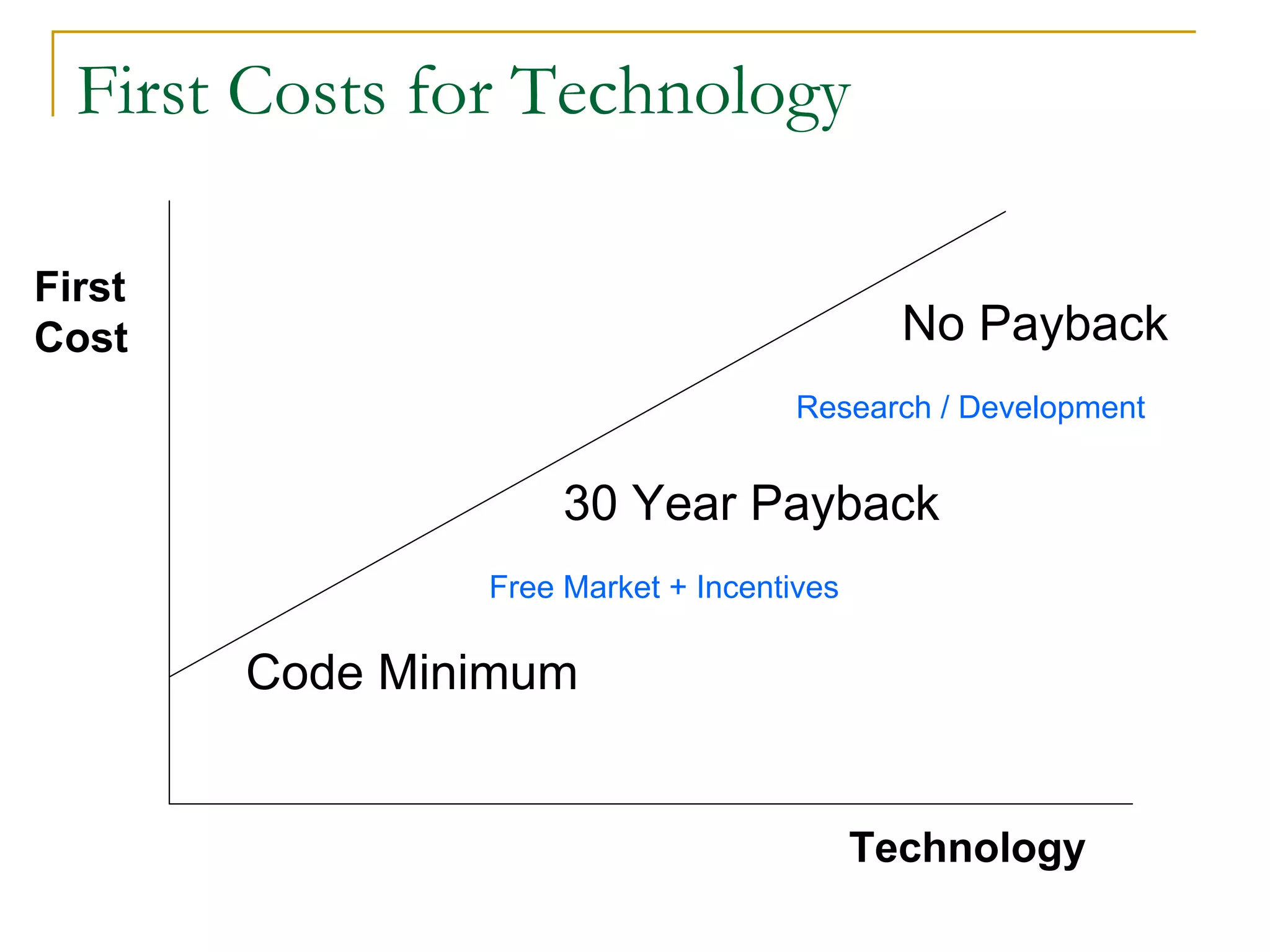

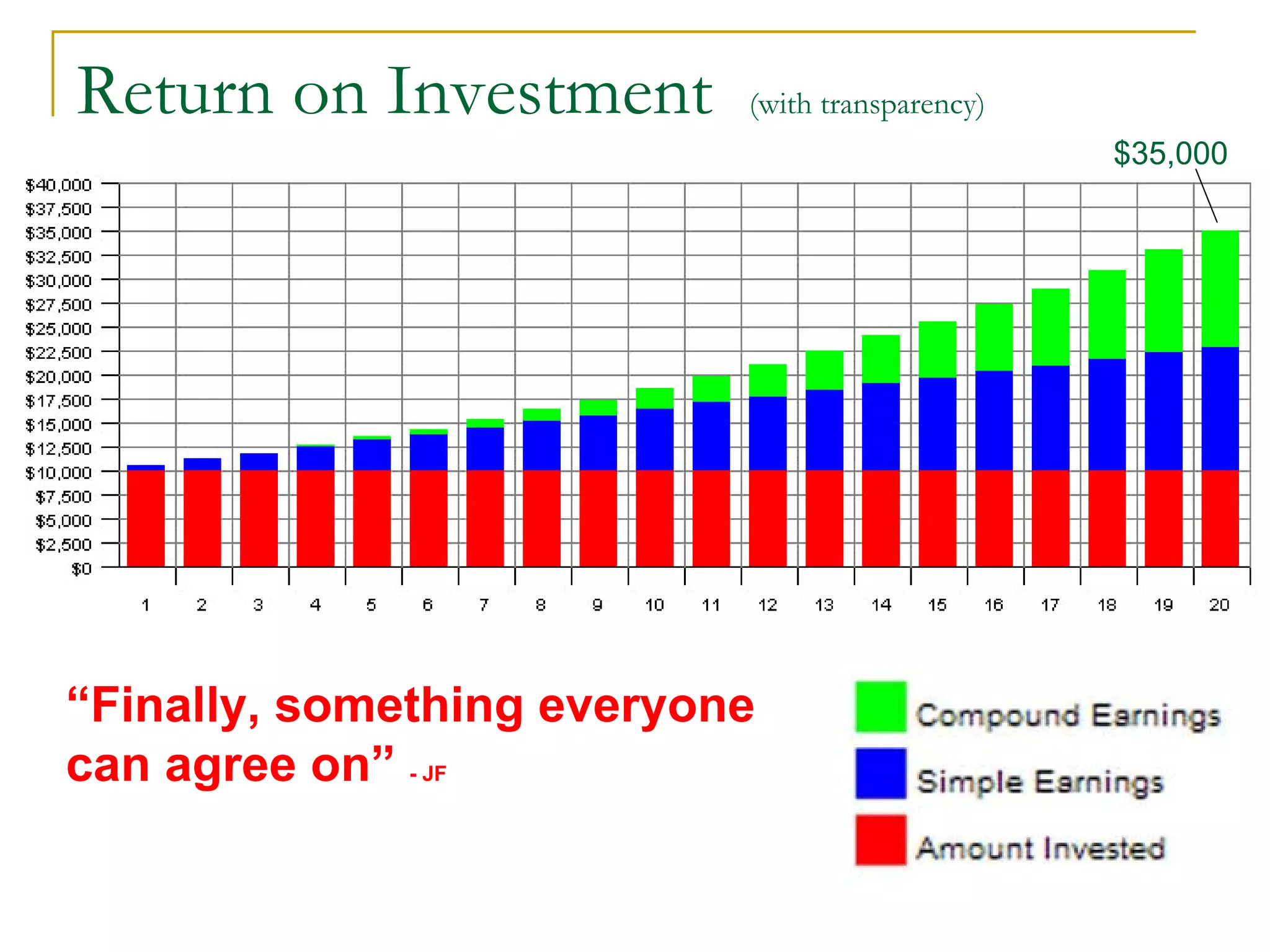

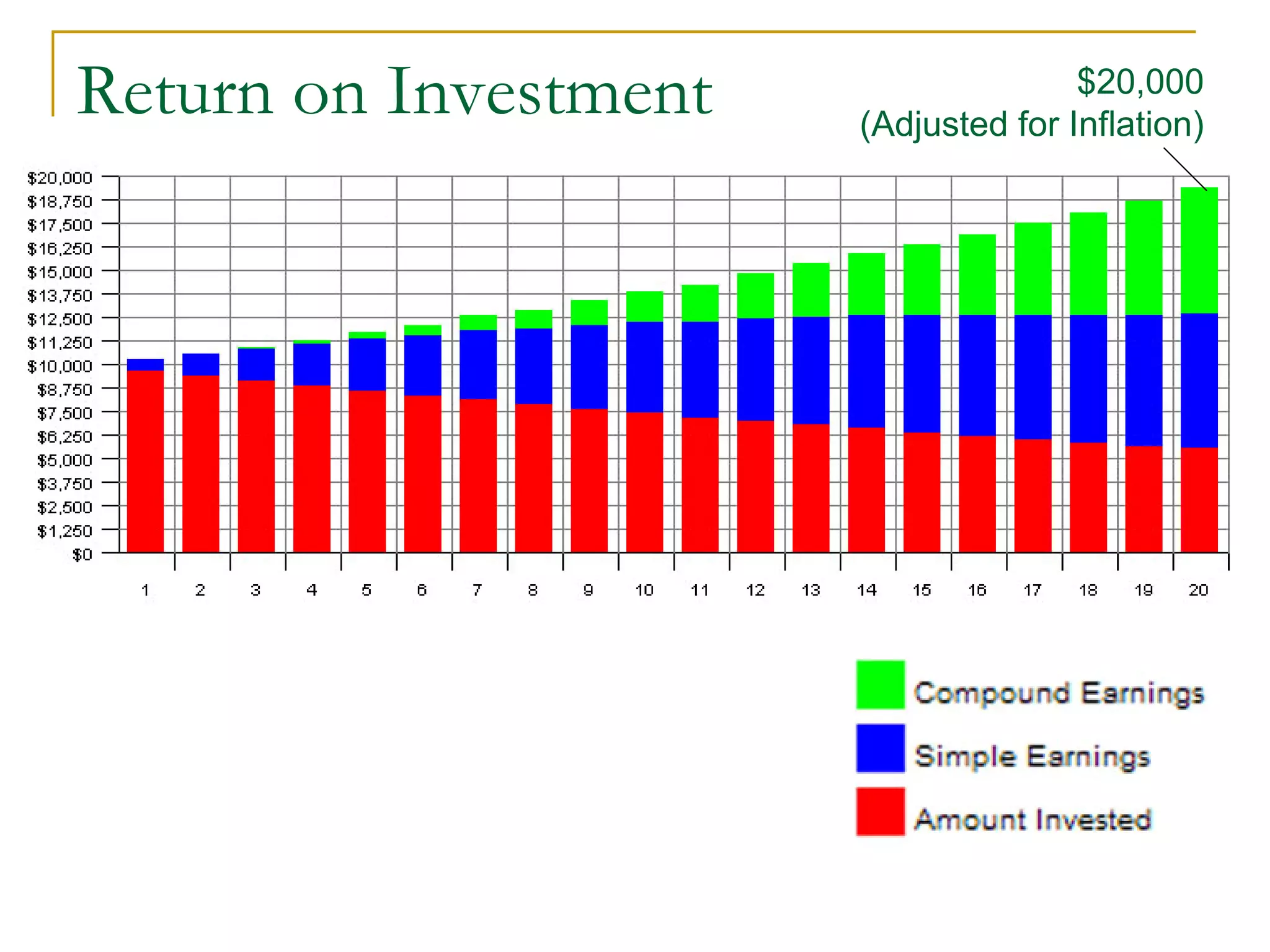

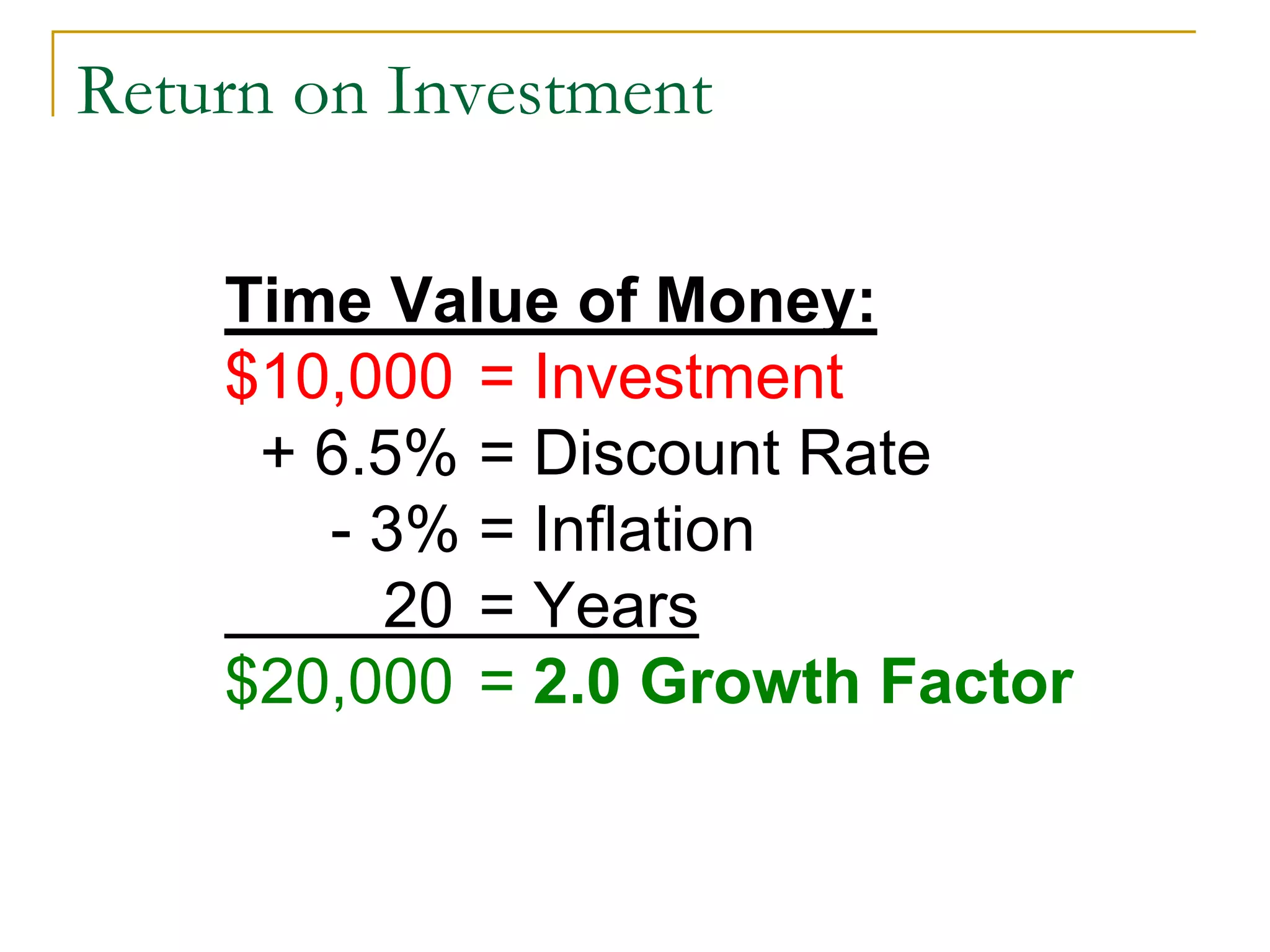

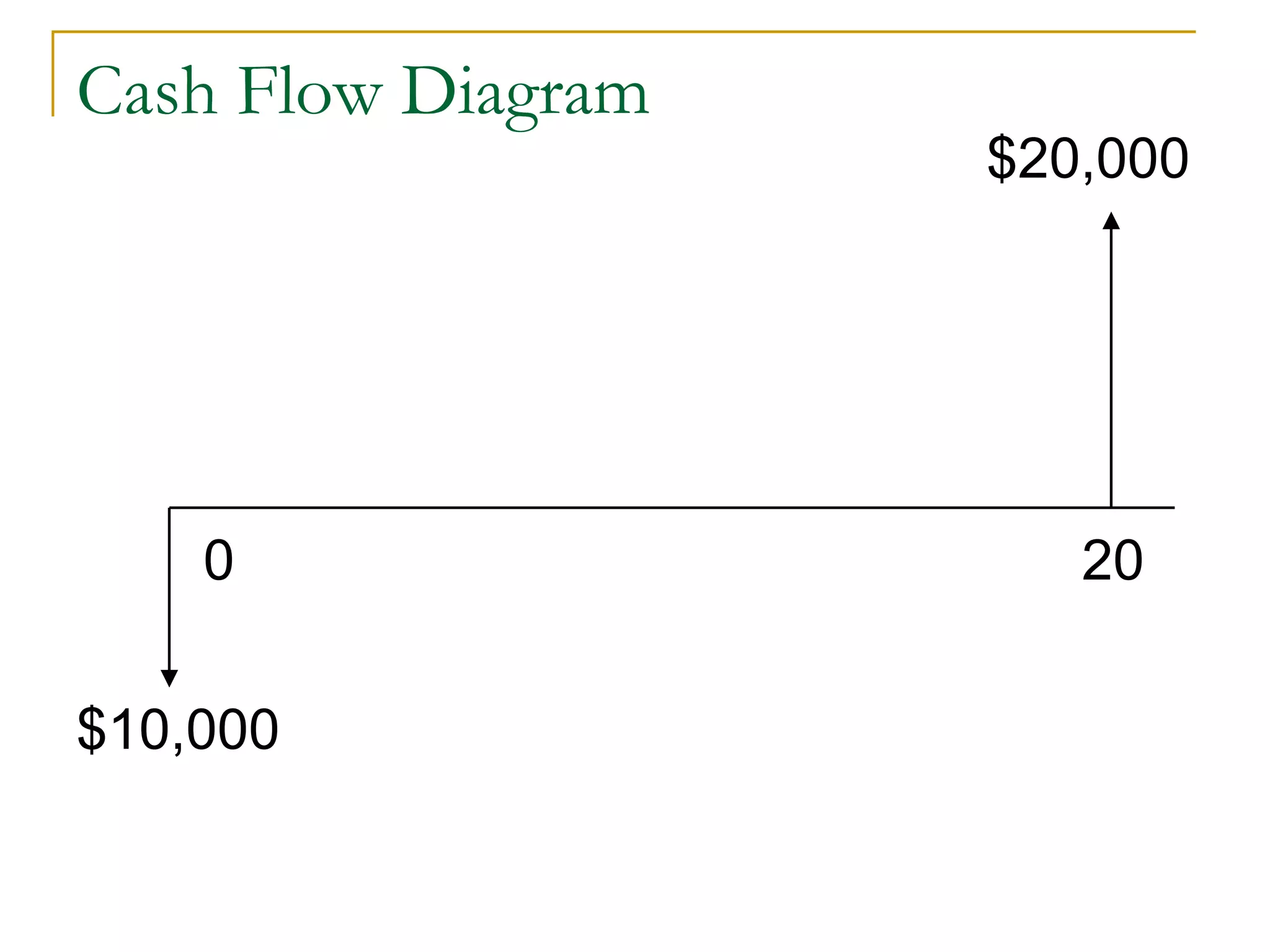

