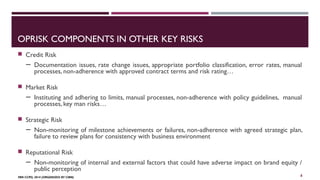

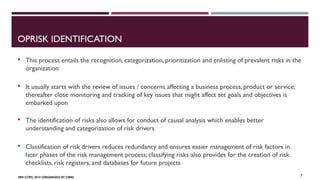

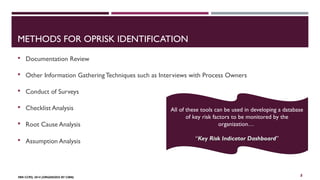

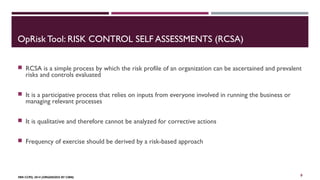

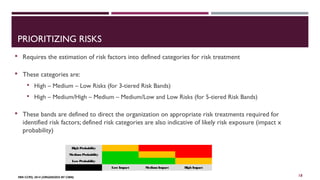

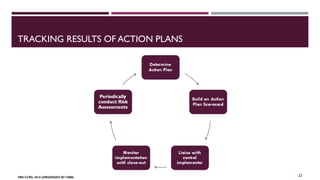

The document provides a comprehensive overview of operational risk management, including definitions, classifications, and components of operational risks. It outlines methods for identifying risks, tools for assessment, and techniques for prioritizing and mitigating risks within an organization. Additionally, it emphasizes the importance of organizational culture and involvement at all levels for effective risk management.