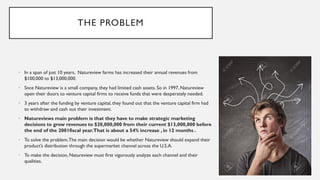

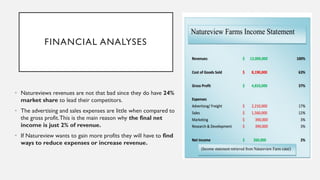

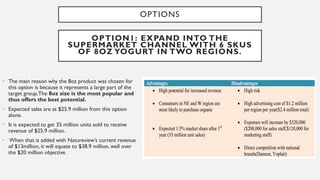

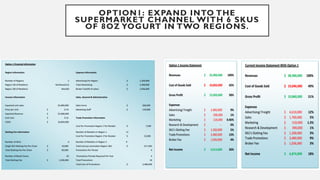

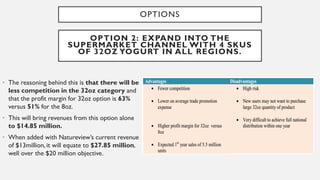

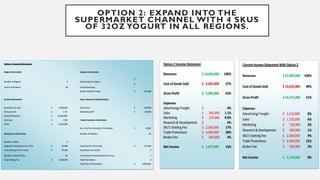

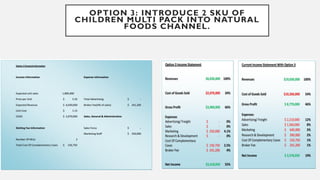

NatureView Farms, a refrigerated yogurt manufacturer, faces the challenge of increasing its revenue from $13 million to $20 million within a year, primarily due to the withdrawal of a venture capital firm. The company evaluates three options for growth: expanding 8oz yogurt distribution in supermarkets, introducing 32oz yogurt, or launching a children's multipack in natural food stores, with the third option being the least risky but potentially yielding the lowest revenue. The recommendation is to pursue the third option while ensuring a revenue increase of at least $1 million to meet the financial goal.