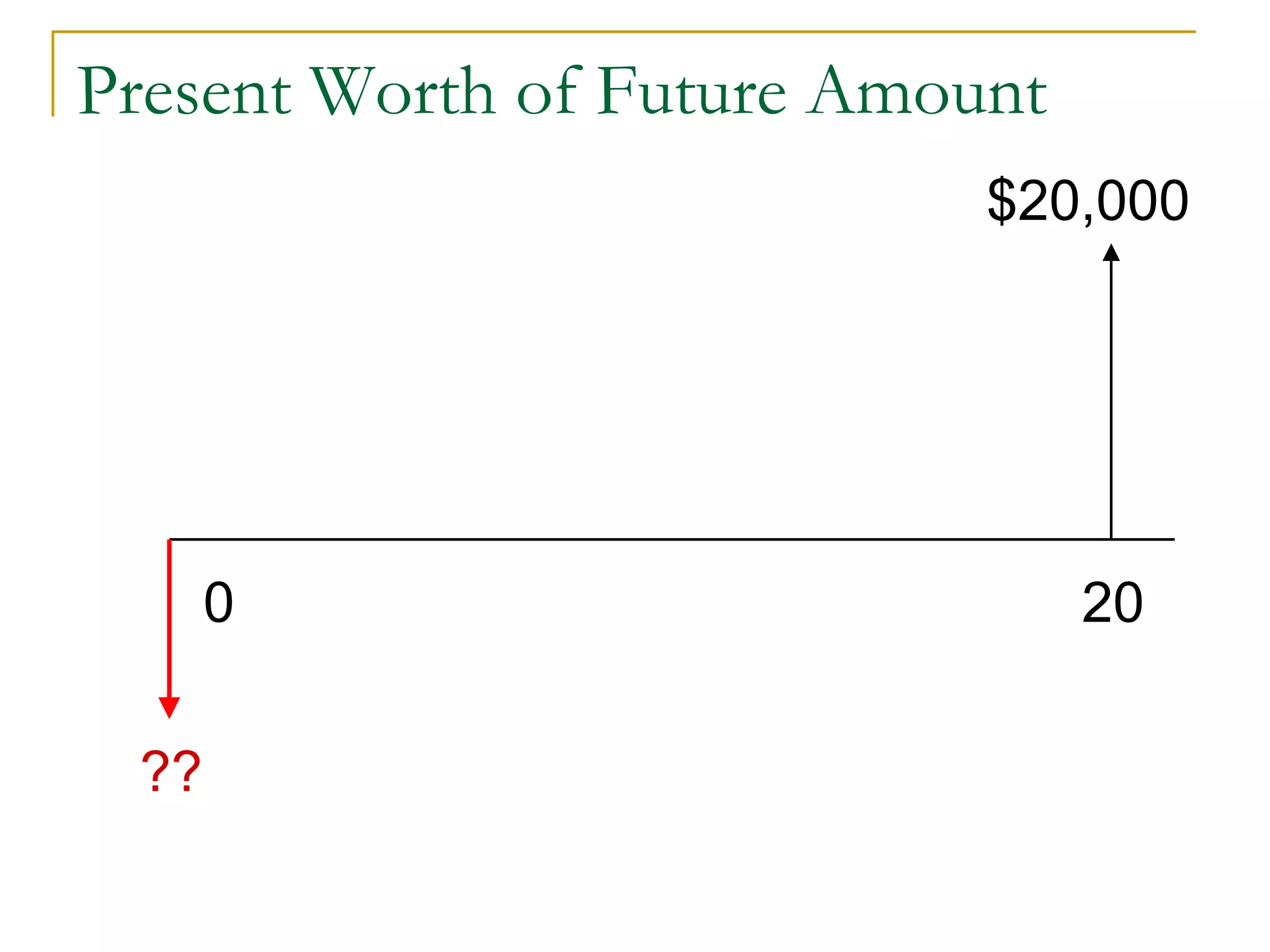

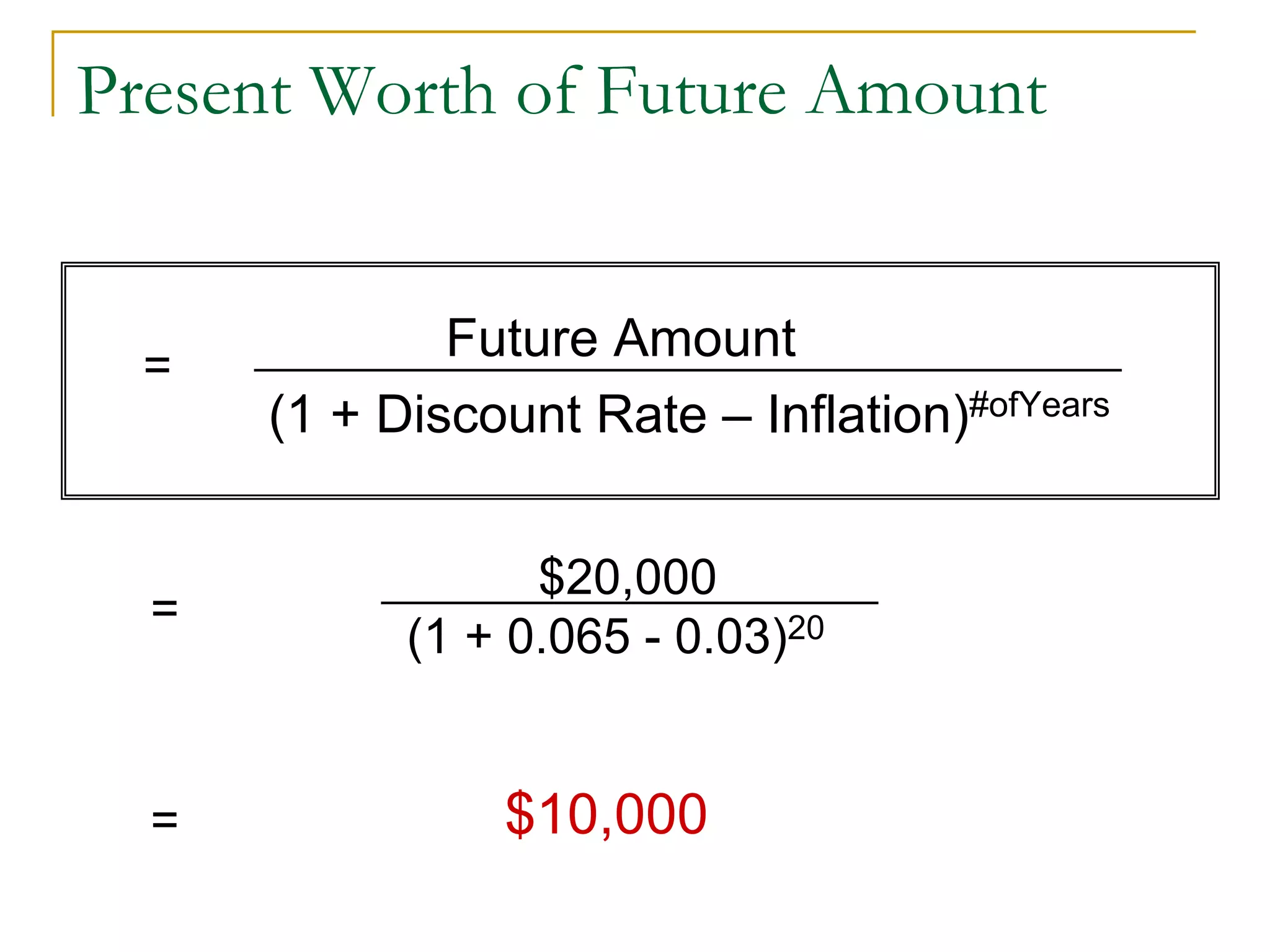

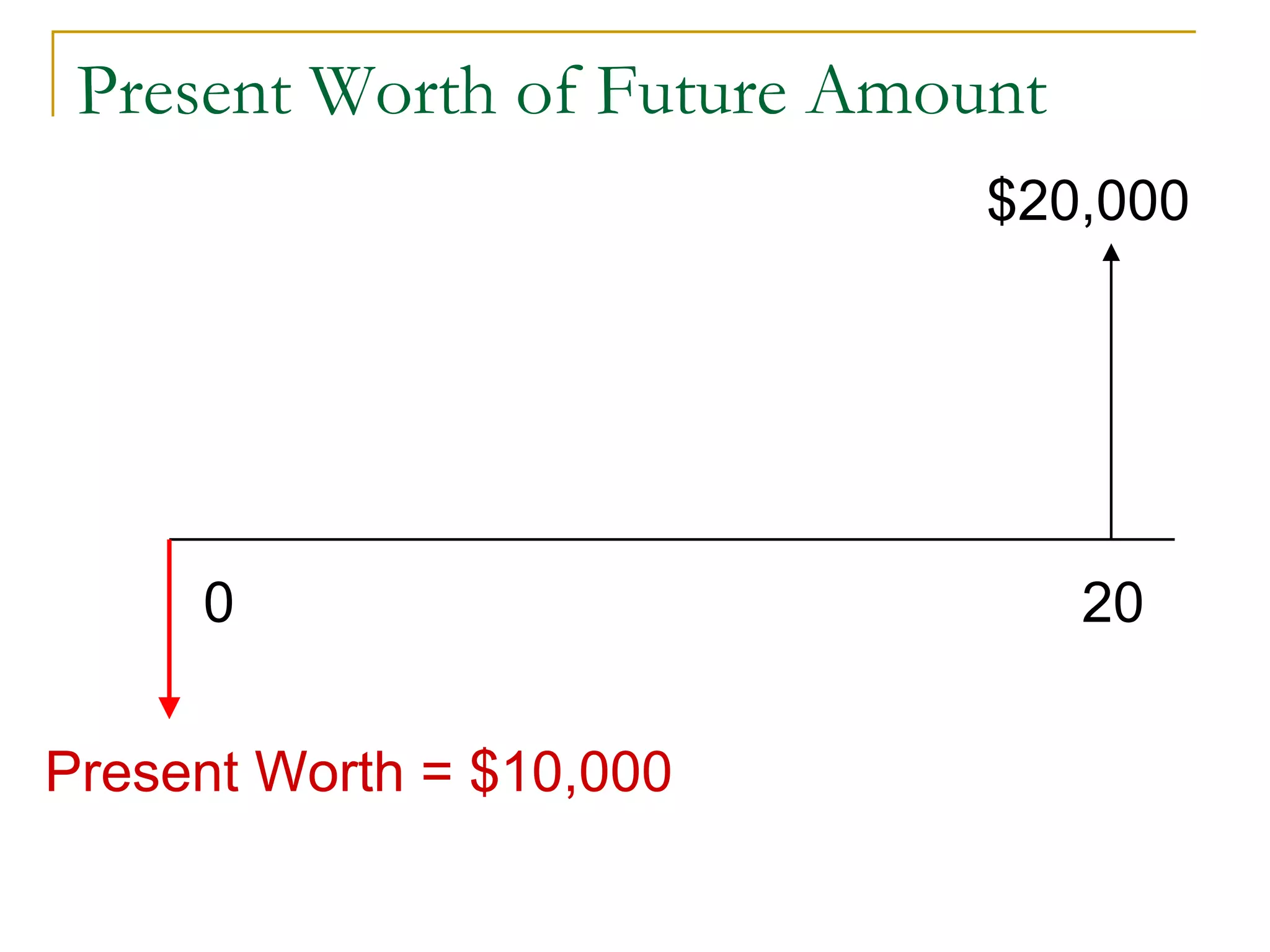

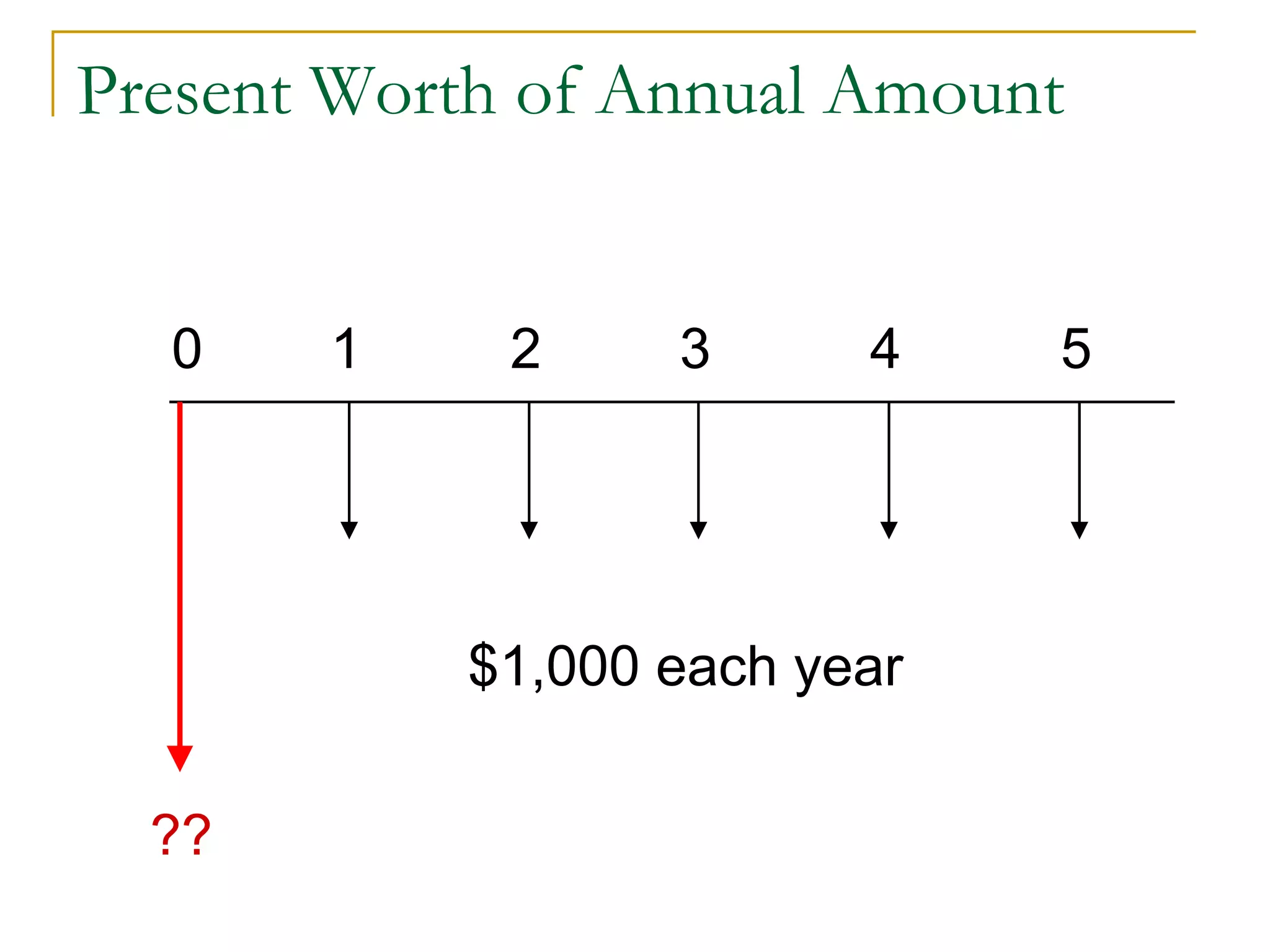

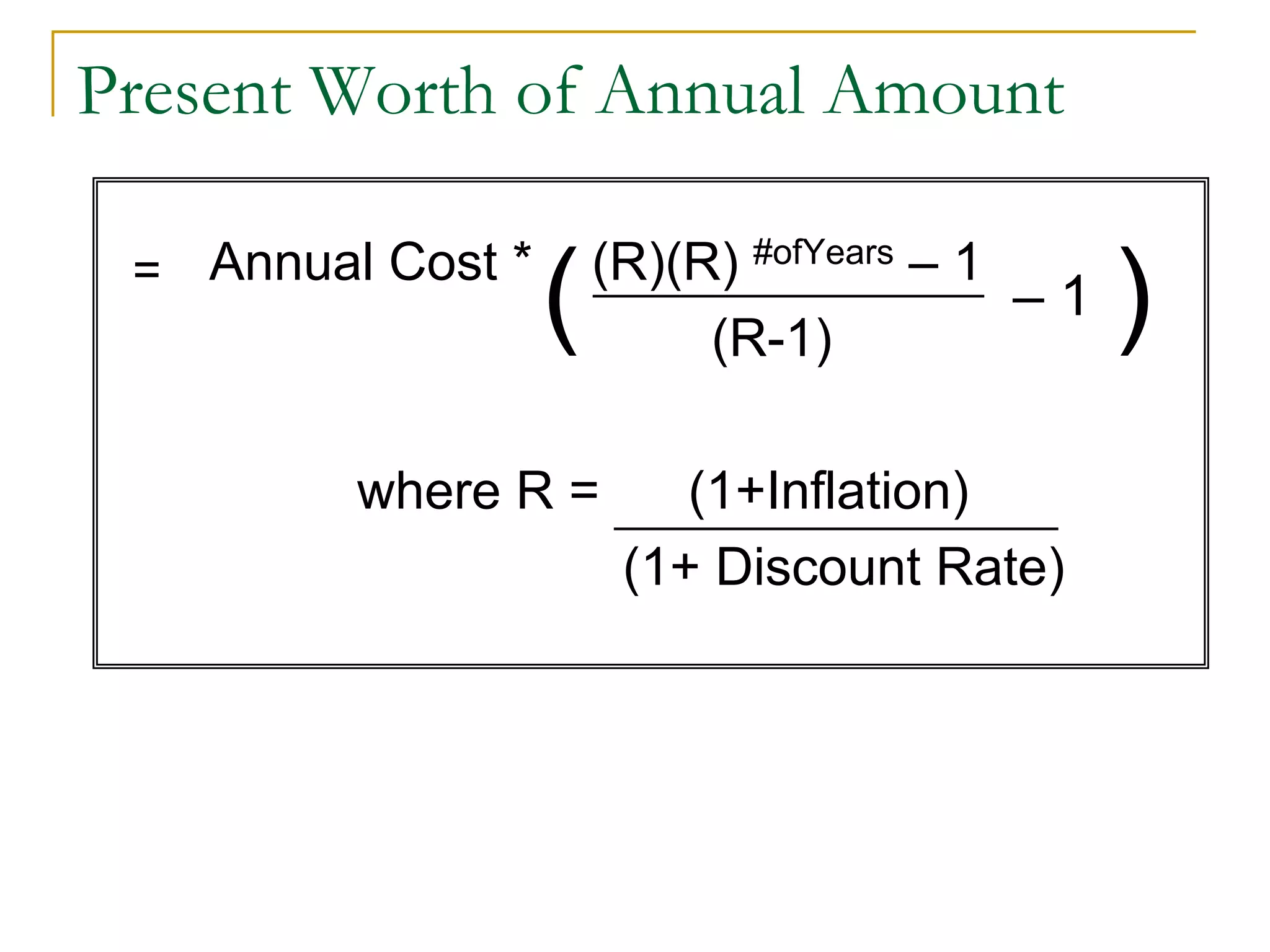

