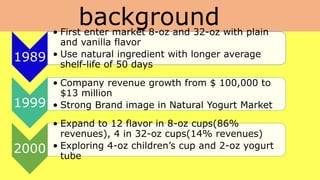

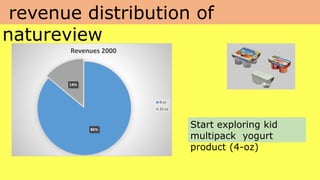

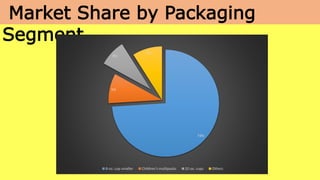

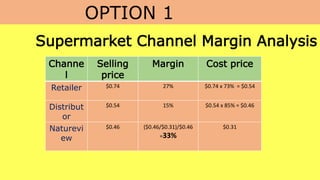

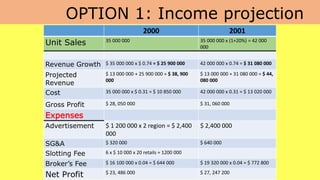

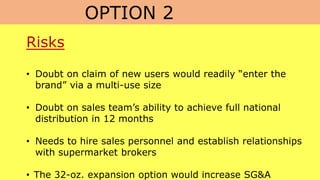

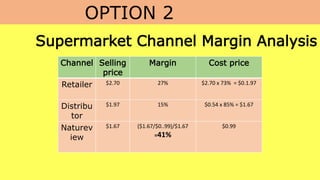

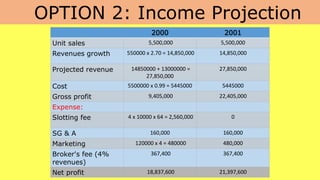

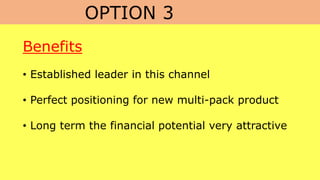

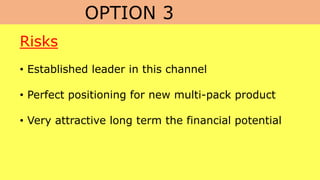

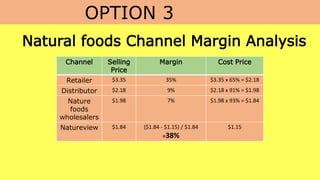

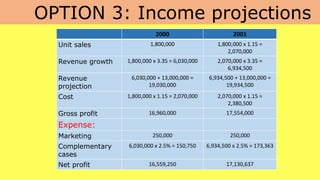

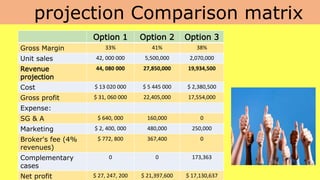

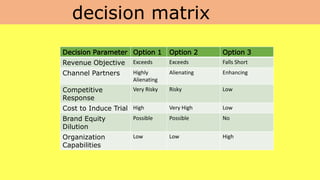

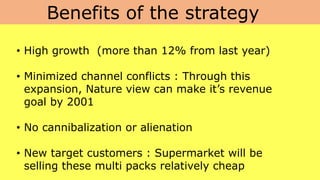

This document provides background information on Natureview Farm, a yogurt company that grew from $100,000 in revenue in 1989 to $13 million in 1999 by selling natural yogurt through natural food stores. In 2000, Natureview sought to grow further by exploring new distribution channels and products. Three options were proposed: 1) Expand 8-oz cups to supermarkets, 2) Expand 32-oz cups nationally, or 3) Launch a children's multi-pack in natural food stores. Each option was analyzed in terms of benefits, risks, margins and projected financials. Ultimately, expanding the multi-pack line to select supermarket regions in the Northeast and West was recommended as a way to reach the $20 million revenue goal while minimizing risks