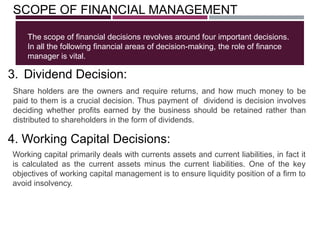

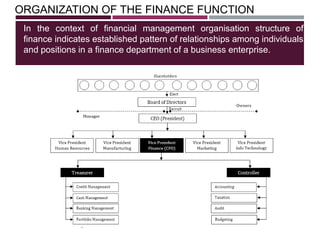

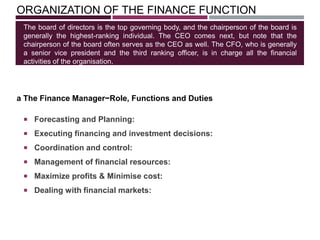

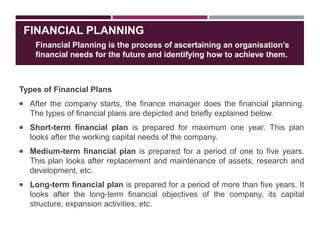

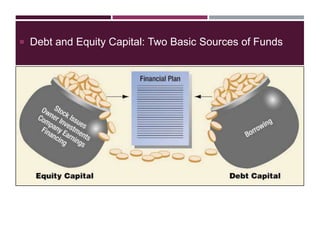

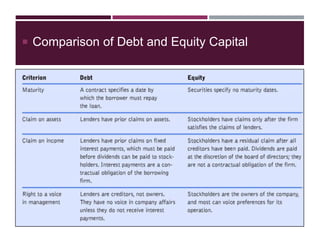

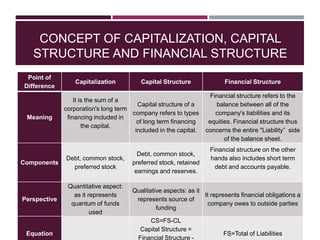

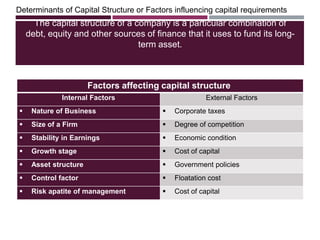

This document provides an overview of financial management concepts including the financial goals of profit and wealth maximization. It discusses the finance functions of investment, financing, and dividend decisions. The costs of capital such as cost of debt, preferred stock, equity, and retained earnings are explained. The document also covers topics such as the scope of financial management decisions, organization of the finance function, financial planning process, sources of funds, and concepts of financing decisions, capitalization, capital structure, and financial structure. Determinants that influence a company's capital structure are also outlined.

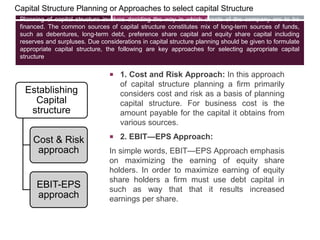

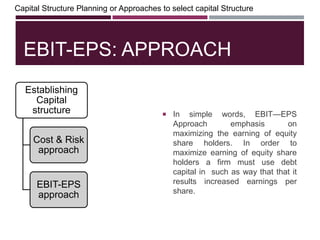

![FORMAT FOR COMPUTING EBIT & EPS

Particulars Amount

Sales revenue --------

Less : Variable Cost --------

Contribution [C] --------

Less: Fixed Cost --------

Operating Profit or EBIT --------

Less: Interest of Debt capital --------

Earnings Before Tax [EBT] --------

Less: Tax --------

Earnings After Tax [EAT] --------

Less: Dividend on preference shares --------

Earnings Available to Equity Share Holders [EAESH] --------

Earnings Per Share= EAESH ÷ No. of Equity Shares ---](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-48-320.jpg)

