1) The CFO provided information on the firm's capital structure, bond yields, stock prices, tax rates, and growth expectations to estimate the WACC.

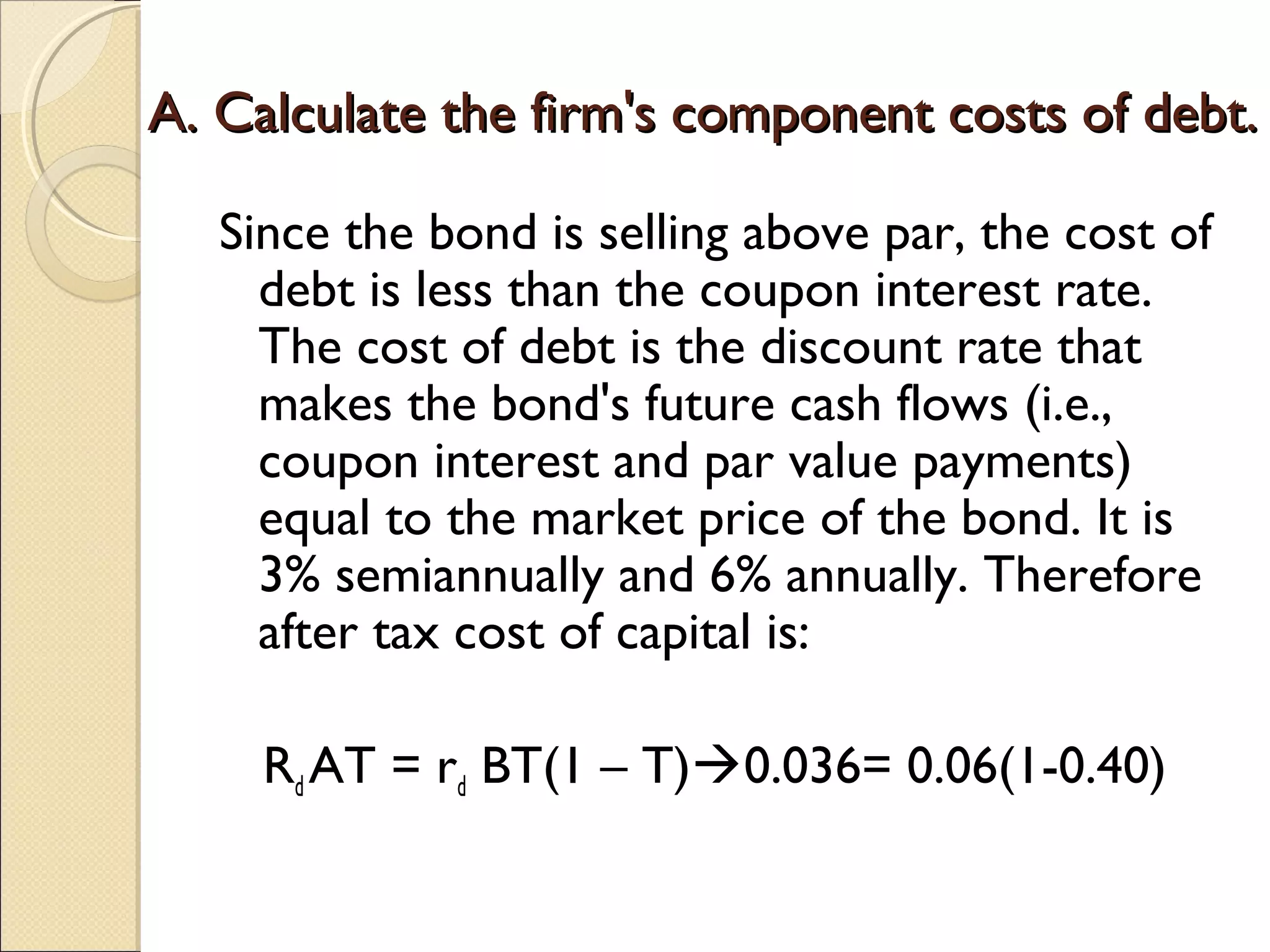

