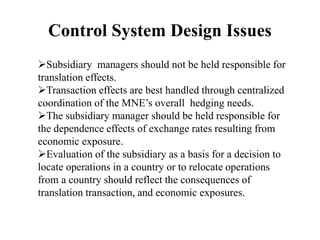

This document discusses management control systems in various types of organizations. It begins by explaining differences in management control for service organizations compared to manufacturing. It then discusses professional services, financial services, healthcare, and non-profit organizations, outlining their special characteristics and management control considerations. The document concludes by examining management control challenges in multinational organizations, including cultural differences, transfer pricing, exchange rates, and performance evaluation metrics.