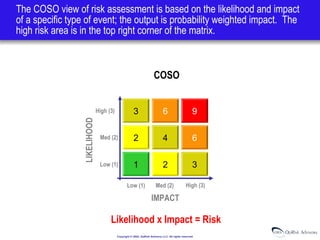

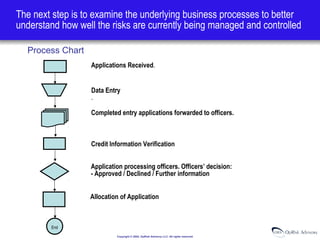

The document discusses operational risk measurement using internal and external loss data to calculate aggregate mean loss and aggregate Value at Risk (VaR). Loss events are placed in a risk matrix and combined to form loss distributions for each risk type. A Monte Carlo simulation is then used to calculate the 99th percentile VaR, providing a measure of unexpected loss exposure. This integrated approach allows measurement of both expected and unexpected operational risk levels across an organization.