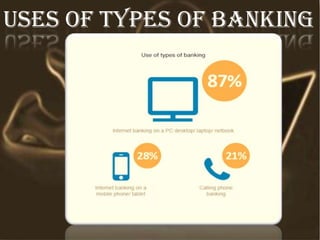

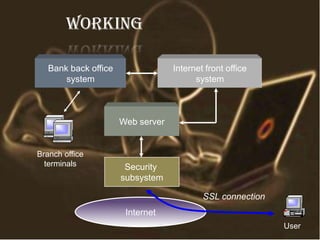

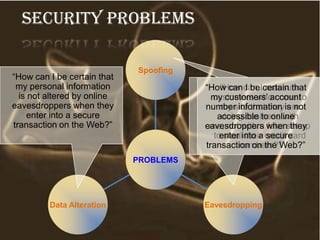

This document discusses internet banking. It begins with a brief history of internet banking starting in 1981 with four major New York City banks offering early home banking services. It then defines internet banking as conducting bank transactions online instead of in person. The document outlines the types of internet banking, services provided, how it works involving web servers and security, advantages like lower costs and convenience, disadvantages like security risks, and concludes that internet banking aims to provide valuable services to consumers by utilizing the internet.