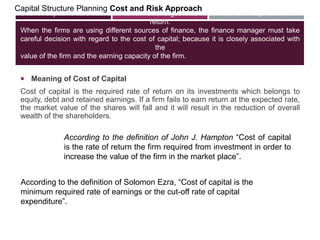

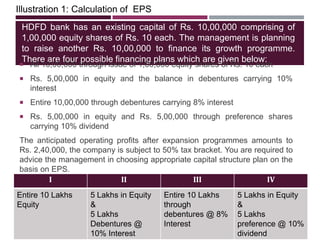

![I II III IV

Entire 10 Lakhs

Equity

5 Lakhs in Equity

&

5 Lakhs

Debentures @

10% Interest

Entire 10 Lakhs

through

debentures @ 8%

Interest

5 Lakhs in Equity

&

5 Lakhs

preference @ 10%

dividend

Illustration 1: Calculation of EPS

Particulars

Existing capital: Rs. 10 Lakhs Financial Plans

Fresh capital required: 10 Lakhs I II III IV

Expected operating Profit [EBIT] 2,40,000 2,40,000 2,40,000 2,40,000

Less: Interest on Debt capital

Plan II: 10% interest on debentures of Rs. 5

Lakhs

Plan III: 8% interest on debentures of 10 Lakhs

No Debt 50,000 80,000 No debt

Earnings Before Tax [EBT] 2,40,000 1,90,000 1,60,000 2,40,000

Less: Tax at 50% on EBT 1,20,000 95,000 80,000 1,20,000

Earnings After Tax [EAT] 1,20,000 95,000 80,000 1,20,000

Less: Preference dividend

Plan IV: 10% dividend on Rs. 5 Lakhs

No Pref. shares No Pref. shares

No Pref.

shares

50,000

Earnings Available to Equity Share Holders 1,20,000 95,000 80,000 70,000

No. of equity Shares

Existing (Rs. 10,00,000 ÷ Rs. 10 each)

New (Plan- I, II and III)

Total equity shares (Existing + New)

1,00,000

1,00,000

2,00,000

1,00,000

50,000

1,50,000

1,00,000

No new shares

1,00,000

1,00,000

50,000

1,50,000

EPS = EAESH ÷ Total equity shares Rs. 0.60 Rs. 0.633 Rs. 0.80 Rs. 0.47

Comments: Since the EPS in plan III is highest, therefore plan III should be](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-50-320.jpg)

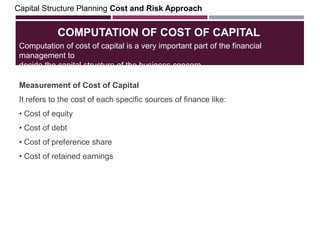

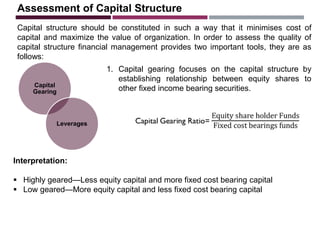

![Illustration 1I: Calculation of EPS

Brave Limited is capitalised with 50,000 equity shares of Rs. 10 each. Company

wants another Rs. 5,00,000 for expansion programme. The following are the

different Plans

1. All equity shares

2. Rs. 2,50,000 in equity and the balance in preference shares carrying 10

dividend

3. Rs. 2,50,000 in debentures and the balance in debentures at 10 interest

4. All debentures at 8% interest

Tax rate is 50% and the existing EBIT is Rs. 60,000 p.a, Calculate EPS for four

plans

Particulars

Existing capital: Rs. 5 Lakhs Financial Plans

Fresh capital required: 5 Lakhs I II III IV

Expected operating Profit [EBIT] 60,000 60,000 60,000 60,000

Less: Interest on Debt capital

Plan III: 10% interest on Loan of Rs. 2.5 Lakhs

Plan IV: 8% interest on debentures of 5 Lakhs

No Debt No Debt 25,000 40,000

Earnings Before Tax [EBT] 60,000 60,000 35,000 20,000

Less: Tax at 50% on EBT 30,000 30,000 17,500 10,000

Earnings After Tax [EAT] 30,000 30,000 17,500 10,000

Less: Preference dividend

Plan II: 10% dividend on Rs. 2.5 Lakhs

No Pref. shares 25,000

No Pref.

