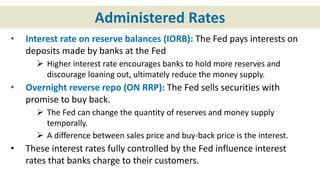

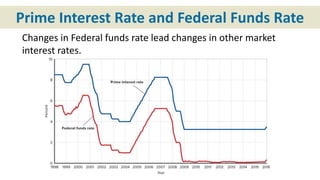

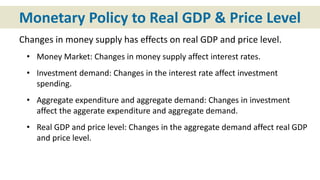

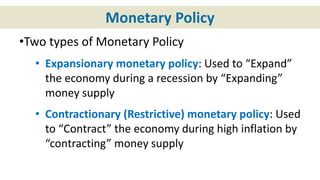

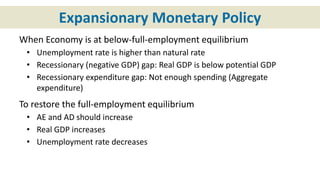

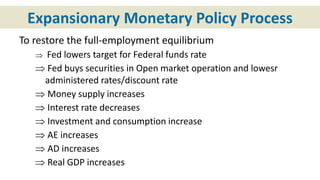

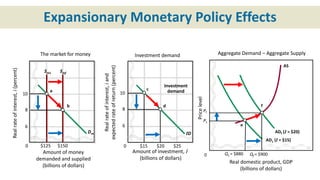

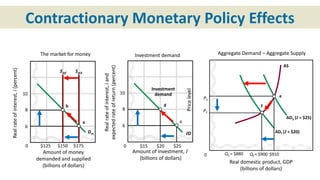

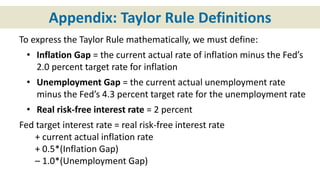

The document discusses monetary policy tools and their effects on economic variables. It describes the Federal Reserve's dual mandate of maximum employment and price stability. The four main tools of monetary policy are open market operations, the discount window, administered rates, and forward guidance. Expansionary monetary policy works to increase money supply and lower interest rates to boost aggregate demand and GDP during recessions. Contractionary policy has the opposite effects to curb inflation. Evaluation of monetary policy addresses its advantages over fiscal policy as well as limitations.