Embed presentation

Downloaded 251 times

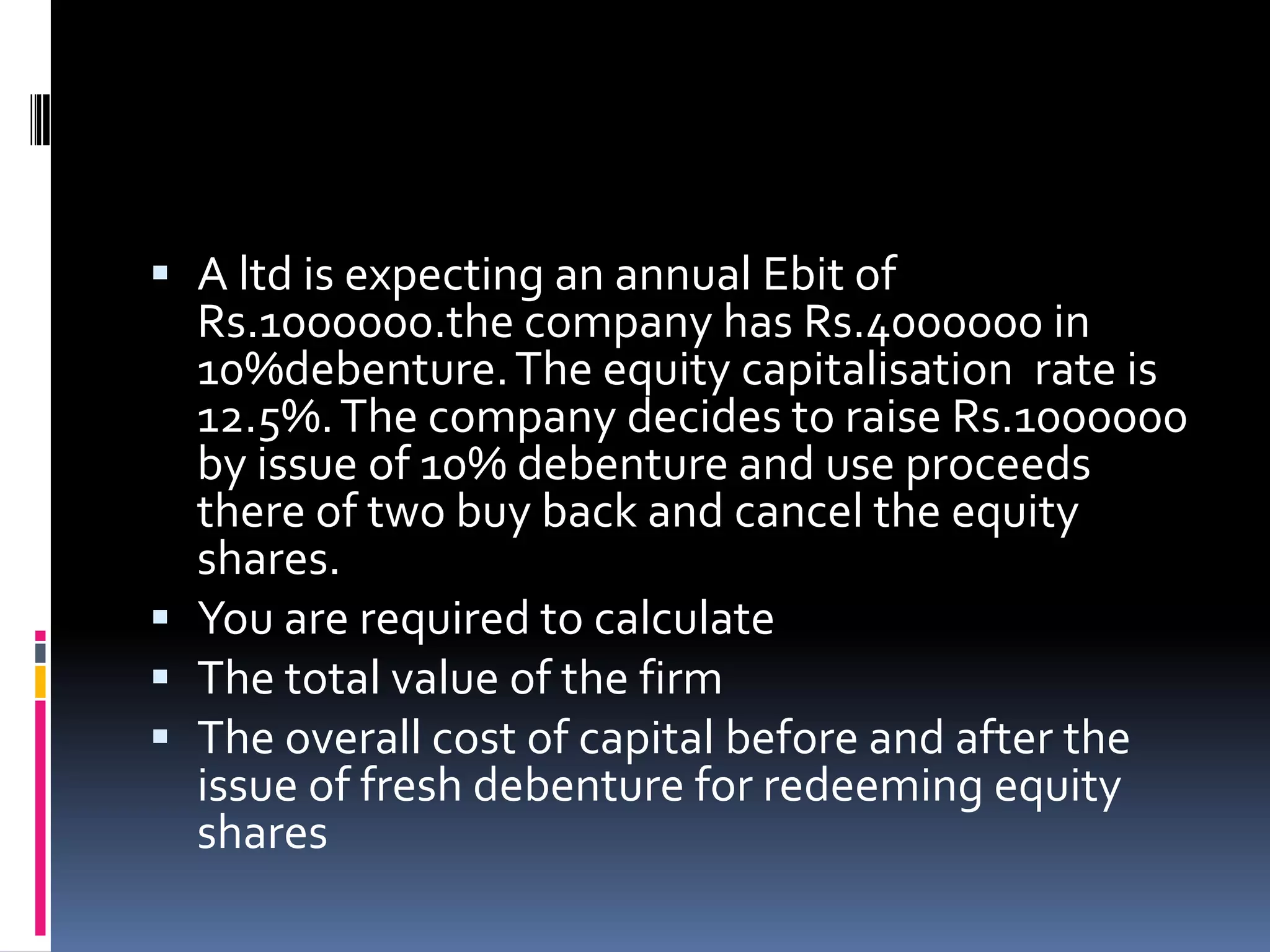

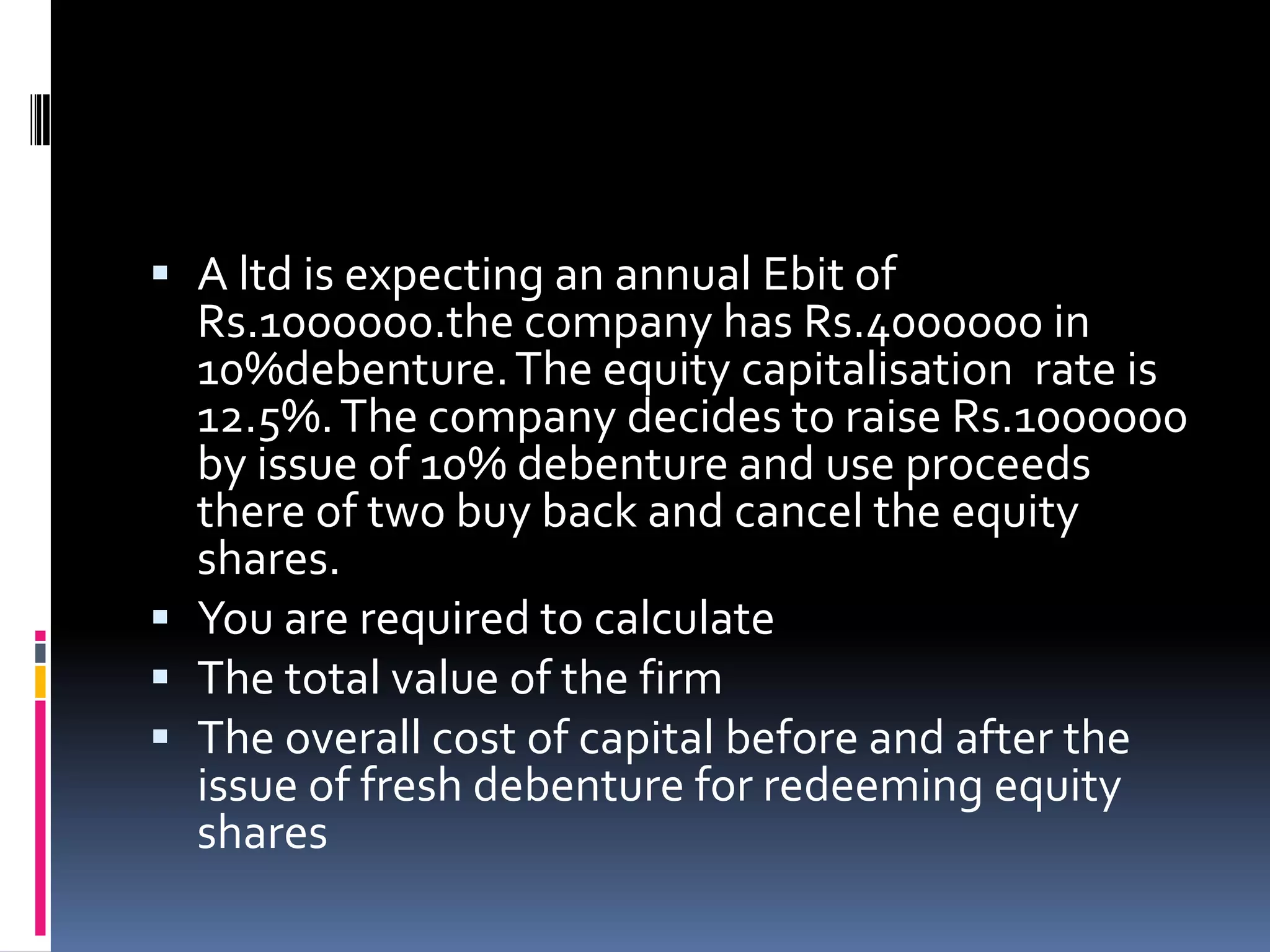

The Net Income approach introduced by David Durand states that a company's capital structure and financial leverage is relevant to the valuation of the firm. According to this approach, increasing financial leverage will decrease the weighted average cost of capital and increase firm value and equity share price. Conversely, decreasing financial leverage will increase the weighted average cost of capital and decrease firm value and equity share price. The key assumptions of this approach are that there are no taxes, the cost of debt is less than the cost of equity, and using debt does not change investor risk perception. The document provides an example calculation to determine a firm's total value, overall cost of capital before and after issuing new debentures to redeem equity shares.