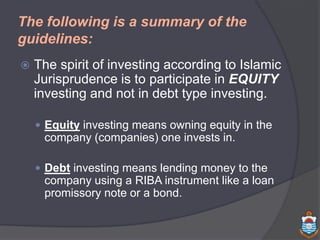

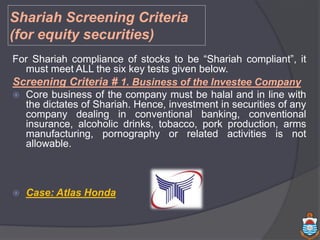

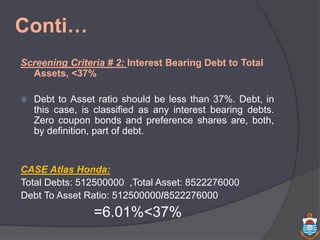

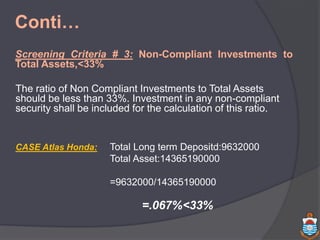

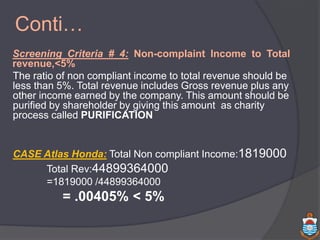

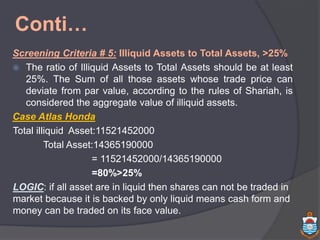

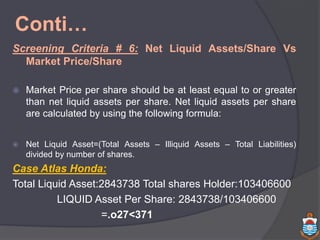

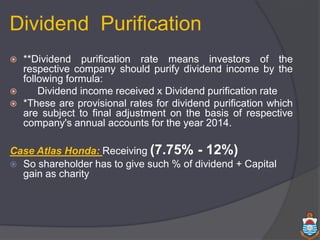

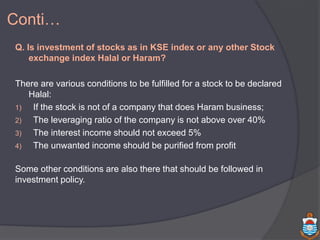

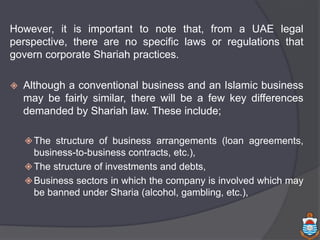

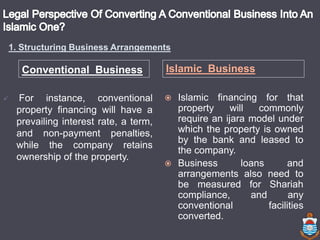

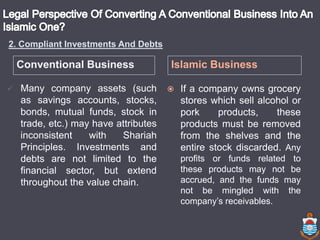

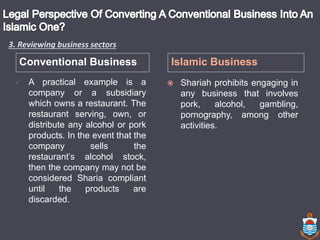

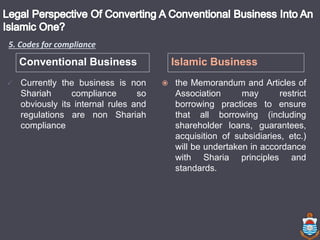

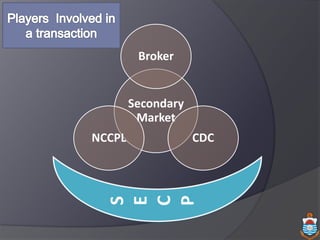

The document discusses Islamic finance, covering topics such as Islamic investment funds, Shariah screening criteria for stocks, and the growth of the Islamic financial industry. It emphasizes the importance of earning halal profits in compliance with Shariah principles and outlines the screening criteria necessary for stocks to be considered Shariah-compliant. The document also provides case studies and highlights differences between conventional and Islamic business practices.