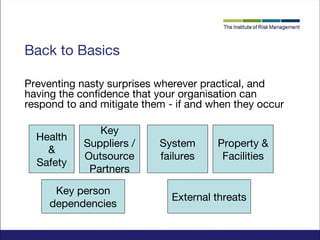

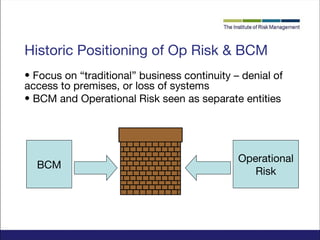

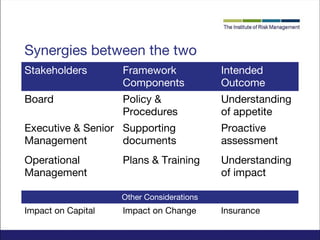

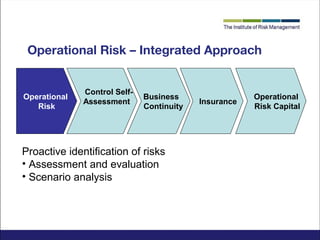

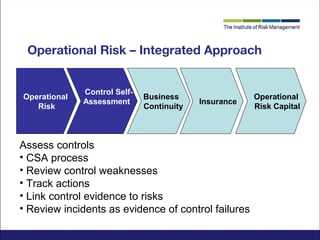

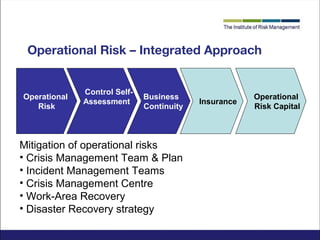

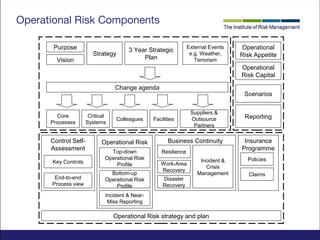

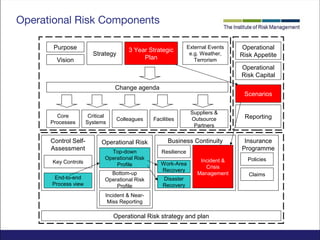

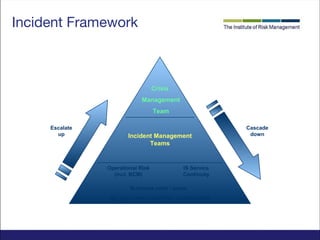

The document discusses integrating operational risk management and business continuity management approaches. It argues that taking an integrated approach provides synergies between the two frameworks in terms of stakeholders, framework components, and intended outcomes. An integrated approach allows for a proactive identification and assessment of risks, evaluation of controls, mitigation of operational risks through business continuity plans and insurance, and calculation of capital requirements. Embedding the integrated approach culturally is also important. The presentation concludes that an integrated operational risk and business continuity framework can help define risk appetite, be practical and simple for businesses to implement, and drive efficiencies.