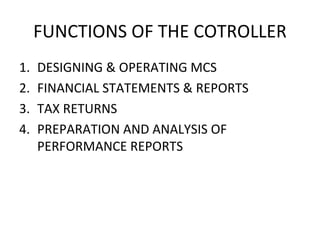

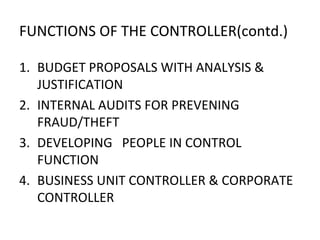

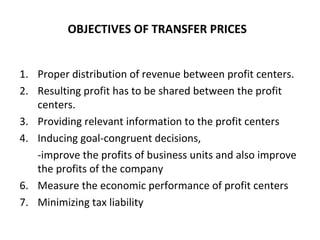

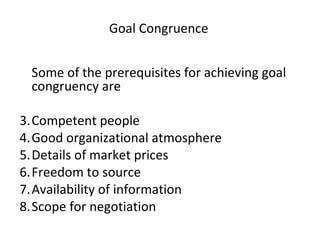

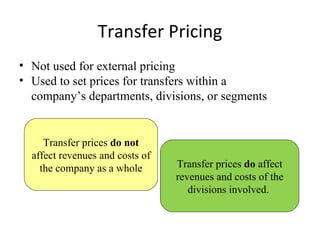

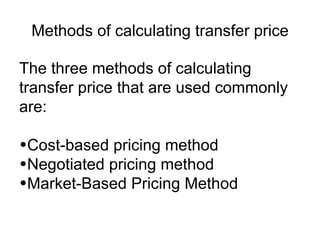

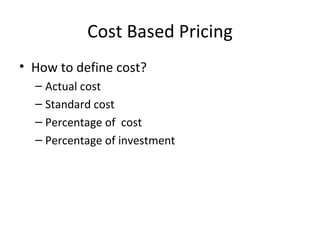

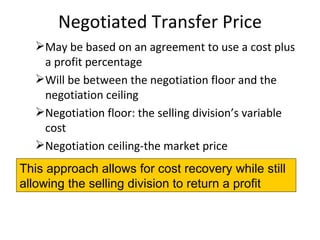

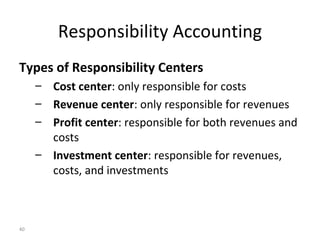

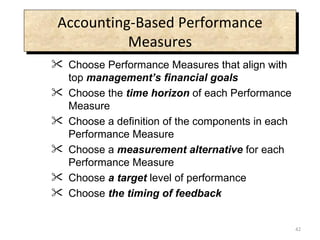

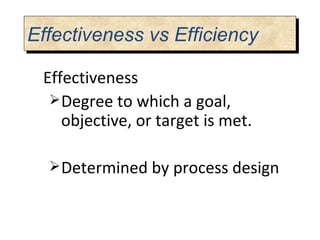

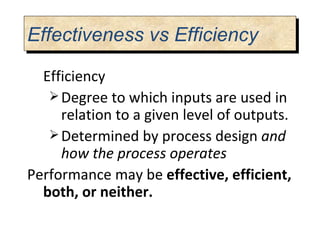

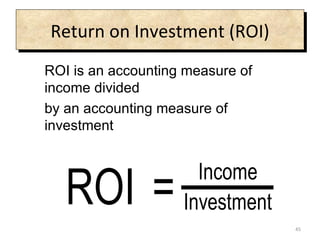

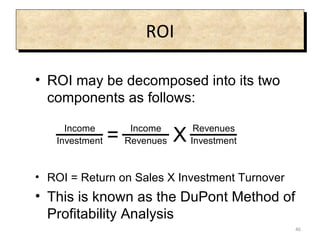

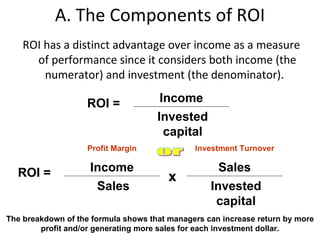

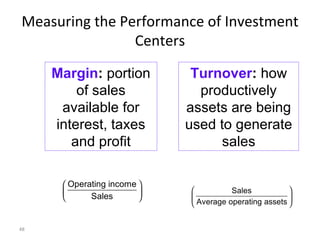

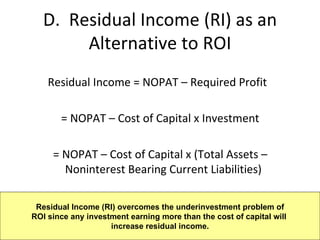

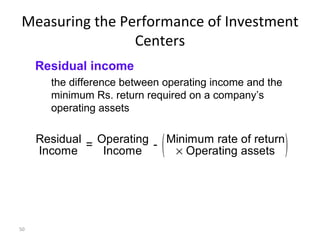

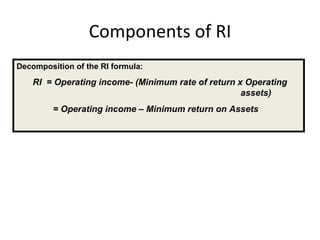

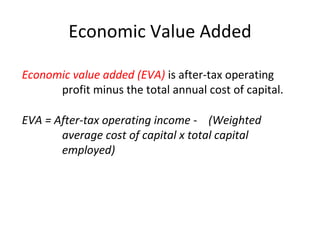

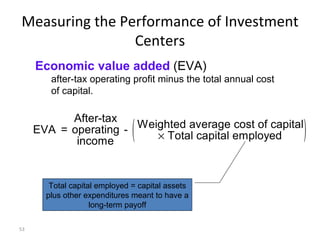

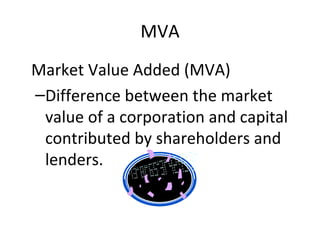

This document discusses management control systems and responsibility centers. It defines different types of responsibility centers like cost centers, revenue centers, and profit centers. It also discusses different performance measures used to evaluate responsibility centers like ROI, ROA, and MVA. The document discusses in detail concepts like return on investment, residual income, and economic value added which are used to measure the performance of investment centers. It also talks about transfer pricing and different methods used to determine internal transfer prices between divisions of a company.