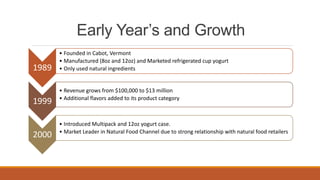

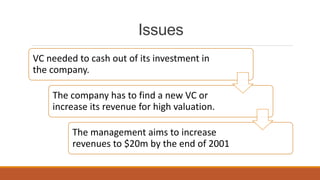

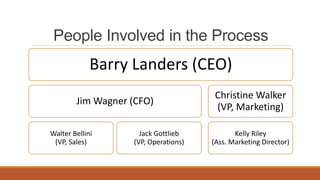

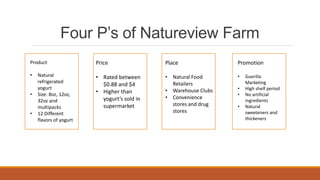

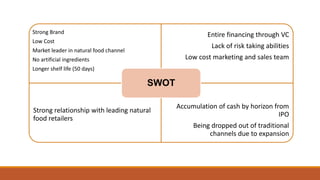

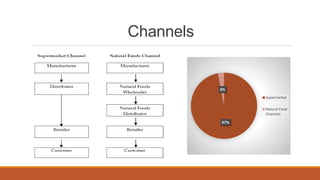

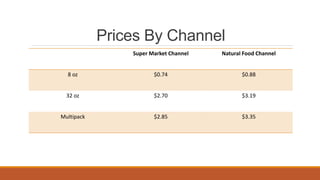

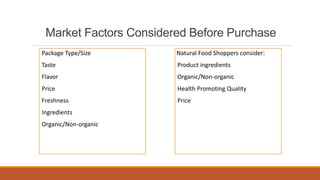

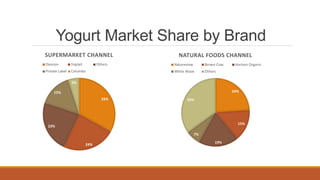

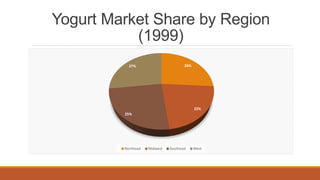

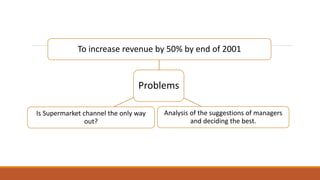

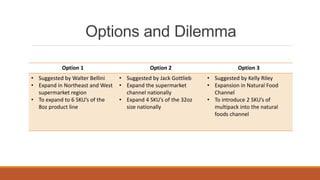

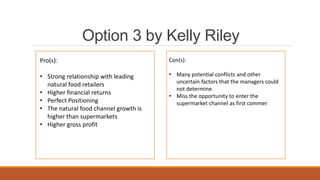

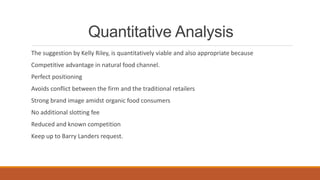

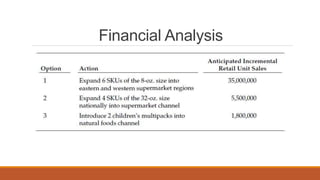

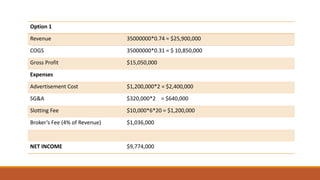

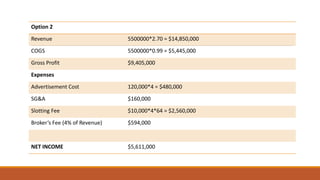

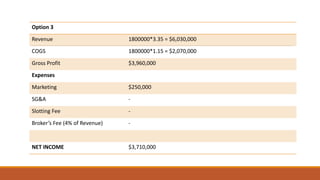

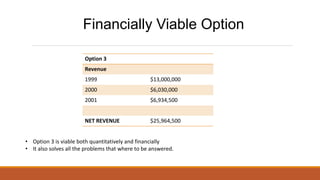

Natureview Farm is a yogurt manufacturer founded in 1989 in Cabot, Vermont. By 1999, revenue had grown from $100,000 to $13 million. In 2000, it introduced multipacks and larger sizes. It is the market leader in the natural food channel but needs to increase revenue to $20 million by 2001. Three options for growth were proposed: 1) expand product lines in new regions, 2) expand larger sizes nationally, or 3) introduce multipacks in natural food channels. Quantitative and financial analysis showed that the third option was viable and aligned with the company's strengths in natural channels. This would solve the problem of revenue growth without conflicts in traditional supermarket channels.