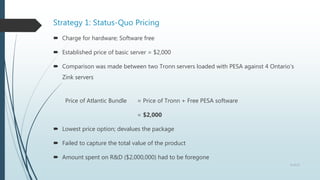

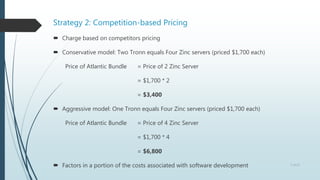

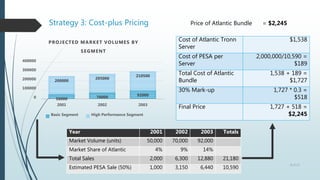

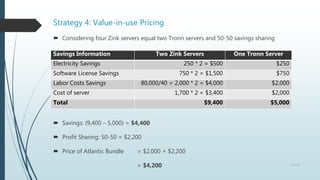

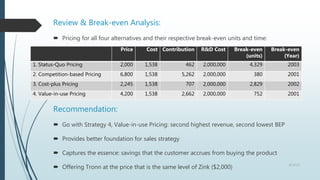

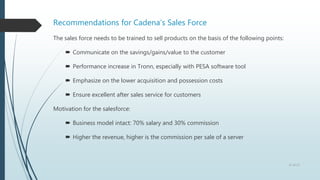

The document discusses four pricing strategies for Atlantic Computers' new "Atlantic Bundle" product, which consists of their new Tronn server and PESA software. The strategies are: 1) status-quo pricing, 2) competition-based pricing, 3) cost-plus pricing, and 4) value-in-use pricing. After reviewing the strategies and conducting a break-even analysis, it is recommended to use value-in-use pricing of $4,200 per bundle. This captures the savings customers realize and has one of the lowest break-even points. Recommendations are also provided for training Atlantic's sales force to sell based on the bundle's value and savings. Potential reactions from main competitor Zink

![Reaction of Zink’s management to the threat posed to Atlantic Bundle

Short Term:

Zink’s management might reduce the price of its server

If so, Atlantic can charge the client according to the cost plus approach and show the

savings ($2,611) to them.

[Zink’s price can fall up to their costs of $1,214 countering Atlantic’s cost of $2,246. Since

four servers are needed, the total cost for Zink equals $1,214 * 4 = $4,856.

Therefore, savings = $(4,856 - 2,245) = $2,611]

Long Term:

Zink’s management may come up with an identical software

Atlantic can provide the PESA software free in that case

12 of 13](https://image.slidesharecdn.com/a6-mm-atlanticcomputers-170216151704/85/Atlantic-Computers-A-Bundle-of-Pricing-Options-12-320.jpg)