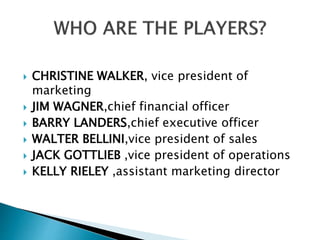

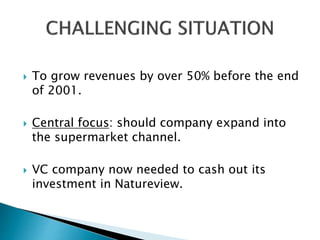

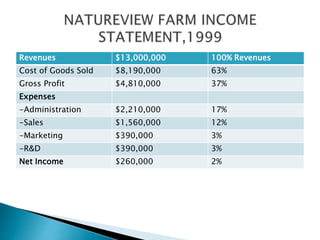

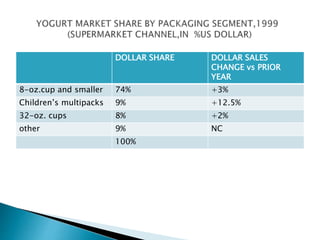

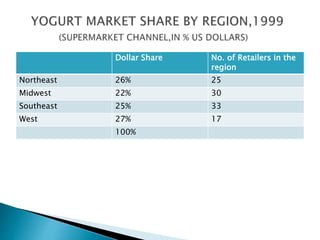

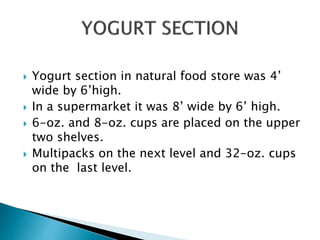

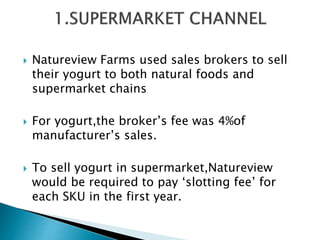

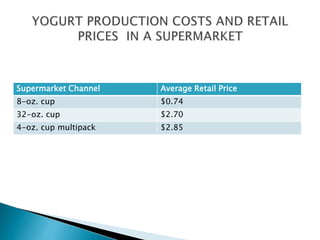

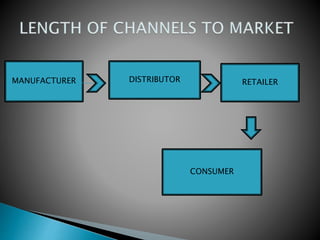

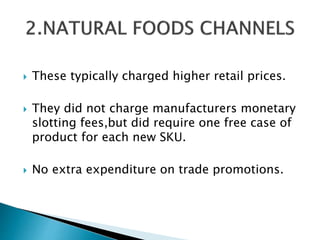

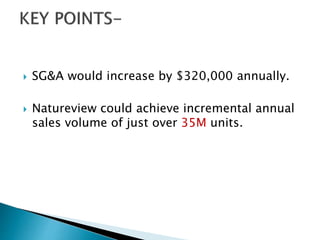

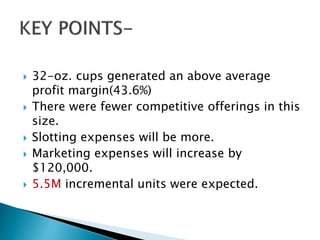

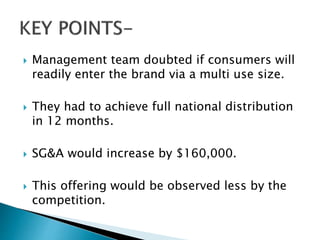

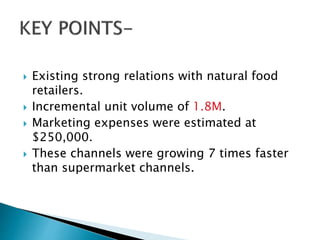

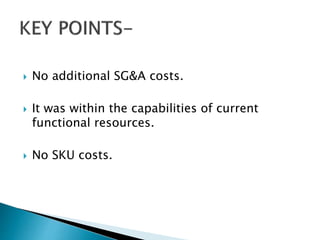

This document describes Natureview Farm, a small yogurt manufacturer founded in 1989 in Vermont. It discusses Natureview's executives, finances, product lines, distribution channels, and competitors. The company is considering three options to grow revenues by 50%: 1) Expanding 6 SKUs into supermarkets, 2) Expanding 4 large-size SKUs nationally in supermarkets, or 3) Adding 2 children's multipack SKUs in natural food stores. The third option is deemed most viable as it requires the least investment and can generate $20 million while allowing Natureview to stay within its capabilities and keep its current consumers and distribution channels happy.