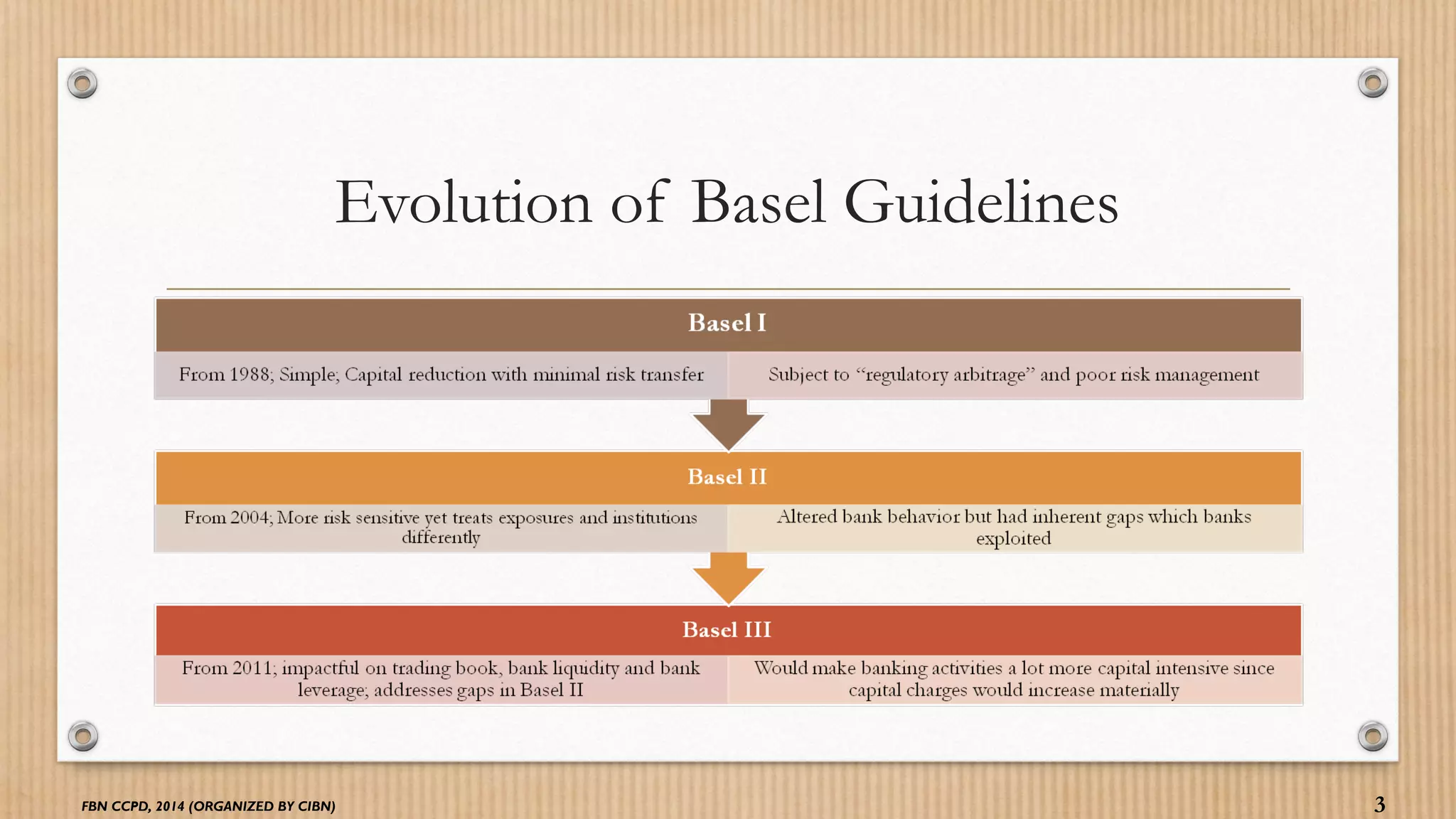

This presentation discusses operational risk under Basel II and III. It provides an overview of the evolution of Basel guidelines and the focus of the Basel II framework on providing capital standards for banks to mitigate financial and operational risks. It defines operational risk and discusses the approaches to estimating capital - basic indicator, standardized, and advanced measurement. The presentation notes some pitfalls of Basel II and the focus of Basel III on increased capital requirements and liquidity standards. It addresses ongoing challenges in operational risk management and potential improvements.