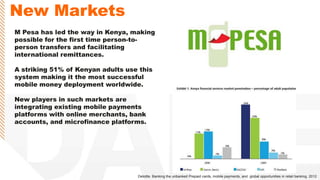

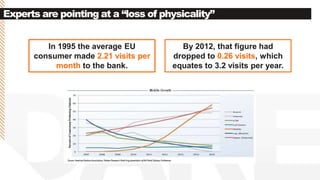

The document explores the significant growth of mobile banking, highlighting how consumer visits to physical banks have drastically declined in favor of mobile services. It emphasizes the importance of innovation, convenience, and building customer relationships to enhance user experiences and retain loyalty in the banking sector. Additionally, it discusses various successful case studies and strategies being adopted by banks and fintech companies to meet the evolving demands of consumers, particularly in reaching unbanked populations.

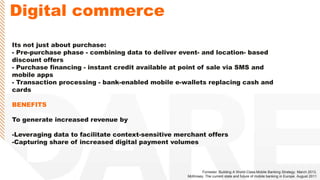

![A variety of new players are

entering the market, including

tech specialists such as Google,

start-ups such as Square, and

established online payment

providers such as PayPal.

Google in particular has bold

plans: It wants to close the last

mile and is willing to give away

everything to merchants

(including point-of-sale

terminals, digital wallets, and

Trusted Service Manager [TSM]

services) to make this happen.

Digital commerce](https://image.slidesharecdn.com/disruptionmobileandfinancialservices-130708161009-phpapp01/85/Disruption-mobile-and-financial-services-13-320.jpg)