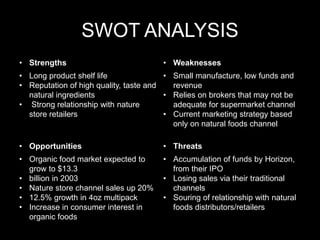

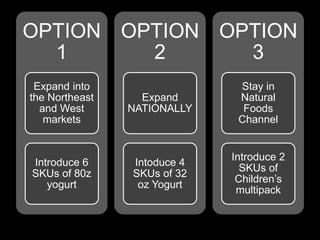

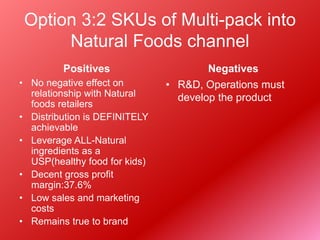

Natureview Farms seeks to increase revenue from $13 million to $20 million by 2001 to satisfy venture capital backers looking to cash out. The management must evaluate options to maximize revenue and valuation for a new investor. Option 3 is recommended: introduce 2 new children's yogurt multipack SKUs in the natural foods channel. This option achieves the target revenue, minimizes risk, and allows Natureview to remain true to its brand without damaging current partnerships. It also requires the least additional costs while still earning substantial revenues and profitability.