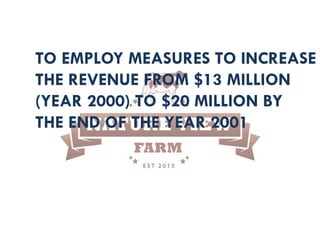

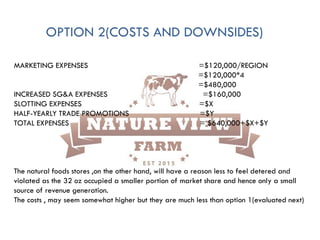

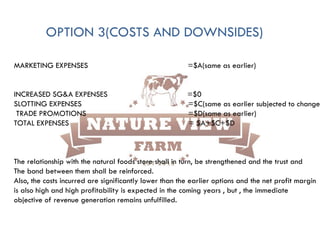

Natureview Farm was seeking to increase its annual revenue from $13 million to $20 million. It considered three options: 1) Expanding yogurt SKUs in supermarkets, 2) Launching larger yogurt cups nationally in supermarkets, or 3) Introducing children's multipacks in natural food stores. Analysis showed option 2 could generate the needed $7 million increase while maintaining relationships and involving lower costs than option 1. Option 3 would not meet the revenue goal. Therefore, the recommended decision was to launch larger yogurt cups in supermarkets.