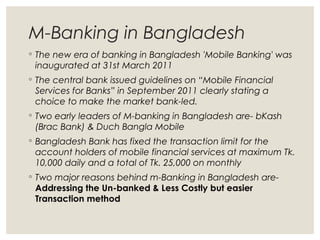

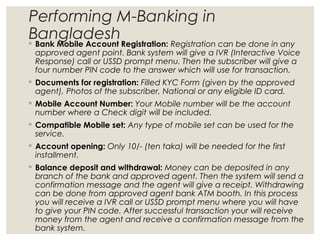

Mobile banking allows users to conduct financial transactions through their mobile devices. It originated in the late 1990s and early 2000s with the development of SMS banking and third generation mobile networks. Mobile banking provides benefits like convenience, mobility, and lower costs. In Bangladesh, mobile banking is popular for addressing the unbanked population and facilitating cheaper transactions. Some challenges to its growth include poor infrastructure, high costs, and legal/policy barriers.