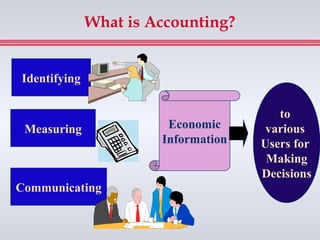

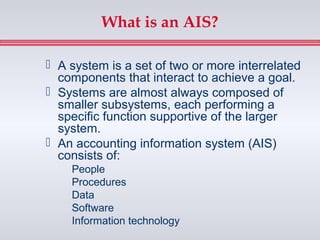

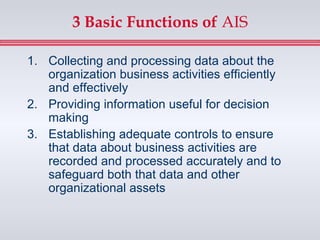

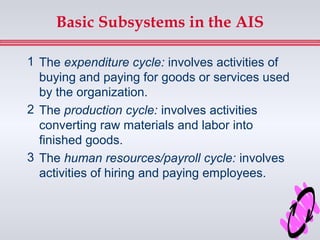

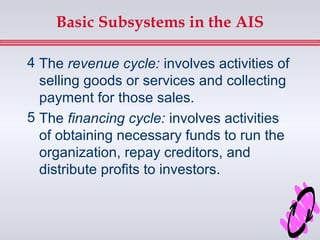

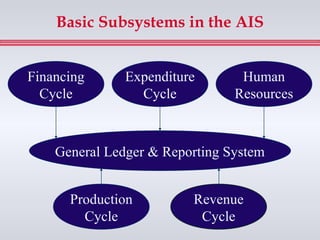

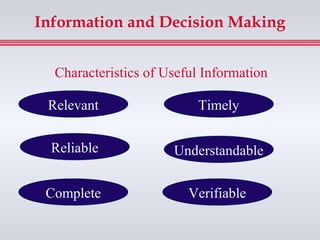

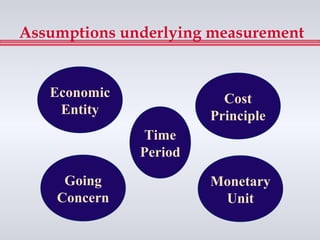

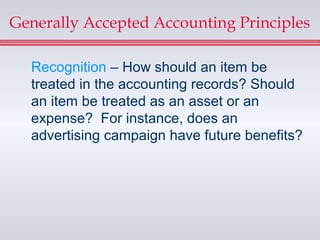

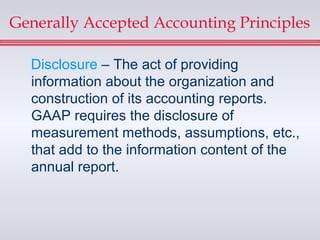

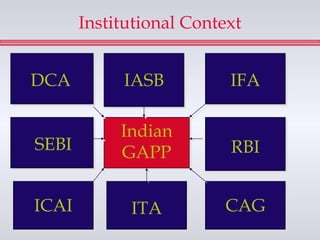

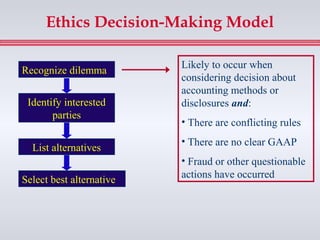

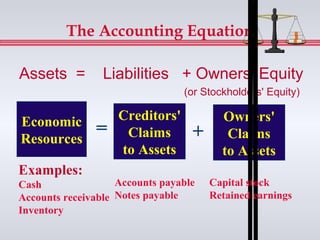

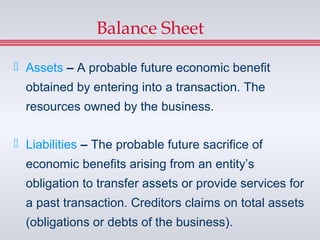

The document provides an overview of financial reporting and accounting information systems. It discusses key concepts such as the definition of accounting, the purpose of an accounting information system (AIS), the basic subsystems and functions of an AIS, how an AIS can add value to an organization, and information and decision making. The document also covers accounting concepts and assumptions including the economic entity, cost principle, going concern, monetary unit, and time period assumptions underlying financial measurement and reporting.