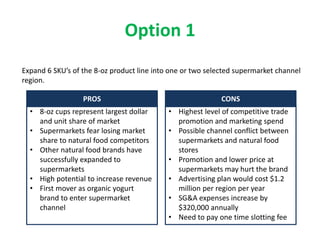

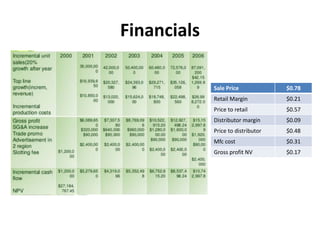

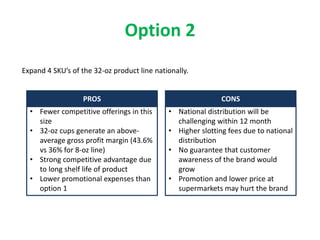

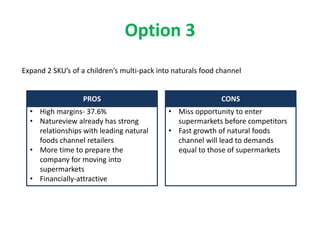

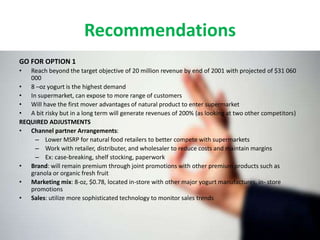

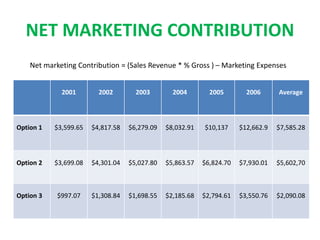

NatureView Farm, established in 1989, aims to increase its revenue by over 50% within 23 months amidst a growing organic market. Three options for expansion include entering supermarkets with 8-oz cups, expanding 32-oz cups nationally, or growing the children's multi-pack in natural food channels. The recommendation favors option 1 for its high demand and first-mover advantage in supermarkets, despite some risks.