This document discusses management control in decentralized organizations. It covers several key points:

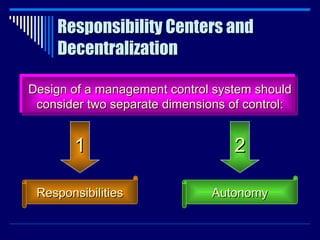

1) Decentralization delegates decision making to lower levels which has benefits like better local knowledge but also costs like potential misaligned decisions.

2) Companies find balancing decentralization in some areas with centralization in others works best.

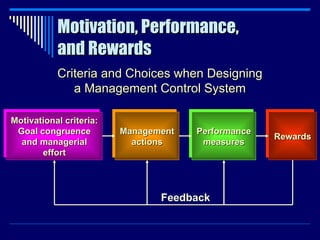

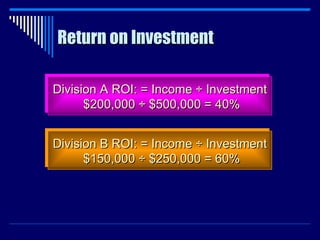

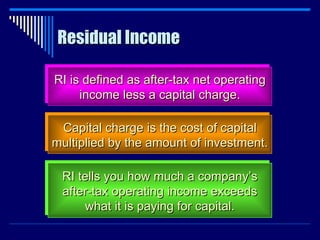

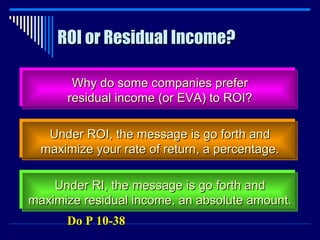

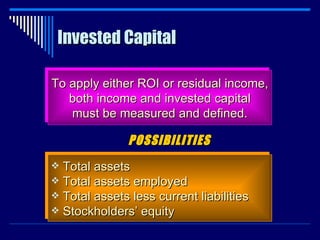

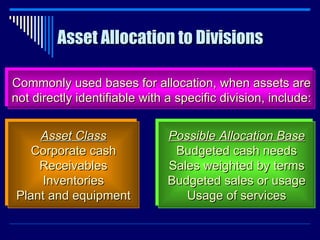

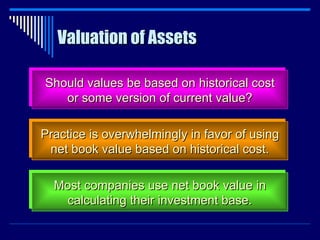

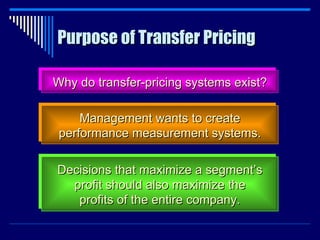

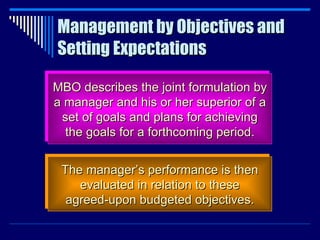

3) Performance measures and incentives should be carefully designed to motivate managers' efforts toward the overall organization's goals.

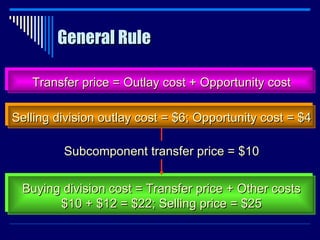

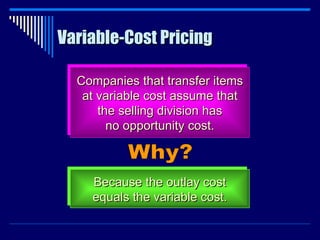

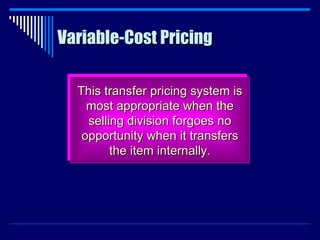

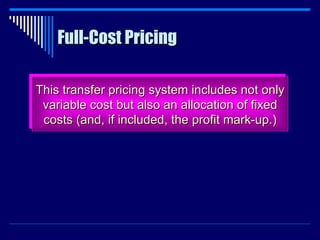

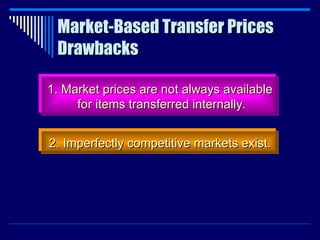

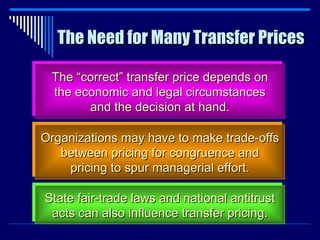

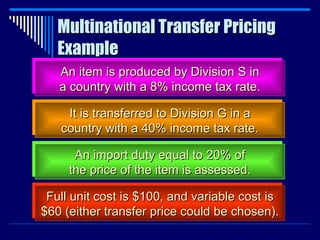

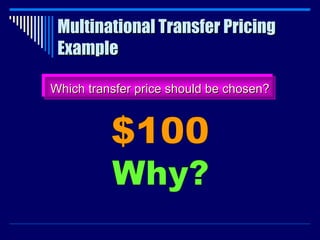

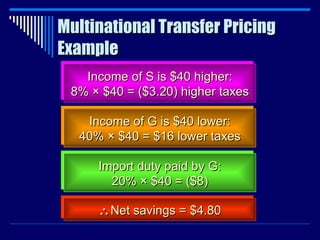

4) Transfer pricing between organizational units requires consideration of costs, market prices, and tax implications.