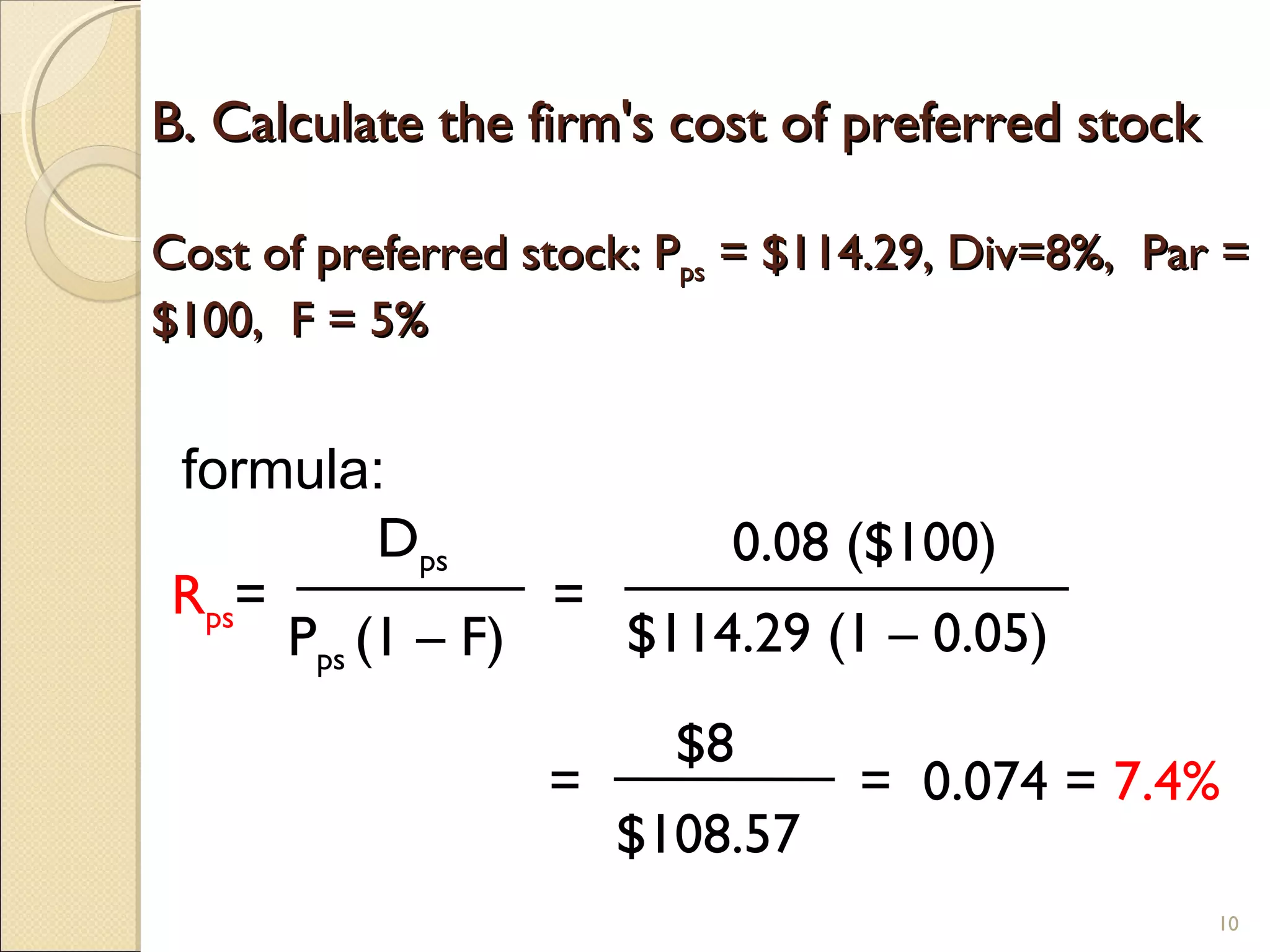

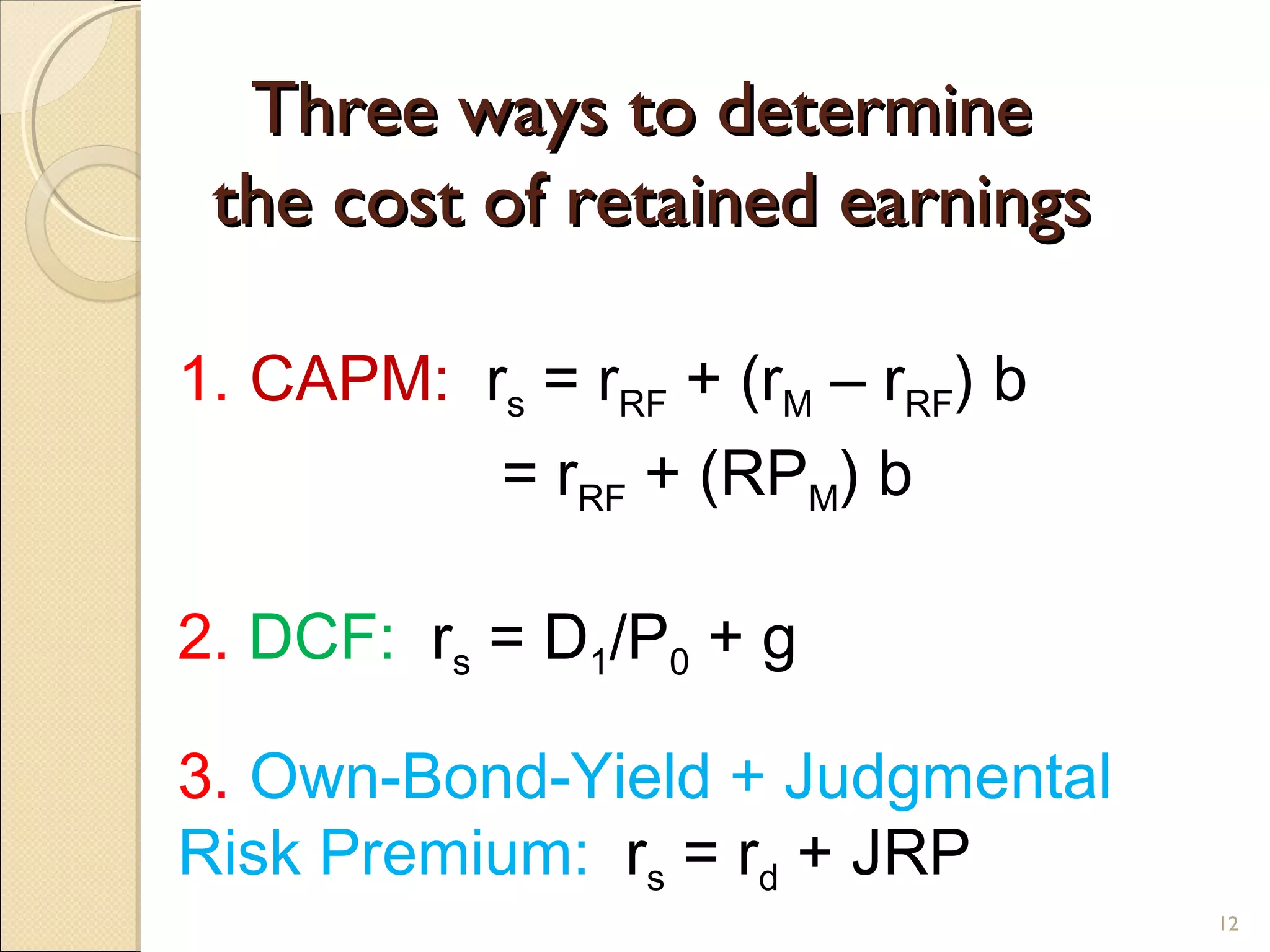

2) The costs of debt, preferred stock, and retained earnings were calculated using the bond yield, dividend yield, CAPM, and DCF approaches.

