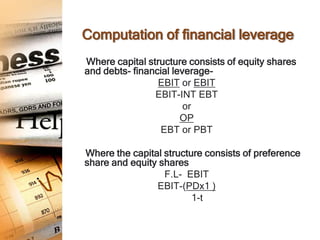

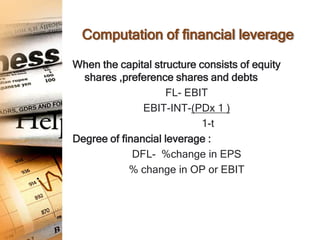

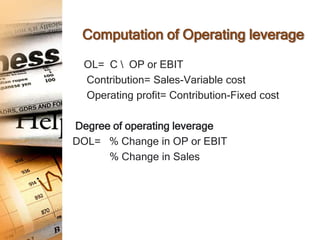

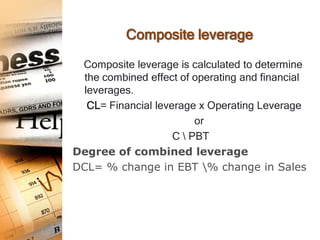

The document discusses different types of leverage used in business. It defines leverage as using fixed costs to magnify returns. There are three main types discussed: financial leverage uses debt financing, operating leverage uses fixed operating costs, and composite leverage considers the combined effects of financial and operating leverage. Formulas are provided to calculate each type of leverage based on earnings, sales, costs, and capital structure. The importance and effects of leverage on profits and risk are also mentioned.