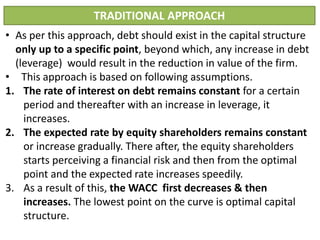

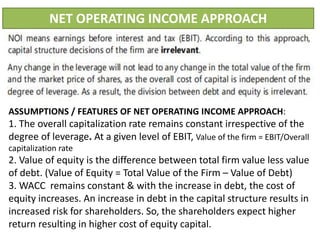

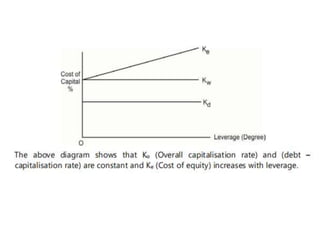

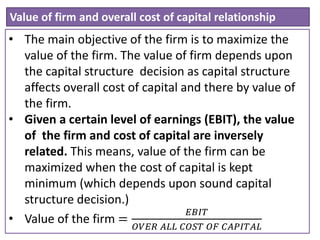

The document discusses capital structure in financial management, highlighting its components such as equity, debt, and retained earnings. It explains the importance of balancing control, risk, and cost in capital structure decisions to maximize a firm's value, with various approaches like the net income approach, traditional approach, and Modigliani and Miller approach detailed. Additionally, it explores concepts including weighted average cost of capital (WACC) and the risk-return tradeoff in relation to an optimal capital structure.

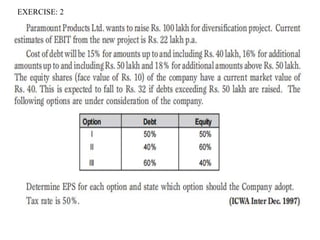

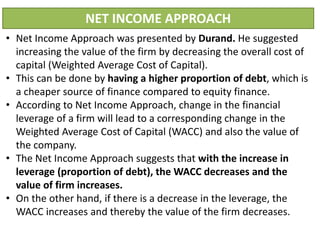

![Illustration: There are two firms A and B similar in all aspects except in the degree of

leverage employed by them. Financial data of both the firms are as follow.

Particulars Firm – A Firm – B

(O) Operating income Rs. 10,000 Rs. 10,000

( I ) Interest on debt Rs. Nil Rs. 3,000

(P) Equity Earnings Rs. 10,000 Rs. 7,000

(rE)Cost of equity capital 10 % 10 %

(rD)Cost of debt capital 6 % 6 %

E Market value of equity Rs. 1,00,000 Rs. 70,000

D Market value of debt Rs. Nil Rs. 50,000

V Total value of the firm(D+E) Rs. 1,00,000 Rs. 1,20,000

Average cost of capital = rD [

𝑫

𝑫+𝑬

] +rE [

𝑬

𝑫+𝑬

]

FIRM - A = 6 % [ 0 / 100000] + 10 % [ 100000/100000]

FIRM - A = 0 + 10

FIRM - A = 10 %

FIRM - B = 6 % [ 50000 / 120000] + 10 % [ 70000/120000]

FIRM – B = 0.025 + 0.0583

FIRM- B = 0.0833 X 100

FIRM - B = 8.33 %

We can see Firm B has used leverage which has reduced its cost of capital to 8.33 %.](https://image.slidesharecdn.com/capitalstructure-230607084900-efa4ea60/85/capital-structure-pptx-15-320.jpg)