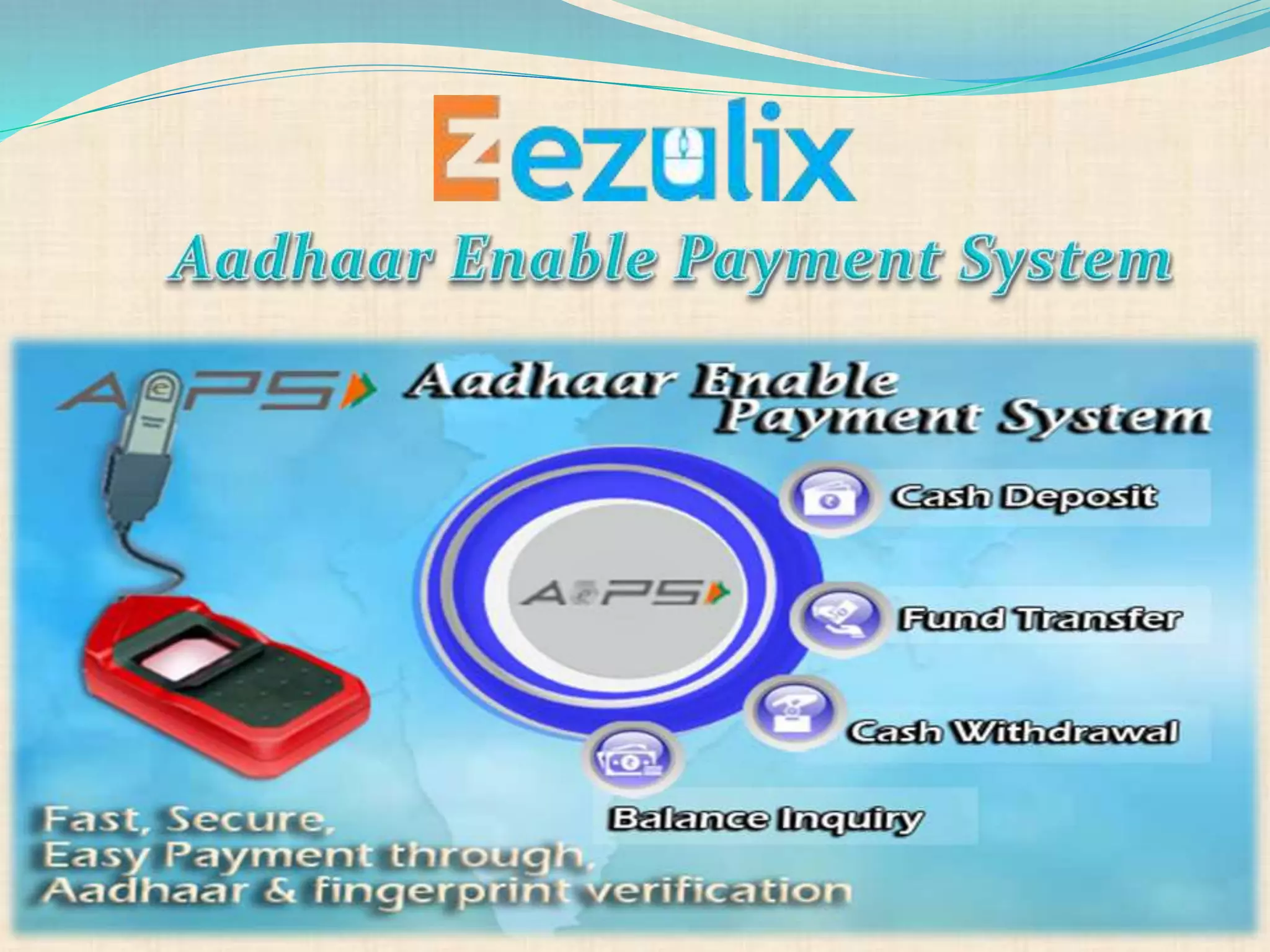

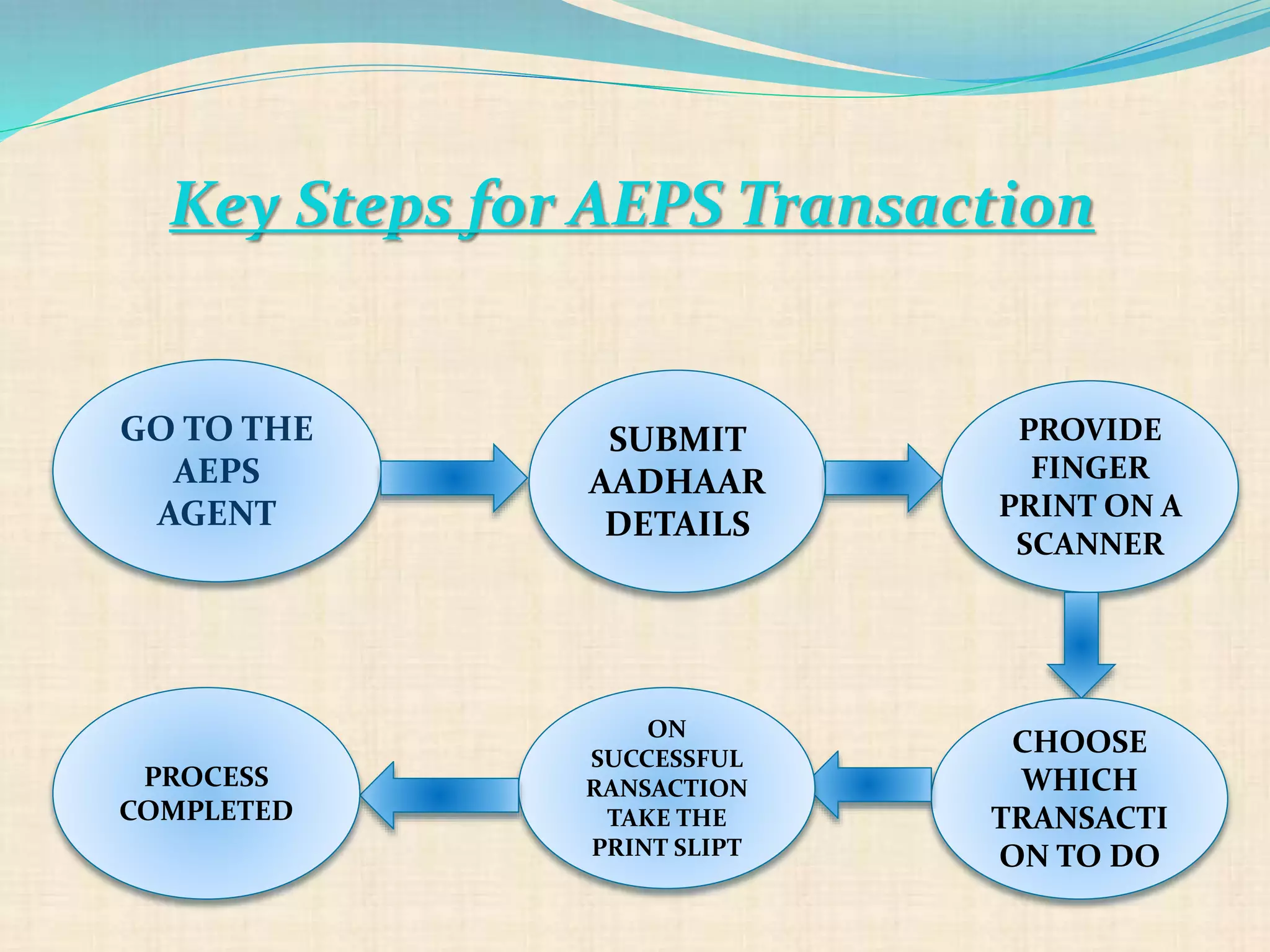

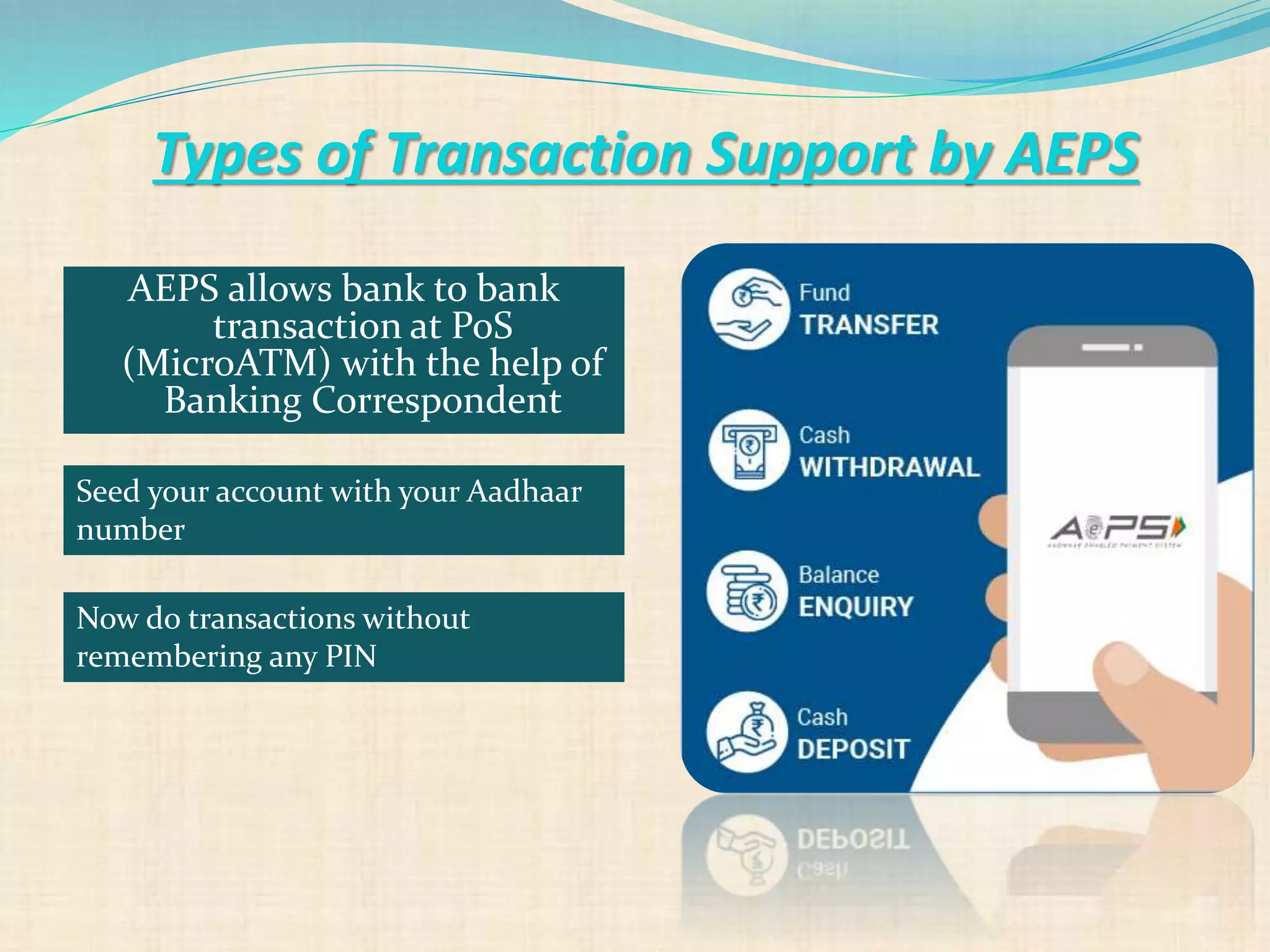

The Aadhaar Enabled Payment System (AEPS) is a financial service approved by the Reserve Bank of India that allows bank customers to perform transactions using biometrically authenticated Aadhaar numbers. It facilitates cash deposits, withdrawals, balance inquiries, and fund transfers via micro-ATMs through banking correspondents, providing a secure and convenient banking solution without the need for signatures or debit cards. AEPS software enables the creation of agents who can perform transactions and earn commissions, thus enhancing business performance in the banking sector.