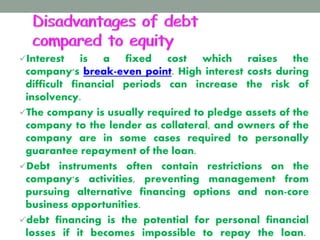

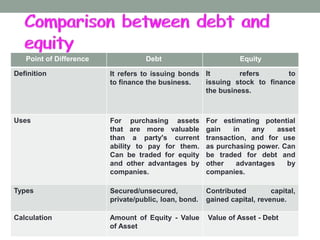

Companies can raise capital through either debt or equity financing. Debt financing involves taking a loan that must be repaid with interest, while equity financing involves selling ownership stakes in the company. There are several pros and cons to each approach. Debt is generally easier to obtain but subjects the company to fixed repayment obligations, while equity does not require repayment but dilutes ownership and control of the company. The best financing structure depends on the specific needs and risks involved for each business.