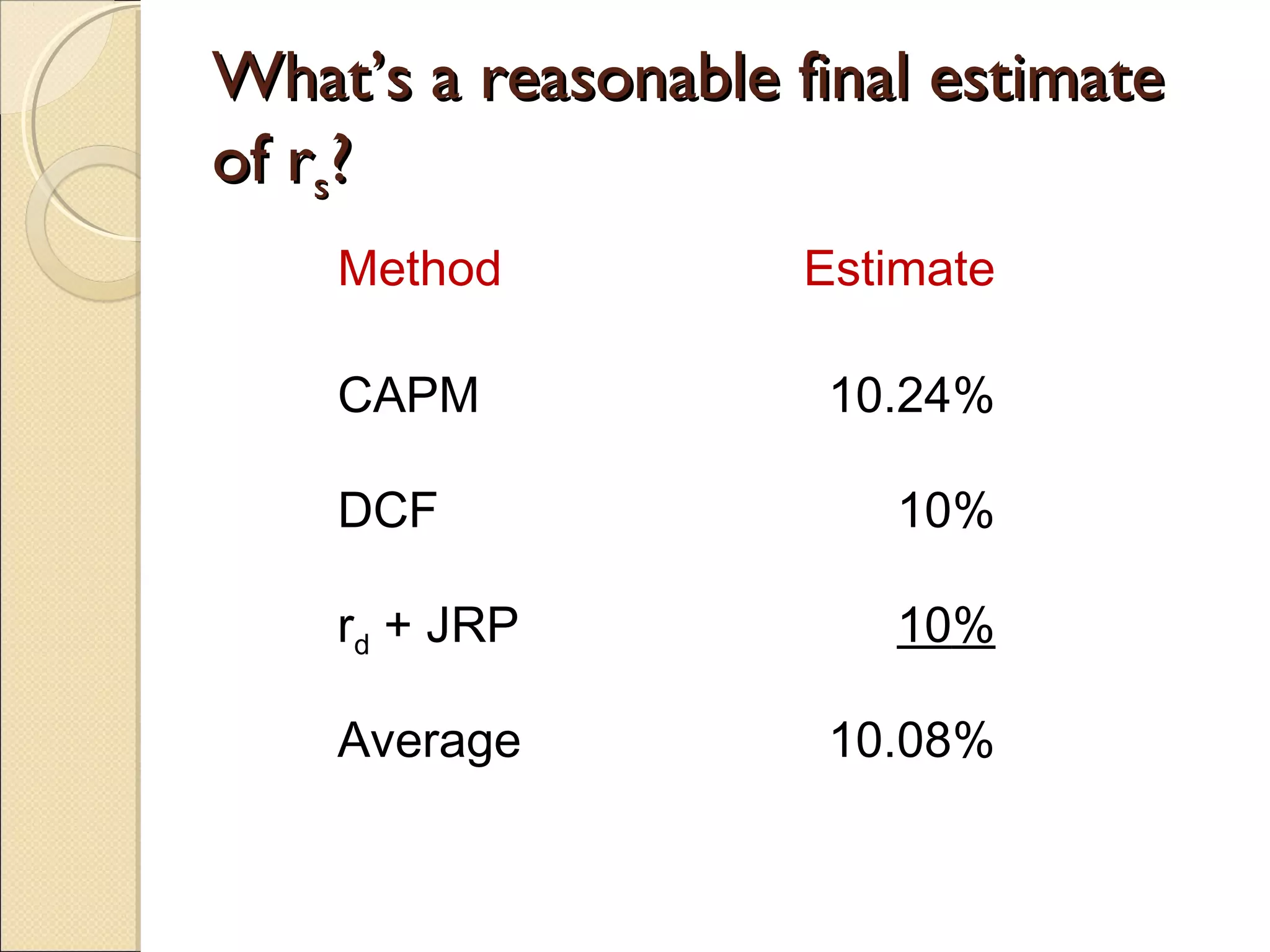

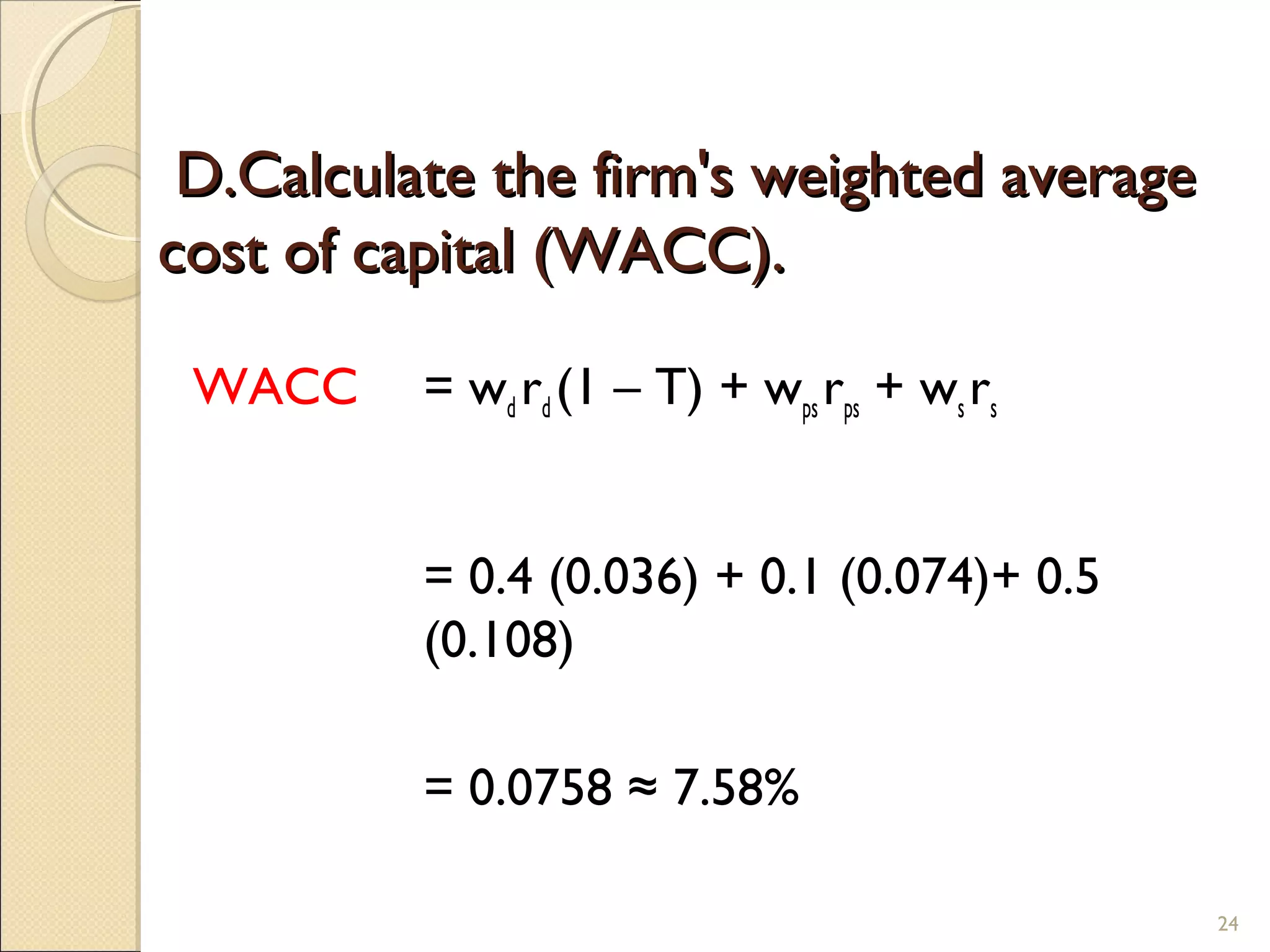

3) The WACC was estimated to be 7.58% using a 40% weight on debt at 3.6%, 10% weight on preferred stock at 7.4%, and 50% weight on retained earnings at 10.08%.

