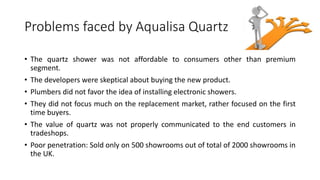

This document discusses the UK shower market and Aqualisa's Quartz shower. It notes that existing shower options had issues like inconsistent water temperature, unattractive designs, and difficult installation. The document then analyzes Aqualisa's competitors and notes its small market share of 7%. It outlines the value propositions of the Quartz for plumbers and consumers, including its easy installation, reliable temperature control, and premium design. Key issues, target customer segments, and a premium positioning are proposed to increase adoption of the new Quartz shower.