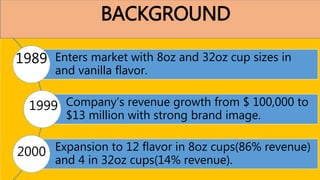

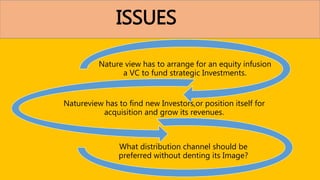

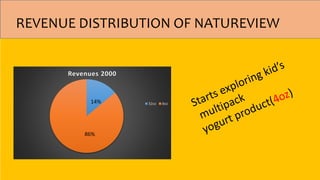

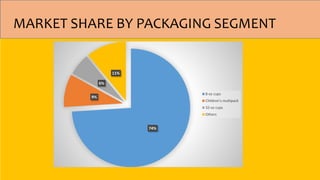

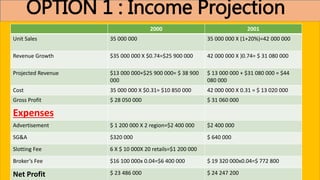

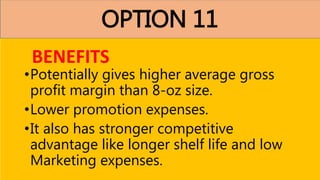

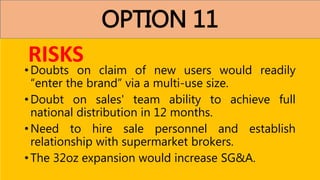

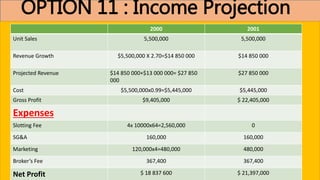

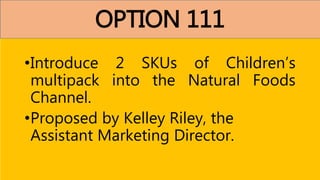

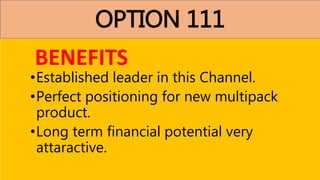

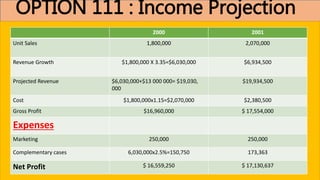

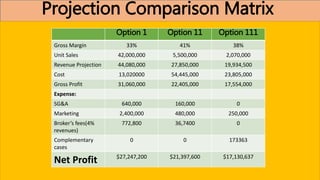

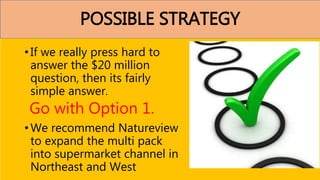

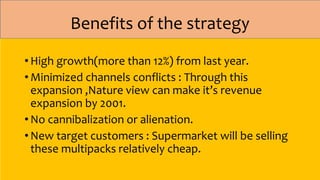

Natureview Farm produces organic yogurt and seeks to grow its revenues from $13 million to $20 million. It considers three options: 1) Expanding its 8oz cups into supermarkets, 2) Expanding its 32oz cups nationally, or 3) Introducing multipacks in natural food stores. Option 1 exceeds the revenue target but risks competition and high costs. Option 2 has a high margin but distribution risks. Option 3 has low risks but falls short on revenue. The recommended strategy is to expand the multipacks into select supermarket regions to minimize risks while achieving over 12% revenue growth.