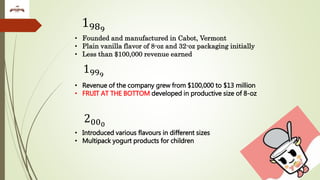

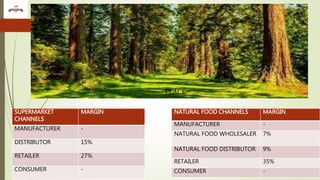

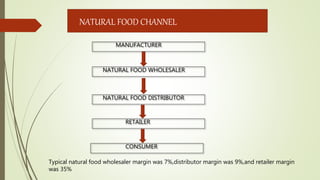

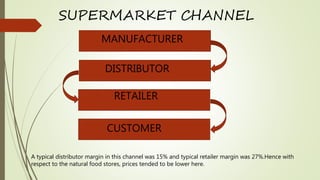

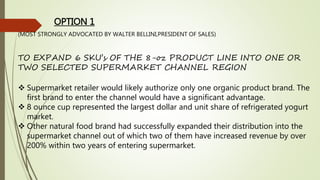

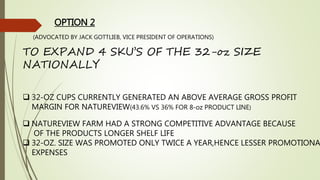

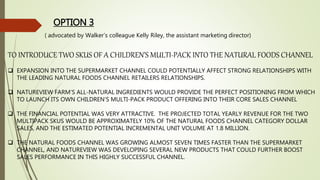

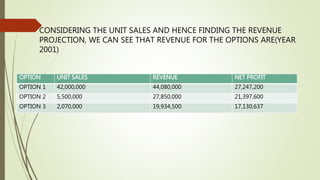

This document analyzes options for expanding the sales of Natureview Farm yogurt. It provides background on the company's founding and growth from $100,000 to $13 million in revenue between 1989 and 2000. It then evaluates 3 options: 1) Expanding the 8oz product line into supermarket channels, 2) Expanding the 32oz size nationally, or 3) Introducing a children's multipack into natural food channels. Option 1 is projected to generate the highest revenue and net profit of $44 million and $27 million respectively. The regional supermarket expansion is advocated as the best option as it presents an opportunity to gain market share before competitors and exposes the brand to more customers long-term, exceeding the revenue objective.