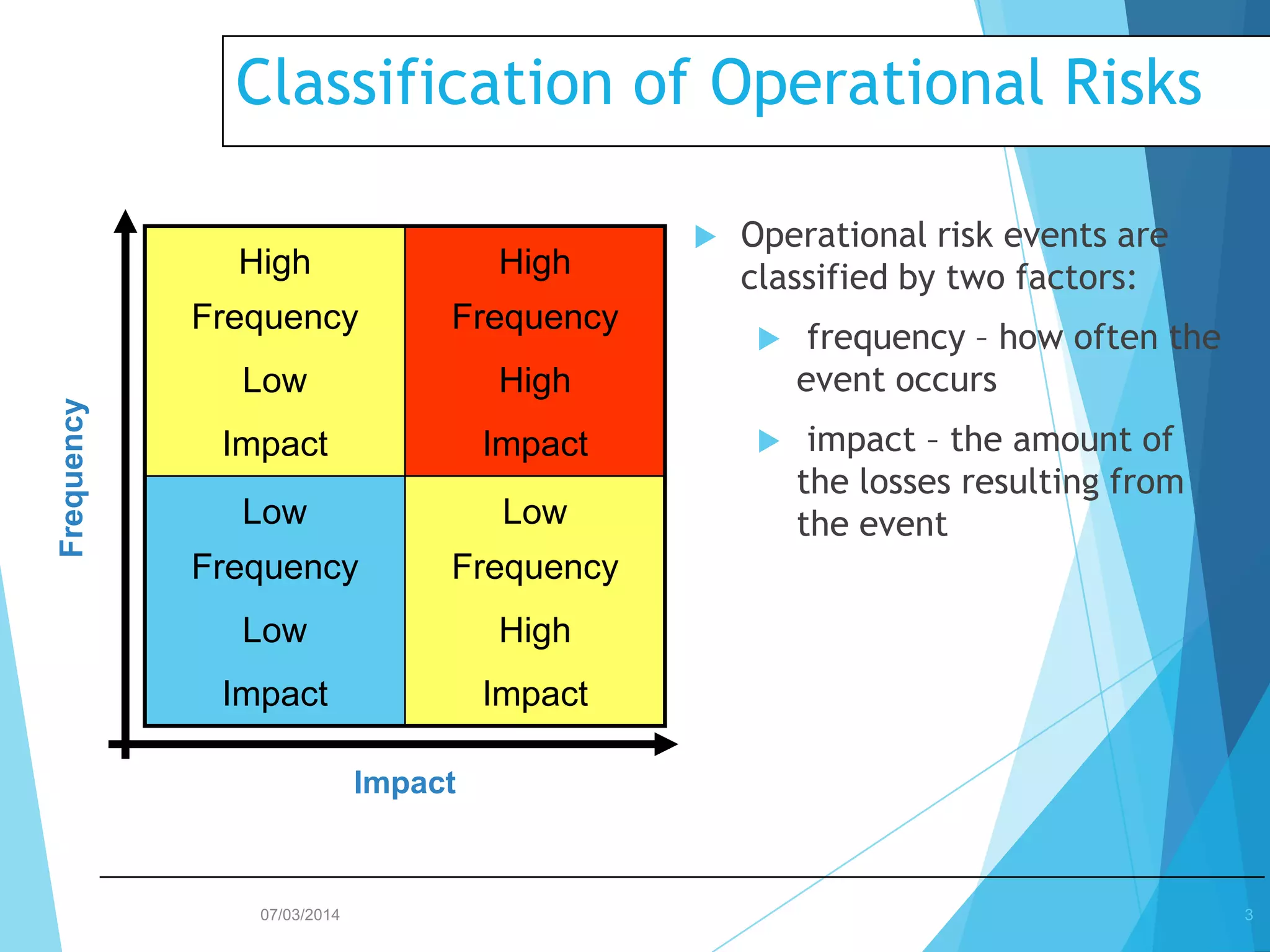

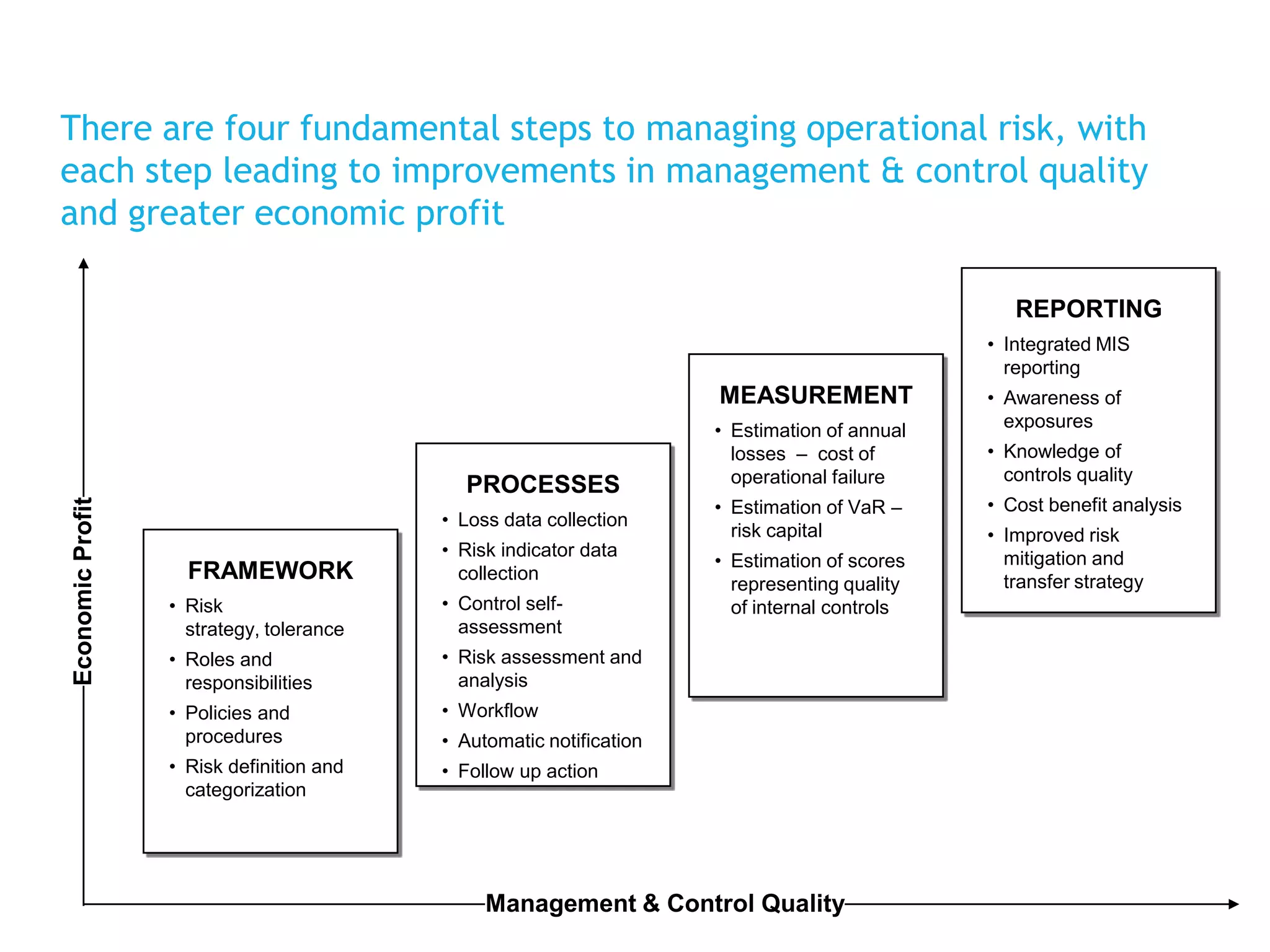

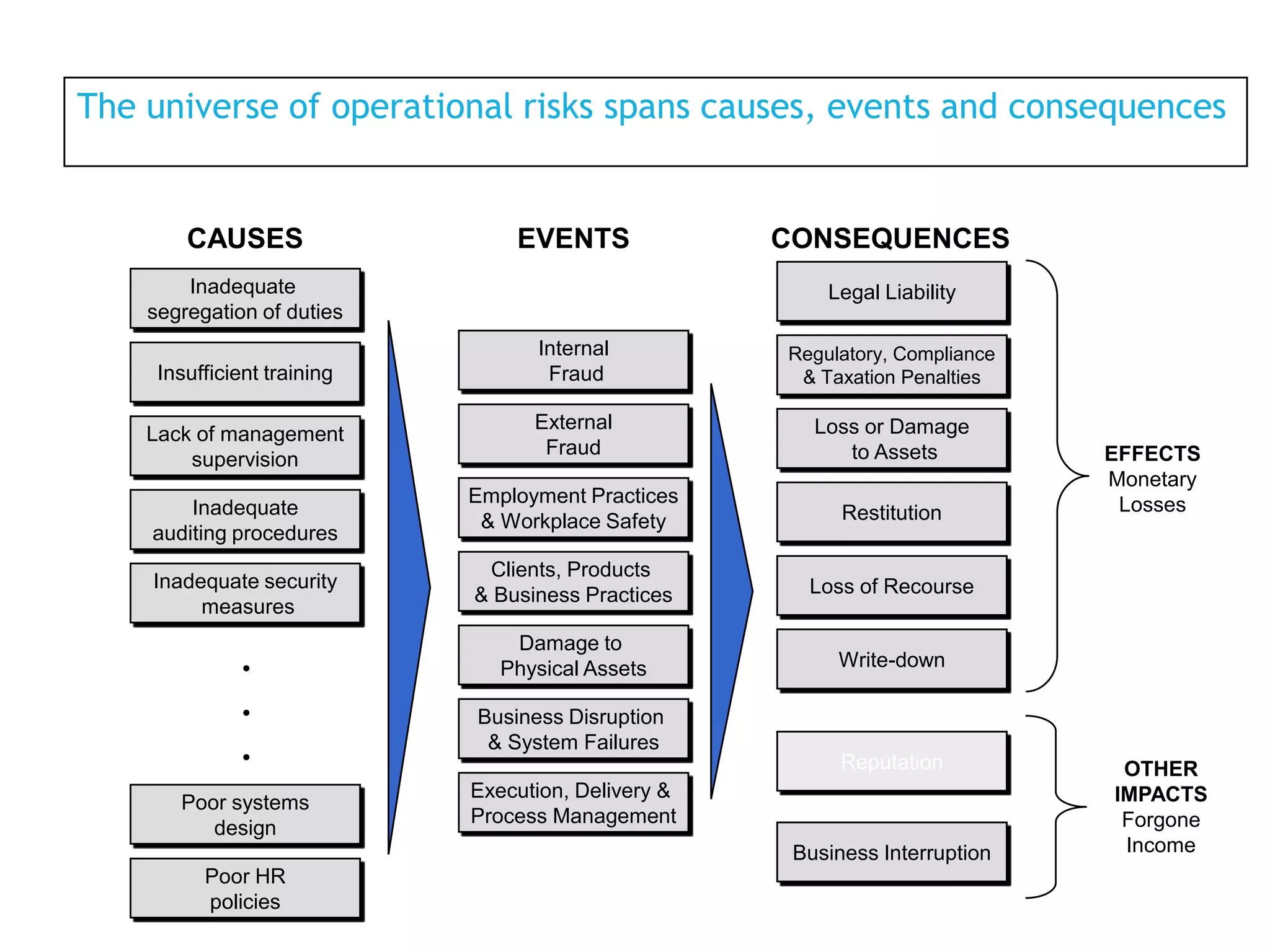