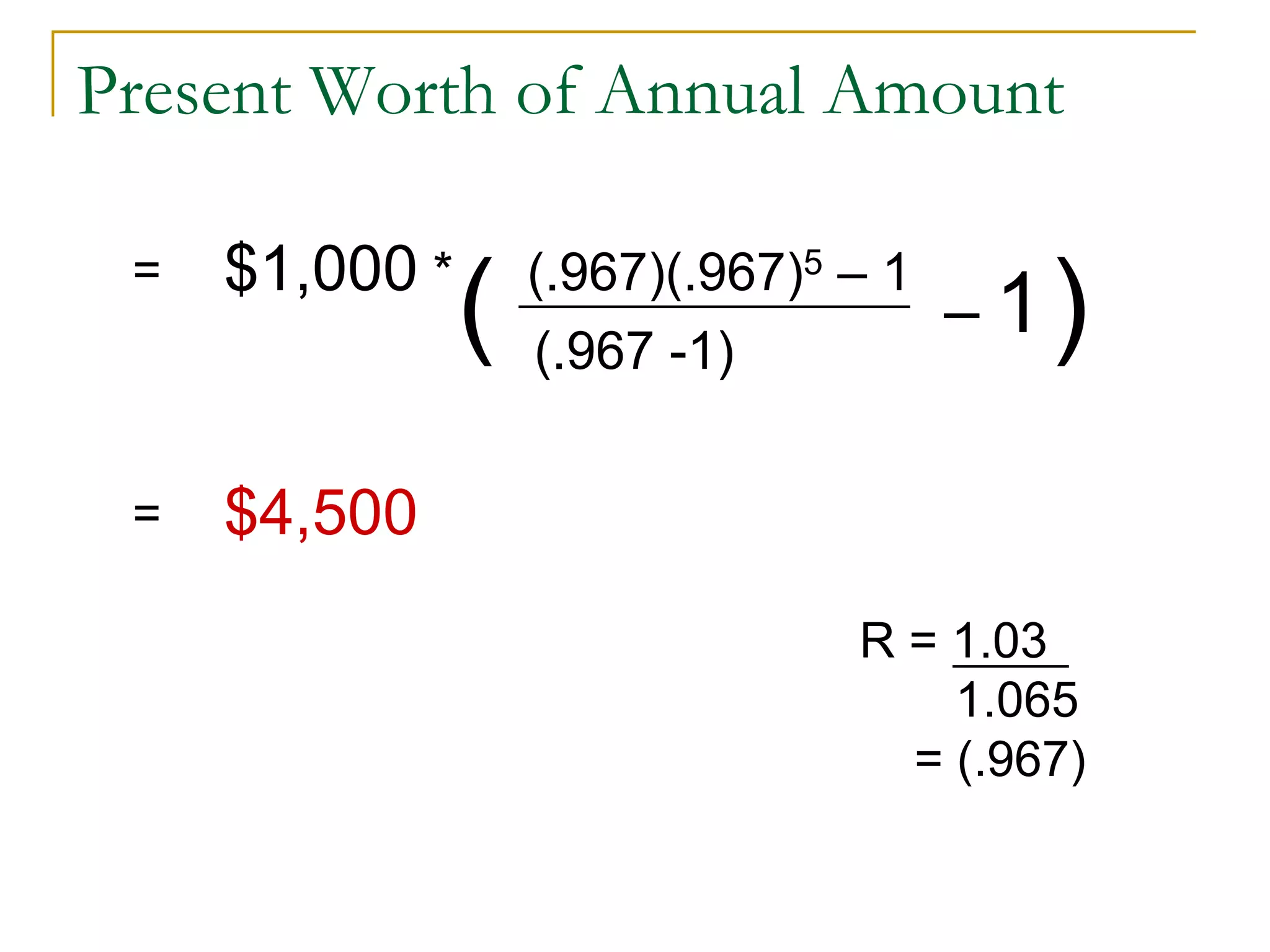

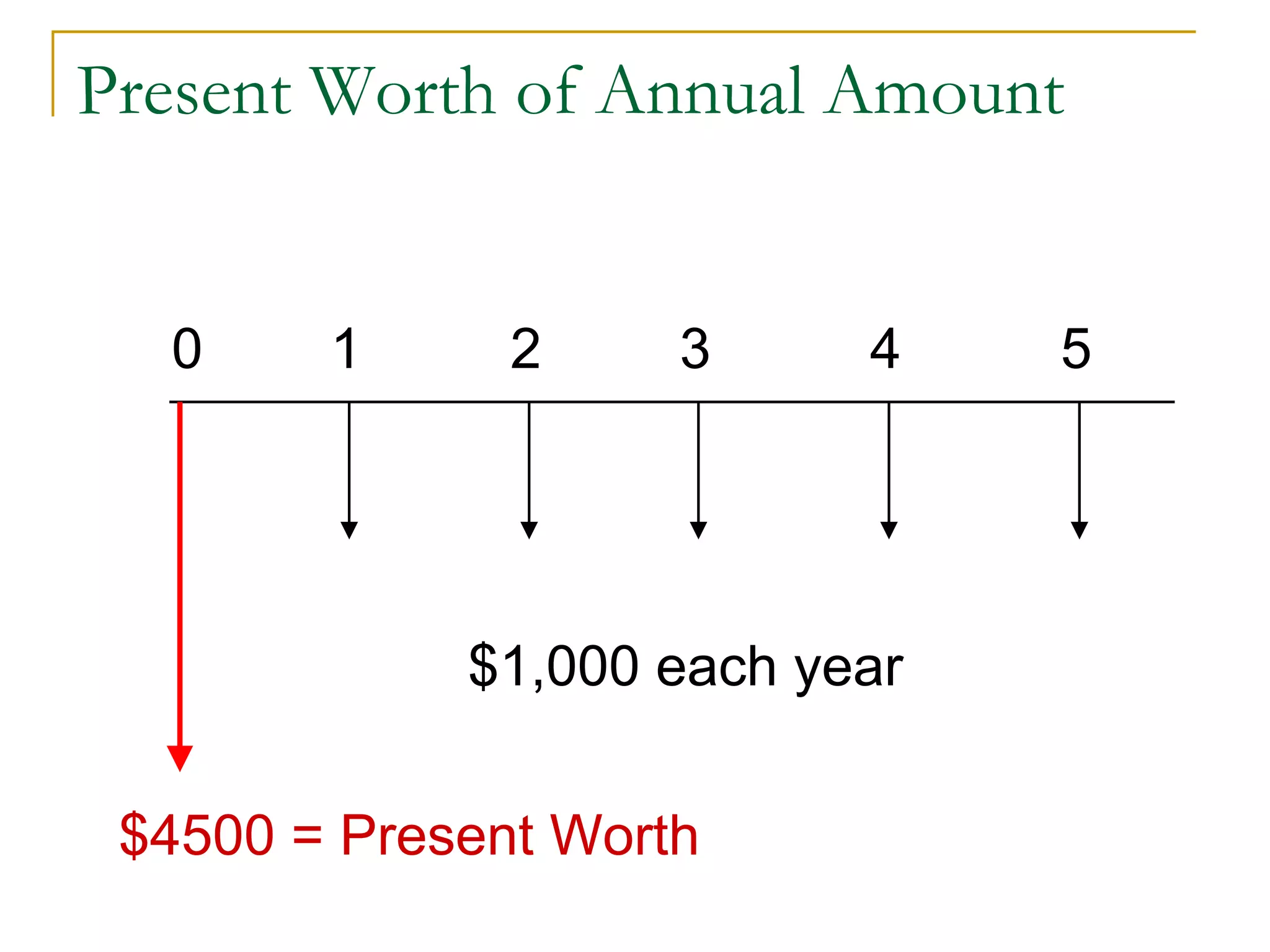

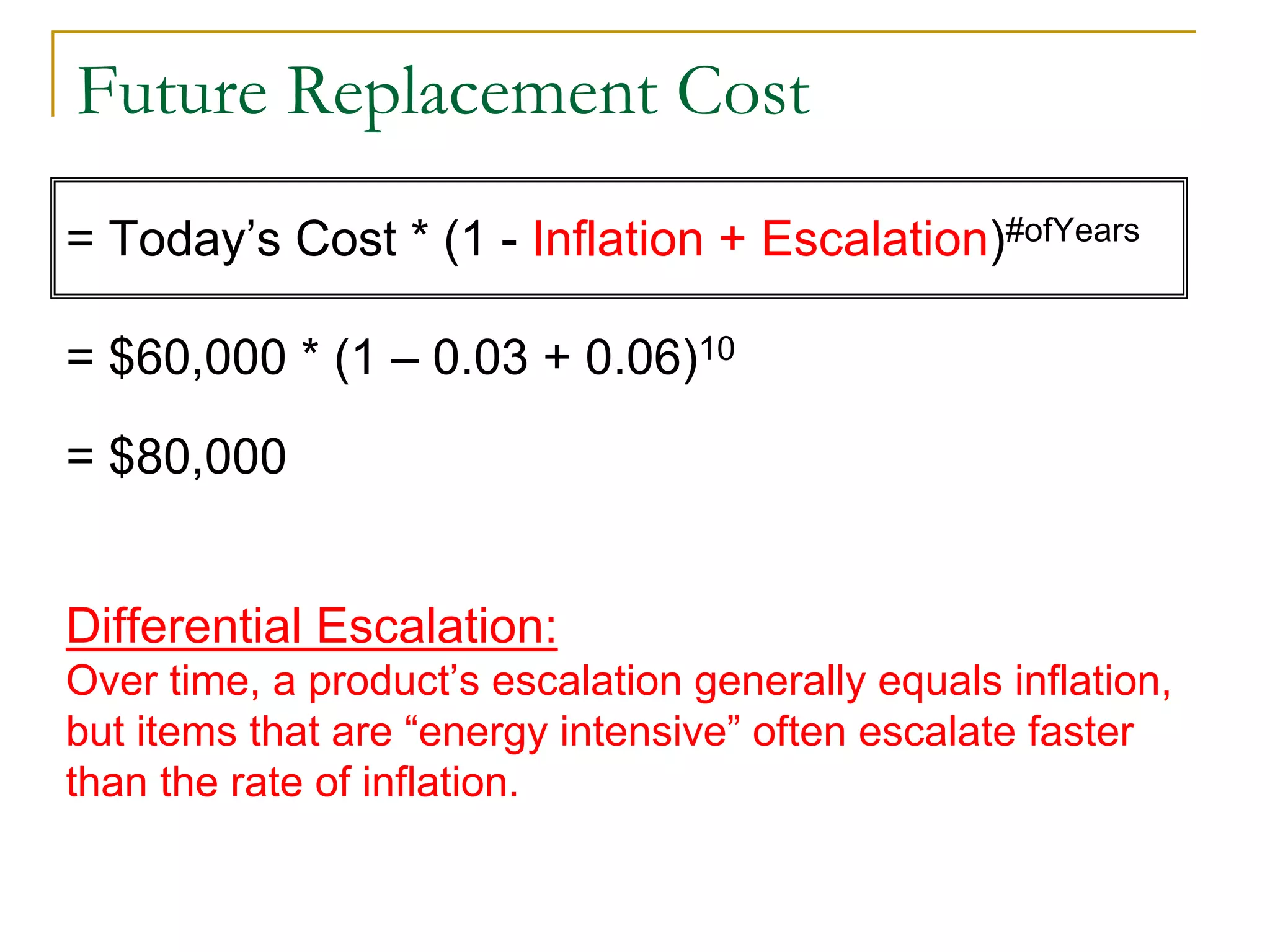

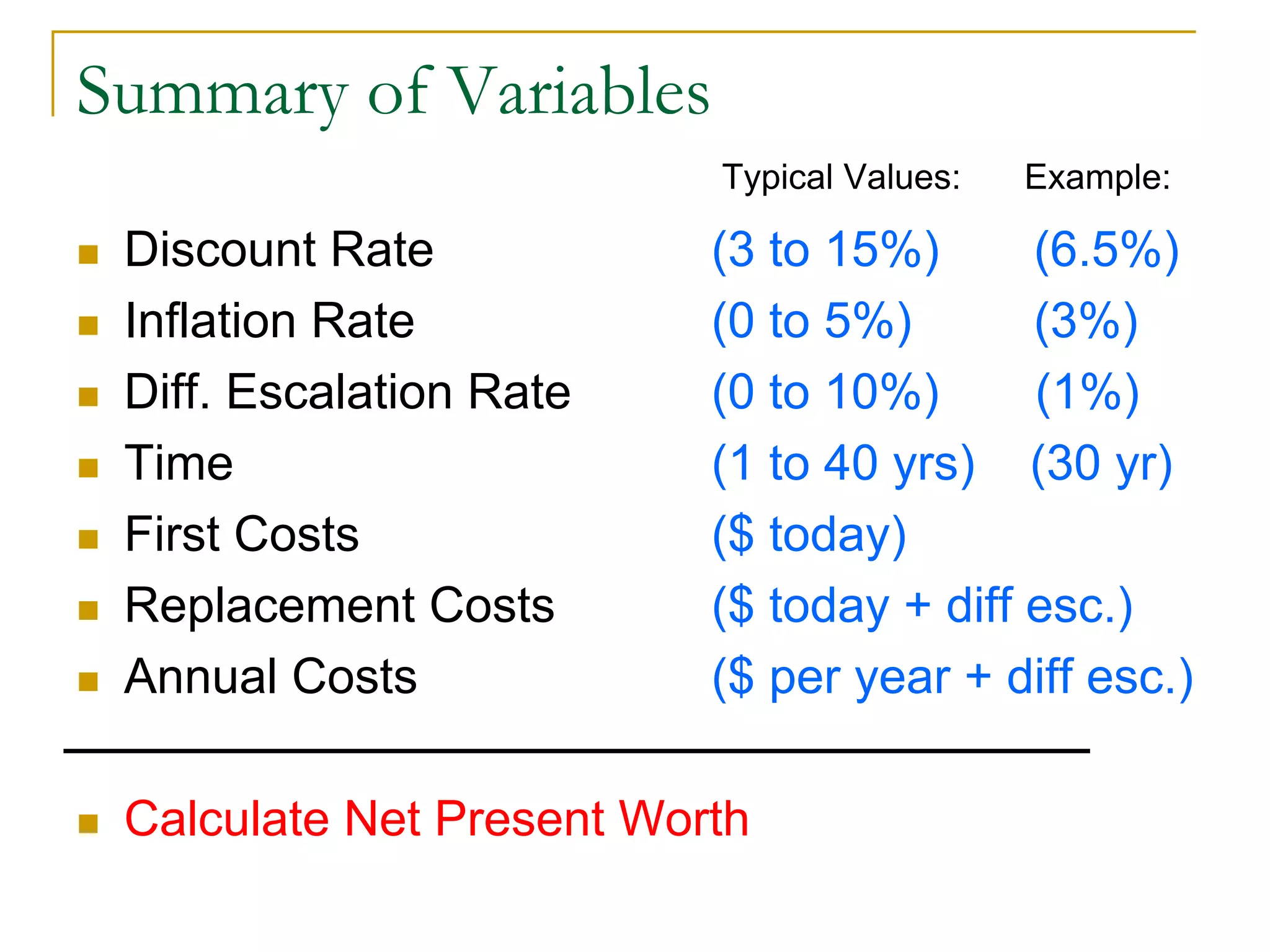

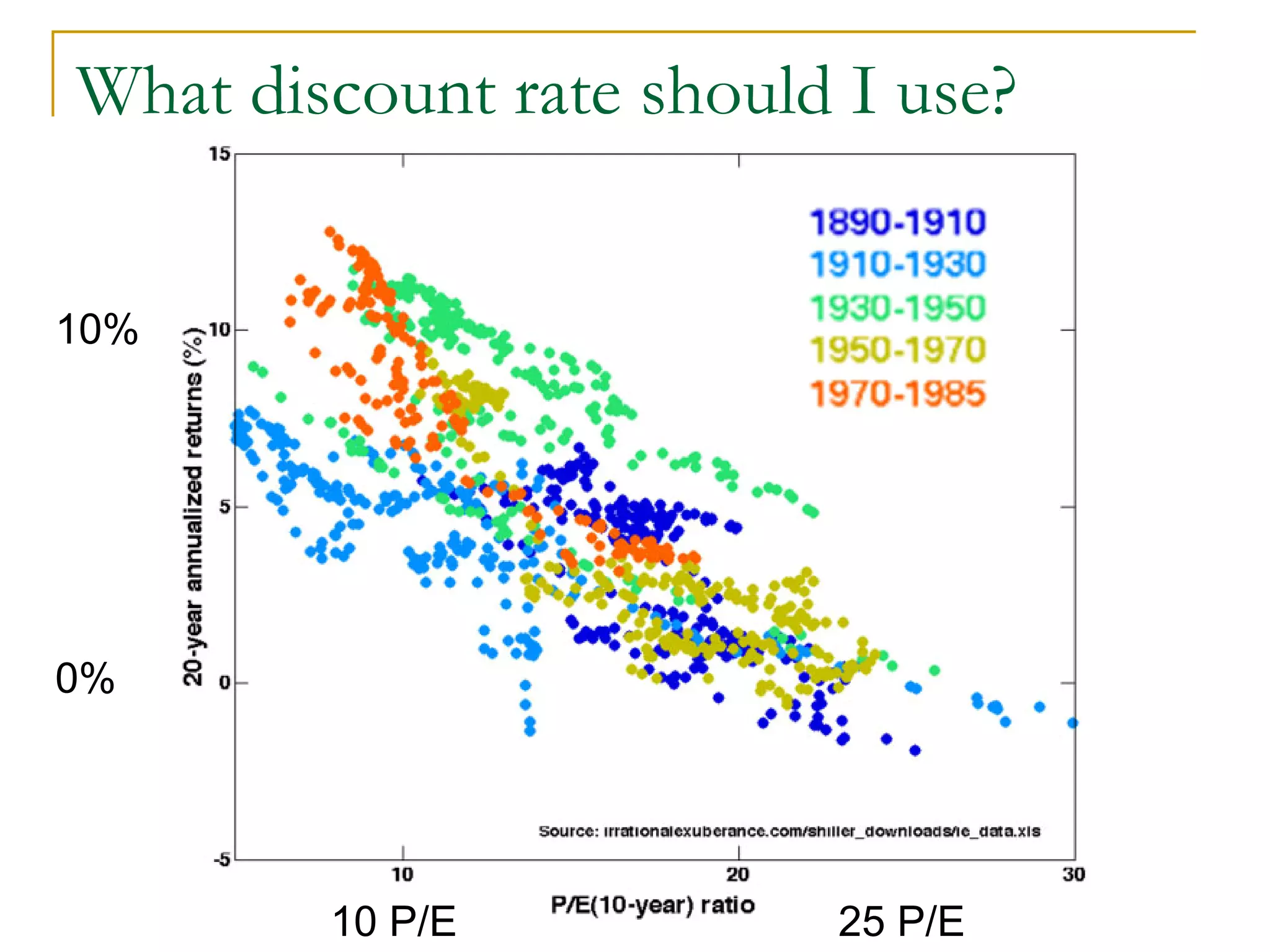