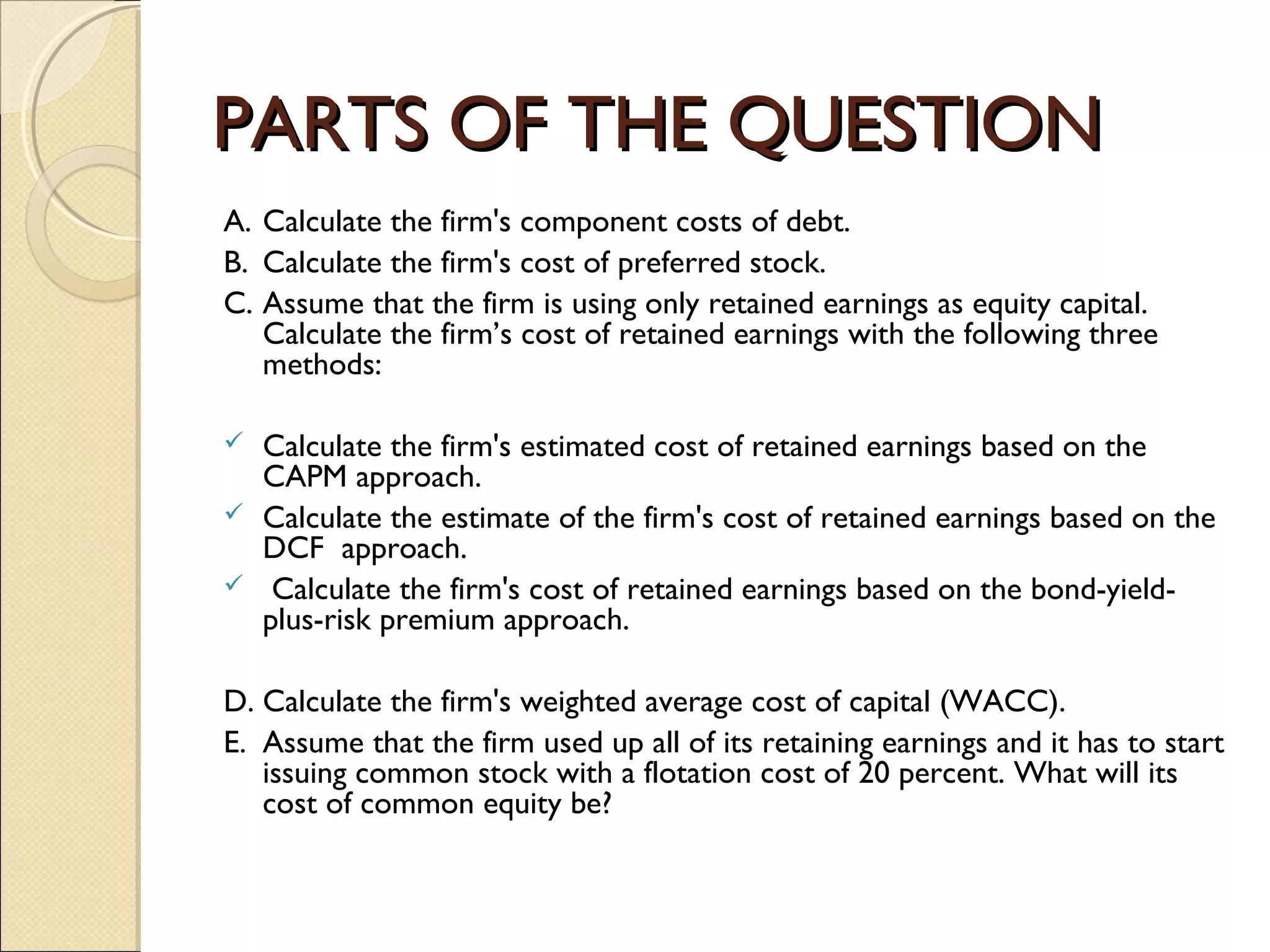

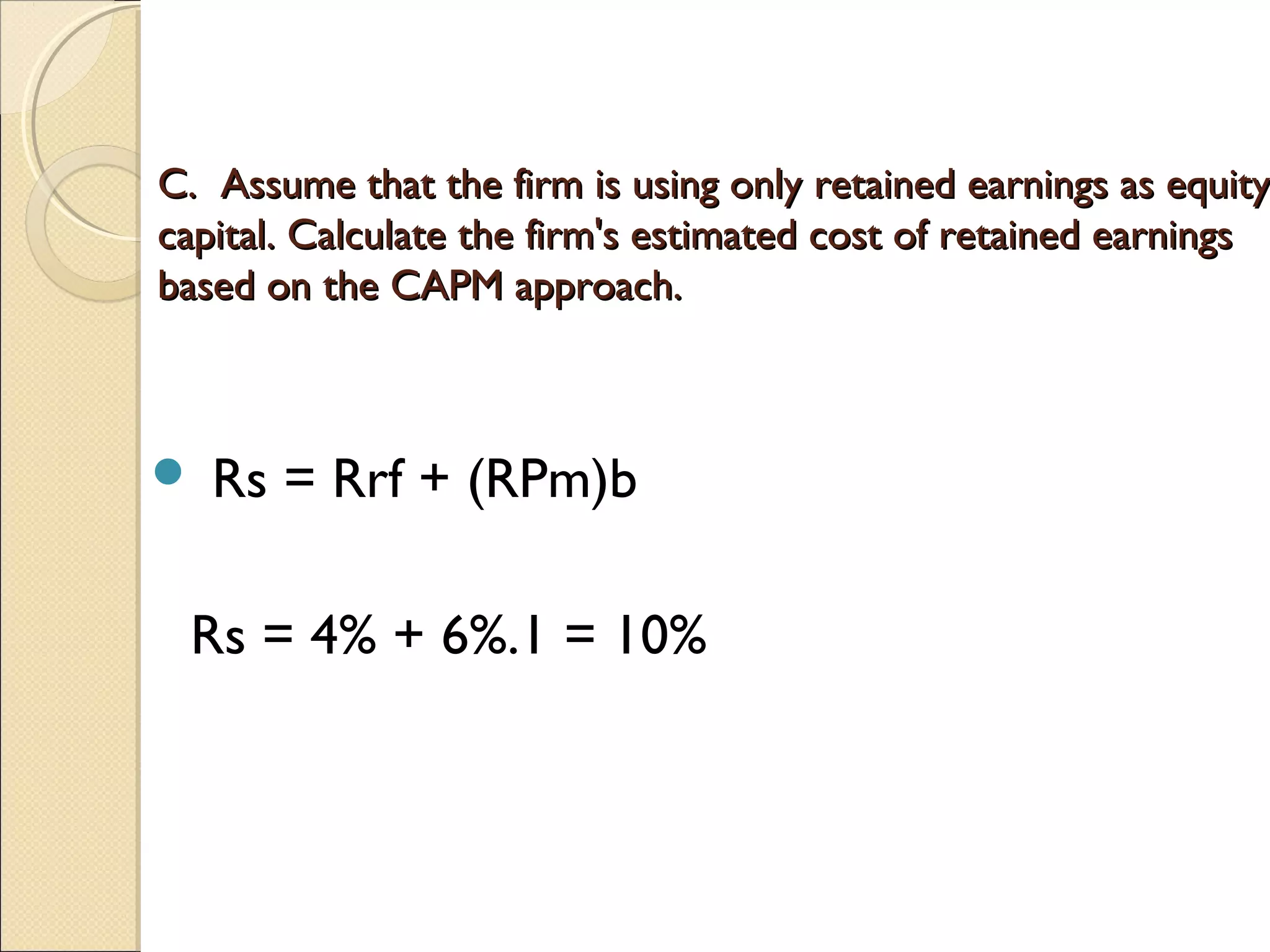

![C. Calculate the estimate of the firm's cost of retained

earnings based on the DCF approach.

