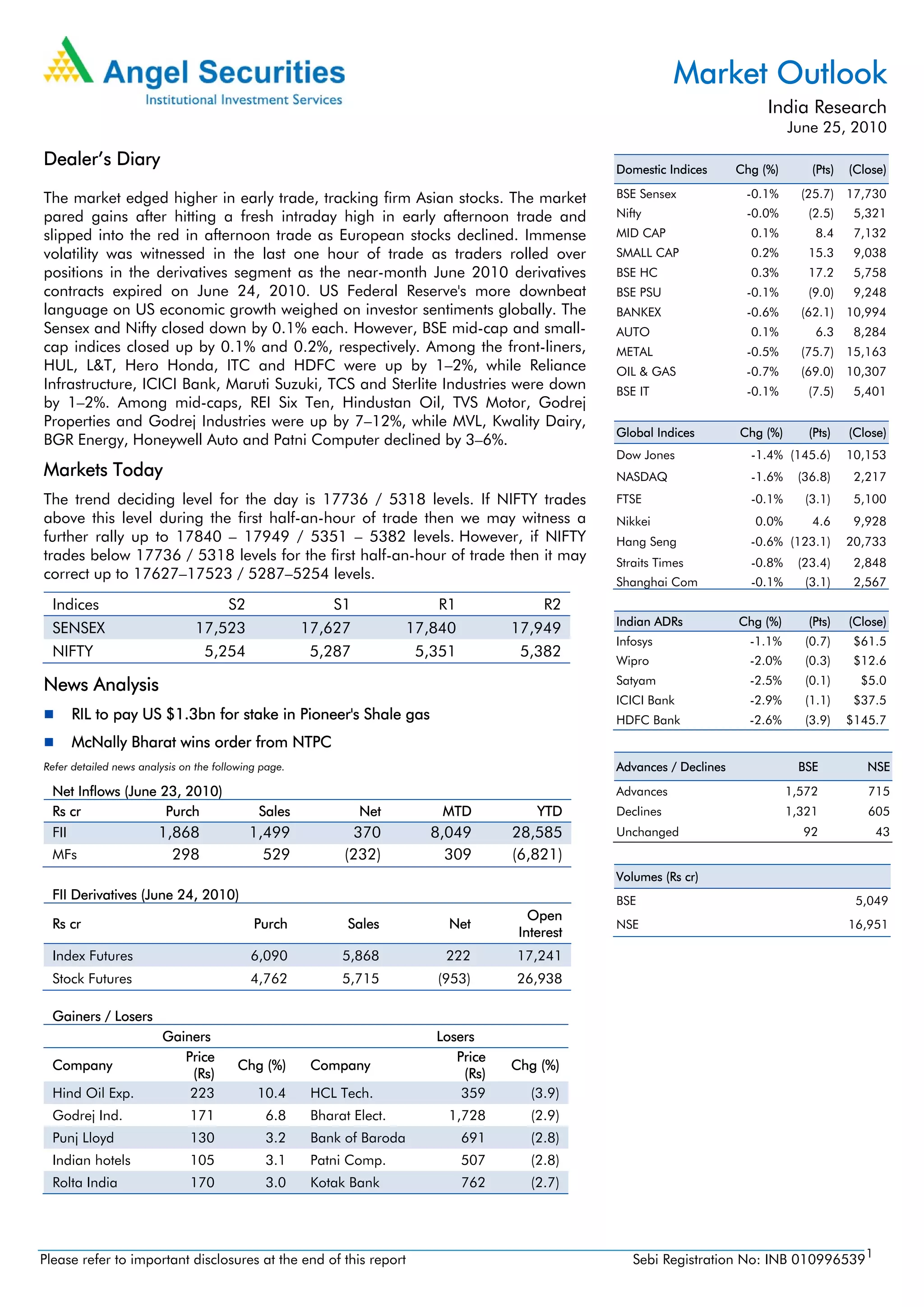

The market edged higher in early trade but later declined, with the Sensex and Nifty closing down 0.1%. Mid-cap and small-cap indices closed up slightly. Reliance Industries agreed to pay $1.3 billion for a stake in Pioneer Natural Resources' shale gas assets in Texas. This adds 4.5 trillion cubic feet of gas to RIL's reserves. McNally Bharat Engineering won an order worth Rs41.4 crore from NTPC.