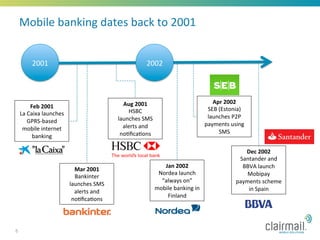

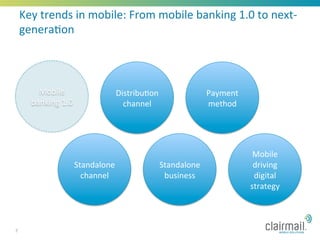

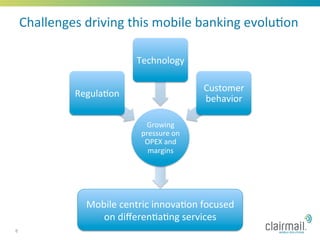

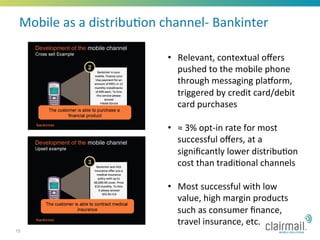

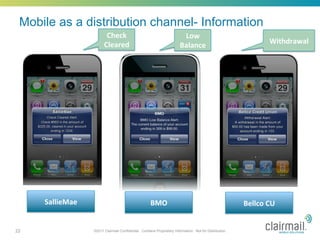

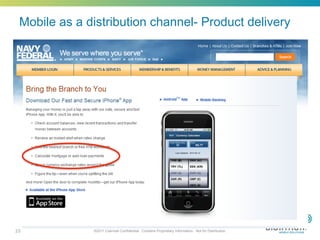

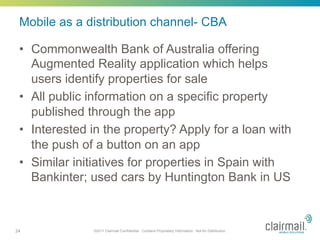

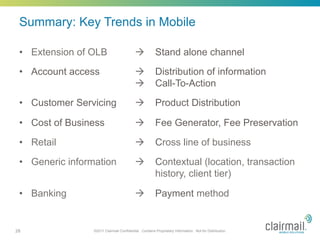

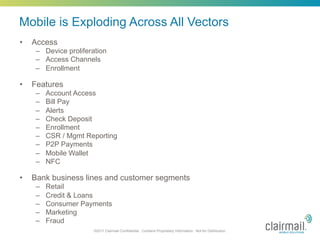

The document discusses key trends in mobile banking and benchmarks for innovation in Europe and the rest of the world (ROW). It covers how some banks have made mobile a standalone channel or distribution channel, focusing on account access, payments, loans, and driving broader digital strategies. Specific examples highlighted include La Caixa making mobile a full channel in Europe, Akbank distributing loans via mobile banners, and Wells Fargo using mobile as a standalone channel in the ROW. The document analyzes how mobile banking is evolving from early notification services to a critical part of digital transformation.