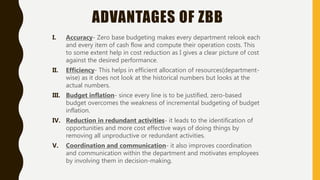

Zero-based budgeting is a method of budgeting where all expenses must be justified for each new period, starting from zero. It identifies the most efficient use of resources to achieve objectives. The marketing department budget for Company XYZ would be determined through zero-based budgeting by justifying each person and expense rather than simply increasing last year's budget. This approach identified that a construction equipment company could make certain parts in-house more cheaply than outsourcing, saving costs over traditional budgeting.