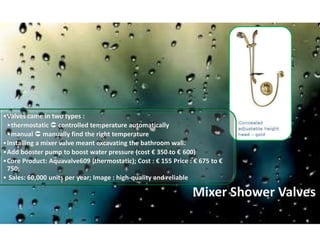

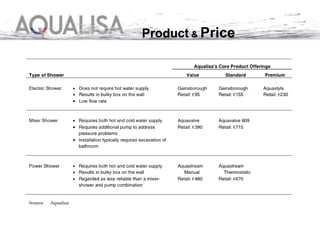

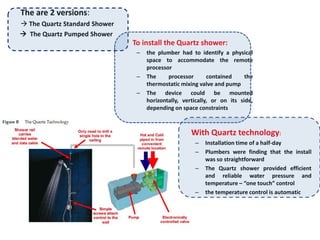

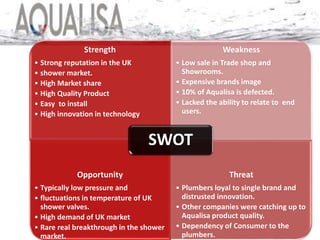

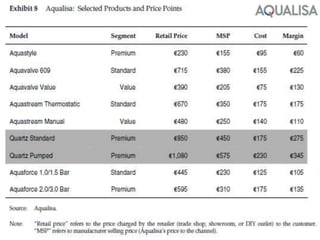

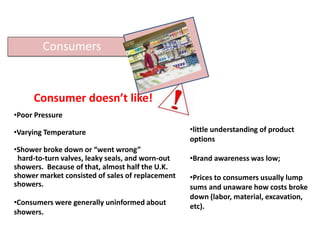

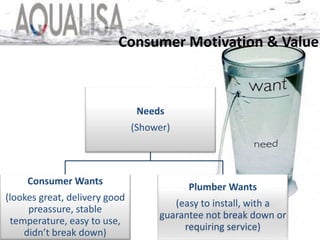

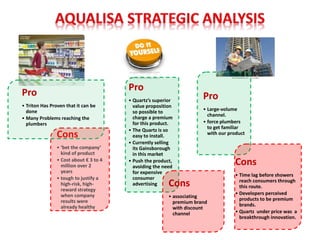

1. The document discusses Aqualisa Quartz, a new shower technology developed by Aqualisa to address issues with UK showers like poor water pressure and temperature fluctuations.

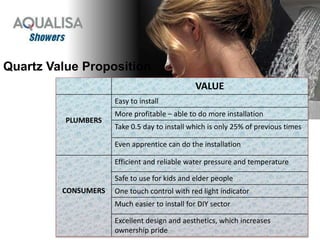

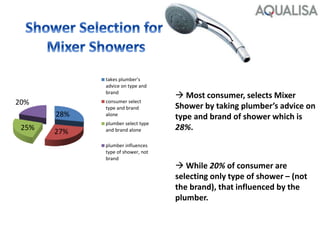

2. Aqualisa Quartz showers were much easier for plumbers to install, taking only half a day compared to previous shower installations. However, they had low initial sales due to plumbers' distrust of new technologies.

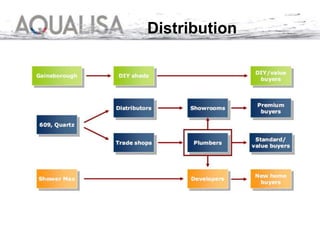

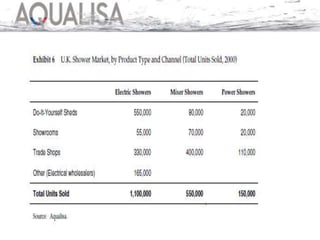

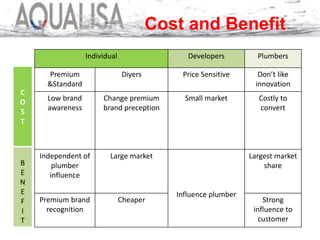

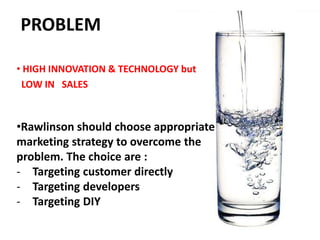

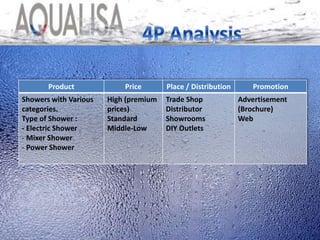

3. The document analyzes Aqualisa's options to increase Quartz shower sales, including targeting customers directly through advertising, working with developers to promote the product, or focusing on the DIY market where installation ease would be highly valuable.