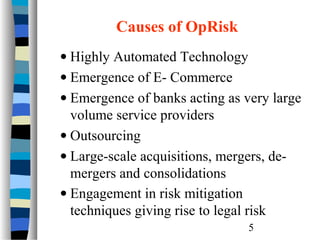

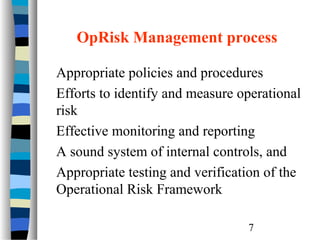

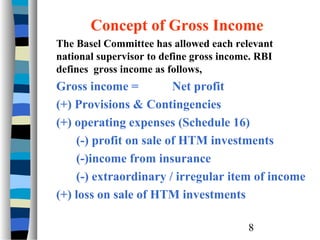

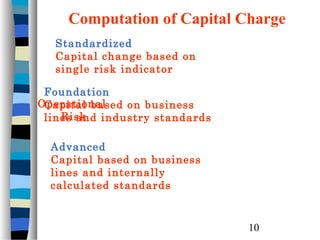

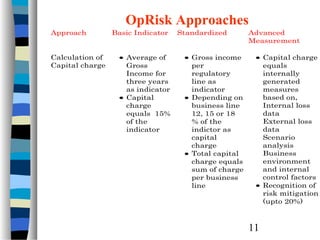

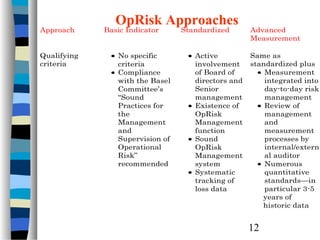

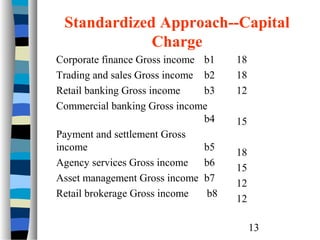

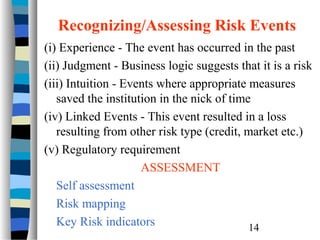

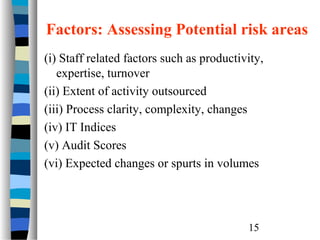

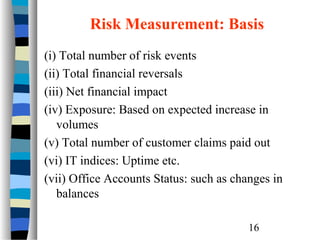

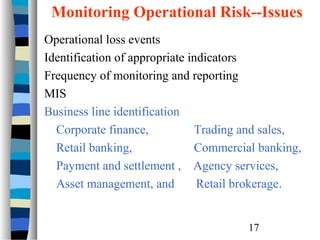

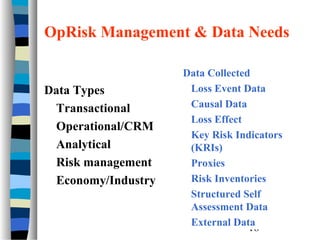

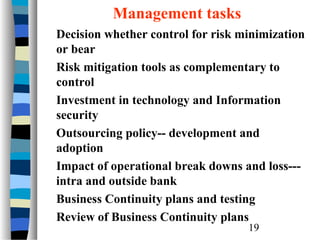

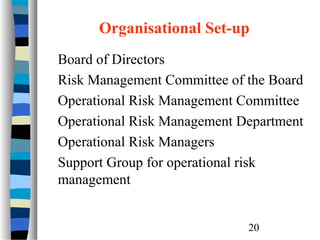

This document discusses operational risk management. It begins with definitions of operational risk and management of operational risk. It then lists common causes of operational risk including internal and external fraud, employment practices, clients/products, damage to assets, business disruption, execution errors, highly automated technology, e-commerce, outsourcing, and mergers and acquisitions. It discusses approaches to calculating capital charges for operational risk under the basic indicator, standardized, and advanced measurement approaches. It also outlines factors for assessing and measuring operational risk events, monitoring operational risk, and data needs for operational risk management. Finally, it discusses management tasks related to operational risk mitigation and the typical organizational set-up for operational risk management.