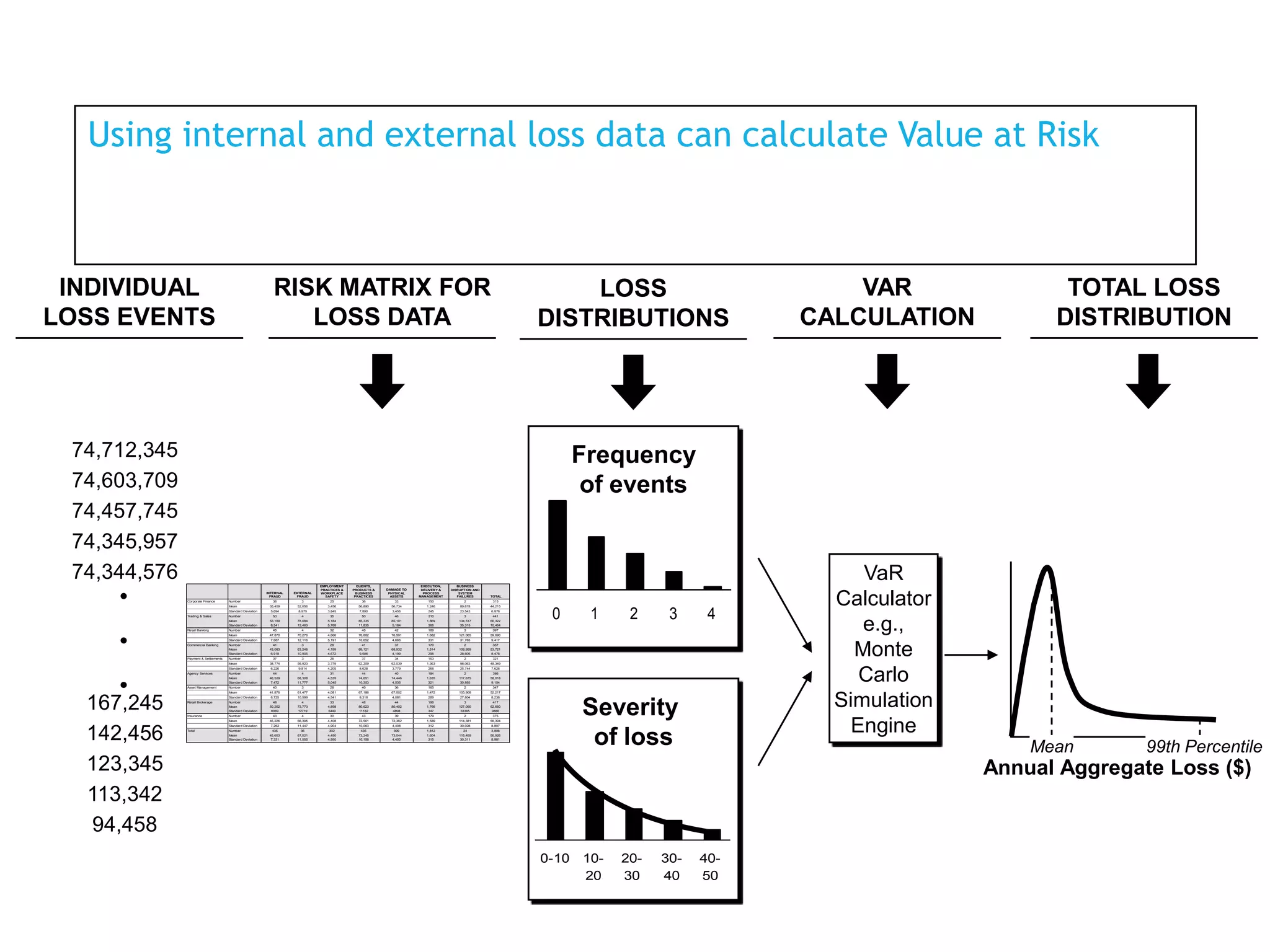

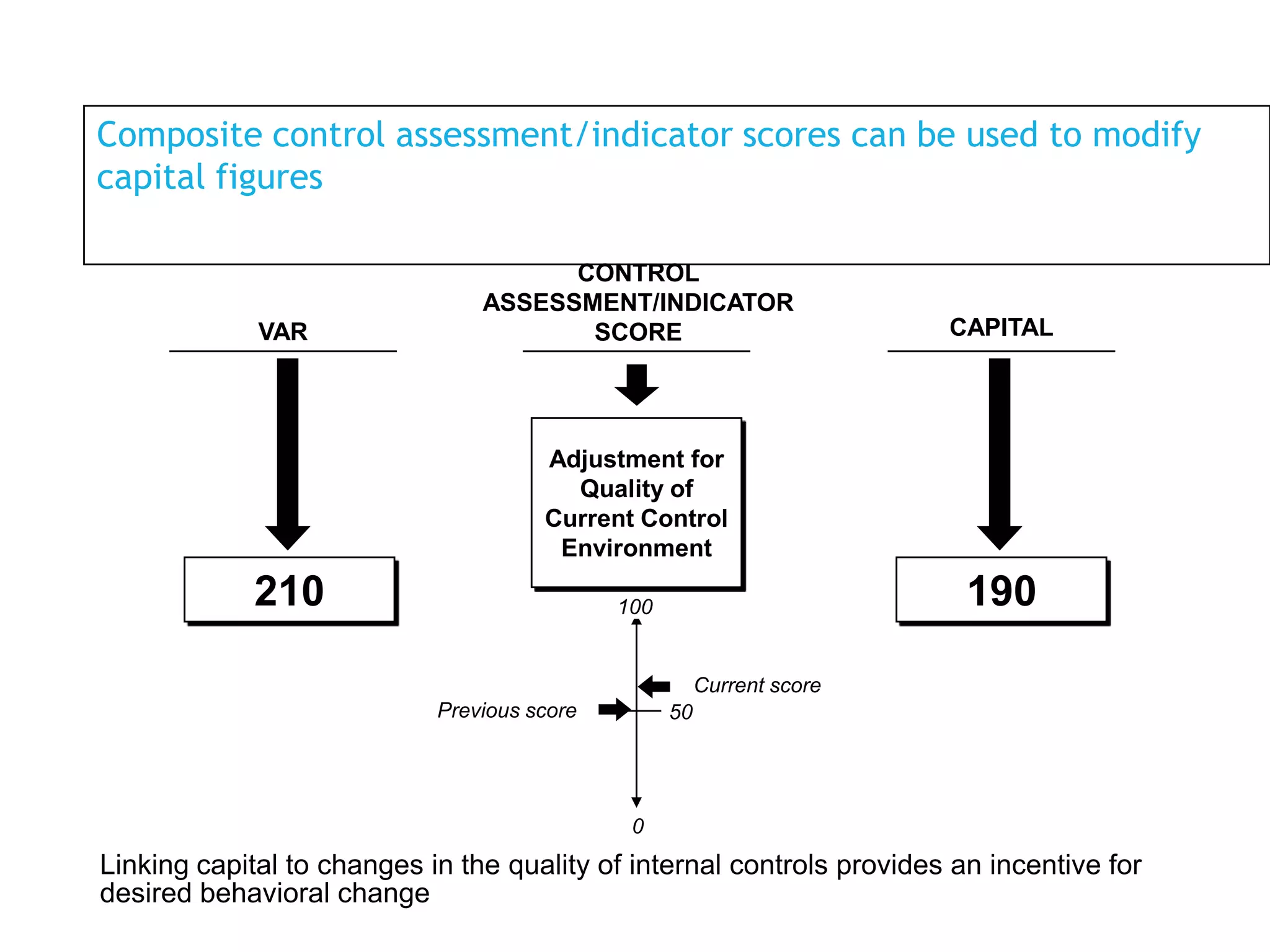

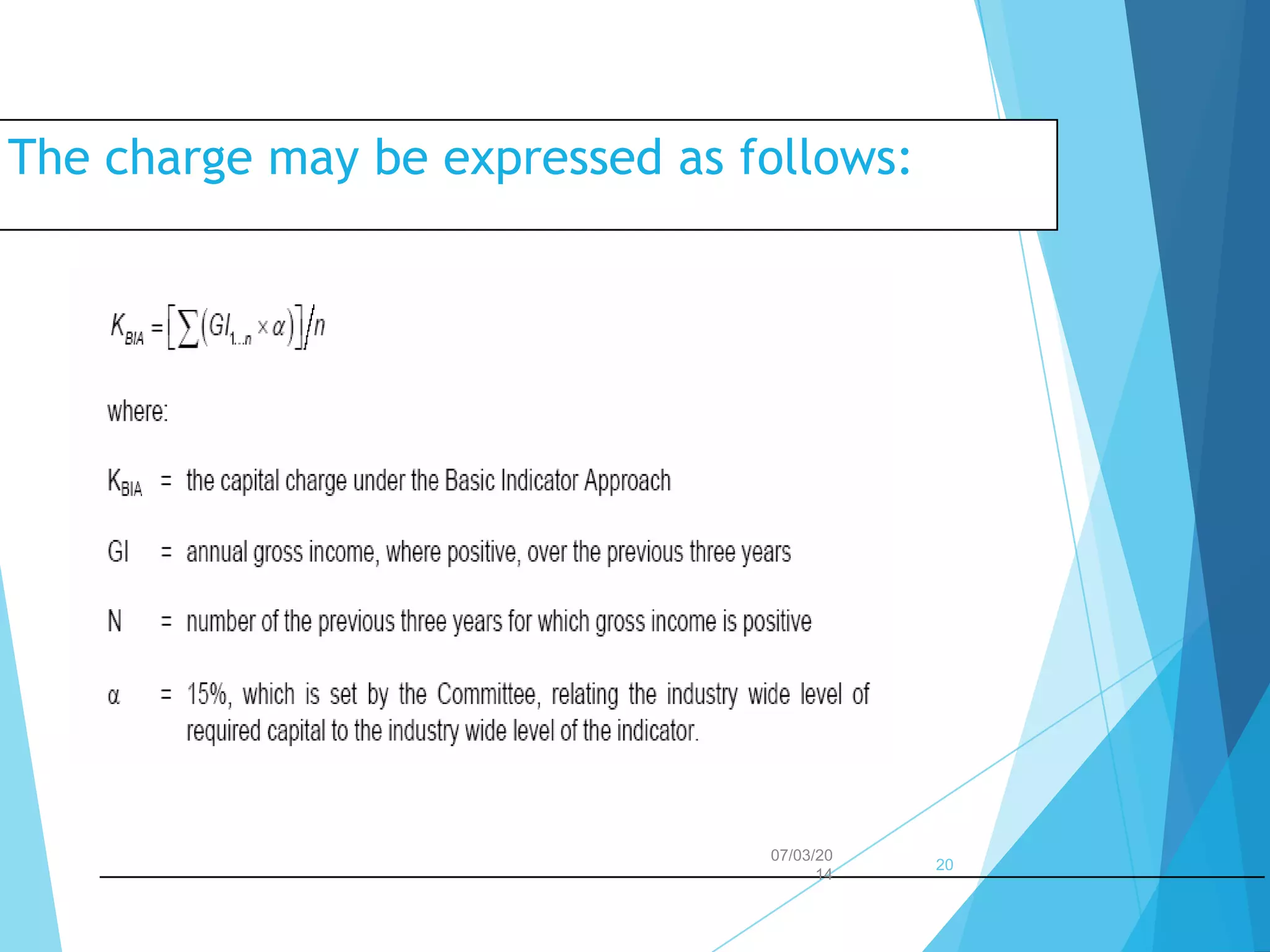

