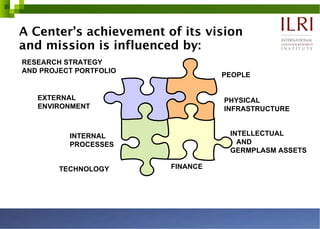

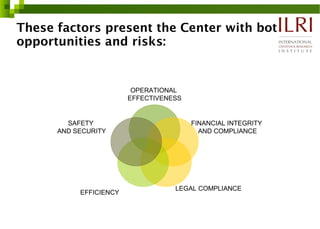

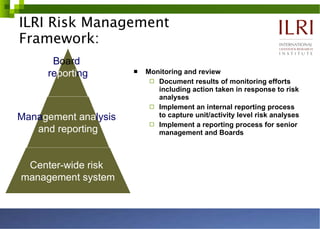

This document outlines a two-day risk management training for ILRI staff. Day one covers principles of risk management and methodologies and techniques. Day two focuses on identifying and assessing risks at ILRI, including group feedback sessions and discussing ILRI's risk management going forward. The document defines risk management and discusses establishing a risk management framework at the organizational level with key principles like establishing context, identifying risks, analyzing risks, treating risks, and monitoring and reviewing risks. It provides examples of enterprise, project and partnership risks to consider and discusses risk reporting requirements.