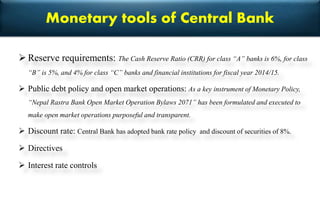

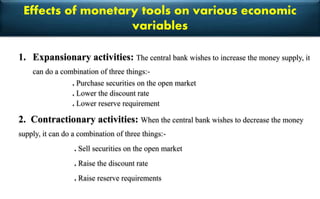

The document outlines the role and functions of central banks, specifically focusing on the Nepal Rastra Bank, established in 1956. It details the objectives of central banks, including regulating economic activities, formulating monetary policy, and managing money supply and foreign currency. Additionally, it discusses monetary tools used by central banks, such as reserve requirements and open market operations, and their effects on economic variables.