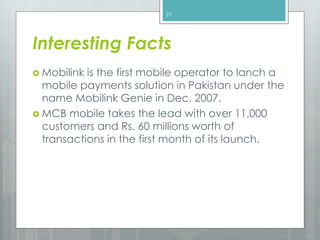

Mobile banking allows customers to conduct financial transactions through mobile devices. It began with SMS banking and later expanded to mobile web and apps. Standard Chartered Bank offers Breeze mobile banking which allows customers to check balances, transfer funds between accounts, track ATM locations, and more. Muslim Commercial Bank offers SMS banking services that enable customers to make payments, check balances, and view statements on their mobile phones. Mobile banking provides convenience for customers and has significant potential for growth in Pakistan given the large number of mobile users compared to bank account holders.