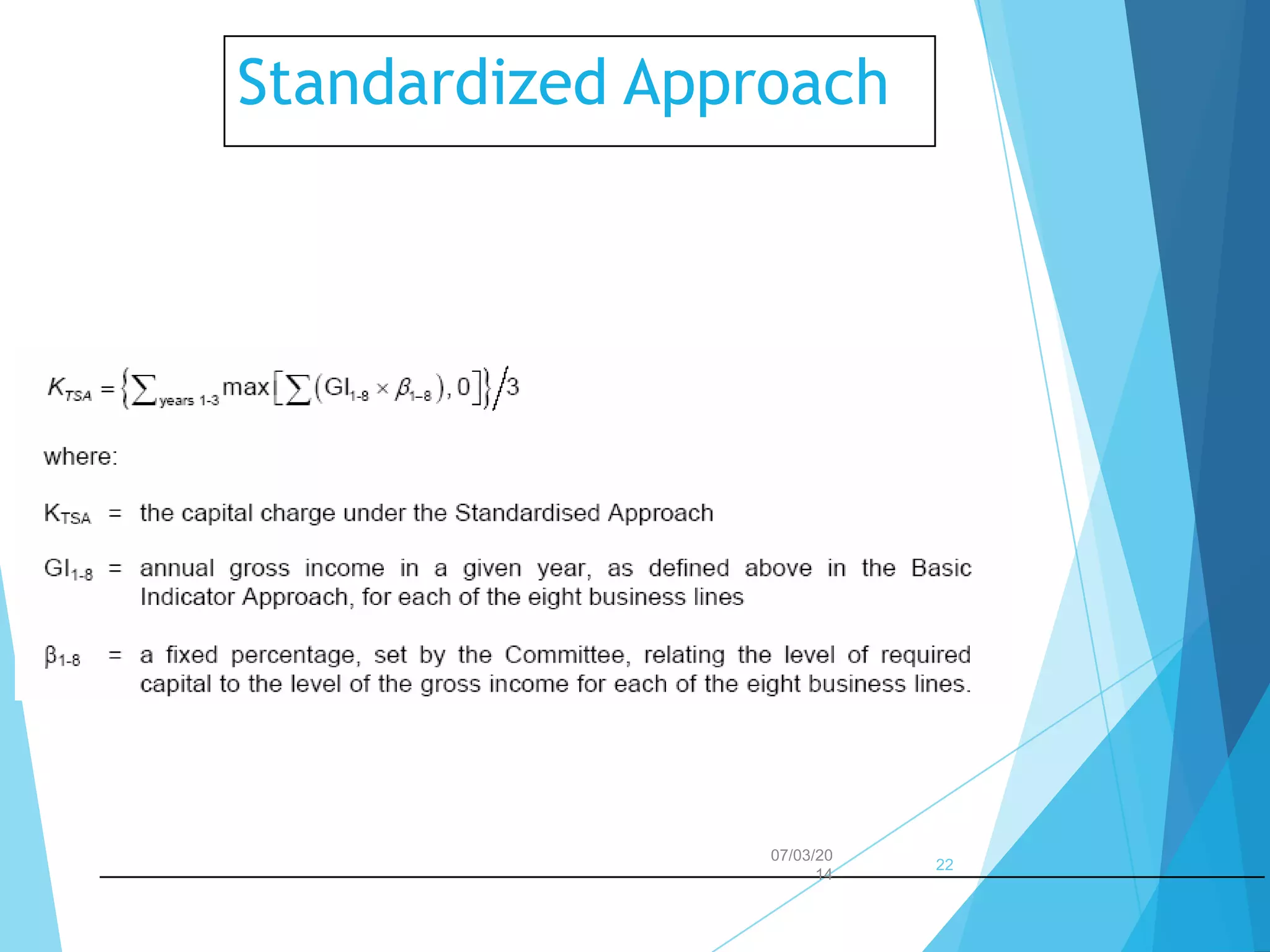

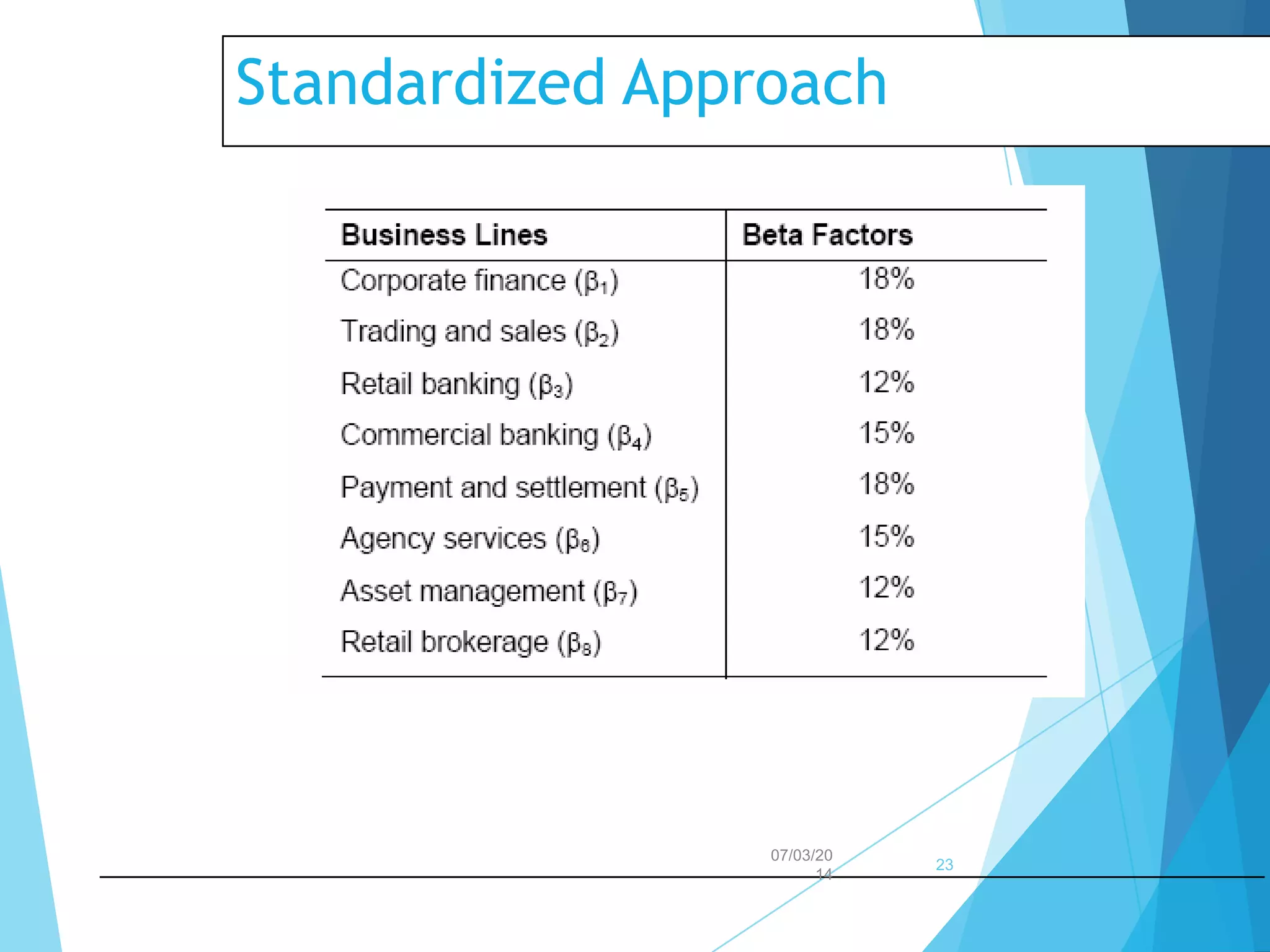

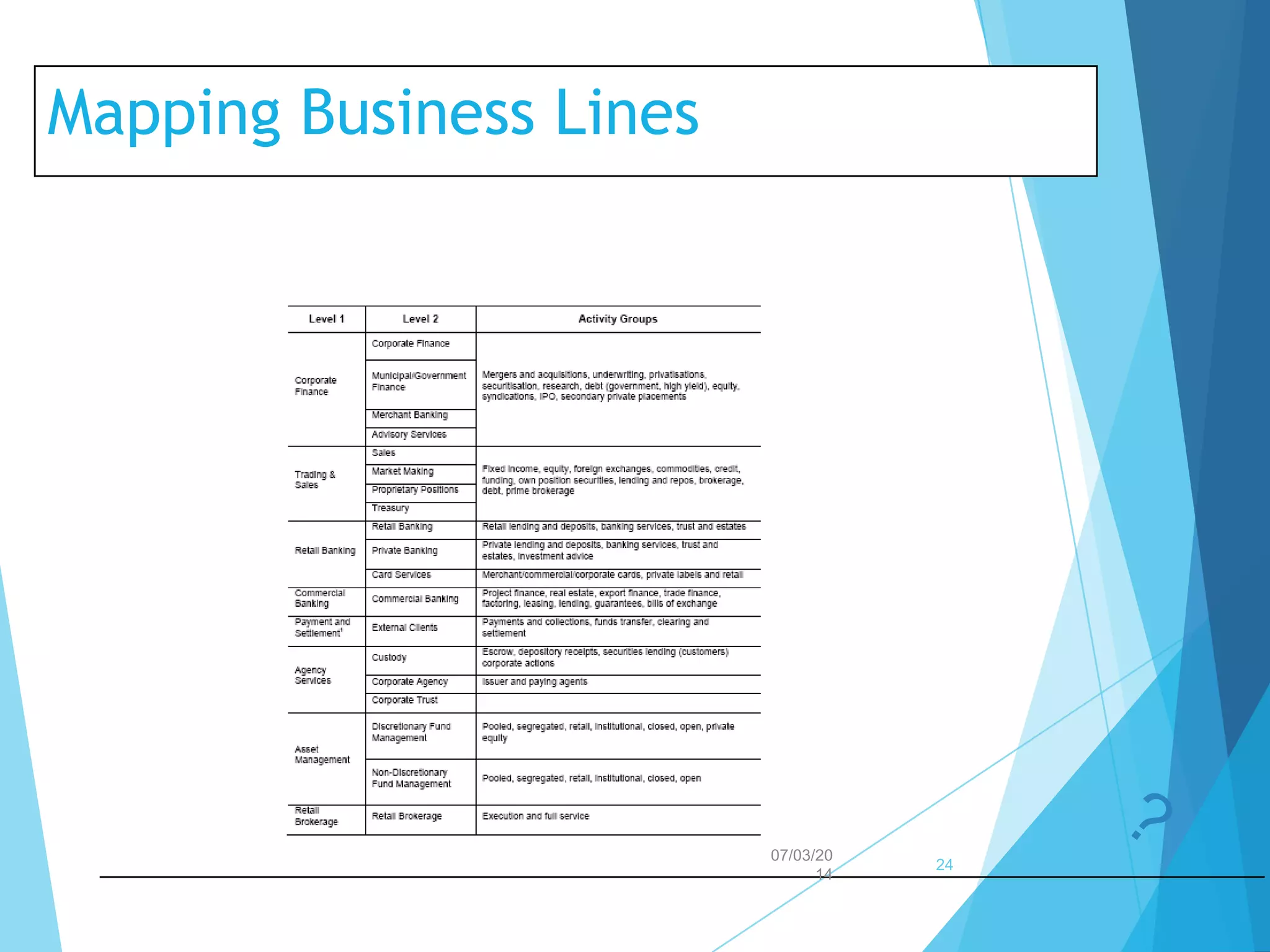

Operational risk can result in losses from internal failures or external events. It is classified based on frequency and impact of events. Management typically focuses on low frequency/high impact events and high frequency/low impact events. The Basel Accords define three approaches to operational risk capital requirements: Basic Indicator, Standardized, and Advanced Measurement. The Standardized Approach divides business activities into eight lines and assigns a beta multiplier to each line's gross income. The Advanced Measurement Approach uses banks' internal models to calculate regulatory capital.