shares

No Pref. shares

Earnings Available to Equity Share Holders 30,000 5,000 17,500 10,000

No. of equity Shares

Existing (Rs. 5,00,000 ÷ Rs. 10 each)

New (In all plans except IV)

Total equity shares (Existing + New)

50,000

50,000

1,00,000

50,000

25,000

75,000

50,000

25,000

75,000

50,000

No new

shares

50,000](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-51-320.jpg)

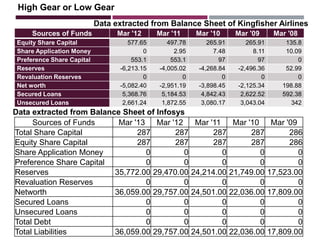

![[A] OPERATING LEVERAGE:

Operating leverage is a measure to establish relation

between a firm's fixed cost and variable cost and its

impact of profits.

EBIT: Earnings Before Interest and Tax

Contribution = Sales — Variable cost

Interpretation:

Criteria Outcome Impact on Profitability (EBIT)

When, C>FC Favourable Positive EBIT

When, C<FC Unfavourable Negative EBIT](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-56-320.jpg)

![[B] FINANCIAL LEVERAGE

It determines the impact of using debt financing (debentures

and bonds or long term loans) on the earnings of

shareholders.

EBIT: Earnings Before Interest and Tax

EBT: Earnings Before Tax [EBIT – Interest(i)]

EPS: Earnings Per Share

Interpretation:

Criteria Outcome Impact on Profitability (EBT)

When, EBIT > Interest payable Favourable Positive EBT

When, EBIT < Interest payable Unfavourable Negative EBT](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-57-320.jpg)

![[C] COMBINED LEVERAGE

As the name suggests, Combined leverage represents the total effect of

the operating and financial leverages on the earning per share[EPS]. In

other words, combined leverage shows the total risks associated with the

firm. It is the product of both the leverages.

Interpretation:

The combined leverage can work in either direction. It would be favourable if

sales increase and unfavourable in the reverse scenario.](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-58-320.jpg)

![STEPS IN CALCULATION OF LEVERAGES AND

EPS: GENERAL INCOME STATEMENT FORMAT

Particulars Amount

Sales revenue --------

Less : Variable Cost --------

Contribution [C] --------

Less: Fixed Cost --------

Operating Profit or EBIT --------

Less: Interest of Debt capital --------

Earnings Before Tax [EBT] --------](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-59-320.jpg)

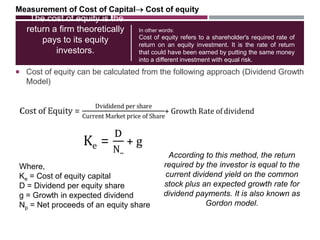

![A company has sales of Rs. 60,00,000, variable cost of Rs.

40,00,000, fixed cost of Rs. 5,00,000 and debt of Rs. 30,00,000 at

10% rate of interest. Calculate operating, financial, operating and

combined leverages.

Particulars Amount

Sales 60,00,00

0

Less: Variable cost 40,00,00

0

Contribution [C] 20,00,00

0

Less: Fixed Cost 5,00,000

Operating Profit or EBIT 15,00,00

0

Less: Interest on Debt Capital (10% on Rs. 30,00,000 ) 3,00,000

Earnings Before Tax [EBT] 12,00,00

0

1.25

1.33

1.6625

Illustration 1: Calculation of Leverages

Comments:

Since, EBIT is > Interest payable, this means firm has sufficient operating profits to pay interest on debt

capital and therefore it has favourable financial.

Since, Contribution is > Fixed cost, this means firm has sufficient sales revenue to meet its fixed cost and

therefore it has favourable operating leverage and positive operating profit.

Combined leverage is also favourable.](https://image.slidesharecdn.com/financialmanagementpondicherry-140323121153-phpapp01/85/Financial-management-60-320.jpg)