This document provides an overview of key concepts in corporate finance including:

- Definitions of finance, business finance, and financial management.

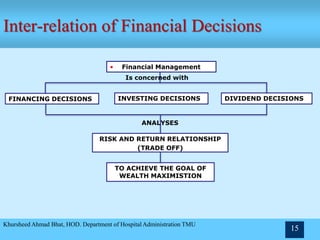

- The objectives of financial management being profit maximization and wealth maximization.

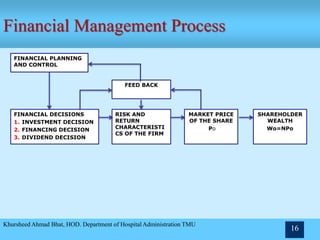

- The scope and importance of financial management in planning, raising funds, investment decisions, and more.

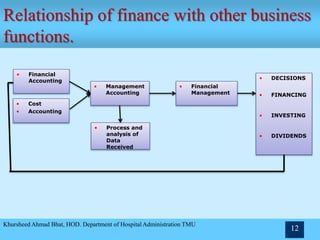

- The relationship between financial management and other business functions like production, accounting, and marketing.

- The roles and functions of a finance manager in areas like financial planning, acquiring and investing funds.