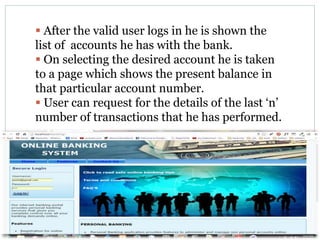

The document discusses online banking, including its definition as conducting financial transactions electronically rather than at a physical branch. It outlines the requirements and procedures for online banking, such as having internet access, registering with a bank, and logging in with a username and password. The key features and advantages of online banking are also summarized, such as lower transaction costs, ability to access accounts anywhere, and immediate money transfers.