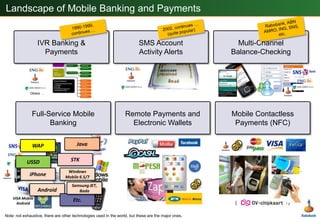

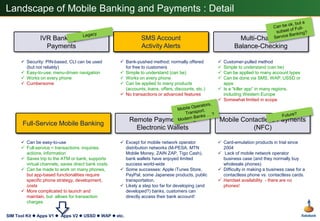

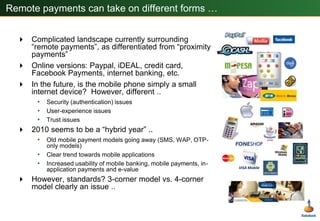

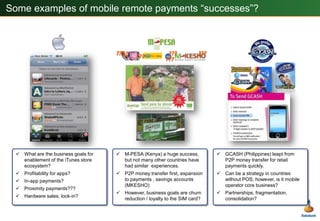

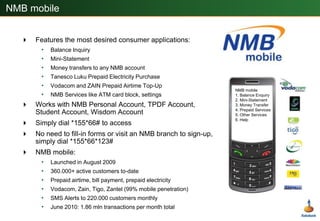

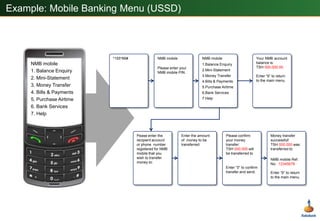

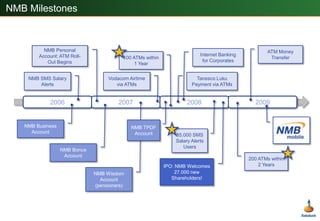

The document presents an overview of mobile banking and payments developments within Rabobank, highlighting case studies from various countries. It discusses the evolution of mobile banking technologies, successful implementations, and the challenges faced in developing full-service banking solutions. Additionally, it emphasizes the importance of usability, customer engagement, and effective product management strategies in enhancing mobile banking services.