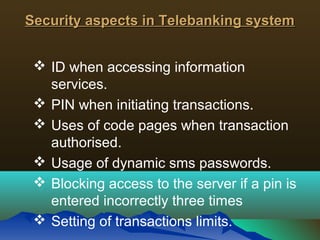

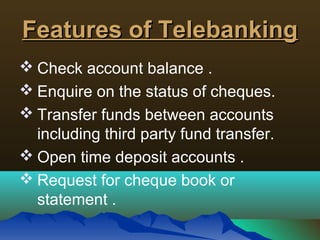

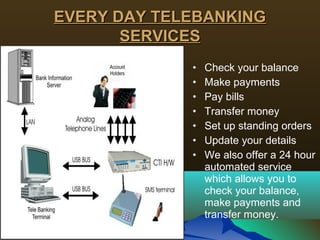

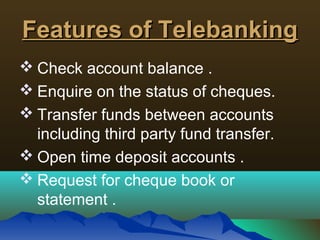

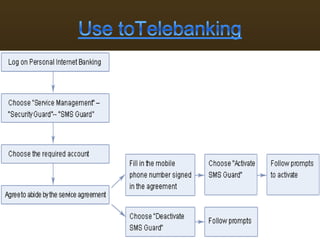

Telebanking, also known as telephone banking, allows customers to perform financial transactions over the phone without visiting a bank branch. It provides services like checking account balances, transferring funds, paying bills, and more. Telebanking uses security features like passwords, PINs, and transaction limits to protect customer accounts. It offers customers convenient access to their banking needs at any time without needing to visit in person.