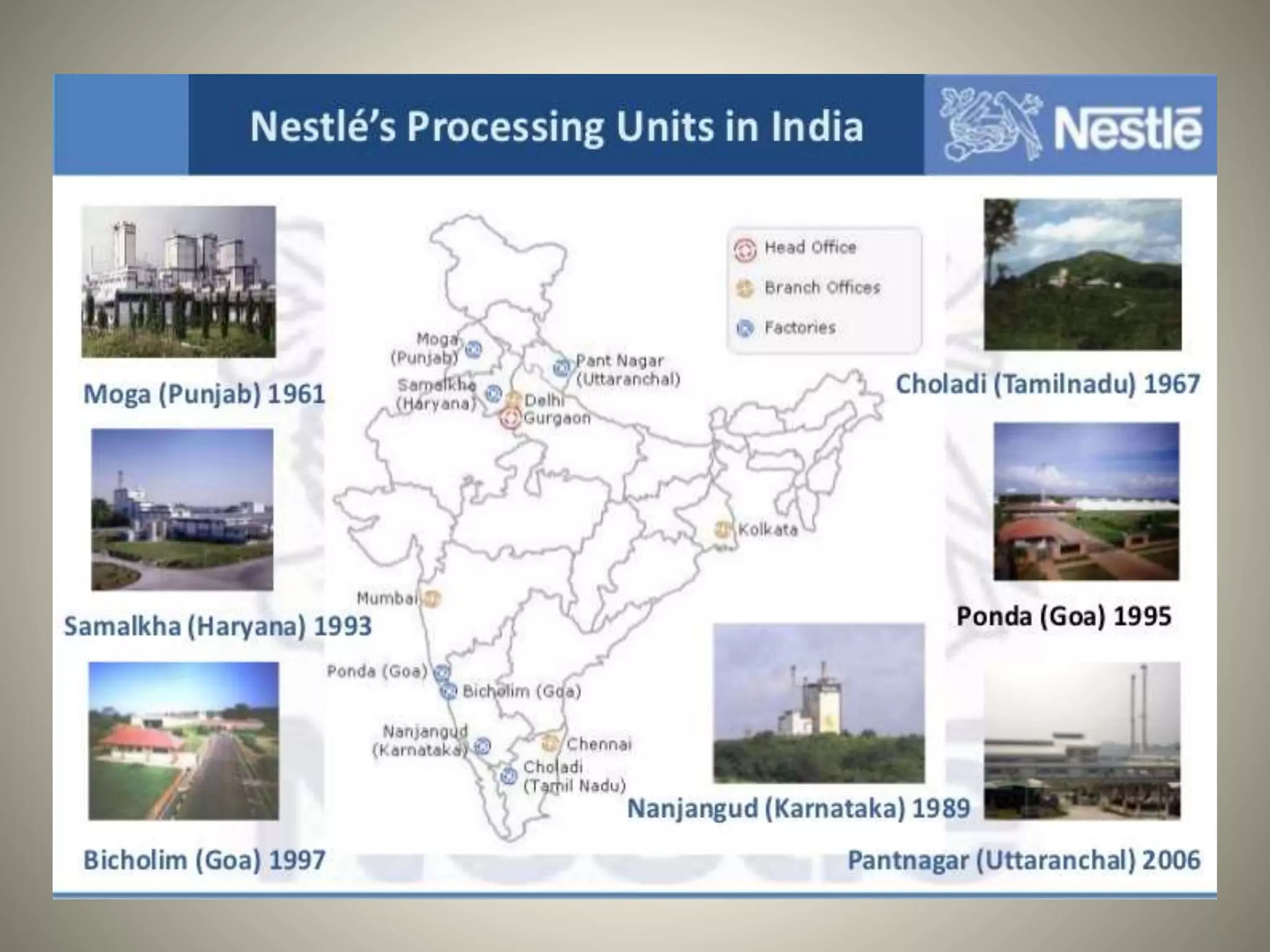

Henry O Nestle founded Nestle in 1867 with the objective of becoming the largest and best brand food manufacturer. Some of Nestle's first products included Farine Lactee Nestle, a substitute for mother's milk. Currently, Nestle has numerous brands and products across food and beverages categories globally. In India, Nestle entered in 1912 and has since established various factories and production plants, investing billions of rupees over the years. Nestle India remains highly profitable with steady growth in revenues, profits, and share prices over the past decade.