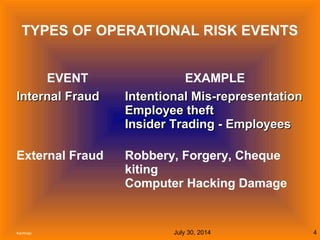

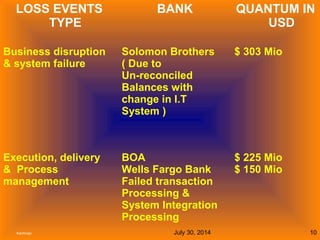

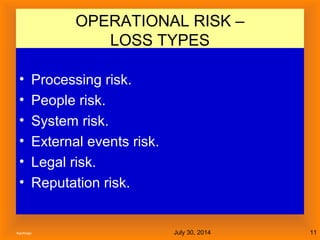

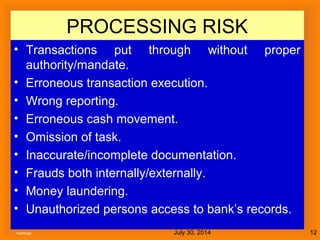

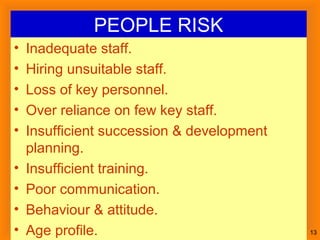

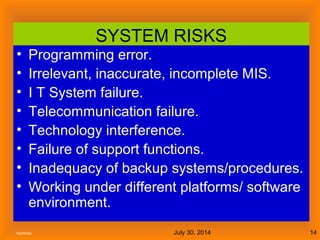

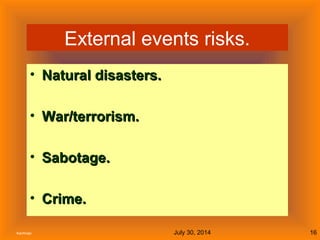

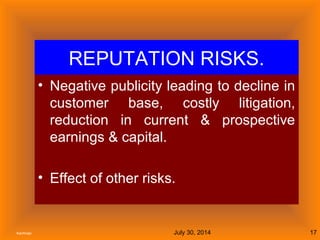

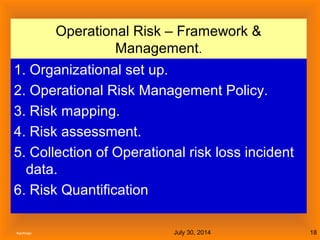

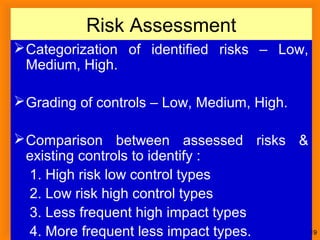

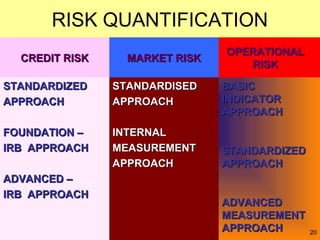

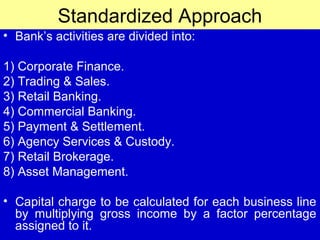

Operational risk is the risk of loss from failed internal processes, people, systems or external events. It is embedded in all bank activities and processes. Major types of operational risk include internal and external fraud, workplace issues, damage to physical assets, business disruptions, client/product issues, and legal risks. Common operational risk events in banking include losses from internal fraud, external fraud, improper sales practices, physical damage, system failures, and failed transaction processing. The document outlines approaches for quantifying and measuring operational risk, including the Basic Indicator Approach, Standardized Approach, and Advanced Measurement Approach. The Advanced Measurement Approach, which uses internal loss data and assessment methods, is most beneficial for banks.