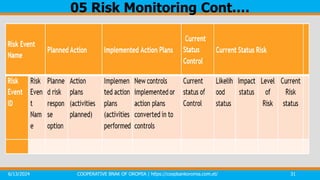

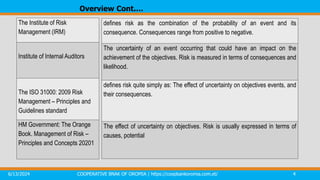

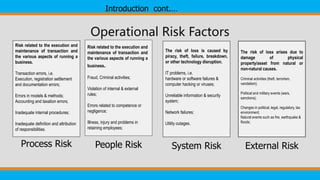

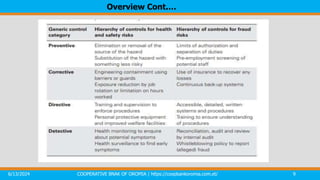

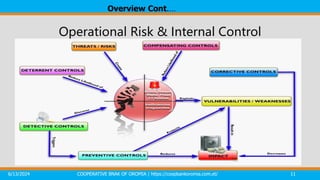

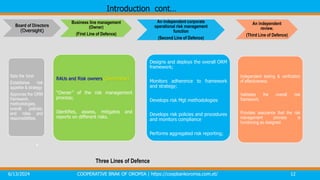

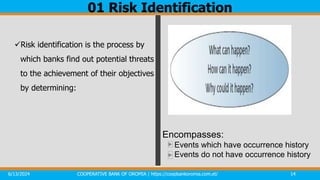

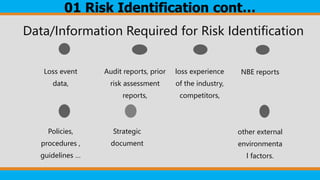

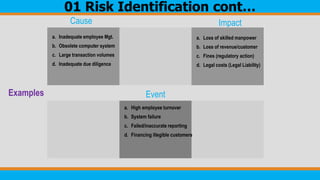

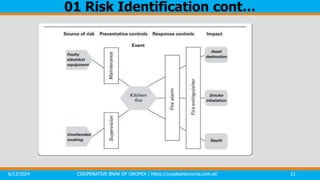

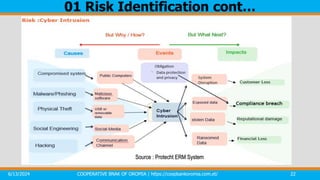

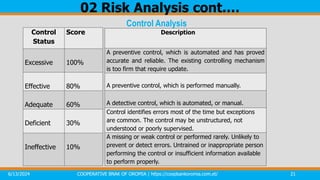

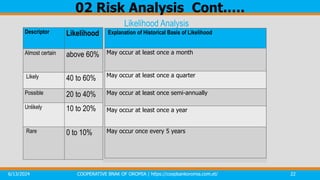

The document outlines the operational risk assessment training for the Cooperative Bank of Oromia, detailing the definitions and types of risks encountered in the banking sector, including financial and non-financial risks. It emphasizes the importance of risk management processes, which entail identifying, analyzing, and treating risks, incorporating frameworks such as the three lines of defense model. Additionally, it discusses techniques for risk identification, risk analysis, and the implementation of action plans to address identified risks.

![Impact Analysis

Sco

re

Rating Financial loss Health and safety Reputation and Image Performance Regulatory

1.

Insignific

ant

Less than 0.005% of the

Bank’s capital.

No or only minor personal injury or

health impact; First aid needed but

no days lost.

No local media attention or coverage Up to 5% variation

on objectives

accomplishment.

No noticeable regulatory impacts;

2.

Minor

[0.005% to 0.01%] of

the Bank’s capital.

Minor injury; Medical treatment and

up to 1 week incapacity to resume

work.

Low local news coverage but not appearing on

news headlines or not shared by social media; but

quickly remedied.

(5% - 10%]

variation on

objectives

accomplishment.

Temporary non-compliance with

regulatory requirements;

verbal corrective advice or

warning from regulatory organ.

3.

Moderate

(0.01% to 1%] of the

Bank’s capital.

Noticeable or significant

injuries or health impacts;

Possible hospitalization and

up to 1 month incapacity to

resume work.

Moderate local news coverage, (national

short period of time negative media

coverage).

Appearing on news headlines of less than

three mass media or shared by one social

media.

(10%-25%]

variation on

objectives

accomplishment

Short period of time non-

compliance with significant

regulatory requirements.

Written warnings from regulatory

organ.

4.

Major

(1% to 5%] of the

Bank’s capital.

Single death and/or long-term

illness or multiple serious injuries or

health impacts.

High local news profile, (National long

period of time negative media coverage);

Appearing on news headlines of more than

three mass media and shared by more than

one social media.

Significant loss of market share.

(25%-50%]

variation on

objectives

accomplishment

Significant non-compliance with

essential regulatory

requirements.

Financial loss and imprisonment

of staff.

5.

Extreme

Greater than 5% of the

Bank’s capital.

Multiple deaths or very sever health

crises/injuries/ disabilities

Widespread local and international news

coverage, and almost all social medias;

international long period of time negative

media coverage; game-changing loss of

market share

More than 50%

variation on

objectives

accomplishment

Long period of time or indefinite

non-compliance with essential

regulatory requirements;

Partial or full business

closure/business discontinuation

02 Risk Analysis Cont.….

6/13/2024 COOPERATIVE BNAK OF OROMIA | https://coopbankoromia.com.et/ 23](https://image.slidesharecdn.com/pptoformrefinedapproved-240613104632-c8a7d887/85/Operational-Risk-Managment-ORM-refined-approved-pptx-26-320.jpg)