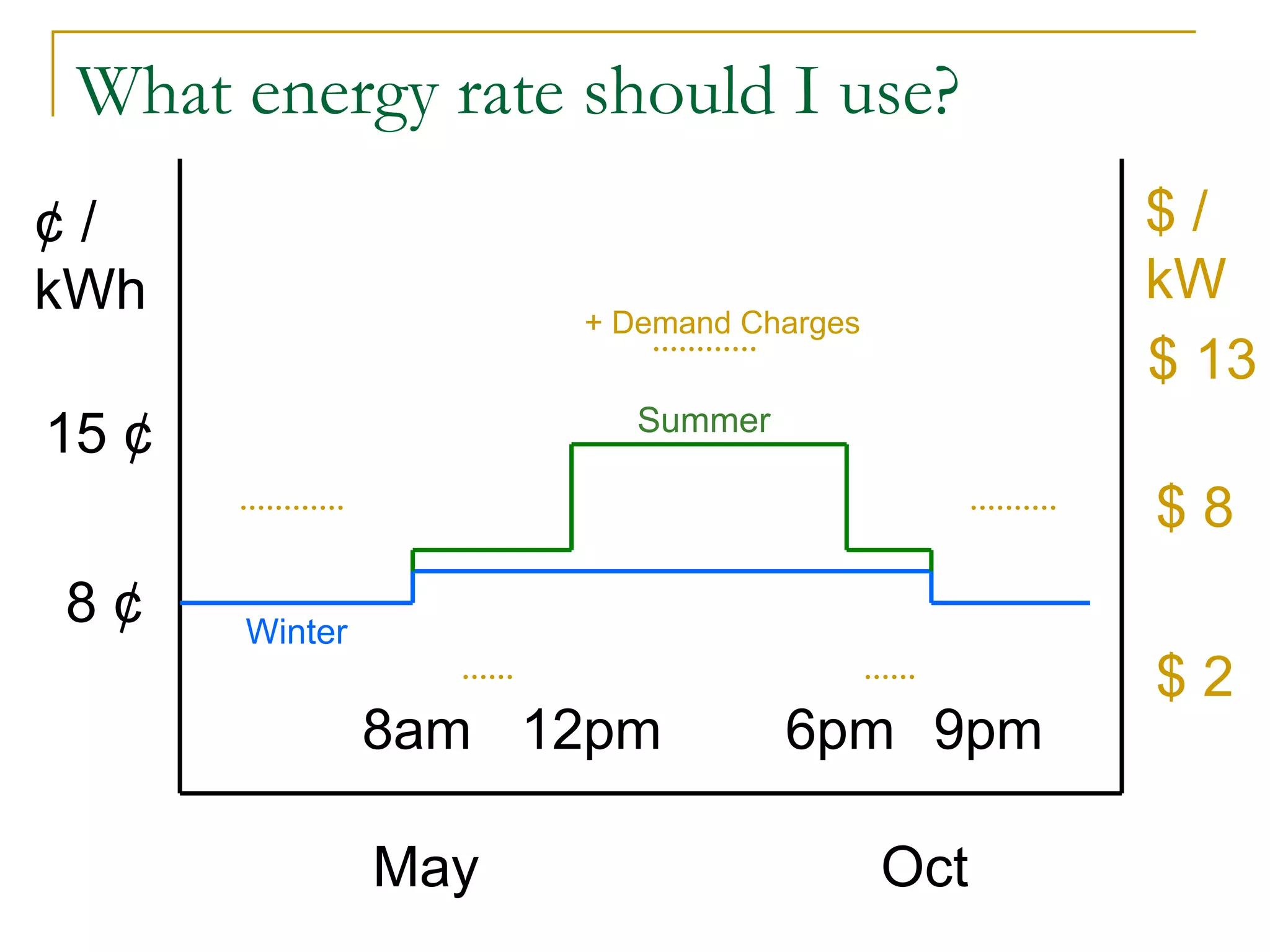

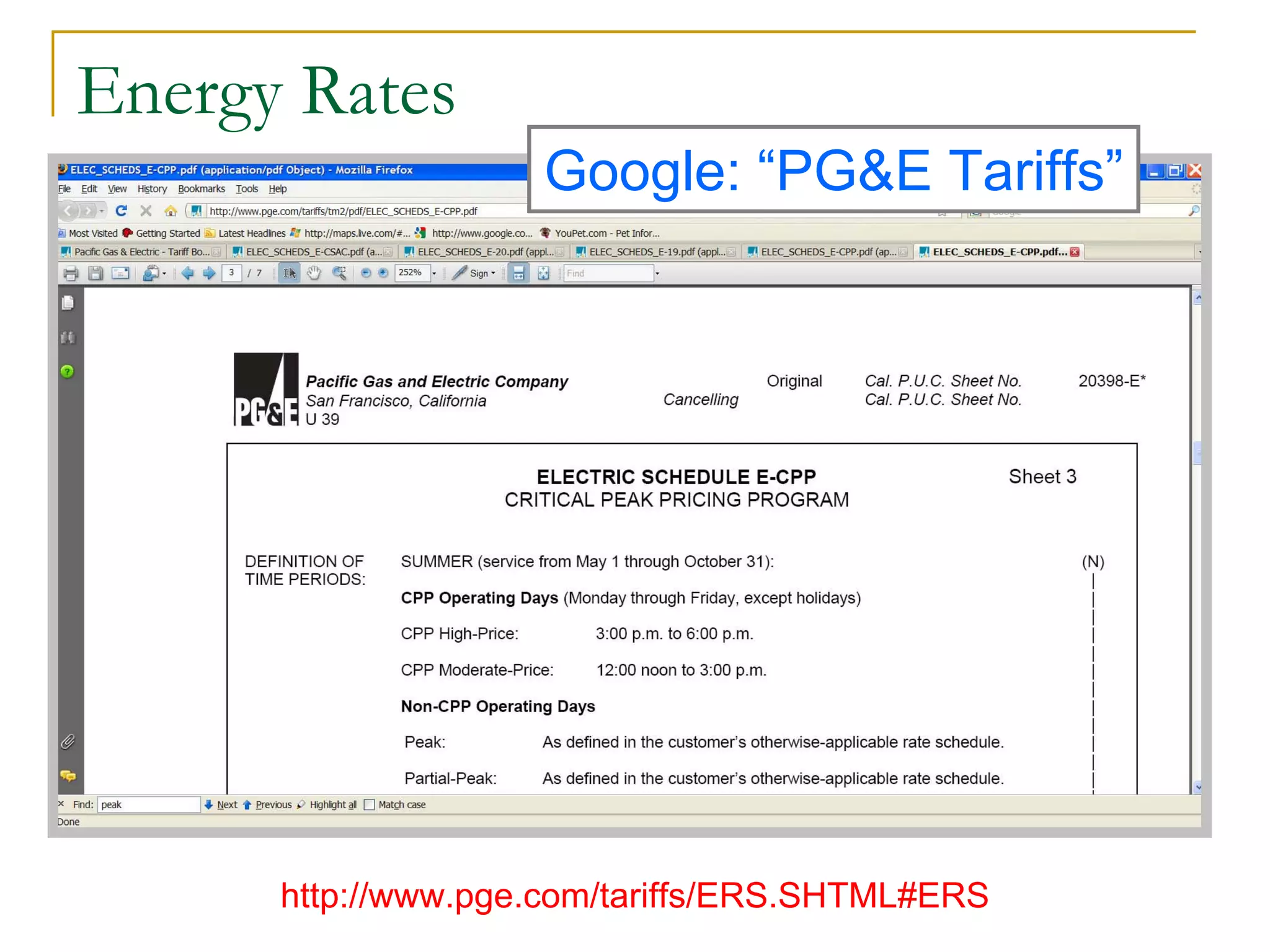

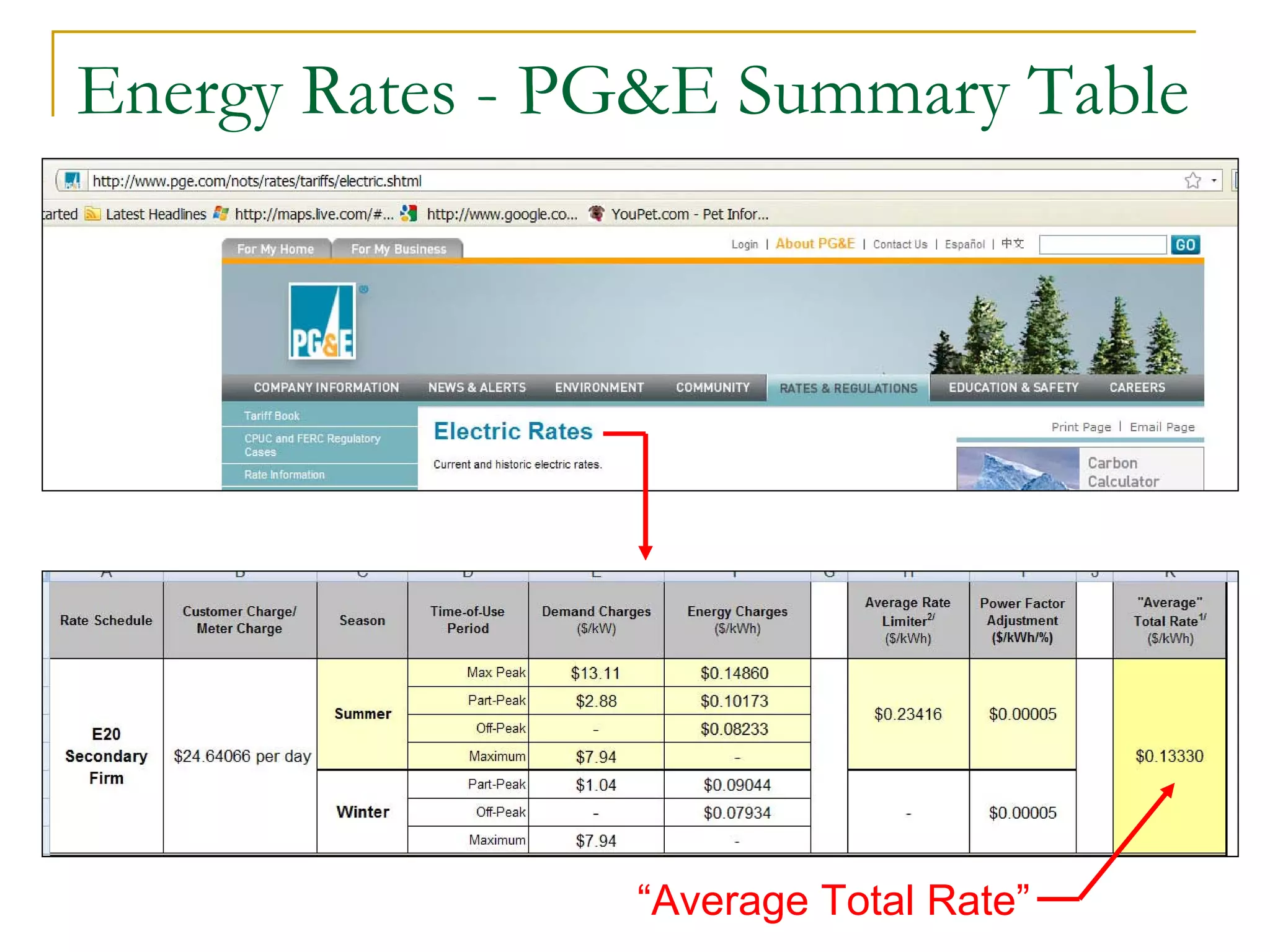

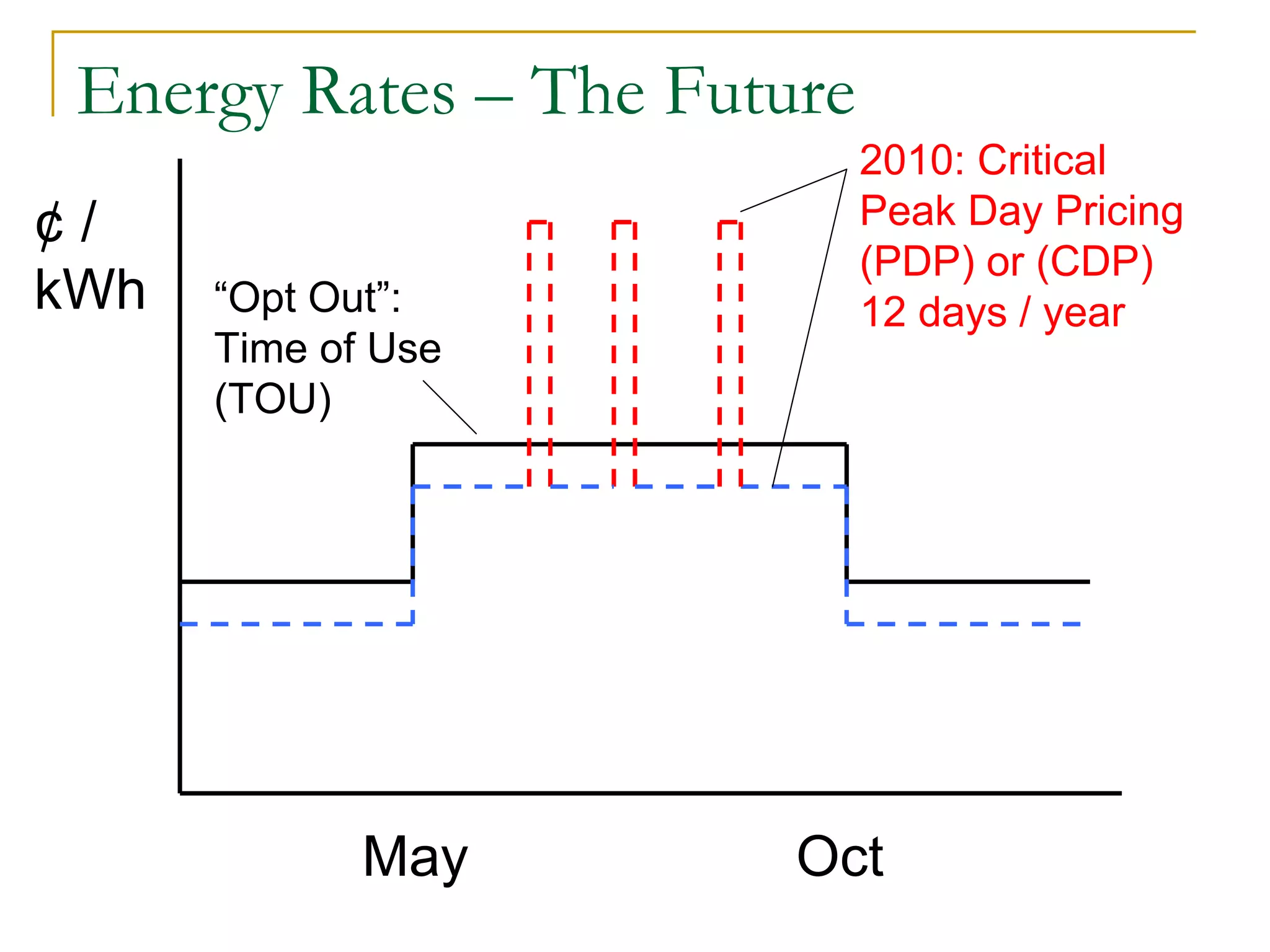

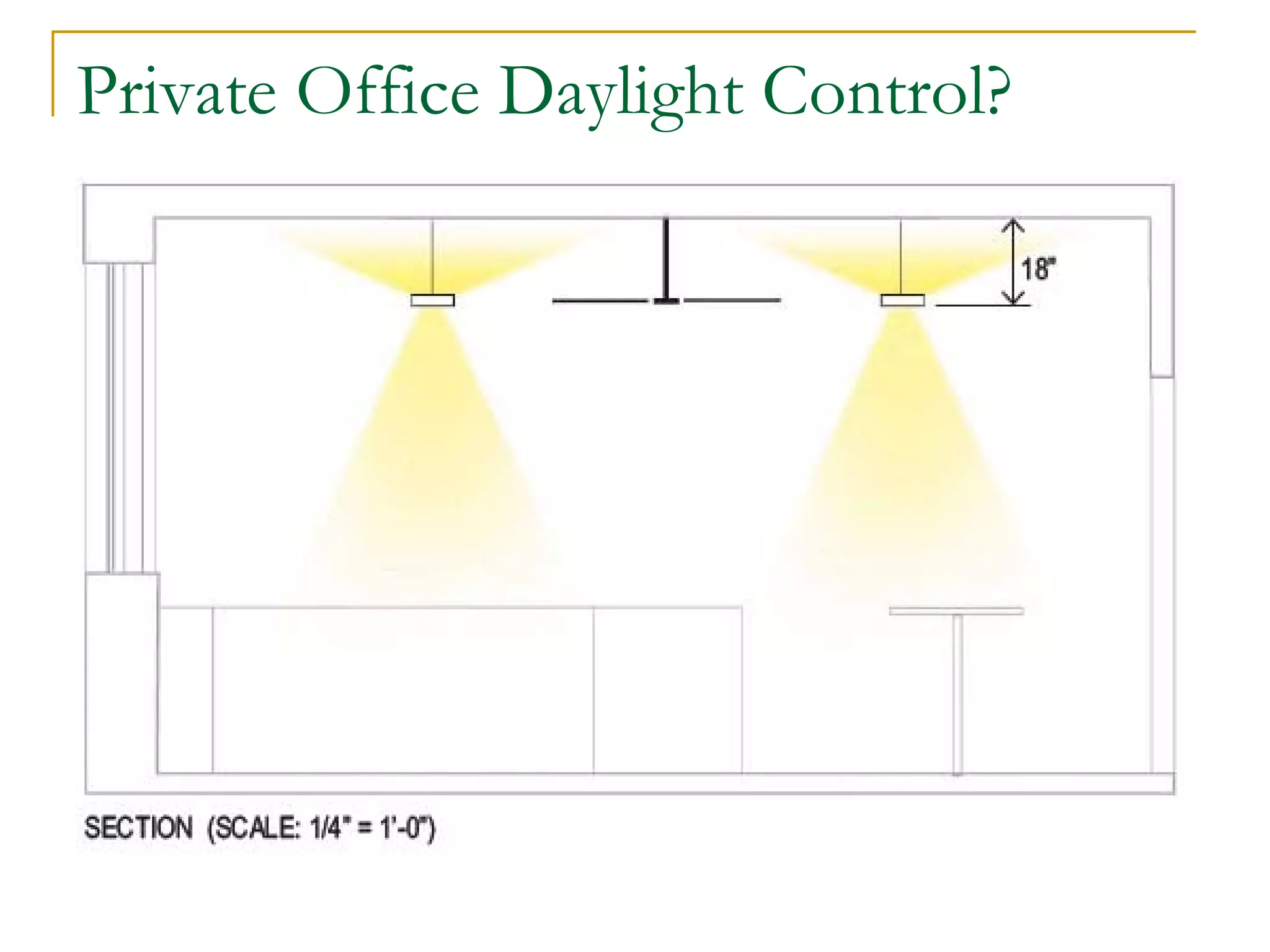

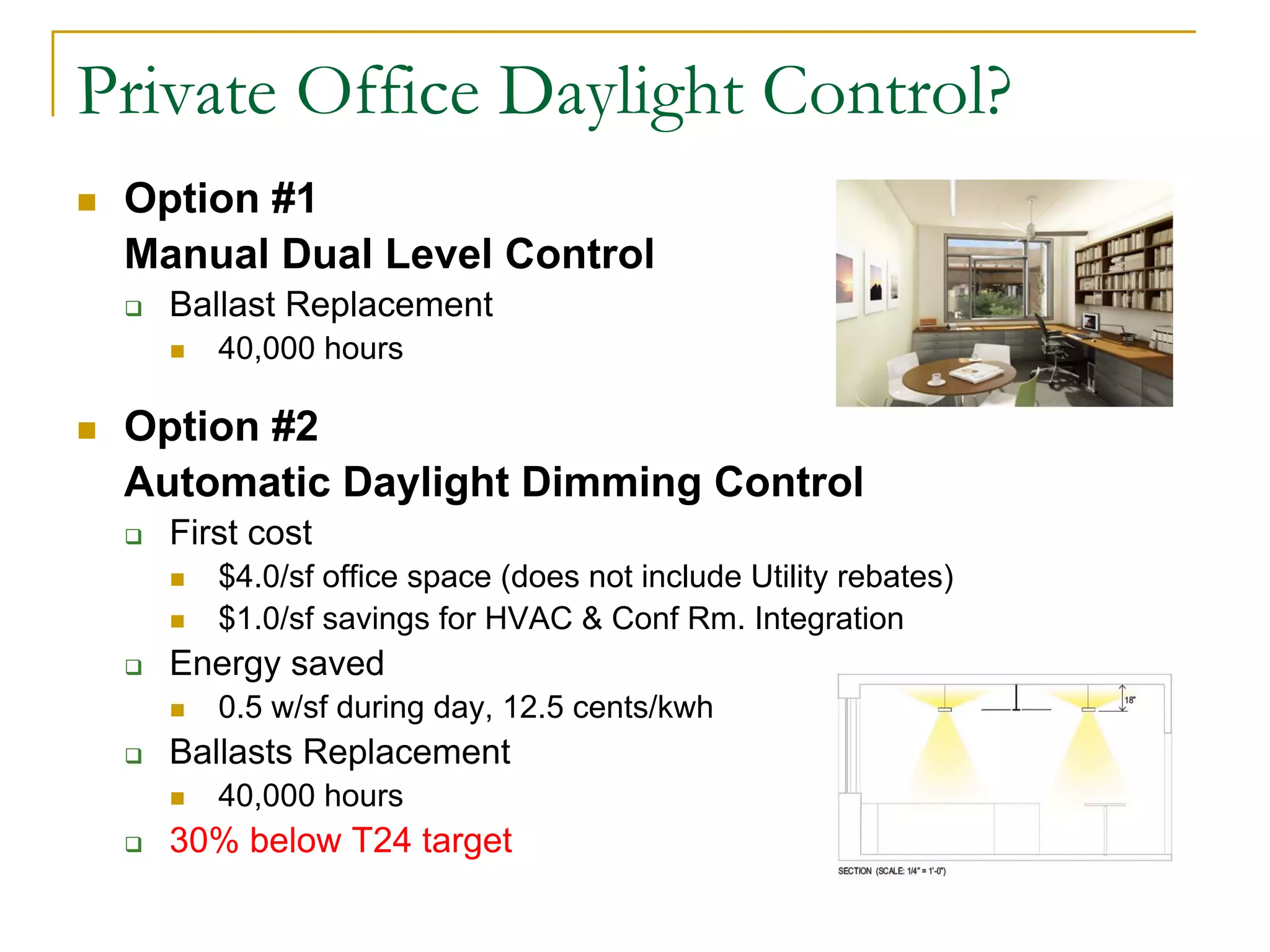

