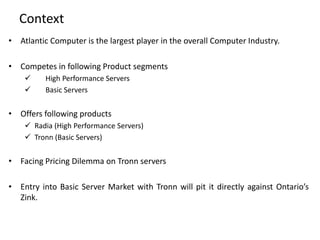

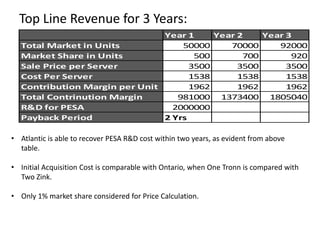

This document summarizes a case analysis for Atlantic Computer Inc regarding pricing strategies for its new basic server product called Tronn. Key points:

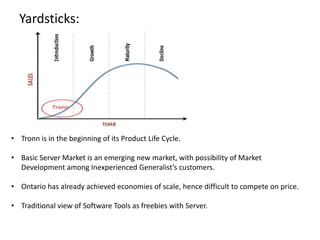

- Atlantic faces a pricing dilemma for Tronn as it enters the basic server market dominated by Ontario's Zink server.

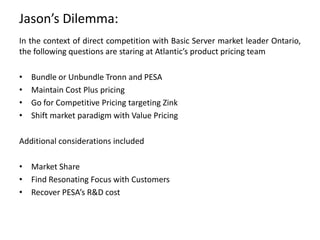

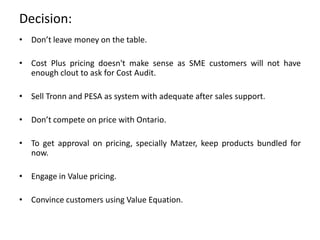

- Options include bundling/unbundling Tronn and software, maintaining cost-plus pricing, competitive pricing, or value pricing.

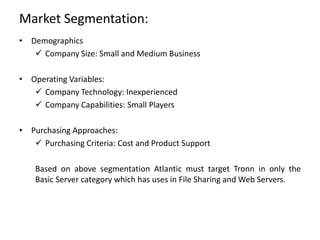

- Tronn targets small/medium businesses with inexperienced IT needs for file/web servers.

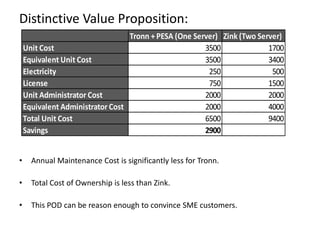

- A value proposition shows Tronn with bundled software has lower total cost of ownership than two Zink servers.

- The decision is made to value price T