• Rs = [D0 * (1+g)] / P0 + g

• Rs = 3 * (1.04) / 50 + 0.04 = 0.1024](https://image.slidesharecdn.com/anlsuralwacccalculation-130120080127-phpapp01/75/Anil-Sural-WACC-Calculation-16-2048.jpg)

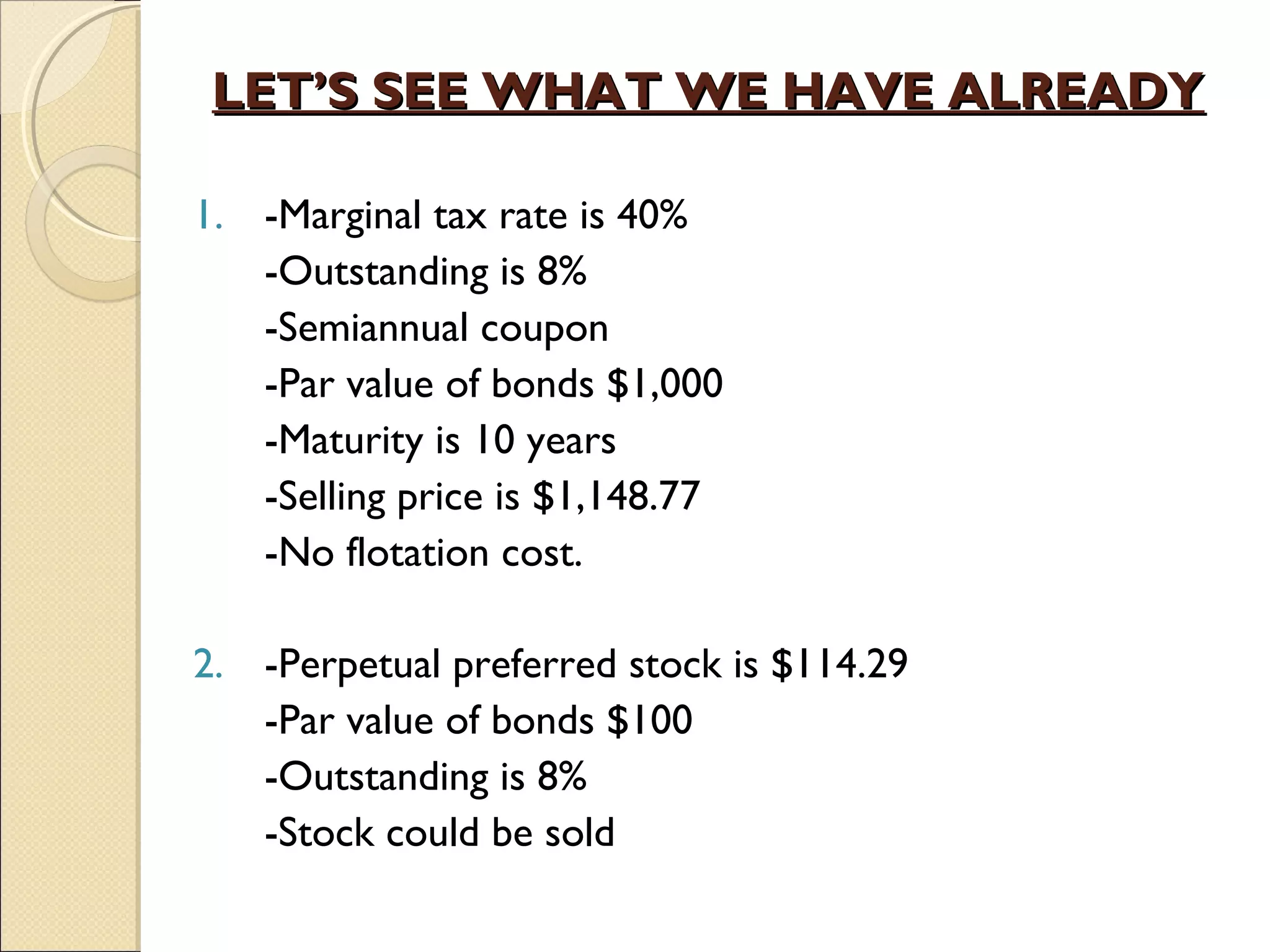

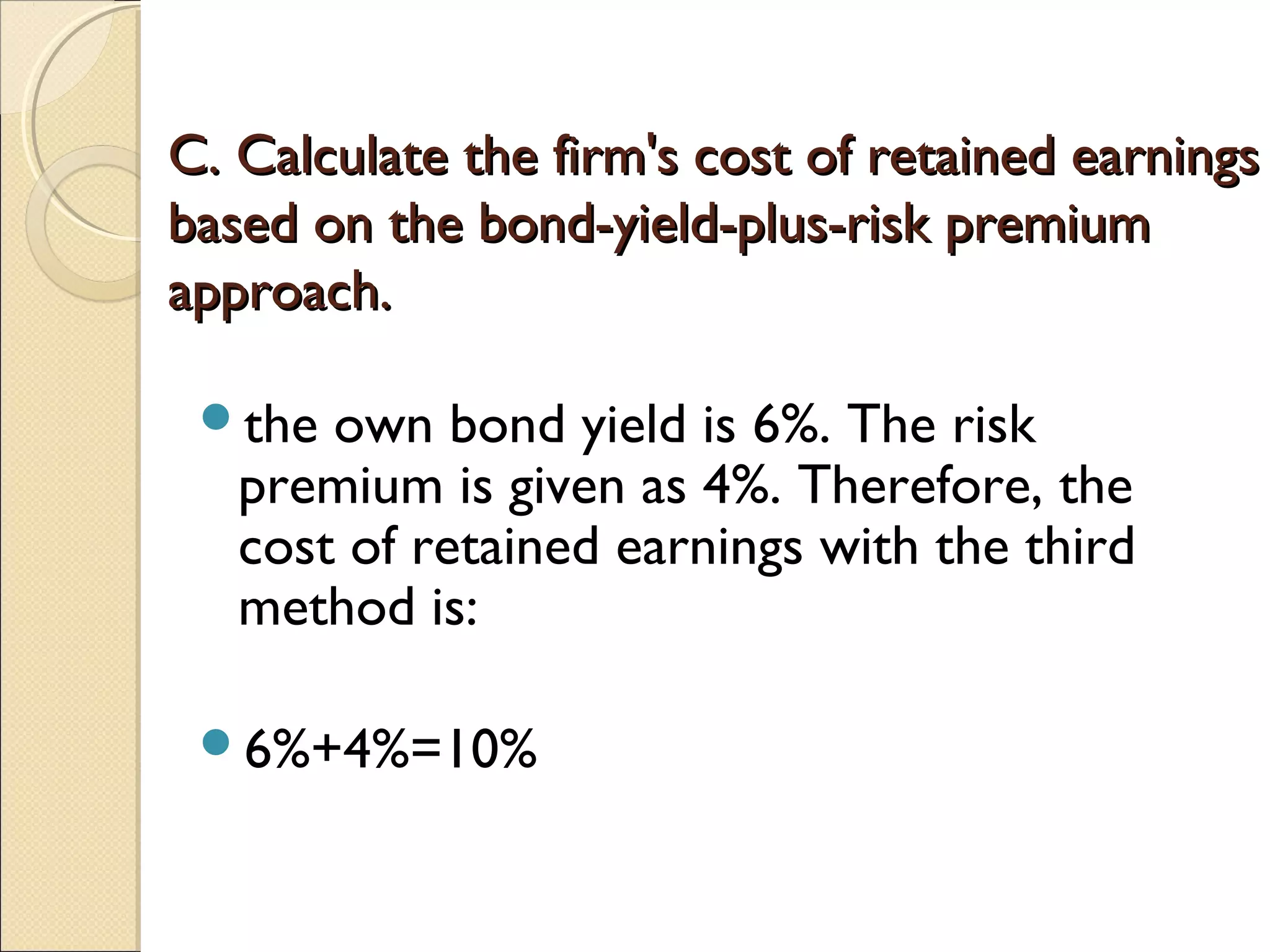

![E.Assume that the firm used up all of its retaining earnings and it

has to start issuing common stock with a flotation cost of 20

percent. What will its cost of common equity be?

Re = [ D0 * (1+ g) ] / [P0 * (1-F) ] + g

Re = [3 * ( 1+0.04) ] / [ 50 * ( 1- 0.2)] + 0.04

= 0.118](https://image.slidesharecdn.com/anlsuralwacccalculation-130120080127-phpapp01/75/Anil-Sural-WACC-Calculation-26-2048.jpg)