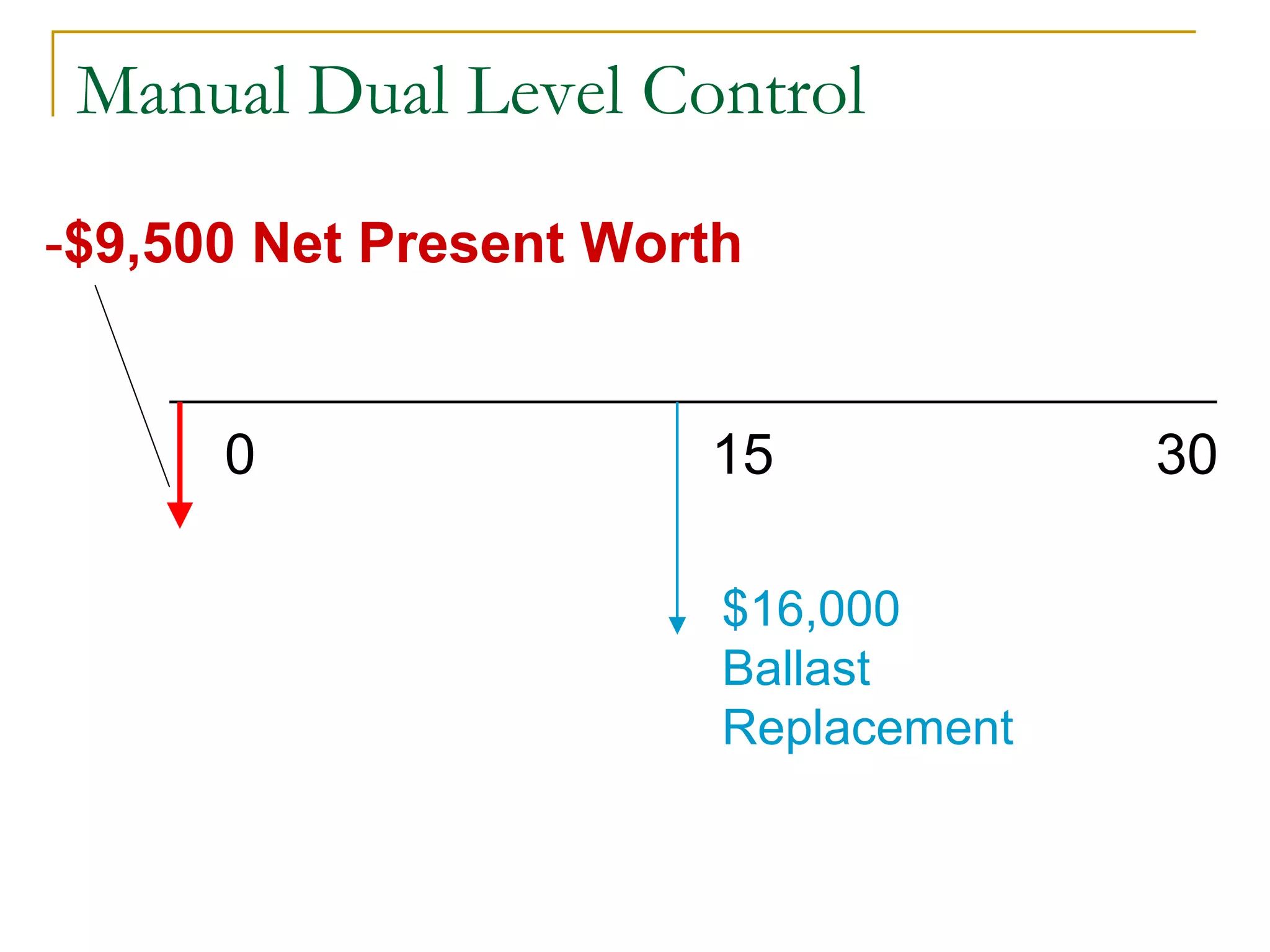

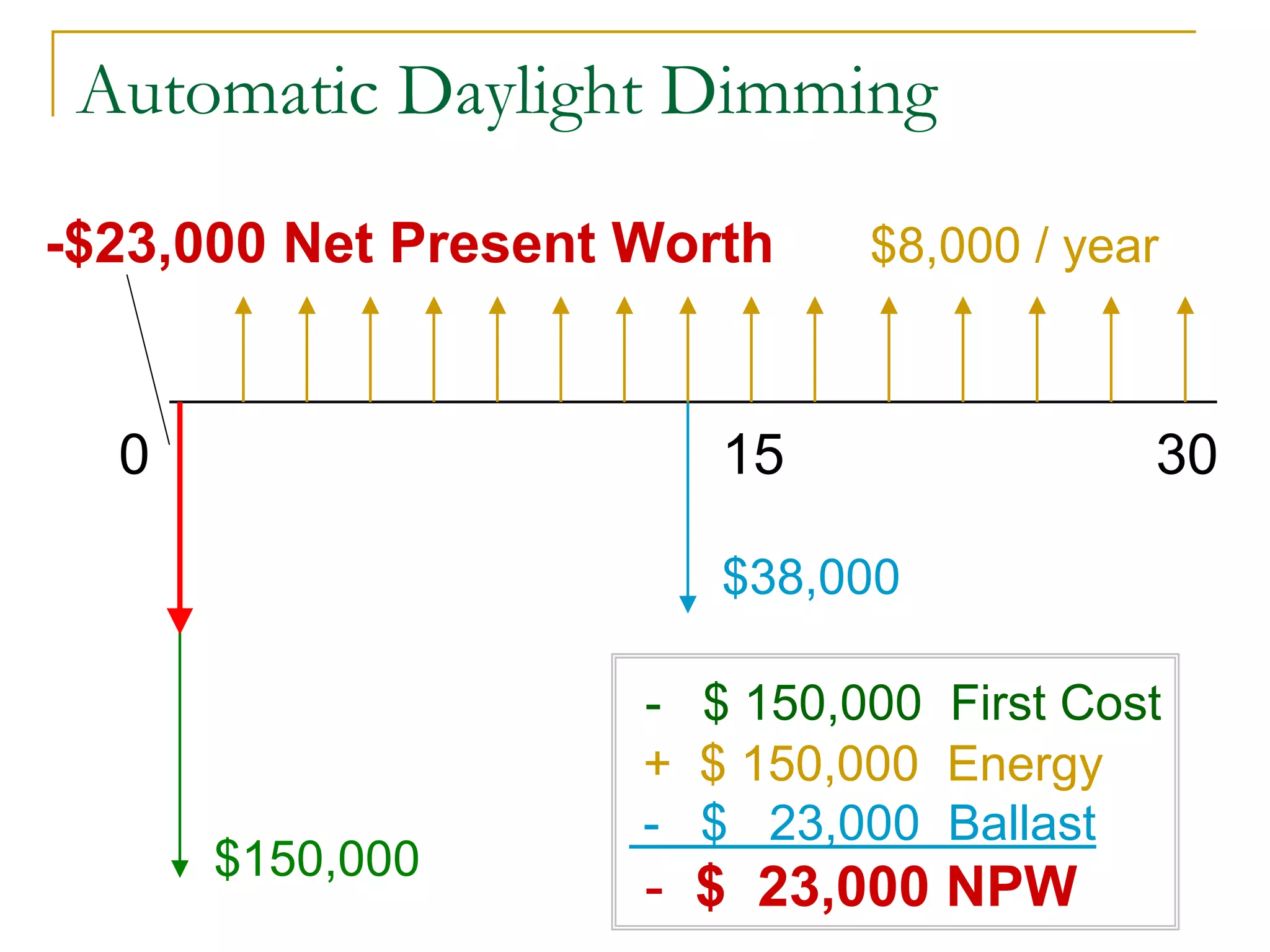

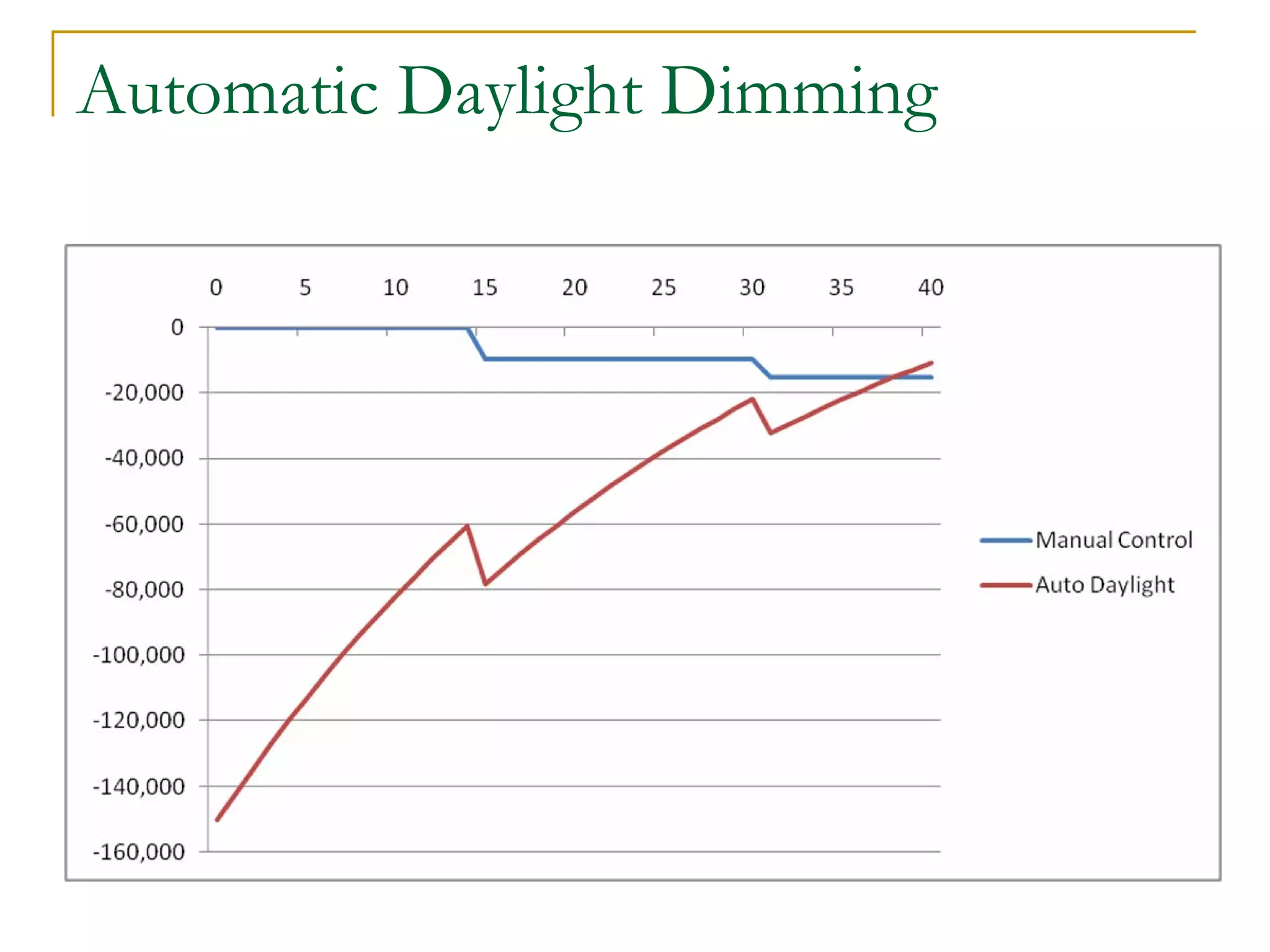

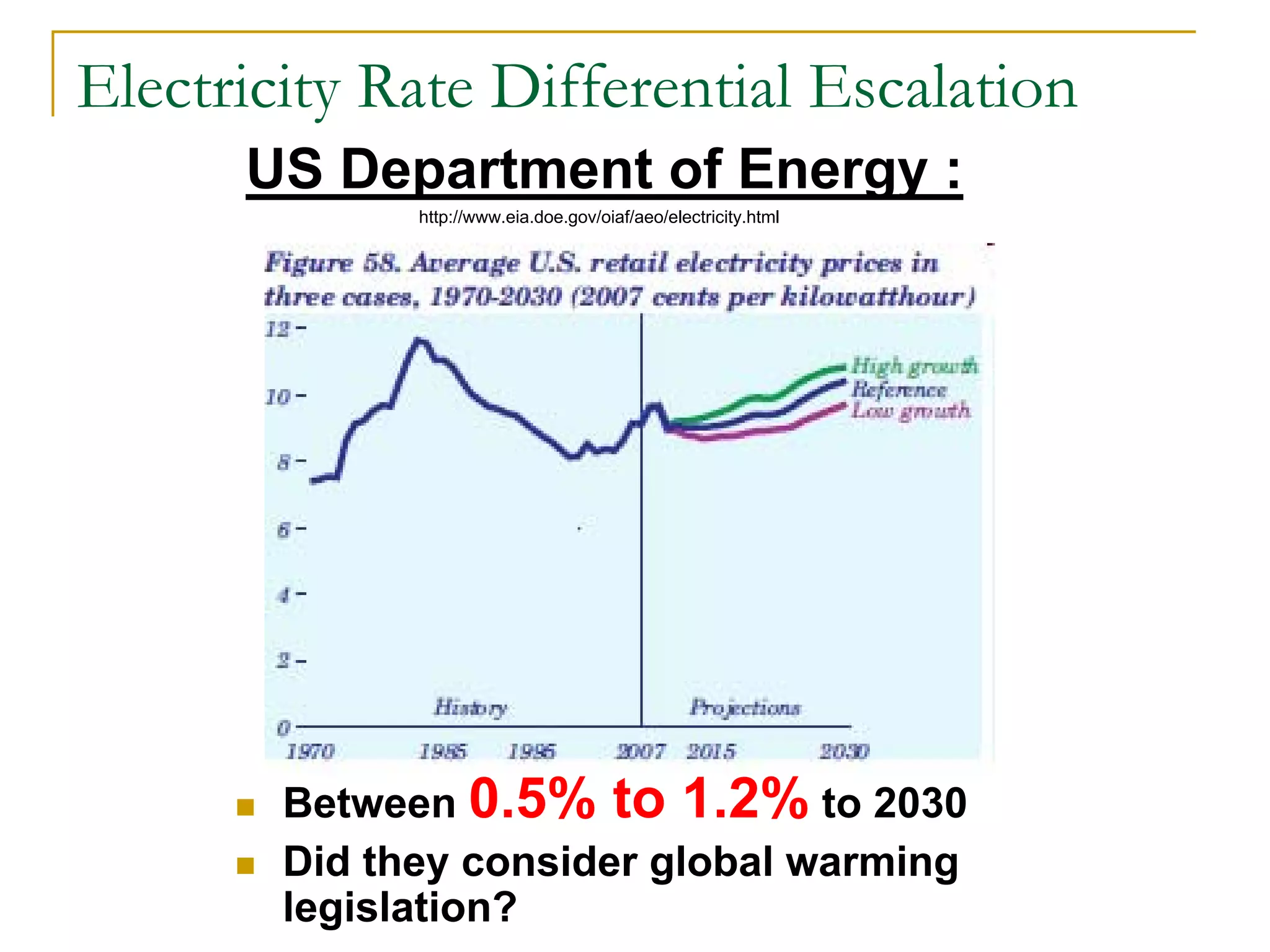

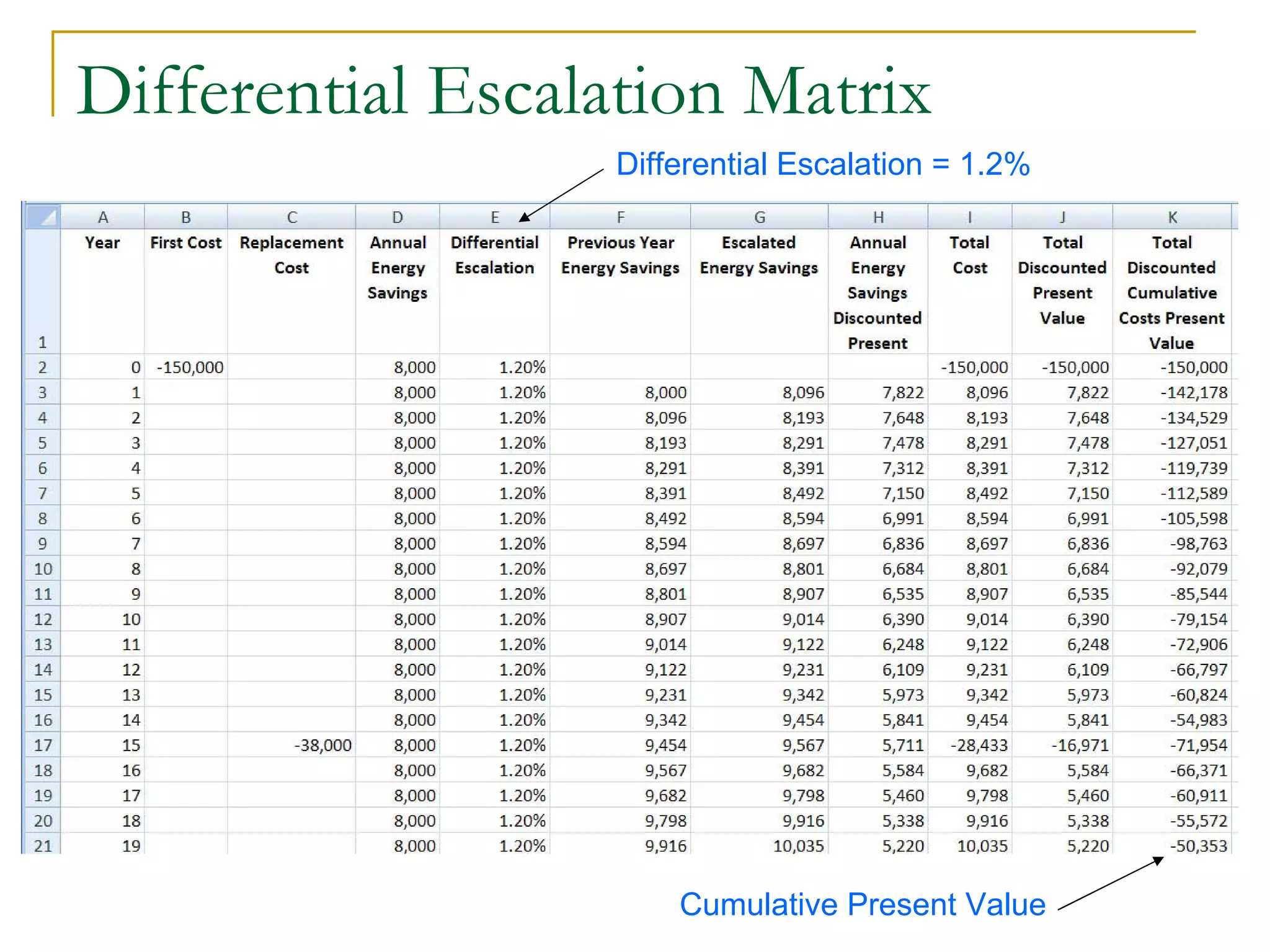

