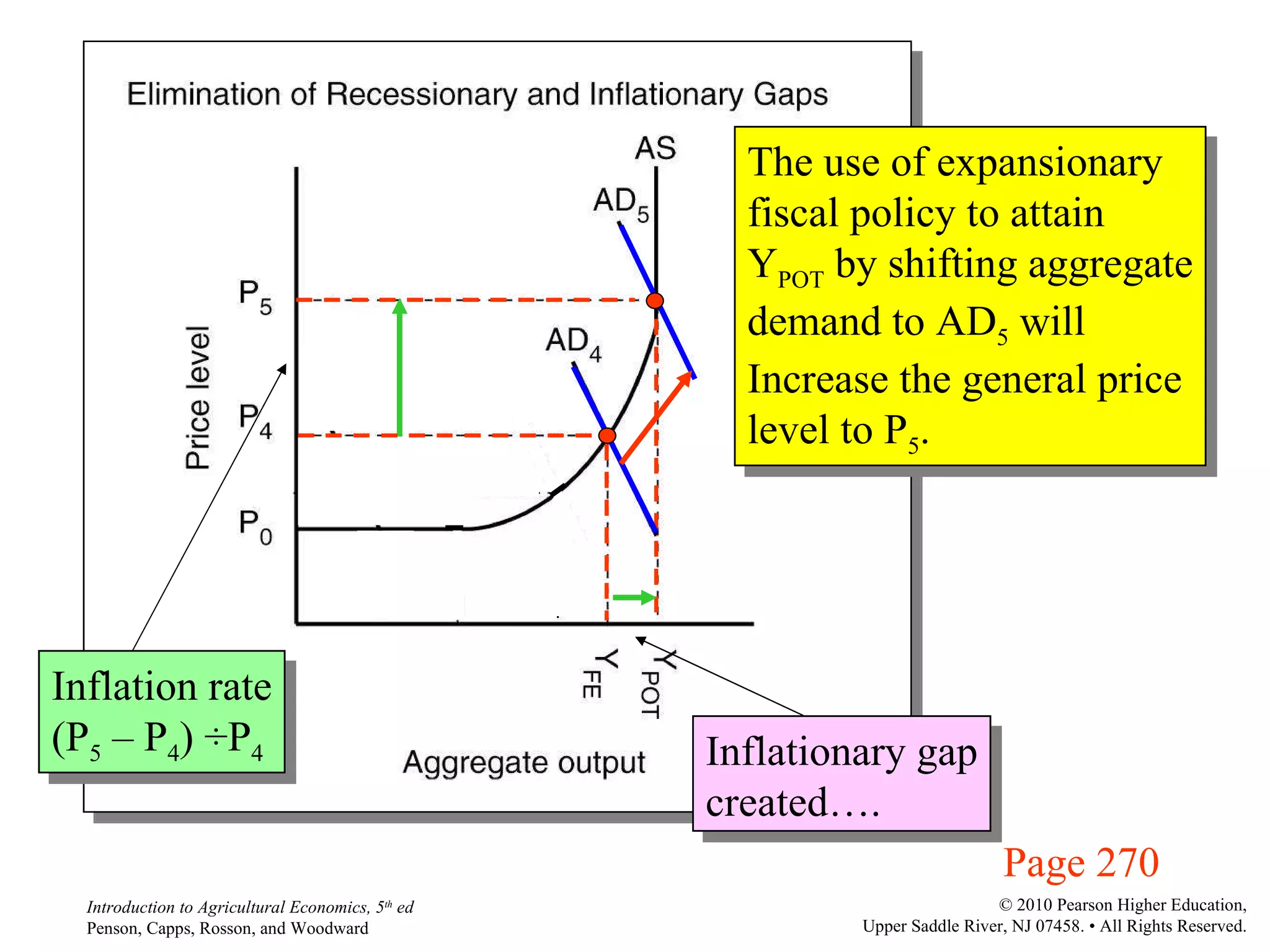

The document summarizes key topics in macroeconomic policy fundamentals including monetary policy conducted by the Federal Reserve System and fiscal policy at the federal level. It describes the functions of money and the Federal Reserve System, how the money supply is determined, and the effects of monetary policy tools. It also discusses fiscal policy tools used by the federal government, trends in budget deficits and national debt, and the impacts of expansionary and contractionary fiscal policy actions.