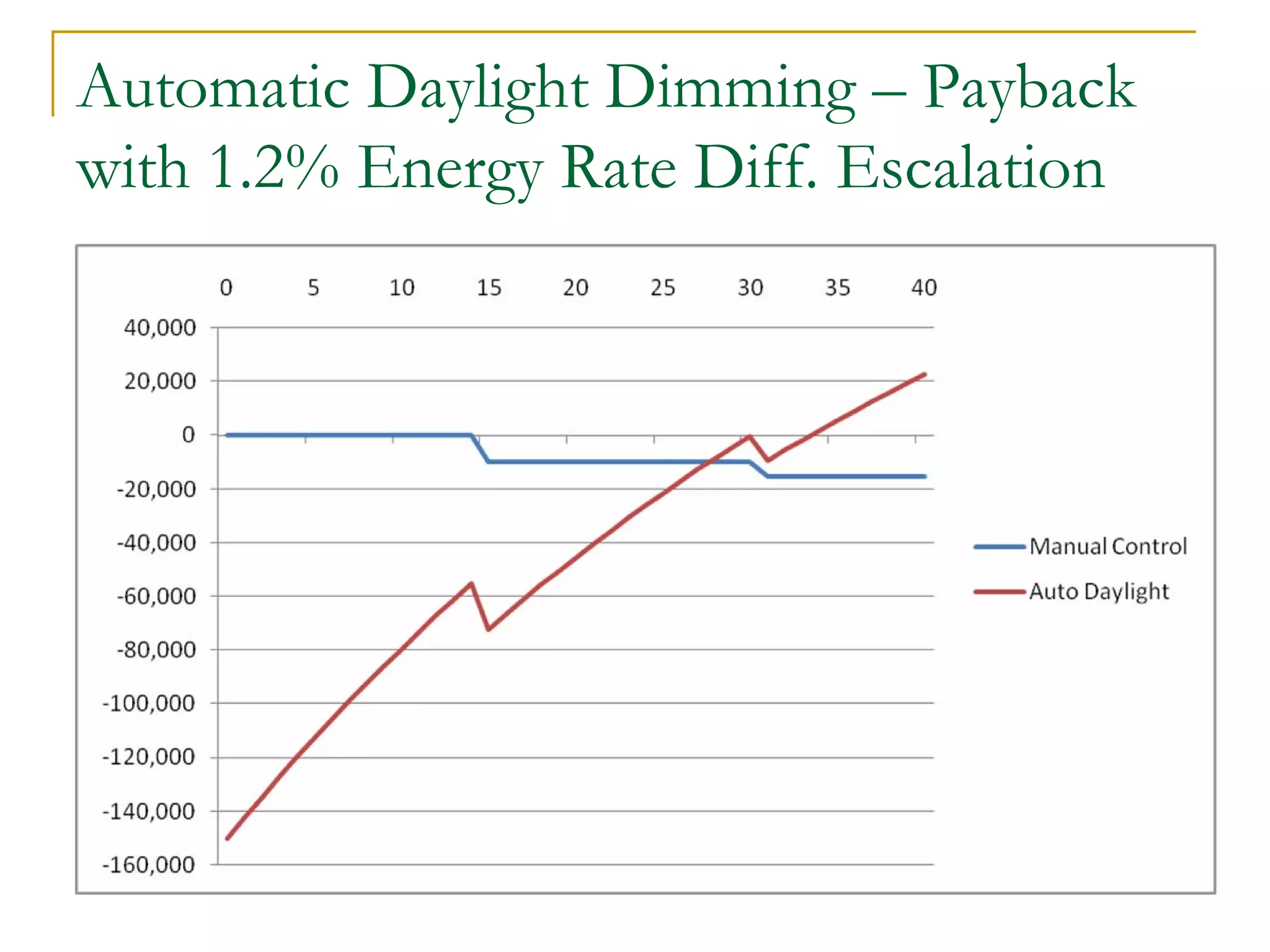

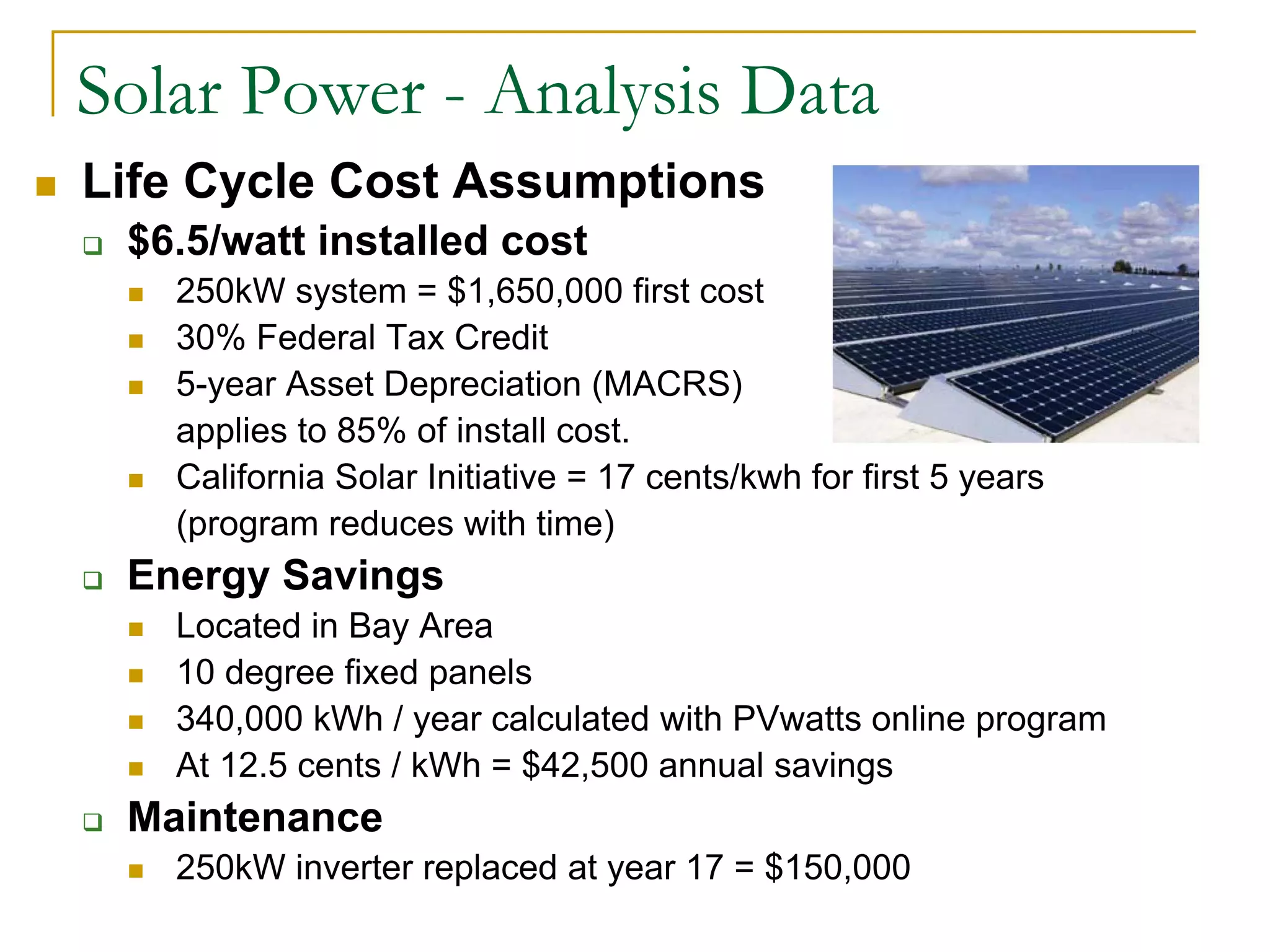

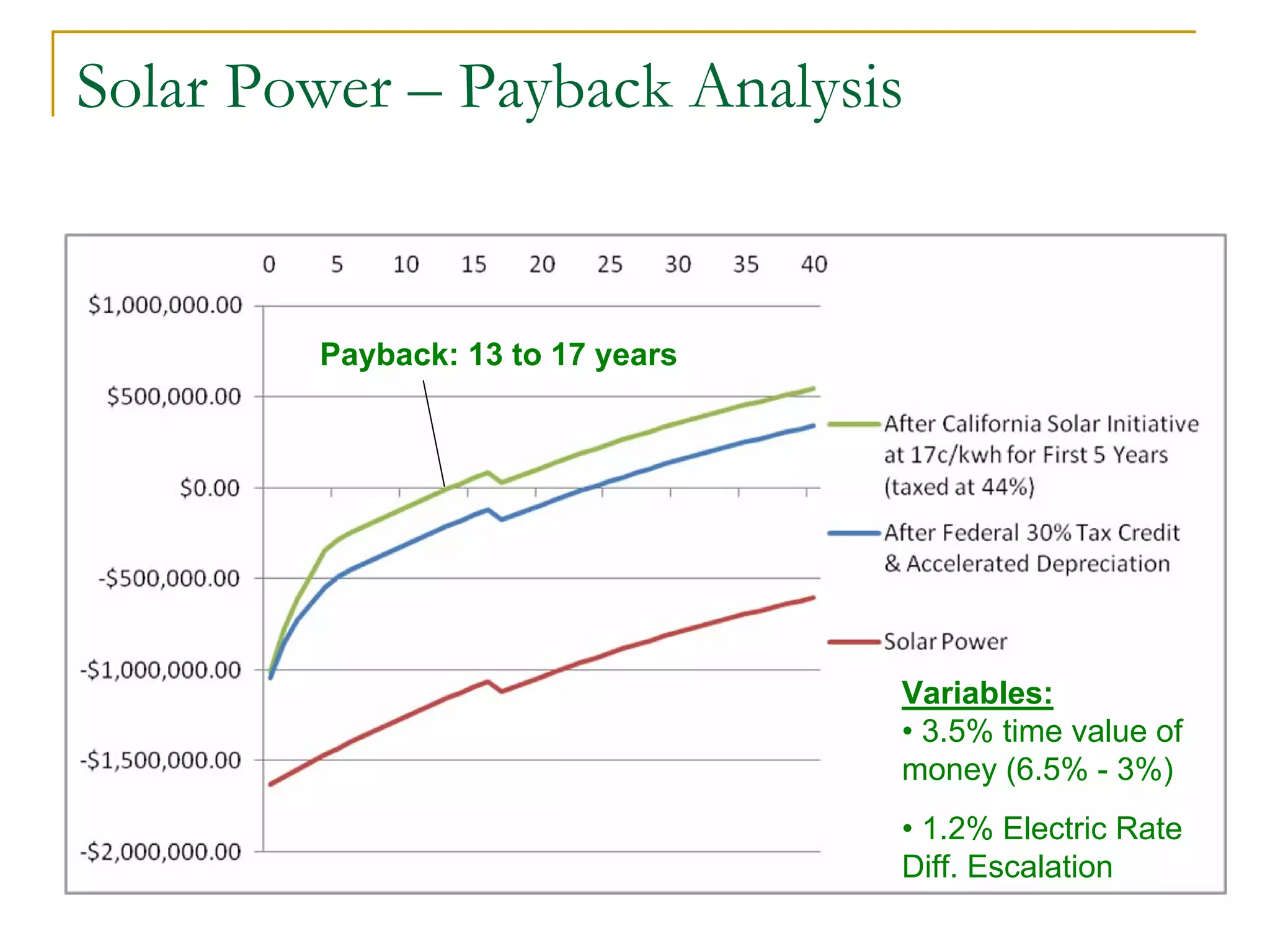

This document presents a life cycle cost analysis presentation by Jamie Fox, PE, LEED AP from The Engineering Enterprise. It discusses key considerations in life cycle cost analysis like discount rates, inflation rates, energy rates, and examples analyzing the costs and savings of options like installing automatic daylight dimming controls in an office or a solar power system. The presentation provides information on calculating present worth values and payback periods for investments under various assumptions.